Multiple Side Hustles Is The New American Job Market: TBL Weekly #88Despite the BLS' best efforts, the bleak truth of the job market has never been more apparent.Welcome to TBL Weekly #88—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

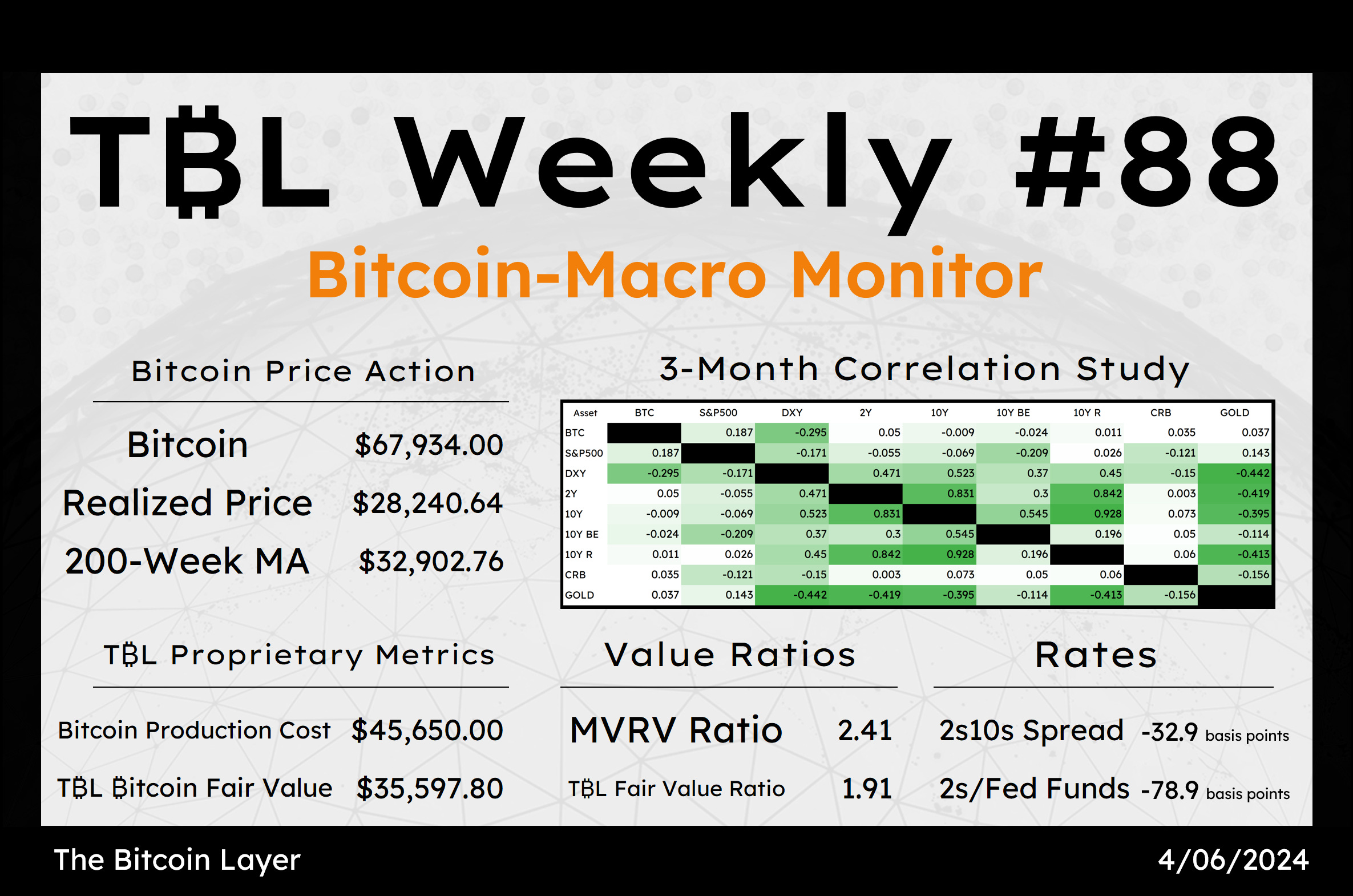

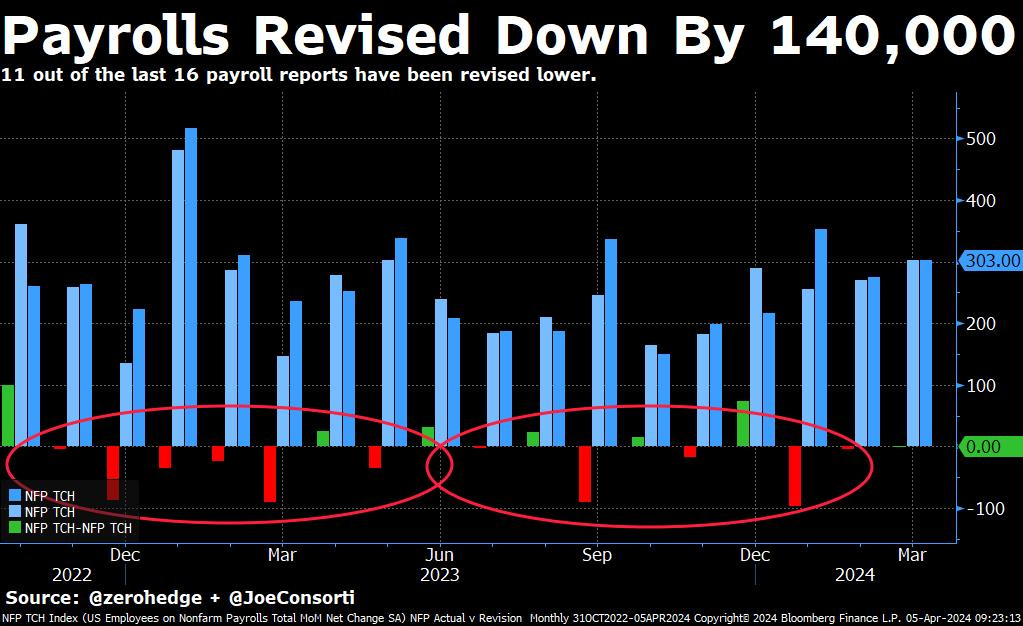

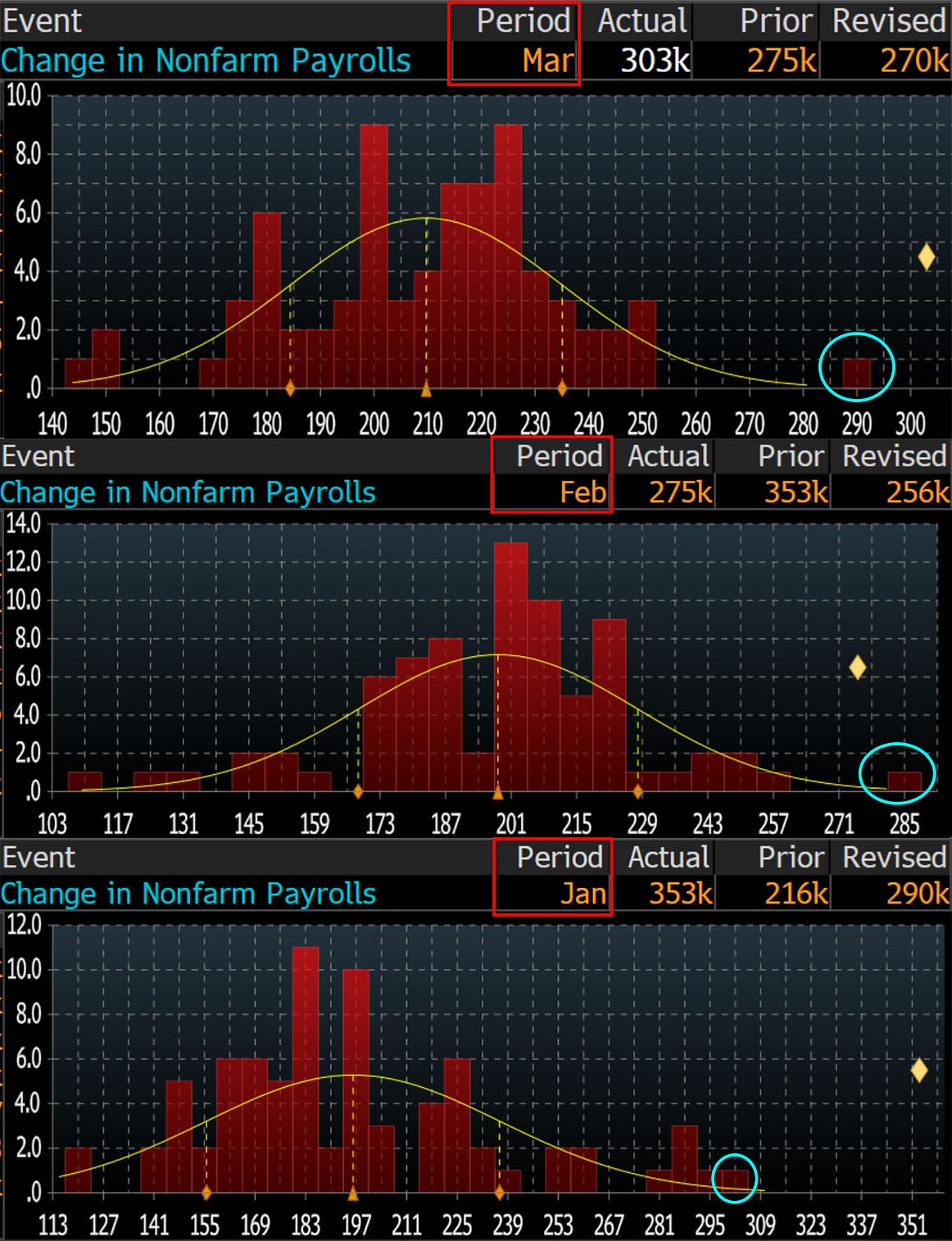

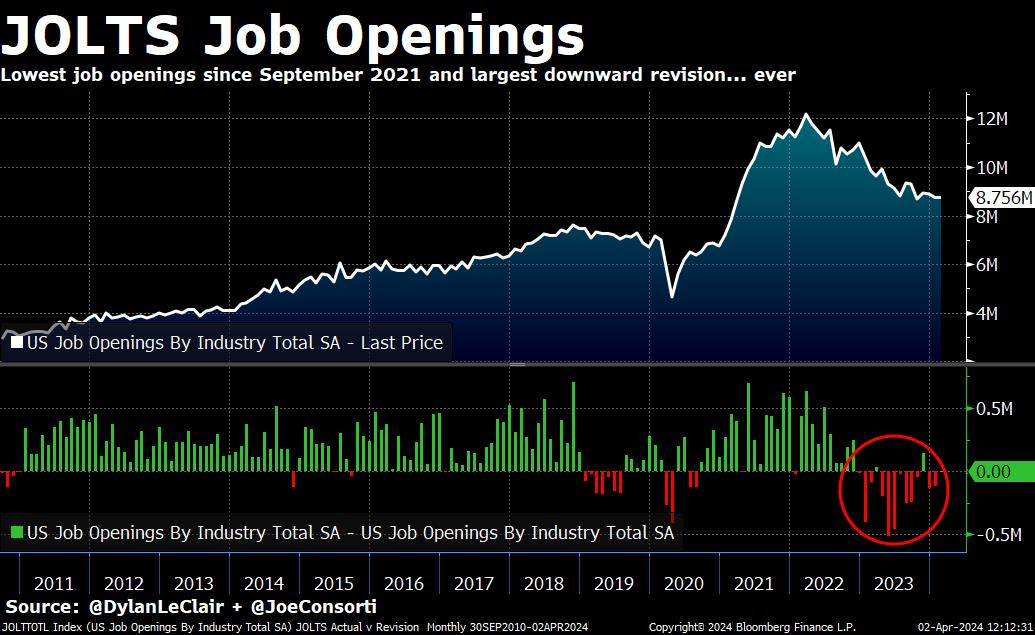

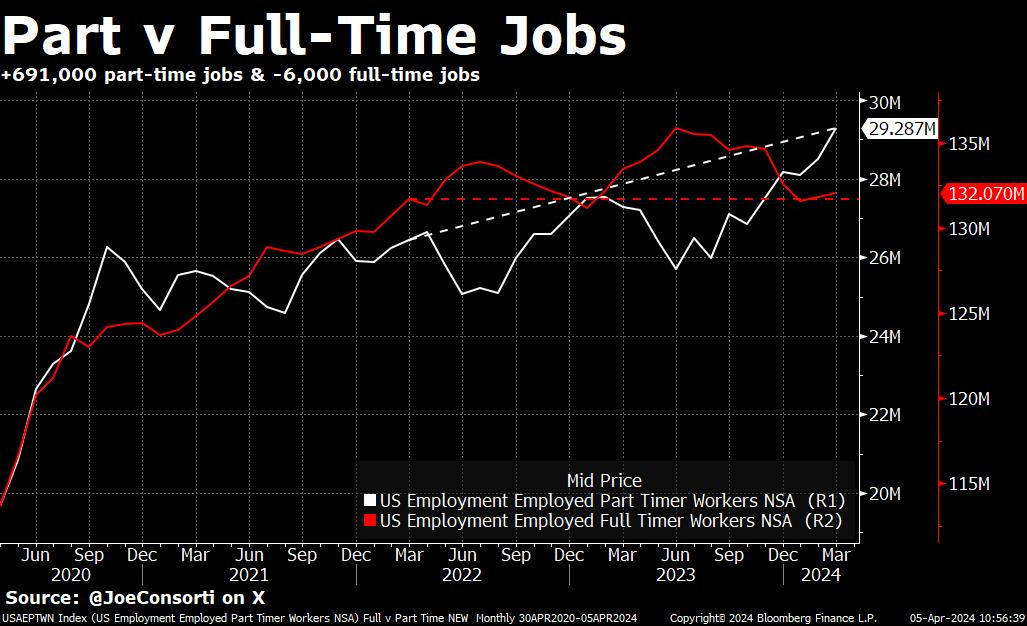

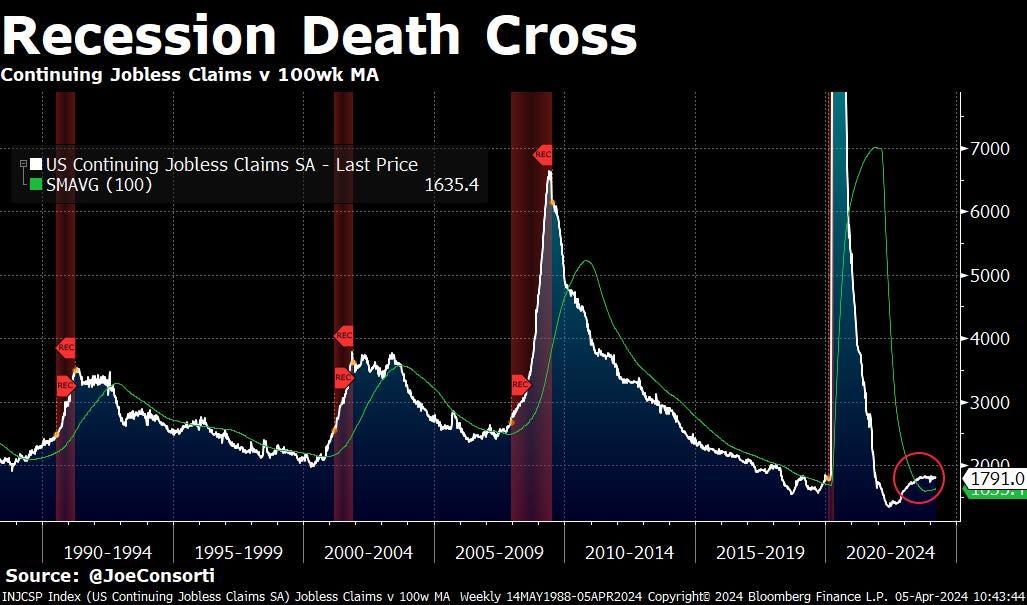

River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Good morning everyone, Friday’s nonfarm payrolls report beat expectations by coming in 89,000 jobs higher than analyst forecasts—a staggering beat. As with all jobs data this cycle, the caveat to this “strong” report is that the previous month's report was quietly revised down by 7,000 jobs. That makes number 11 of the last 16 nonfarm payrolls reports that have been quietly revised down one month later. We can expect today’s “beat” to follow in kind, but not make any news chyrons to maintain the illusion of a robust job market: It has gotten completely absurd—January’s NFP report was a 5-sigma beat, February’s was a 3-sigma beat, and March’s report released yesterday morning was a 4-sigma beat. Three earth-shattering reports in succession like this are statistically impossible. Every print has been the furthest to the right you can possibly go on a standard distribution. Furthermore, all 2 of the 3 NFP reports released this year had job growth higher than the highest estimate on Wall Street. The only way that this can occur is by intentionally fudging the numbers with fake data, and the change in nonfarm payrolls headline prints are clearly being manipulated in a way we can’t quite describe. Yes, broad economic data has been stellar, and most of the adjusted NFP numbers have still been over 200,000. But these numbers more resemble Bureau of Labor Statistics psychosis. It doesn’t end there. Earlier in the week on Tuesday, JOLTS job openings data was released, and it revised down the previous month’s growth by 115,000 jobs. That makes 12 of the last 14 job openings reports revised down later. Economists in D.C. project strength in the initial headline, then quietly lower it a month later, a crisis management tactic to not upset markets, and to keep political campaigns intact. The acronym BLS, the organization responsible for this data, doesn’t stand for the Bureau of Labor Statistics these days as much as it stands for the Bureau of Lying Statisticians: Under the hood, it’s not all sunshine and rainbows as the BLS would have you believe. Breaking down the report, 71,000 government jobs were added while 8,000 manufacturing jobs were lost. Additionally, the 71k increase in government jobs is the second-highest monthly increase in government jobs in 16 months. The government is taking an increasingly large share of the job growth pie relative to private industry. People with 2 or more jobs, both full and part-time, have now spent 3 months near its all-time high of 8.47 million people. The 25% price inflation since 2021 coupled with >4.5% interest rates across the board have ravaged people's wallets from both ends, and more people than ever are taking 2+ jobs to maintain the same standard of living: Full-time jobs have not risen in 2 years, but part-time jobs have risen by 3 million roles. In March, part-time jobs rose by 691,000 roles while full-time jobs fell by 6,000 roles. This is the story of the US economy: taking on side hustles to pay the mortgage. In the Fed’s pursuit of reigning in prices with high interest rates while the Treasury stimulates them with record budget deficits, it has created a gig economy, wherein having a single job is a luxury and the new normal is a mix of 2, 3, and even 4 or more part and full-time roles in order to make a comfortable living: Amidst all of this part-time job growth, continuing jobless claims have actually flattened and started declining—something that rarely ever happens in the US economy after it has started accelerating and rising above its 100-week moving average as it has now. To cross back underneath this ‘recession death cross’ after rising 200,000 jobs above it would be a first for any cycle here in the US, and a testament to just how many economic indicators have been made worthless thanks to the Fed and US Treasury’s distortions since 2020. Specifically on jobless claims, we recognize the potential of a situation in which switching over to the gig economy from a full-time job is preventing this indicator from serving its full purpose of showing those needing unemployment assistance: One final piece for you this morning: the high-prices-high-rates combo hasn’t just destroyed consumers, it’s also destroying businesses. Discount retailers like Dollar Tree and Dollar General operate on paper-thin margins and they’ve been hammered by the current regime of stagflation. One of these chains, the 99 Cents Only Store, has announced it will be shuttering all 371 of its locations. Capital destruction is underway as businesses are forced to deleverage, and it will only continue to metastasize: Inflation can only be reigned in with some degree of discipline at the policymaking level—the uniparty only exacerbates the issue. It should be noted that with years of Quantitative Easing after the Great Financial Crisis of 2007-2009, inflation levels were modest while asset price inflation remained tremendous. Now, with the fiscal deficits of 2009-2019 becoming fiscal bloodletting of 2020-2024+, the wheels have fallen off. Inflation isn’t going back to 9%, at least we don’t believe, but its punitive effects are taking a toll on society. Have you seen all the “how am I supposed to survive?” videos circulating on social media? Next WeekIn the week ahead, we have our eye on Tuesday’s NFIB Small Business Optimism report for insight as to how small businesses are faring this late in the cycle, as the pain of tight credit may start to weigh on smaller players. The highlight of the week, or lowlight depending on how you view it, is Wednesday’s CPI report. The expectation is for a massive bump up from the current 3.2% YoY rate to 3.5%, which is in line with the price pressures that are rearing their head again according to last week’s ISM Services and Manufacturing Prices Paid reports. On Thursday, we’ll have our eye on initial and continuing jobless claims, one of our favorite weekly series to get a continuous pulse on the labor market’s direction as we continue to flesh out our hypothesis on the gig economy. And finally, to round out the week on Friday, we’ll have our sights set on the April prelim of the UMich consumer sentiment survey, offering a window into how consumers are managing the mix of sky-high part-time jobs, sticky inflation, and government spending helping money circulate throughout the economy to nobody’s end. It is expected to decline from an index value of 79.4 to 78.7: Finally, Treasuries start hitting the market in duration size next week, as $39 billion of 10s and $22 billion of 30s get delivered to the market on Wednesday and Thursday, respectively. Settlement is not until the following week, on April 15th, so any funding issues won’t be next week’s business. With weakness in the stock market, gold on absolute fire, and Treasury yields hitting year-to-date highs across the curve, we are extremely focused on the dollar to see if it demonstrates global financial tightness. The wrecking ball is playing hide-and-seek. If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops. Here are some quick links to all the TBL content you may have missed this week: MondayPrice is truth. Thursday’s $50 pop in the gold price has carried over in the opening trading hours of April in Asia. What is gold’s jump trying to tell us? It’s something quite serious. To think about gold’s place in the global financial system, we study the global trio of balance sheets and how they interact. Check out—Gold to $3,000 In this episode, Nik and Matt Dines provide an explainer on global banking regulations, Basel III, and leverage ratio regulations. Matt helps us understand the history of the Bank for International Settlements and Basel-originated leverage ratios for banks. We learn the difference between asset-side and liability-side regulations and discuss the United Stated implementation: the Supplementary Leverage Ratio (SLR). Check out—Explaining Global Banking, Basel III, & SLR  WednesdayIn this episode, Nik is joined by Cognitive Investments partner Jacob Shapiro to discuss India. Jacob helps us understand the Indian political scene and gives background on the rise of current Prime Minister Narendra Modi. We ask Jacob about India's economic future and whether politics will help or hurt the country's growth aspirations. Check out—India Rising Into Global Economic Powerhouse  ThursdayIt’s a fight over money. I witnessed firsthand as a money markets trader responsible for the daily cash needs of large institutional clients that the calendar matters a lot. And while month-end and quarter-end dates certainly affect marginal positioning, both for investment managers and the sell side on Wall Street alike, large payment dates matter much more. Think back to the repo crisis of September 2019—the initial explanation for the spike in repo rates was the September 15th tax payment deadline for corporates. As companies paid money to the government, money leaves one area of the financial system and enters another. Until that money comes back into the economy, it’s technically missing in action. We aren’t predicting a repeat of any sort, but we can certainly use this moment to teach and speculate. Let’s break down this fight. Check out—Markets update: Tax Day, bitcoin, stocks, & rates FridayIn this episode, Nik is joined by Bitcoin historian Pete Rizzo on Satoshi Nakamoto's birthday. Pete explains the history of Satoshi's April 5 birthday and its significance, speaks to Bitcoin's origins by diving into the cypherpunk movement, and breaks down early Satoshi email and online communication for a better understanding of his motivations. Check out—Happy Birthday, Satoshi Nakamoto  Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! That’s all for our markets recap—have a great weekend, everyone! River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, April 6, 2024

Multiple Side Hustles Is The New American Job Market: TBL Weekly #88

Subscribe to:

Post Comments (Atom)

Popular Posts

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment