Welcome to TBL Weekly #99—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

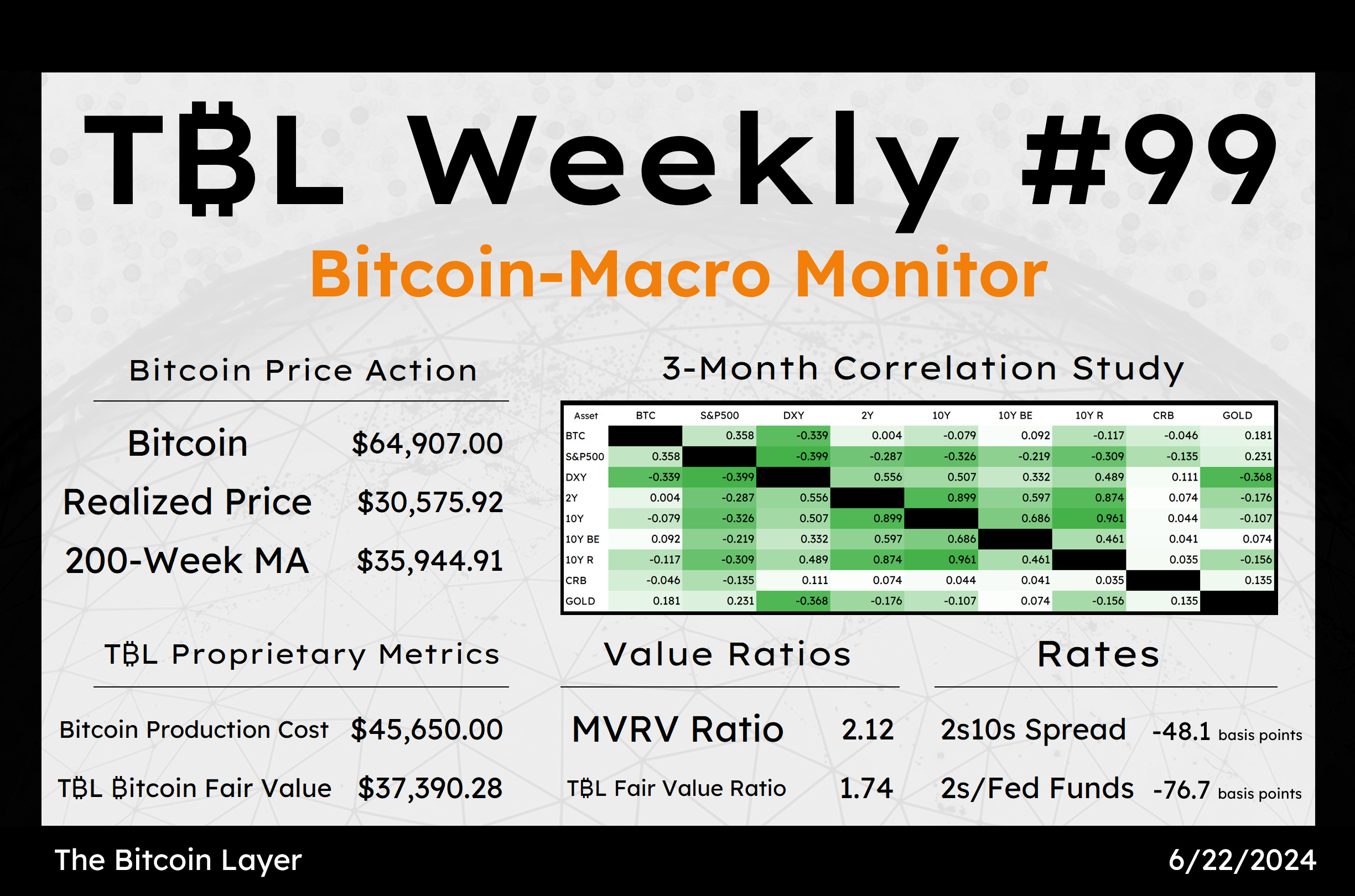

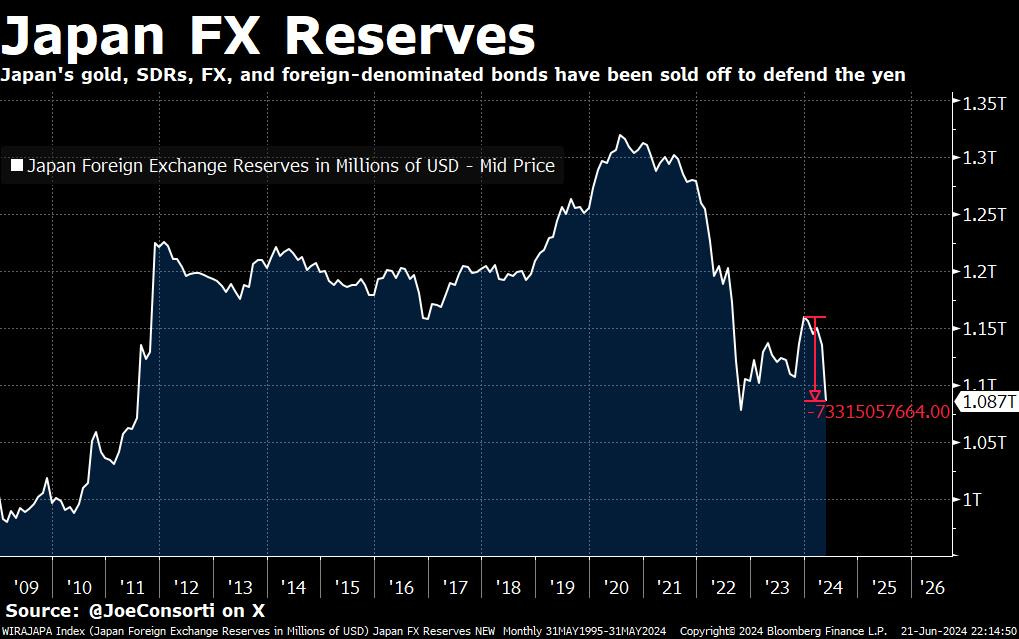

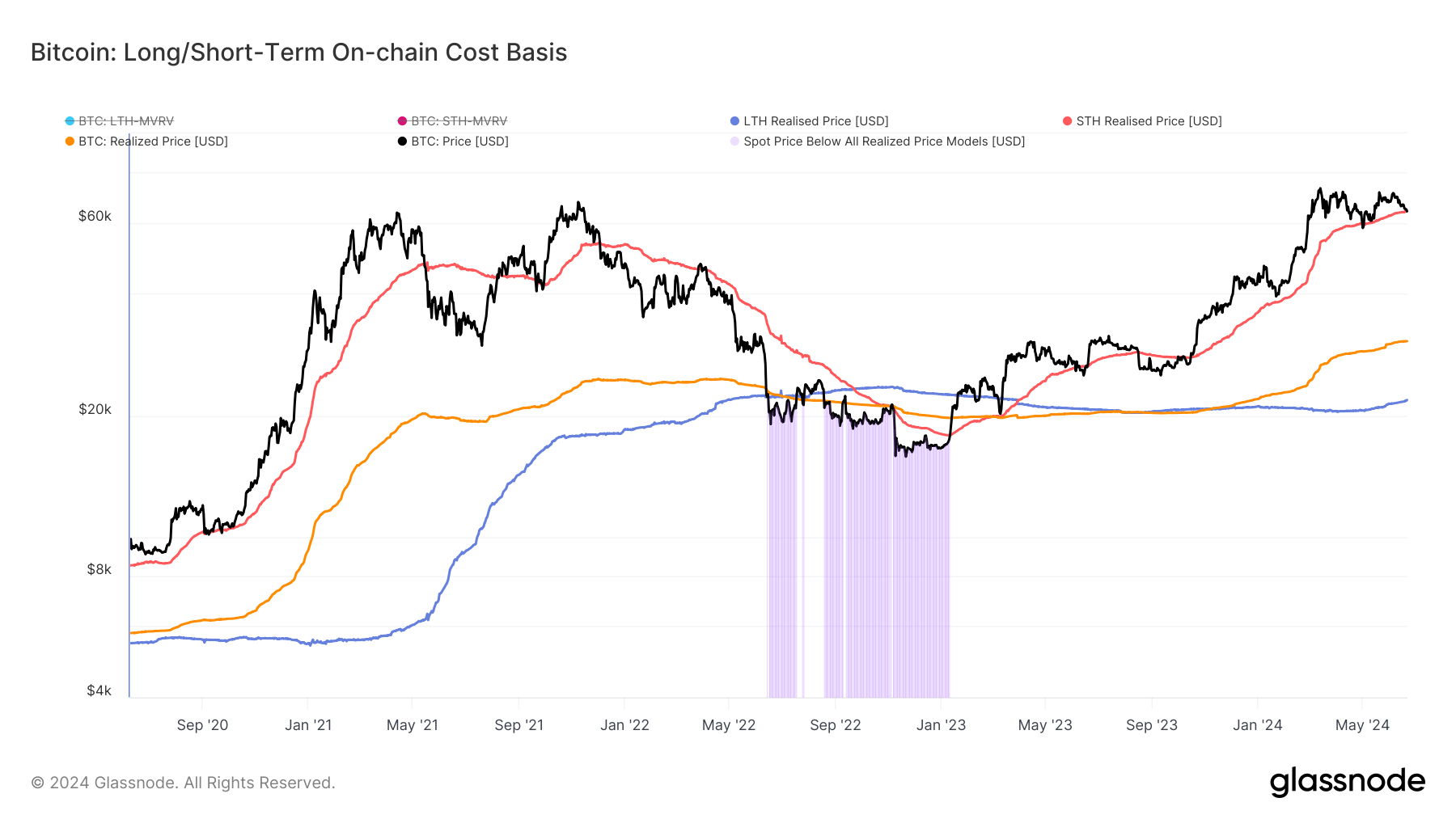

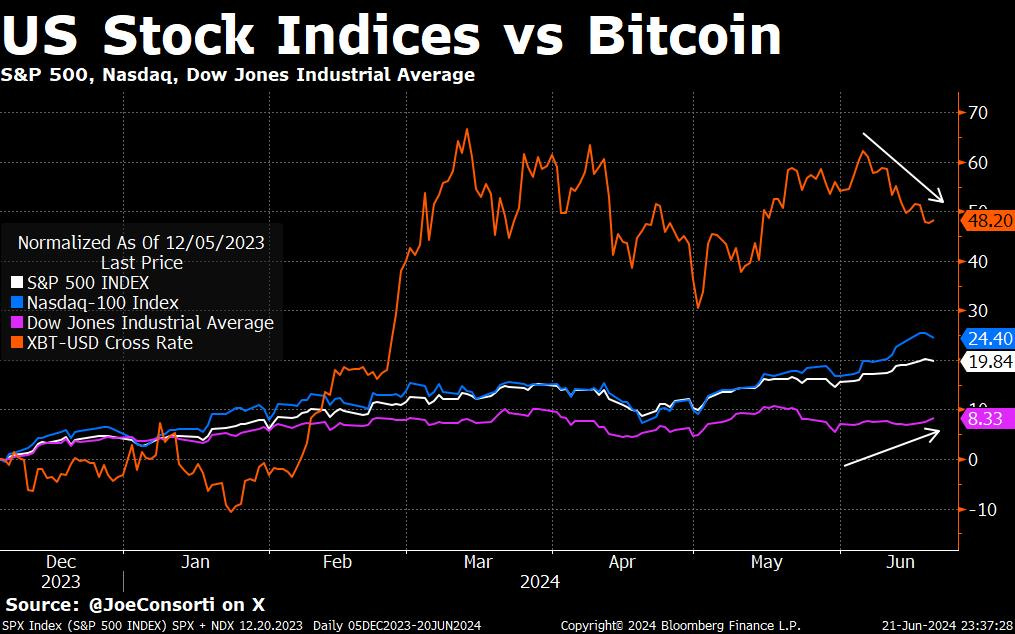

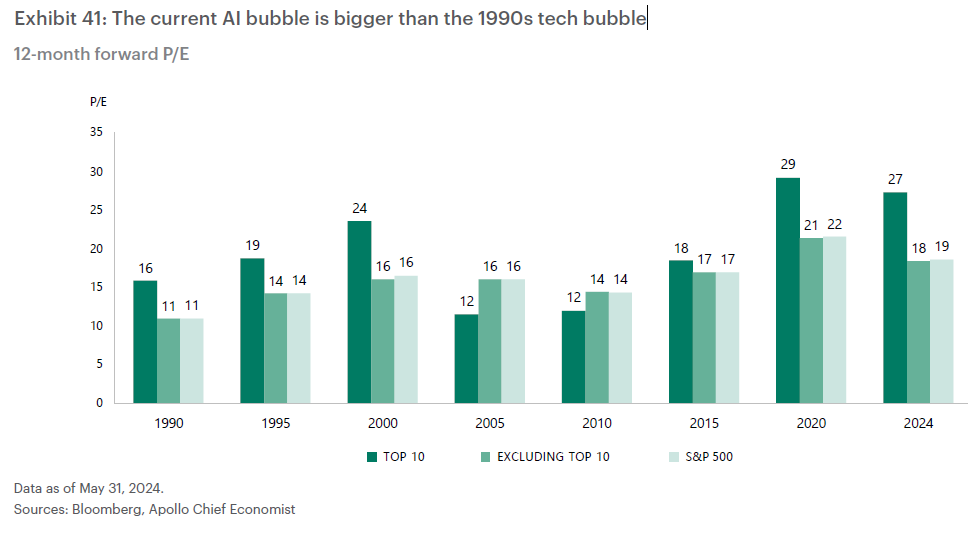

River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Good morning TBL Readers, happy Saturday ☕ Japan’s loosening of yield curve control to let yields rise and strengthen the yen has not worked out in its favor less than 9 months in. By letting go of its perpetual government bond-buying program and allowing yields to rise freely, the goal has been to attract foreign investment into Japan and yen-denominated Japanese assets to strengthen the yen. The yen has not strengthened as a result of Japan’s efforts. In fact, it has now dropped to an over 3-decade low against the US dollar despite JGB yields rising. Japan has stayed in the bond market even after dropping yield-curve control just to ensure stability. It has sold $73.3 billion in gold, SDRs, FX, and foreign-denominated bonds to prop up the Japanese yen since January 1st: These efforts have been in vain, and the yen has still fallen 14%—a lot of wasted money from the Bank of Japan and probable distress from the Ministry of Finance as the yen simply can’t be saved regardless of what the BoJ/MOF does to intervene, and a definite headache for Mrs. Watanabe. Options are running out for JPY, with the USDJPY pair weakening from 140.25 at the start of the year to 159.80 at the time of writing: Zooming out, it’s a one-way trip. USDJPY is within 40 pips of a 34-year low of 160.20: Word on the street is that Japan is taking the yen and falling on its sword to inflate away its debt problem—an accentuated form of what we have here in the United States, where the BoJ owns way more of its own government debt than the Fed does US Treasury debt. By letting the yen depreciate, Japan is effectively reducing the nominal value of its debt. The BoJ’s plan to scale back its bond-buying program further supports this strategy. This move can be seen as a form of voluntary default through inflation, a scenario that other developed countries might face in the future. We are still bullish risk as discussed over the last several weeks, but I’m going to cover another view of what bitcoin is doing right now—purely to weigh both sides, play devil’s advocate, and be probabilistic analysts. Bitcoin has notably underperformed stocks since the start of the month, which we’ll discuss more later. This is atypical of bitcoin, which usually moves with high sensitivity in the direction of the rest of the risk-asset bucket. The other characteristic of bitcoin is that it will often move in advance of broader moves in risk, being the first to signal a trend shift from bullish to bearish and vice versa. Maybe this 3-week period of bitcoin underperforming the stock market isn’t a “malfunction” of BTC, a change in the correlation regime, or due to bitcoin-native post-halving factors: maybe it’s just flashing red for something that may be about to happen all across risk. Long-short positioning in the perpetual futures market is rather neutral by historical standards, with the premium that longs pay shorts at roughly half a basis point every 8 hours. Very little froth either way in perpetual futures, lending to the boring tumult reflected in the price: Bitcoin is sputtering but not quite spiraling, which it will continue to do if bulls don’t step in and firmly establish a floor. The levels at which a floor can be firmly set are $64,000, which is the average network short-term holder purchase price, and the 200d moving average, which is in the low $57,000 area. We didn’t have enough momentum to break out in early June, and now there seems to be little excitement or verve in buyers stepping in to put a firm floor underneath bitcoin here: Zooming out on the spot bitcoin chart and adding in the 200-day simple and exponential moving averages, bitcoin is still $7,000 above key support level #2. We crossed underneath briefly halfway through last year, but this level doesn’t serve as support during bull markets as much as it signals a flip between bull and bear markets when the spot price falls underneath it. A last-ditch level. For now, though, we’re still way up in the clouds. In bitcoin, all it takes is one -7% day to be challenging it: Bitcoin has officially fallen underneath support level #1, the short-term holder cost basis. STH cost basis at the time of writing is $64,370, whereas bitcoin’s price is now underneath it at ~$64,200. We look to see whether or not we spend a material amount of time underneath here and keep chugging downward or bounce back as fairweather buyers look to hold the line at their entry point. For now, the inaction and indifference in spot around this price level is not the most encouraging: The market mantra “sell in May and go away” seems to have only applied to bitcoin so far, so is bitcoin really just foreshadowing what’s to come for the rest of risk? Bitcoin’s role as the last remaining fire alarm, unencumbered from a balance sheet or shareholder duties, may be functioning perfectly. Given that this is an election year, and the stock market is one of the last things in an ever-waning arsenal of pros for the incumbent president, if bitcoin is foreshadowing underperformance all across risk for the rest of the year, we expect that to be swiftly corrected. Our base case is that if this is the explanation for bitcoin’s current tumult, it won’t be long before the powers that be step in to fix it (Fed’s unofficial S&P 500 mandate). Why is bitcoin down this month even as the tech-heavy Nasdaq 100 is absolutely ripping? Post-halving miner capitulation may not be a strong enough catalyst to have caused such a divergence. Therefore, maybe the divergence is explained by bitcoin serving its tried-and-true function as a fire alarm that front runs the rest of risk: Playing probabilities here: as the stock market’s performance gets concentrated in fewer and fewer names, mainly AI, it raises fragility that the rally can sustain itself. Almost like if the engines on a SpaceX rocket failed one by one as it came in to land vertically—you may still be able to stick the landing, but the fragility of that outcome rises as the performance of the rocket’s function is left to fewer and fewer engines that are still operating properly. To say that this isn’t at least a little concerning is disingenuous and irresponsible:

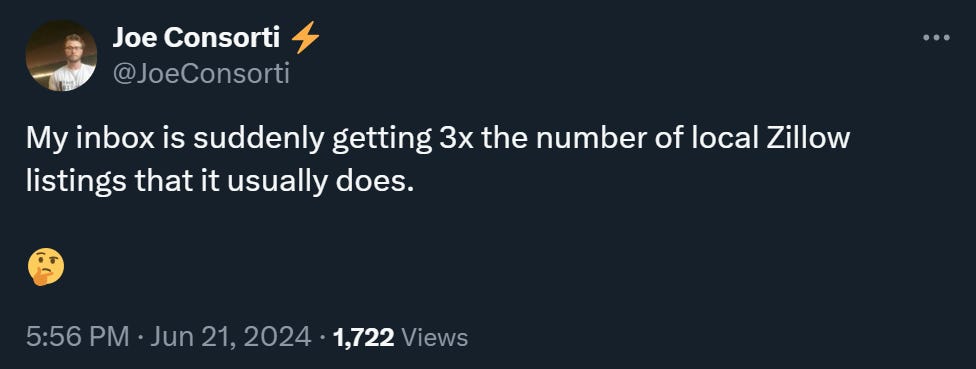

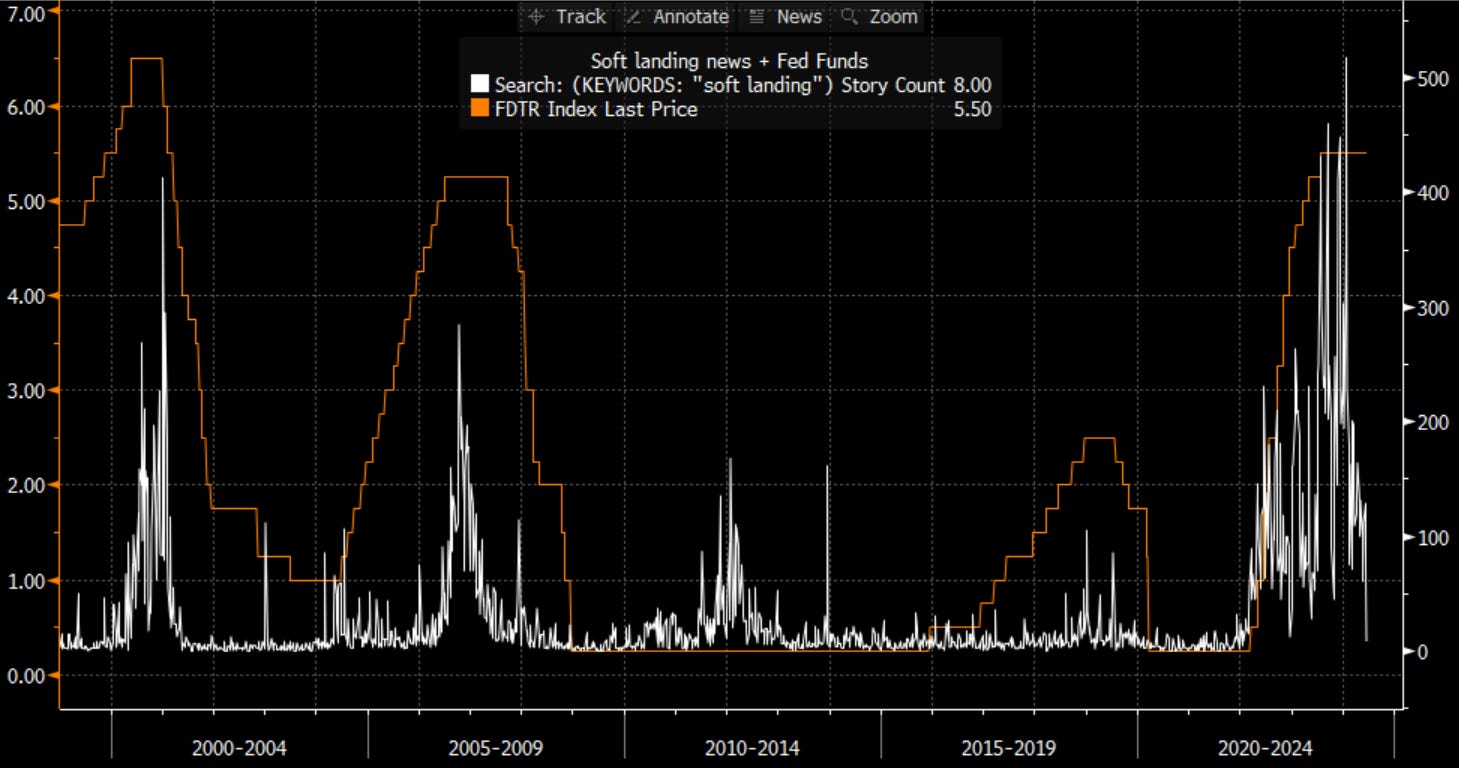

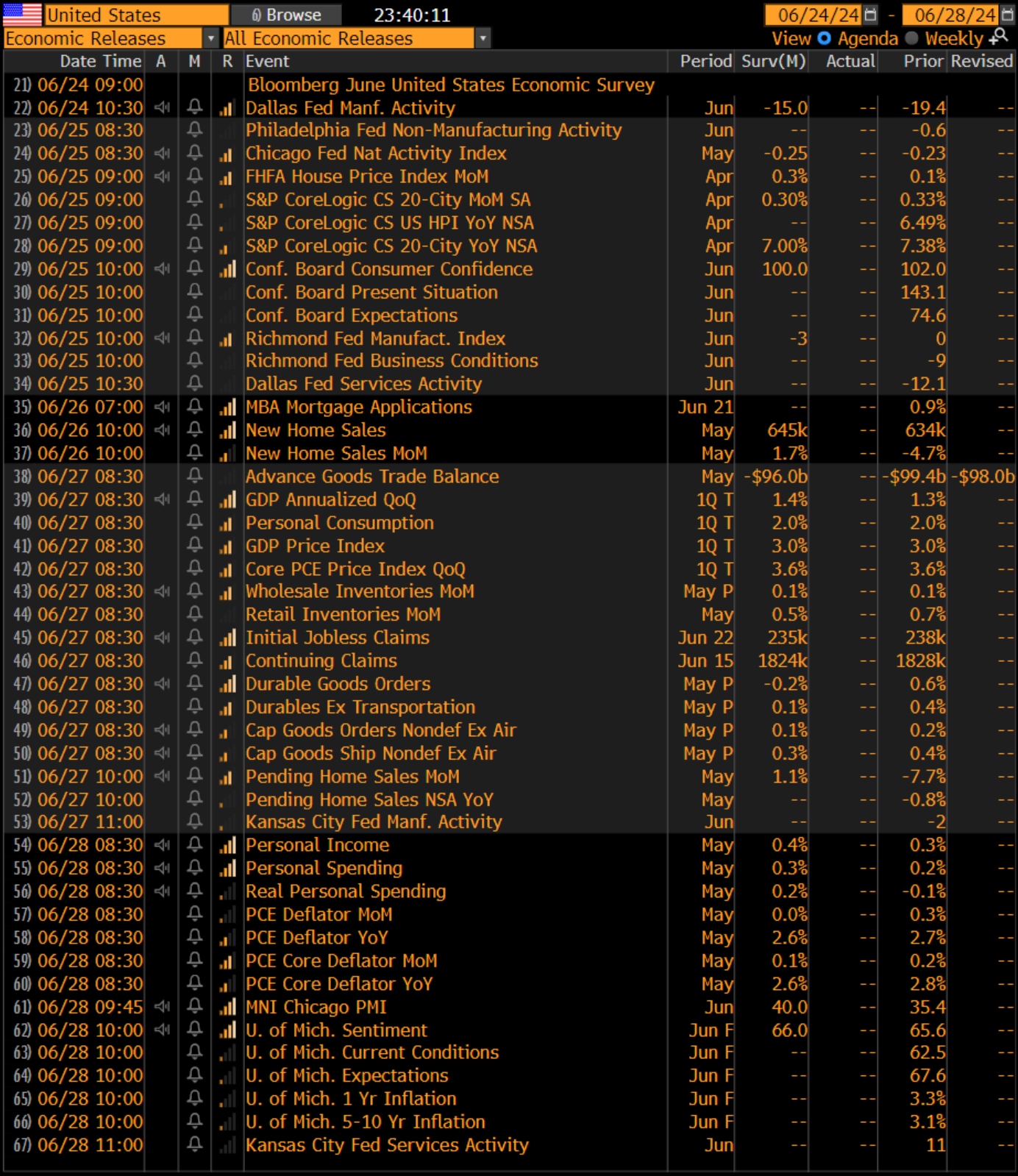

Has the music stopped yet? Absolutely not. But always keep your eye on a chair. A final anecdote before I bid you adieu and pass it off to Nik to wrap our 99th issue of TBL Weekly, the local home listings in my Zillow inbox have been coming in more frequently than usual. Further, I’m noticing plenty of these homes coming in with asking prices that are pretty big haircuts on their market estimate. Existing home sales haven’t plummeted, and listings aren’t soaring either, but you’ve seen the for sale signs and so have we. Anecdotes lead data, so we’ll see how this plays out: Soft-landing headlines have dropped to zero. I don’t even need to say it: Next Week with NikIt’s not just Joe’s Zillow alerts—I am spending an inordinate amount of time in the Redfin Data Center. Weekly and monthly data across listings, price drops, and inventory age have my attention, as I’m seeing the enormous spike in listings building up into a seasonal pattern that could spell trouble for residential real estate sellers. I cannot unhear, no matter how hard I try, Jerome Powell firmly admitting that spot rents falling has contributed to his opinion that the Fed should start cutting rates soon on inevitable shelter disinflation. This is the new trend: Redfin > Nonfarm Payrolls, from an economic analysis perspective, of course. A housing problem, whether mini-crash or crisis, would be incredibly material on the path of inflation and US economic growth, as well as the response mechanisms from the fiscal and monetary side. All jokes aside, this is why we are watching housing so closely. Next week brings month-end drama, and we’re here for it. With some very large Treasury auctions in the front end of the yield curve and settlement at the end of the week, dealers will have their hands full in balancing that with the end of the first half of 2024. We’ll have our eyes not just on SOFR, but any repo rates that might print slightly north of the Fed’s corridor (5.5%). A genuine test of ample reserves. From an economic perspective, we aren’t necessarily fascinated by anything next week. Personal spending/income and weekly jobless claims probably hold the most weight, while we’ll be picking apart some of the other series for signal. Speaking of which, does anybody know what day Redfin will update June 2024 total nationwide listings? If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month. Want TBL Pro for your entire company? Email us at corporate@thebitcoinlayer.com for company-wide subscriptions. Here are some quick links to all the TBL content you may have missed this week: TuesdayBitcoin did not break above $80,000. The setup and the market structure were there, but the momentum to push bitcoin above its 3-month descending channel, past the low-$70,000 range, and up beyond new all-time highs never came to fruition. Today, we’re going to take a look at bitcoin-native activity within ETFs, on-chain, and price action using candlesticks. Then we take a look at Goldman Sachs’ bold 6,300 end-of-year target for the S&P 500, and the conditions the market needs to get there. Check out—Getting a lay of the land In this video, Joe walks through why bitcoin did not break above the low-$70,000 range despite having the setup for it. He talks about what's next for bitcoin as it approaches a key support level called Short-Term Holder Realized Price (STHRP). STHRP has served both as a floor for bitcoin to bounce off of during prior bull runs, but also as confirmation of a downtrend if bitcoin makes a sustained moved below it. You won't want to miss this episode. Check out—Bitcoin Approaching A KEY Support Level... Will It Bounce Or Break?  WednesdayIn this episode, Nik answers a question from the audience about bitcoin's purpose on our hectic financial world. We present the case for bitcoin as a tool for wealth preservation. By comparing bitcoin to money, currency, commodities, properties, and assets, we conclude that bitcoin's most valuable characteristic is helping people achieve deflation in a highly inflationary world. Nik discusses bitcoin and equity correlation, $100 trillion in global bank assets, and presents incredible charts on assets priced in BTC. Check out—Bitcoin Preserves Wealth  ThursdayOn Monday, we’ll debut our new quantitative weekly report. In addition to returns, prices, technical levels we’re watching across asset classes, and a summary of our overarching narratives, the report will include a new Bitcoin Indicator. It won’t be easy, and it certainly can’t be advertised to have any predictive power, but our mission is now to synthesize our framework around bitcoin’s size, global position, and growth potential with movements in the global financial system into a high-signal quantitative metric. Today’s letter is about the building blocks of this new Bitcoin Indicator, available to TBL Pros. Check out—Building the ultimate Bitcoin Indicator In this episode, Nik is joined by Marathon Digital Holdings CEO Fred Thiel. Fred shares details surrounding the company's historical bitcoin mining agreement with the Kenyan government, skillfully describes the global energy landscape in the AI era, and details why bitcoin is a revolutionary force in the future of energy consumption. Heating homes in Finland, anaerobic digestion of methane, and the global deficiency of electricity transmission are also discussed. Check out—Bitcoin Is REVOLUTIONIZING Energy Consumption Worldwide  FridayIt’s Thinking time. This week we turn to India. More specifically, we cover if India will help the US to tech victory over China, J.P. Morgan’s $40 billion investment in Indian bonds, and Bloomberg’s analysis on India becoming the next global growth driver. Projections are that in less than 15 years, India’s economy will be larger than China’s. TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy. Check out—TBL Thinks: India to Overtake China by 2037 Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! That’s all for our markets recap—have a great weekend, everyone! River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, June 22, 2024

JPY at 34-Year Lows & Bitcoin May Be Sending a Warning: TBL Weekly #99

Subscribe to:

Post Comments (Atom)

Popular Posts

-

gm Bankless Nation, ETH hit three-year highs today as it popped above $4,100 and we're feeling good. Now, let's dig into s...

-

gm Bankless Nation, the era of Gary Gensler is almost over and Trump made his pick today for his SEC replacement. We've got th...

-

Zoomers' retirement accounts may be in trouble ...

-

Bitcoin On-Chain Activity Report, November 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment