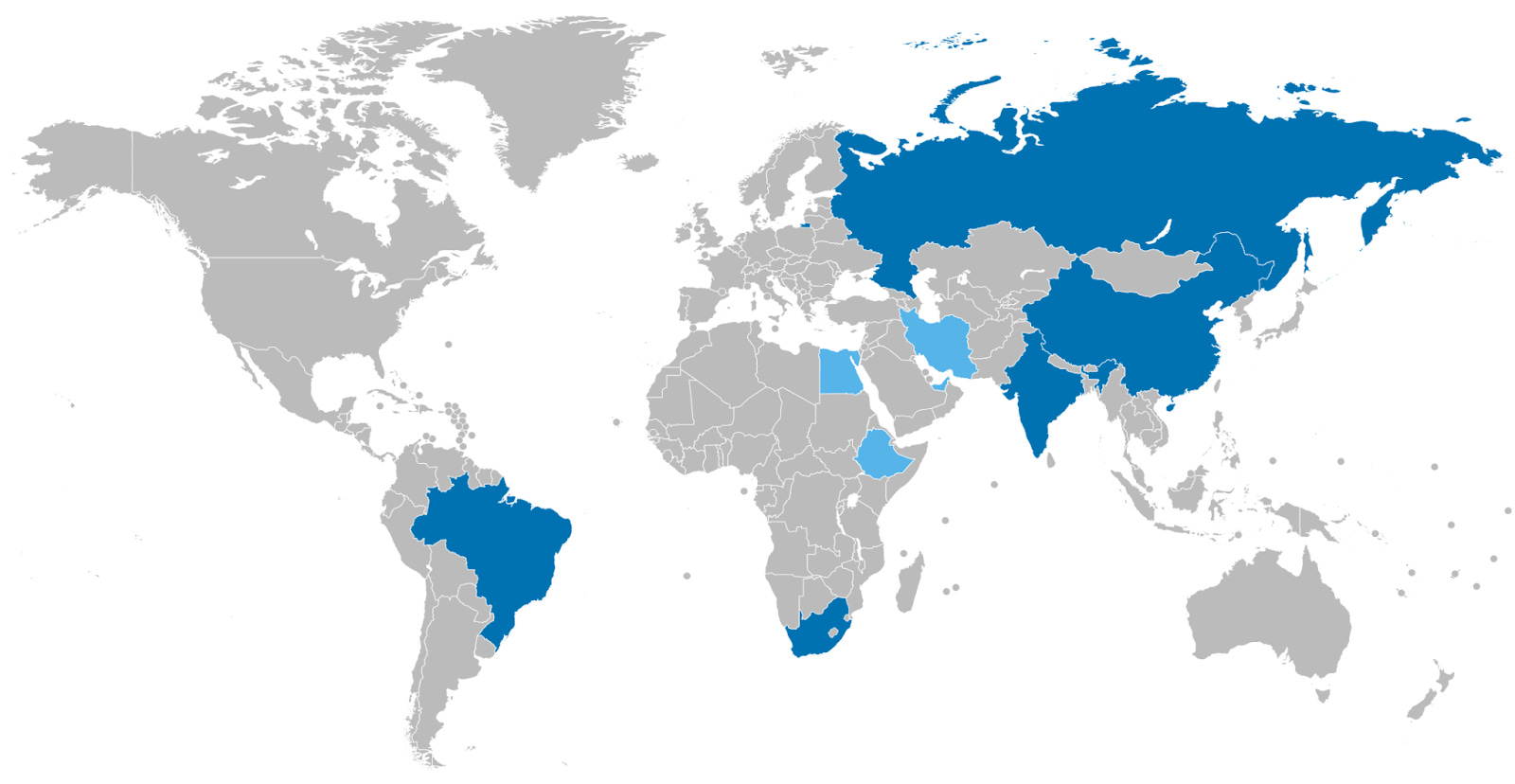

Exploring BRICS Pay: A New Blockchain-Based Payment System Versus Bitcoin's Global InfluenceFrom BRICS Pay to Bitcoin, Comparison and Implied Breakdown of the Old System, Path to the New.BackgroundThe BRICS countries (Brazil, Russia, India, China, South Africa, and this year Egypt, Ethiopia, Iran, the United Arab Emirates) have introduced a new blockchain-based payment system called BRICS Pay. This system operates on a distributed ledger and is not a Central Bank Digital Currency (CBDC) or electronic cash like bitcoin. Its main objective is to facilitate trade and financial transactions between the BRICS nations, enabling payments to be made in their respective national currencies rather than relying on the US dollar or the euro, which is often seen as a step towards dedollarization. Source: Wikipedia Commons BRICS Pay aims to replace the SWIFT system, providing a secure and US-independent (BRICS-dependent) platform for international financial transactions. It's designed to serve various purposes, including cross-border payments between companies, investments, and microfinance. Institutions and businesses in BRICS countries are increasingly adopting this system, and it's intended to simplify and enhance trade and financial transactions among member states. Monetary Evolution or Payment, Perception versus RealityGlobally, there is a growing awareness of the threat posed by CBDCs to privacy, free commerce, and free expression. Specifically, concerns are rising that CBDCs may facilitate the establishment of a communist-style total surveillance economy. In such an economy, every transaction would be meticulously tracked and subject to approval or censorship, enabling authorities to freeze or seize money at their discretion. Moreover, tax and subsidy interventions could be directed with pinpoint accuracy and are vulnerable to corruption and abuse. Additionally, there has been significant speculation in macro circles about the BRICS nations launching their own multinational currency to challenge the US dollar in international trade. BRICS Pay is not a CBDC and does not have the all encompassing power over domestic internal transactions as well as not being a separate currency or unit of account. However, it does exert a certain level of control over international payments. Given these distinctions, it is understandable for confusion to arise regarding the nature of BRICS Pay. Source: OMFIF Long-time Bitcoiners, and newcomers as they familiarize themselves with some of Bitcoin’s intricacies, are primed to notice potential threats to US dollar dominance. They tend to see BRICS Pay as a component of a broader strategic maneuvering in a currency conflict that will eventually lead to a BRICS currency or CBDC. They view Bitcoin serving as a sanctuary from the turmoil of such conflicts...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Wednesday, March 13, 2024

Exploring BRICS Pay: A New Blockchain-Based Payment System Versus Bitcoin's Global Influence

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Macro uncertainty caps upside, keeping Bitcoin range-bound ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

No comments:

Post a Comment