The Bankless Holiday Gift Guide gm Bankless Nation,

The market isn't quite spreading the holiday cheer today, but you still can with some gift ideas from the Bankless team! Today's Issue ⬇️ - ☀️ Need to Know: MONY Moves

J.P. Morgan's latest Ethereum play. - 🎅 Guide: The 2025 Bankless Gift Guide

Give the gift of ETH, and other things. - 🎧 Latest Pod: Can Privacy Win?

A veteran privacy founder talks AI risks.

Sponsor: Coinbase — Borrow against your BTC or ETH on Coinbase, powered by Morpho. . . . NEED TO KNOW J.P. Morgan's MONY Moves - 🏦 J.P. Morgan Debuts Tokenized Money Market Fund on Ethereum. The U.S. dollar yield fund will be available exclusively to qualified investors.

- 💵 Circle Acquihires Axelar's Labs Team & IP. Axelar's AXL is down nearly 25% off today's high as token holders were left cold in the deal.

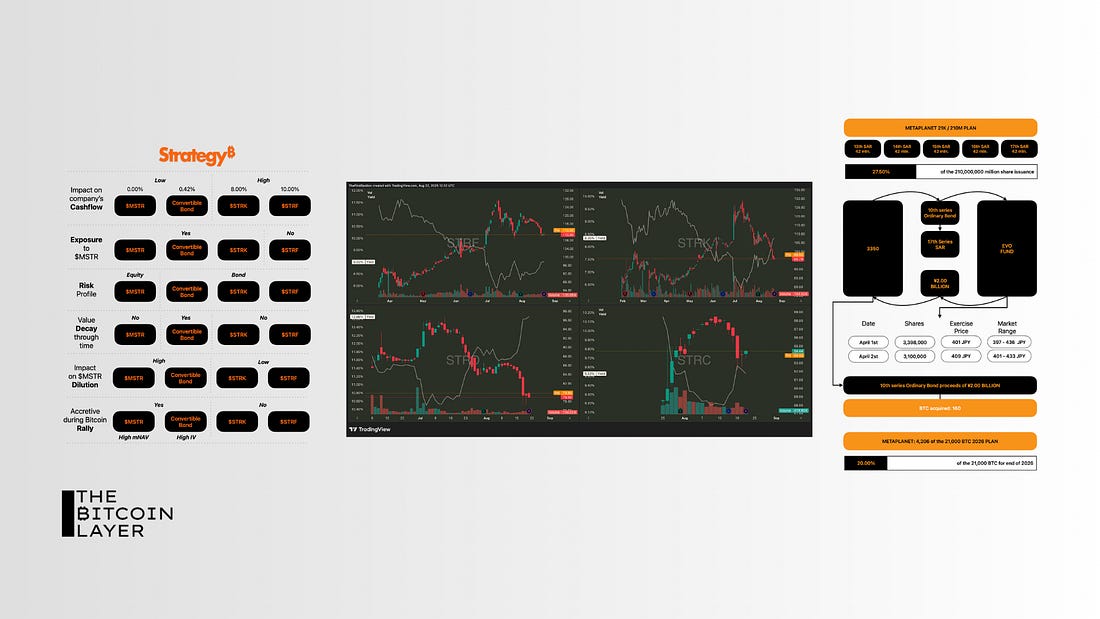

- 🟠 Strategy Announces Another Billion-Dollar Weekly BTC Buy. MSTR shares closed Monday's trading session more than 8% down.

📸 Daily Market Snapshot: Bad vibes proliferated across the timeline as BTC plunged to $85K despite billion-dollar Saylor purchases, and ETH crossed back under $3K. | Prices as of 6pm ET | 24hr | 7d |  | Crypto $2.95T | ↘ 2.1% | ↘ 5.1% |  | BTC $86,304 | ↘ 2.1% | ↘ 5.0% |  | ETH $2,962 | ↘ 3.4% | ↘ 5.3% | FRIEND & SPONSOR: COINBASE You can now borrow against your ETH on Coinbase, powered by Morpho. Eligible customers can borrow up to $5M in USDC against their BTC and up to $1M in USDC against their ETH. Interest rates are variable, typically between 4% and 8%, and respond to market conditions. Repayment schedules are variable, so you can pay on your time. Plus, Coinbase will not treat borrow transactions as taxable events. Now there's a more accessible, cheaper way to cover life's unexpected expenses. . . . CRYPTO CHEER The 2025 Bankless Holiday Gift Guide By: The Bankless Team The Bankless team spends an unhealthy amount of time thinking about the future. That turns out to be pretty useful when it comes to thinking up gift ideas. While of course, the greatest gift for loved ones to unwrap under their trees will always be more ETH, we’ve also rounded up a mix of thoughtful, practical, and occasionally indulgent gifts that help spread self-custody cheer, upgrade daily life, or make the next year a little more bankless. Read on for some of our team's top picks to add to your wish lists.👇 For spreading self-custody cheer...

Okay, maybe you should just start with buying your loved ones ETH :) Burner is a low-cost, dead-simple hardware wallet that costs $9 per card. One is exclusively compatible with Bitcoin, while the other supports both Ethereum and Base. Burner contains the same type of secure elements found in high-end hardware wallets, and uses your smartphone’s NFC connection in combination with the BurnerOS web app to check balances, generate private keys, and sign transactions. - Jack For scrolling fewer tweets at night...

Yes, spending $200 on an alarm clock when your phone already has one on it is probably unreasonable. But... the value of getting your phone a little further away from your bed is priceless. In 2025, I went to great lengths to break my nighttime doomscrolling routine, one of which was buying this alarm clock. The Loftie is over-engineered, majorly upgrades my white noise machine, and wakes me up feeling refreshed – all while allowing me to leave my phone sleeping in a separate room more often. - Luma For listening to Bankless in style...

These headphones are wildly impressive for the price and make listening to music (or your favorite crypto podcast) truly enjoyable. If you already have a good external microphone, they're also likely more than capable for your work setup. Don't just trust me; Ryan Sean Adams and I both use them... so it's Bankless trusted! - Jean-Paul For that special hardware wallet in your life...

Ledger Nanos are some of the most ubiquitous hardware wallets in crypto. But as with any device, these wallets face wear and tear, especially if you use them often. A nice solution here is Ledger's protective container options, which come in "case" or "pod" formats and support both the Nano X and Nano S models. They're simple, nondescript shields that are great for securing your Ledgers for travel, preventing everyday scratches, and so forth. - William For a more Limitless 2026...

Despite seemingly 100% AI uptake among X users this year, research shows only 9% of people use it daily. This Christmas, give your loved ones a competitive edge over that other 91% with a subscription to Gemini Advanced. Sadly, you cannot directly gift a subscription, but a Google Play Store gift card will allow them to purchase 'Google One AI Premium' using their balance. (Important: The gift card currency must match their account region!) - Kristi For reflecting on 2025's crypto conference travel...

One of my favorite new rituals of the past few years has been actually printing out my favorite iPhone photos and shoving them into a good old-fashioned physical album. I’ve been using Kolo's albums, which are excellent quality and come in a bunch of colors (though they’re a little inconsistent with their restocks). I'm eight years into this habit and assembling them each year remains a refreshing way to encapsulate the memories of life that do and don't make it to Instagram. - Luma For tracking your personal offchain data...

I didn’t think a tiny ring could significantly improve my life, but the Oura Ring 4 does exactly that. It quietly tracks sleep, recovery, and stress. It’s super comfortable, sort of gives you style points and the data feels spot-on. I don't really have any complaints. Perfect gift for anyone who wants daily health insights without wearing a chunky watch. - Dave F. For undoing another cycle of aging...

I don’t know about you, but this most recent crypto cycle has aged me significantly. This red and near-infrared light therapy mask is reversing the damage of the bear market on my elevens (the wrinkles you get while squinting at the charts). It’s a splurge, but is sometimes covered by your HSA. This is an essential purchase when ETH is below $3,000. - Rachel For bringing your friends and family into the fold..

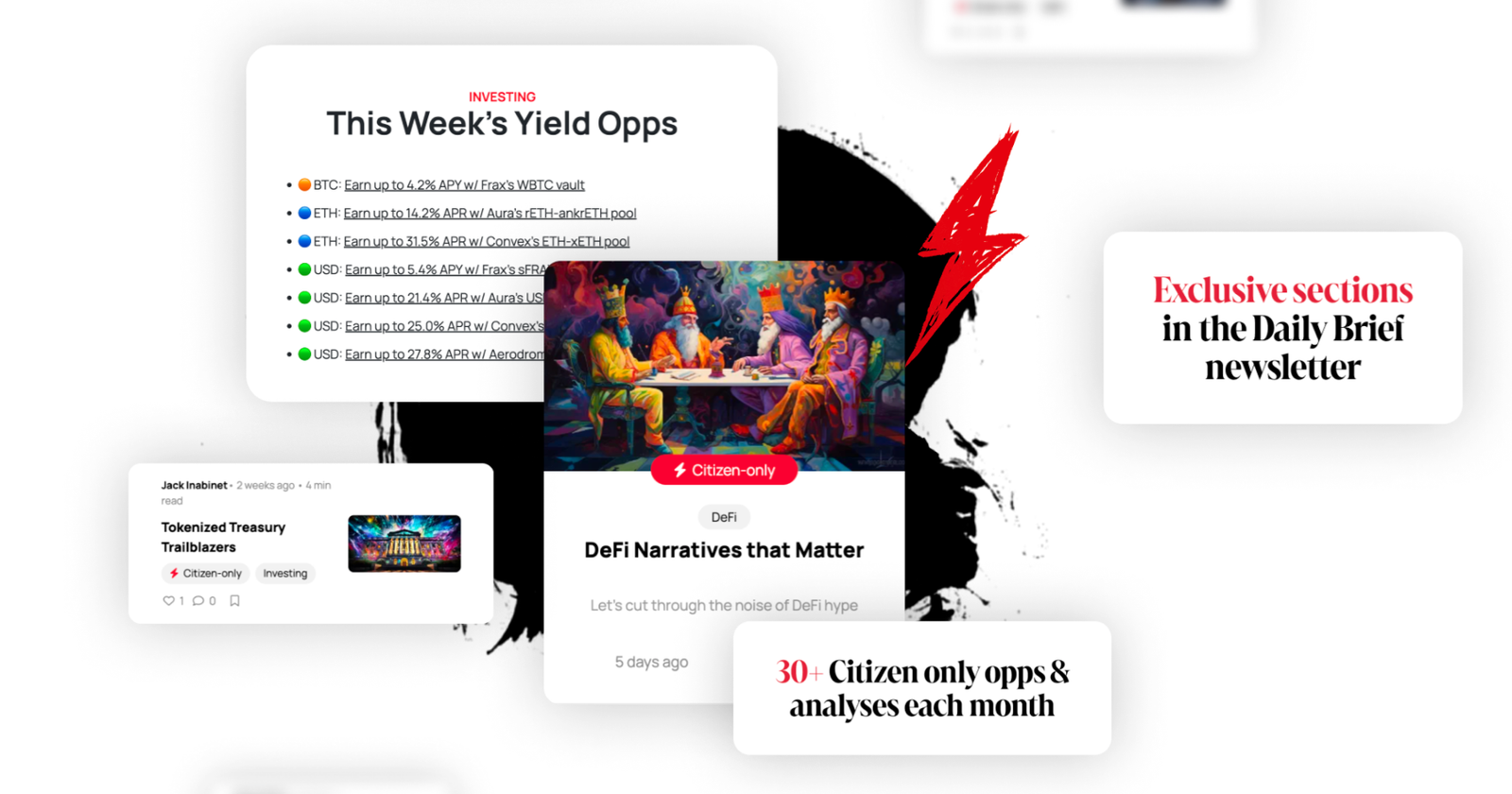

Give the gift of ad-free access to stimulating conversations about this brave new financial future of ours. Bankless broke plenty of new intellectual ground in 2025 inside crypto, AI, personal finance, longevity, space travel, etc... Gifting a year of Citizenship gets you access to these conversations and special Citizen-only podcasts, but also our fabulous daily investor newsletter (with exclusive deep dives). Give the gift of clueing your loved ones into this wild industry that you invest your time and money into, with a front-row seat to the action! 🎅 . . . LATEST POD Is Privacy a Winnable Battle? AI is becoming the most powerful surveillance machine ever built and most people are feeding it their deepest secrets without realizing who can read them.

Proton founder Andy Yen joins Bankless to explain how Big Tech captures your identity, why AI chat logs are a privacy disaster waiting to happen, and what a self-sovereign, user-aligned future could look like.

We explore how AI models profile you, why subscription business models don’t guarantee privacy, how Proton built Lumo without retaining user data, and why encrypted email remains the cornerstone of your digital identity. Andy also breaks down EU “chat control,” Apple’s privacy-washing, the crisis of trust in crypto, and the practical steps anyone can take today to reclaim their digital freedom. Listen along to the full episode 👇 |