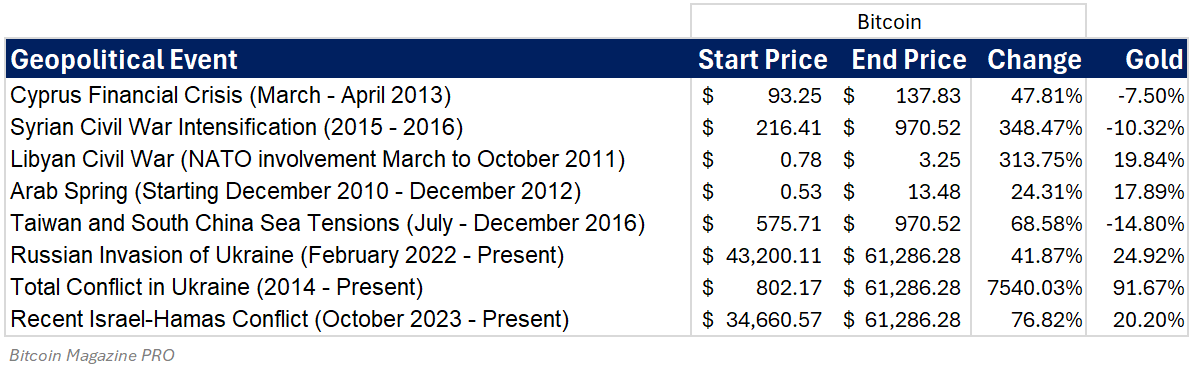

The Geopolitical Significance of BitcoinBitcoin's Role in Geopolitical Crises with Safe Haven Status, Academic Insights, and Inflation Hedging Capabilities, plus a Bonus Chart of the Halving.IntroductionIn a world where geopolitical tensions frequently jar the markets, investors seek refuge in assets that can weather the storm. The question of Bitcoin’s ability to perform during periods of heightened geopolitical tensions has come up with increasing regularity. I wrote about this topic here several months ago on my website, in response to bitcoin’s performance around the Oct. 7th attacks (it is a highly detailed post that I recommend you checkout for tons of charts). The topic is once again coming up as the Israel conflict looks likely to expand into a regional conflict against Iran. The question of whether or not Bitcoin can perform well in a crisis is the one big bearish criticism of Bitcoin in a period where its bullish fundamentals are off the charts. In this post, I’ll attack this from several different angles. First, a simplistic backtest of bitcoin’s price performance during periods of increased geopolitical or monetary risk. Second, we take a look at an academic study using highly sophisticated statistical methods to measure bitcoin’s behavior under geopolitical tensions. Third, Bitcoin’s dual advantage under monetary responses to expanding military conflict. Bitcoin’s Strong History as a Safe HavenTraditionally, safe haven assets are investments that retain or increase in value during times of market uncertainty, with gold long considered the definitive example due to its intrinsic value and historical stability. However, Bitcoin has begun to challenge this status since its inception in 2009, presenting itself as a viable alternative during geopolitical crises. This is noteworthy given Bitcoin's digital and decentralized nature, which contrasts sharply with more traditional assets. Despite the loud voices of the naysayers out there, Bitcoin has performed very well in periods of increased geopolitical risk. Bitcoin's claim as a safe haven has been supported by its performance during specific crises, such as the financial unrest in Cyprus in 2013, where Bitcoin's value surged as investors sought alternatives to conventional financial systems and unstable government situations. I took a simple price history of bitcoin and evaluated it during, what I picked as, recent periods of elevated geopolitical crisis. I then compared it to the price of gold during the same periods. As you can see, bitcoin has outperformed gold in every single period of increased geopolitical tensions! This simple analysis here might not go far enough to assuage investor concerns, but there is also more research being done on this very topic with positive results, such as the following study...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Thursday, April 18, 2024

The Geopolitical Significance of Bitcoin

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

No comments:

Post a Comment