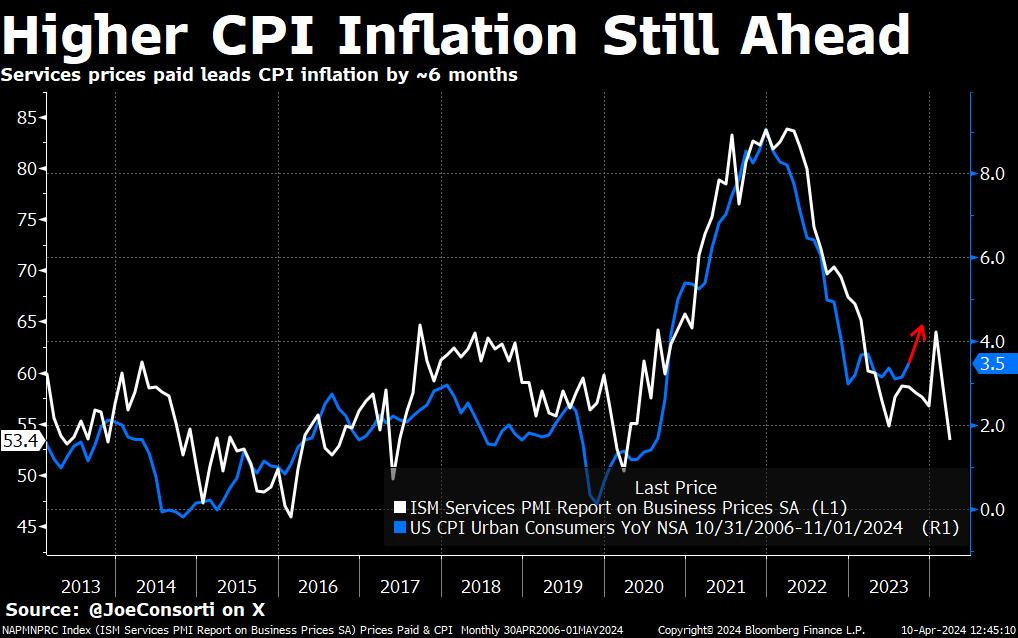

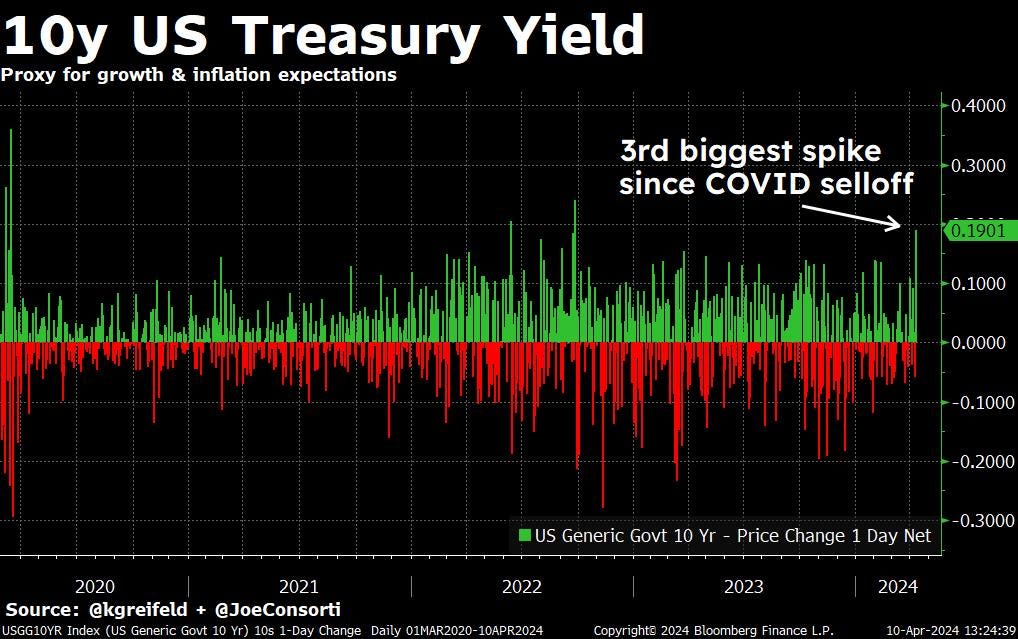

Price Inflation Is 1.5x As High As Before, And It's Not Coming Back DownTen months later, and Powell's preemptive pivot is proving disastrous.River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. March consumer prices came in hotter than analyst expectations. The headline number rose from 3.2% prior to 3.5% in March, beating estimates of 3.4%. Core inflation, which removes volatile food and energy prices (despite those being what most people are impacted by), was flat at 3.8%, beating estimates of 3.7%. Supercore inflation, which is inflation in core services excluding housing, rose to 4.8% year-over-year. According to Torsten Slock from Apollo, core services inflation, which is hugely indicative of consumer spending activity, is accelerating. With a 3-month annualized rate of 8% up from its 6-month annualized rate of 6%, consumers aren’t backing away from services—they are spending more. Even after the holidays. CPI has now spent 10 of the past 12 months totally unmoved above 3%, which is a full 50% higher than the Fed’s long-run target range of 2% yearly growth. With the Fed’s no-recession mandate further solidified by it being an election year wherein economic slowdowns are forbidden, a price inflation rate of 3.5%, 1.5 times higher than what you’ve been used to for 25 years, is the new normal for the foreseeable future: And according to prices paid upstream by services businesses, this is not the end of faster price increases. The ISM survey on service business prices leads CPI inflation by ~6 months, and it highlights a path to 4.3% for yearly consumer price inflation before we make any progress attempting to break below the 3% barrier: CPI inflation has now been locked around 3.5% for 10 months in a row. At the time, Powell’s forecast of a forthcoming rate hiking pause could be justified—CPI inflation had almost 12 consecutive months of dropping like a rock, so forecasting that hikes were ending was a measure to ensure we didn’t fall too far below 2% once we got there. Well, rather than a deceleration in disinflation headed into 2%, Powell’s remarks halted disinflation dead in its tracks. The limbo we’re experiencing now is the result. Bad news for those hopeful that we may one day return to 2%: CPI is LESS volatile in this 3.5% range than it was over the last 25+ years at the Fed's long-run 2% target. For me, this is indicative of the discovery of a new equilibrium level for CPI inflation, rather than a transitory (short) period of stubbornness before returning down lower. Traders are taking the hot growth story painted by CPI today and running away from US Treasuries. It was a horrific day for our favorite risk-free (colloquially) market. Tens first sold off after the hot CPI print, then the auction had a 24% dealer takedown and tailed 3.1 bps, the largest tail since Dec. 2022 and 3rd largest on record—tail meaning a clearing yield higher than the indication moments before auction results. This means that primary dealers were forced to absorb 24% of the action, a sign of weak Treasury demand from investors. This couldn’t come at a worse time, since the Fed is running down its holdings of US Treasuries and funding needs have never been higher. Altogether, this is the biggest one-day spike in the 10-year yield since the COVID panic, up 19+ bps. The Fed may need to hold off on that QT and start considering monetizing some of this, soon: Rate-cut expectations have quickly dissipated, too. In January, the market was pricing in two Fed rate cuts for June—now, there is nothing priced in for June, only one cut priced in for November, and pundits are expecting the Fed to hold off on cutting rates entirely until early 2025. Twos a proxy for front-end policy rate expectations, have now been above 4% for 567 days, the longest period above this level since 2007. The ‘higher for longer’ path for Fed rates is growing to be consensus once again: The June maintenance rate cuts were slated to be for financial stability, but they will have to wait. The Fed minutes were released today and members agreed on slowing the pace of QT—just one example of supporting financial stability without cutting rates. Unironically, if easing is to start before November, another bank must be sacrificed. Anybody know about any embattled regionals we can spread rumors about? The rock and hard place of the United States’ monetary and fiscal situation is beyond the point of no return. Cutting interest rates saves the banks at the expense of sending price inflation back to the moon, while leaving them where they are creating an interest expense problem on the Federal debt that is not sustainable. Political ends now motivate all decisions. Prices have risen by 30% using official data, with many of life’s necessities having doubled, and the decision-makers at the highest level in D.C. are talking about cutting interest rates. CPI inflation hasn’t fallen for one single monthly print since Biden took office, and this is what’s being discussed: This is not a policy failure, it’s a policy triumph. The only way out of the US Treasury’s fiscal problem is through decades of financial repression, wherein price inflation is allowed to run hot and nominally erode the value of the US’ debt, because God knows we’re not paying it down by simultaneously lowering spending and raising taxes. We know what they will choose in the decades to come because we see what they’re choosing to do now. Insulate yourself accordingly by buying what they can’t print more of. Until next time, Joe River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Wednesday, April 10, 2024

Price Inflation Is 1.5x As High As Before, And It's Not Coming Back Down

Subscribe to:

Post Comments (Atom)

Popular Posts

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment