The full post is available to paid members — enjoy a free preview of today’s content! Dear Readers, Bitcoin continues to charge ahead after its first near-30% correction this cycle. Understand our risk outlook in today’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. Don’t forget to register for our next Virtual Q&A, scheduled for this Thursday, July 25th—link for July’s Zoom is below. Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. You might have heard we are raising prices, but this does not affect you if you already are a paying subscriber:

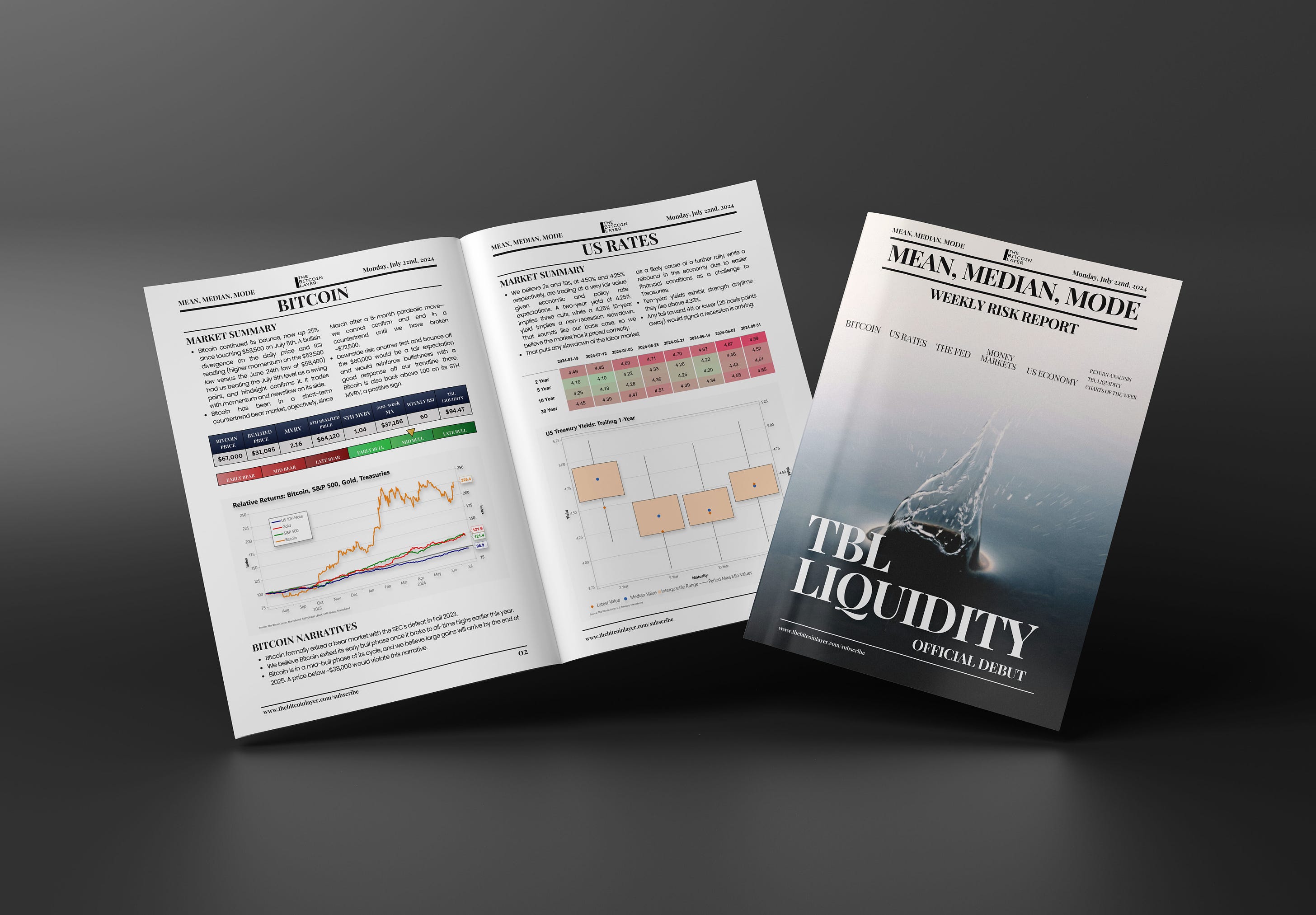

Take the opportunity now to lock in your lifetime price before we raise prices to $499/year! In this week’s version, we present a statistical analysis on our new TBL Liquidity metric. Here is Mean, Median, Mode—your weekly bitcoin & global macro risk report. Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Monday, July 22, 2024

Mean, Median, Mode: July 22nd, 2024

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momen...

-

Plus $200 off! ...

-

Tweeting will now get you points from Kaito. And they'll probably airdrop tokens to the point holders. This pr...

-

gm Bankless Nation, Trump has promised to fire Gary Gensler on day one. What could a pro-crypto SEC look like? ...

No comments:

Post a Comment