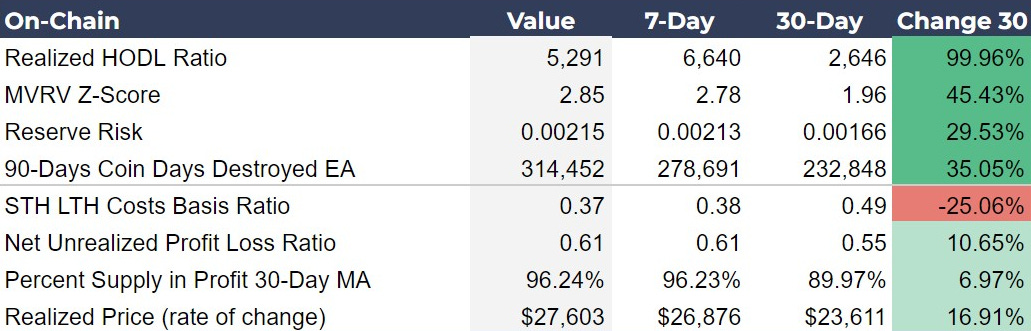

Perfect Setup in Bitcoin Metrics as Quarterly Expiration LoomsProfit-taking might be over as on-chain metrics reset and demand is insatiable. Derivatives are mixed ahead of expiration with slight downside hedging. Global macro tightens.IntroductionOverall, today’s data is consistent with continued bullish sentiment in the Bitcoin space. On-chain and price metrics have moderated where they were grossly overheated, yet maintain bullish trends in key areas. The derivatives data provides insights into strategic hedging and investor sentiment as we approach a significant end-of-quarter expiration—an early one this time, with traditional markets closed for Good Friday. The global macroeconomic environment is tightening and slowing, giving Bitcoin the opportunity to stand out as a vibrant new asset, outside the frailties of a waning credit-based system. Perfect Setup for On-chain MetricsOur on-chain data paints the picture of growing confidence among investors, despite the recent consolidation in price, with key indicators suggesting a relatively early stage in the overall bull market. The Realized HODL Ratio has cooled off in the last week after its massive recent rise seen in the 30-day change. The MVRV Z-Score, which is slightly up from both 7 and 30 days ago, the relatively slow pace of increase here implies steady confidence rather than speculative excess. Similarly, the Reserve Risk's increment over the last 30 days points to growing investor confidence, with current prices seen as attractive for long-term holding. A significant aspect to note is the increase in 90-Days Coin Days Destroyed, indicating heightened activity by long-term holders, which points to LTH redistribution at the previous ATH. This redistribution is also hinted at by the STH LTH Costs Basis Ratio's decrease over 30 days. Coins are definitely moving. Investor Insights

Price and DerivativesThe 50-Day Moving Average (DMA) has seen a substantial increase, moving from $45,575 to $59,386, which is a 30.31% change, indicating a strong bullish trend in the short term. Similarly, the 100 DMA and 200 DMA have also increased, showing gains of 17.30% and 15.58%, respectively, suggesting a consistent upward momentum across different time frames. These moving averages are all rising in order, which means the market is firmly in a bullish trend. It would take a sustained move down under the 50 DMA to bring the overall trend into question...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Tuesday, March 26, 2024

Perfect Setup in Bitcoin Metrics as Quarterly Expiration Looms

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momen...

-

Meet the Minds Behind the Bitcoin Vector Framework ...

-

Bitcoin Treasuries Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Compass 122 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Plus $200 off! ...

No comments:

Post a Comment