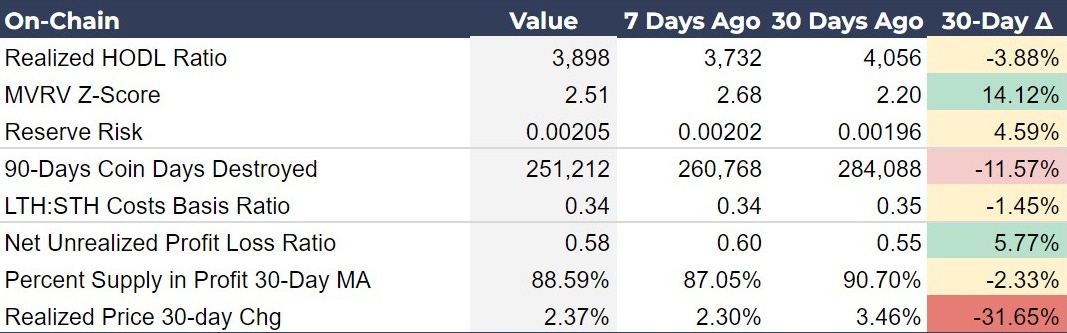

By The Numbers: Key Bitcoin Metrics, Cycles, and Macro PositioningA Comprehensive Review of On-Chain Metrics, Price Trends, Derivatives, and Macroeconomic Indicators.IntroAs Bitcoin navigates the end of its consolidation phase, key metrics reveal increasing confidence among long-term holders and a bullish sentiment among traders. The Realized HODL Ratio and Perps Funding Rate indicate growing optimism, while rising moving averages support a positive price outlook. Despite this optimism, the broader macroeconomic landscape continues to flash cautionary signals, suggesting an impending recession. Investors must balance this bullish sentiment with the reality of tightening liquidity and economic contraction. Let's explore the significant developments and what they mean for the future of Bitcoin. On-Chain Metrics AnalysisEach week, we break down relevant on-chain metrics to reveal insights into Bitcoin cycle timing, anticipate market volatility, and to learn more about Bitcoin’s market dynamics. This type of analysis is unique to Bitcoin due to the openness of the blockchain. The Realized HODL Ratio, the ratio between the value of UTXOs last moved 1-week ago and 1-2 years ago, stands at 3,898, showing a slight decrease from 30 days ago and an increase from 7 days ago. This metric is relatively sensitive due to the 1-week timeframe. It bottomed on May 14th at 2850, therefore is showing a significant bullish shift, signifying the market bottom is likely in for this consolidation period. The Reserve Risk, defined as price / HODL Bank, is inching higher. The HODL bank is a proxy for holders' confidence. If confidence is high and price is low, there is an attractive risk/reward for investors. The current reading of 0.00205 is still on the attractive side. When this metric reaches 0.01 it is time to watch for a cycle top. Increased holding behavior can be seen in the 90-Days Coin Days Destroyed decreasing by 11.57%, and reinforces a bullish outlook. This metric rises as older coins in deep storage are moved, and falls as transactions are dominated by younger coins. The Realized Price 30-day Change can be a useful proxy for tracking the rate of capital inflows and outflows (cost basis rising or falling). This has slowed but is still positive, meaning the overall bullish momentum is still intact, despite a long consolidation period. These metrics collectively suggest a solid foundation for Bitcoin's continued growth, despite minor fluctuations in some indicators...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Tuesday, May 28, 2024

By The Numbers: Key Bitcoin Metrics, Cycles, and Macro Positioning

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hello guys and welcome to my blog, I tried to find one working faucet collector crack and here it is. Just download this crack, install d...

-

Advances in both cryptography and cryptocurrency have made possible a new kind of "techno-democracy" ...

-

Zoomers' retirement accounts may be in trouble ...

-

Bitcoin On-Chain Activity Report, November 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Bitcoin Miners Report, December 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment