The full post is available to paid members — enjoy a free preview of today’s content! China and Canada cut rates, watching the US repo market for troubleThe surprise rate cut in China demonstrates weakness, while the SOFR market is heating up. How we're thinking about Treasury repo rates.Dear Readers, This week, Canada cut rates in an expected move, while China cut rates by more than the usual amount on a day that wasn’t scheduled. It might be safe to conclude that easy financial conditions within US markets isn’t applicable abroad. Conditions that cause central banks overseas to start cutting rates aggressively might be creeping into corners of the repo market as well, but I don’t want to make any unsupported claims. We present data from around the world of markets, discuss bitcoin’s trading range, and think about some extreme downside scenarios for the economy while contemplating what it might mean for stocks and bitcoin. Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. TBL ProIf you already are a paying subscriber:

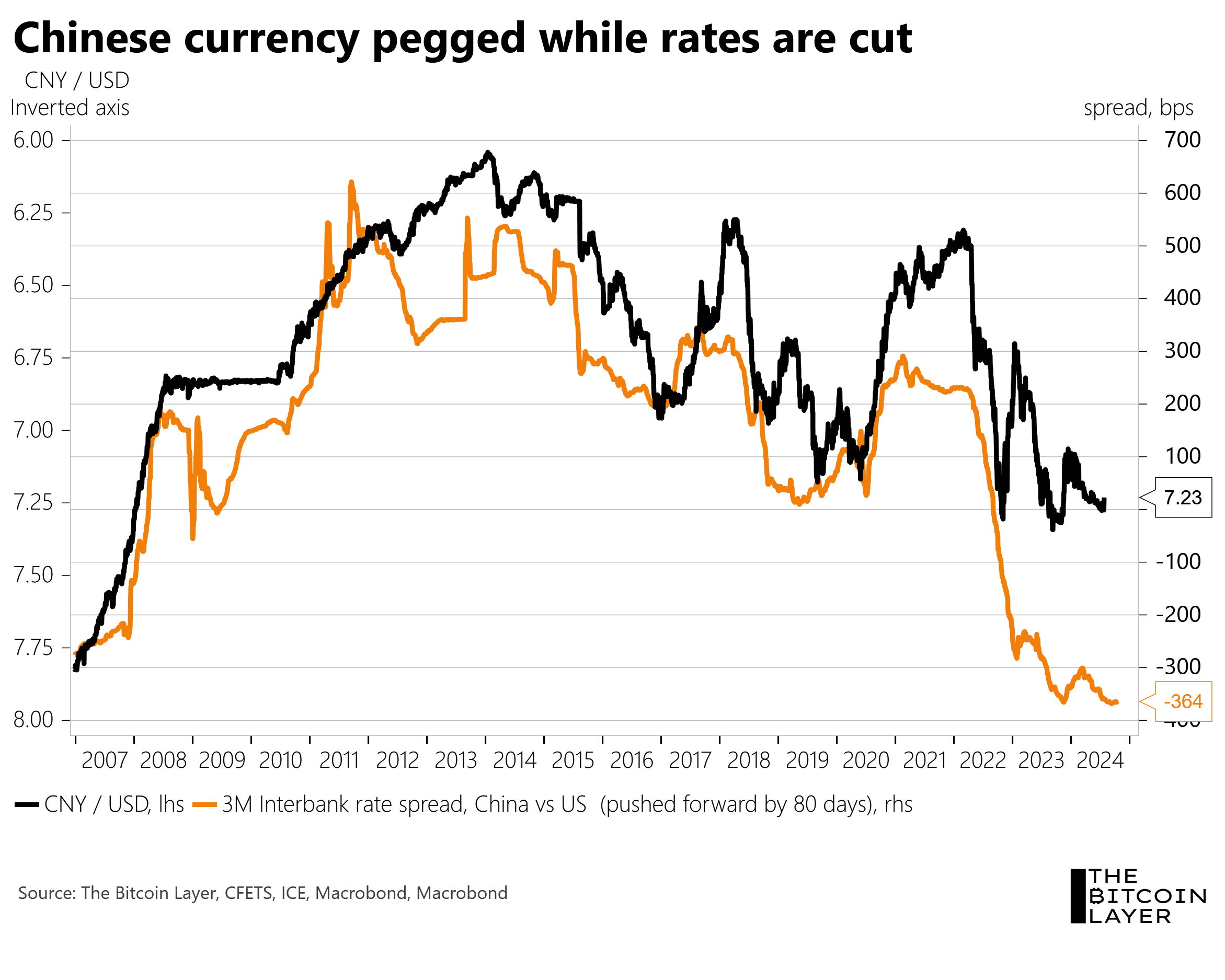

Take the opportunity now to lock in your lifetime price before we raise prices to $499/year! China cuts rates in a surprise moveGenerally, interest rate differentials are the primary drivers of currency rates. For example, if there is an investor with $1 million looking for safe interest, he or she can view the available yields across the world’s government bonds and invest in the highest-yielding one. Dollars will be sold for that foreign currency in order to purchase the bond, so the dollar will weaken on that trade. Apply this to financial markets at large, and you see currencies weaken (or strengthen) when their central banks cut (or hike) rates. That is largely what happened over the past few years as the Fed raised US interest rates—the dollar strengthened. Taking this currency economics 101 to the USD/CNY pair, we should expect that drastic Chinese rate cuts in the face of stable US rates should send the Chinese currency lower. In the following chart, I show in orange US-China interest rate differentials (China with a rate currently 3.64% less than the US rate) should be sending CNY (shown in black with inverted axis) much weaker, to the range of 7.75-8.00. Of course, this is just one overlayed chart and not an actual model, but the Chinese Communist Party has made a policy decision to not let its currency weaken as of yet. Currency flows are likely going against CNY as it floods into dollars, gold, and bitcoin to avoid the coming deval, but the CCP is doing its best to keep the peg. If you suppress something buoyant underwater for long enough, it’ll eventually burst back above the surface—we feel the same way about the dollar relative to the Chinese yuan. This is essentially a recipe for disaster. Keep your eyes open for a large Chinese devaluation at some point, but don’t listen to anybody that isn’t a CCP member too closely on what to expect. It’s a fool’s errand to predict China’s moves. The same cannot be said about the Fed, who does its best to tell us exactly what they will do several months in advance... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, July 26, 2024

China and Canada cut rates, watching the US repo market for trouble

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momen...

-

Plus $200 off! ...

-

Tweeting will now get you points from Kaito. And they'll probably airdrop tokens to the point holders. This pr...

-

gm Bankless Nation, Trump has promised to fire Gary Gensler on day one. What could a pro-crypto SEC look like? ...

No comments:

Post a Comment