Welcome to the Friday edition of the Ecoinometrics newsletter. Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets. Today we'll cover:

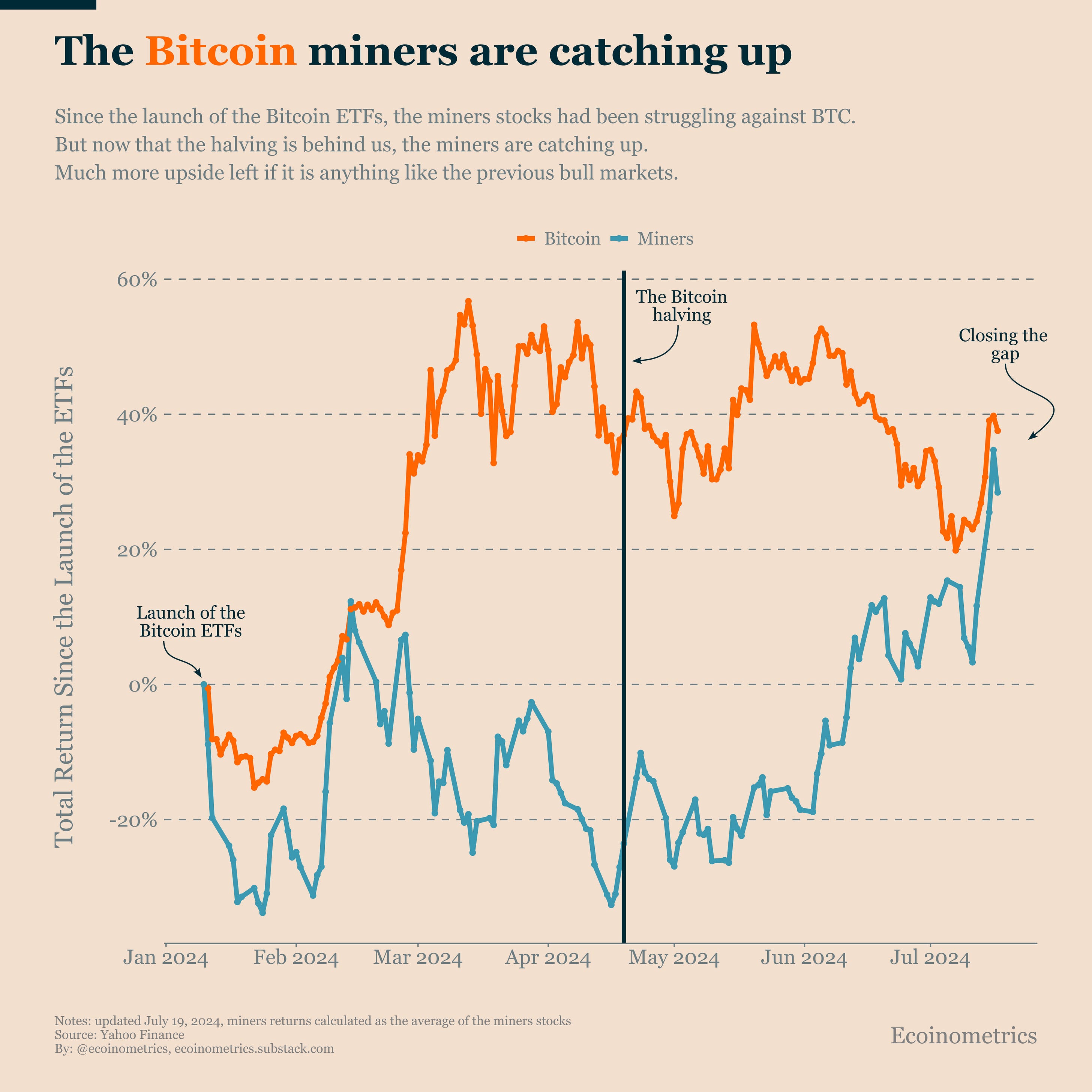

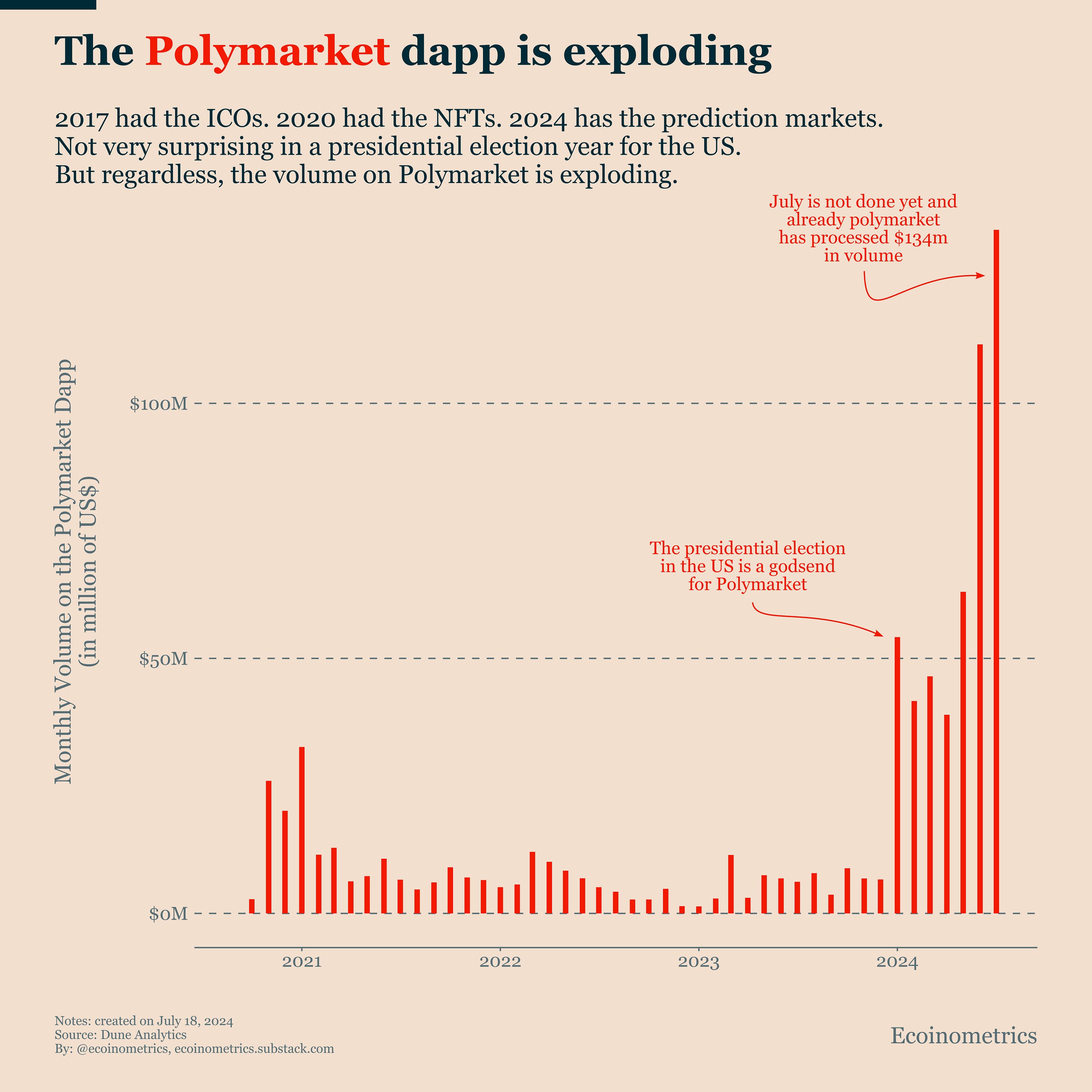

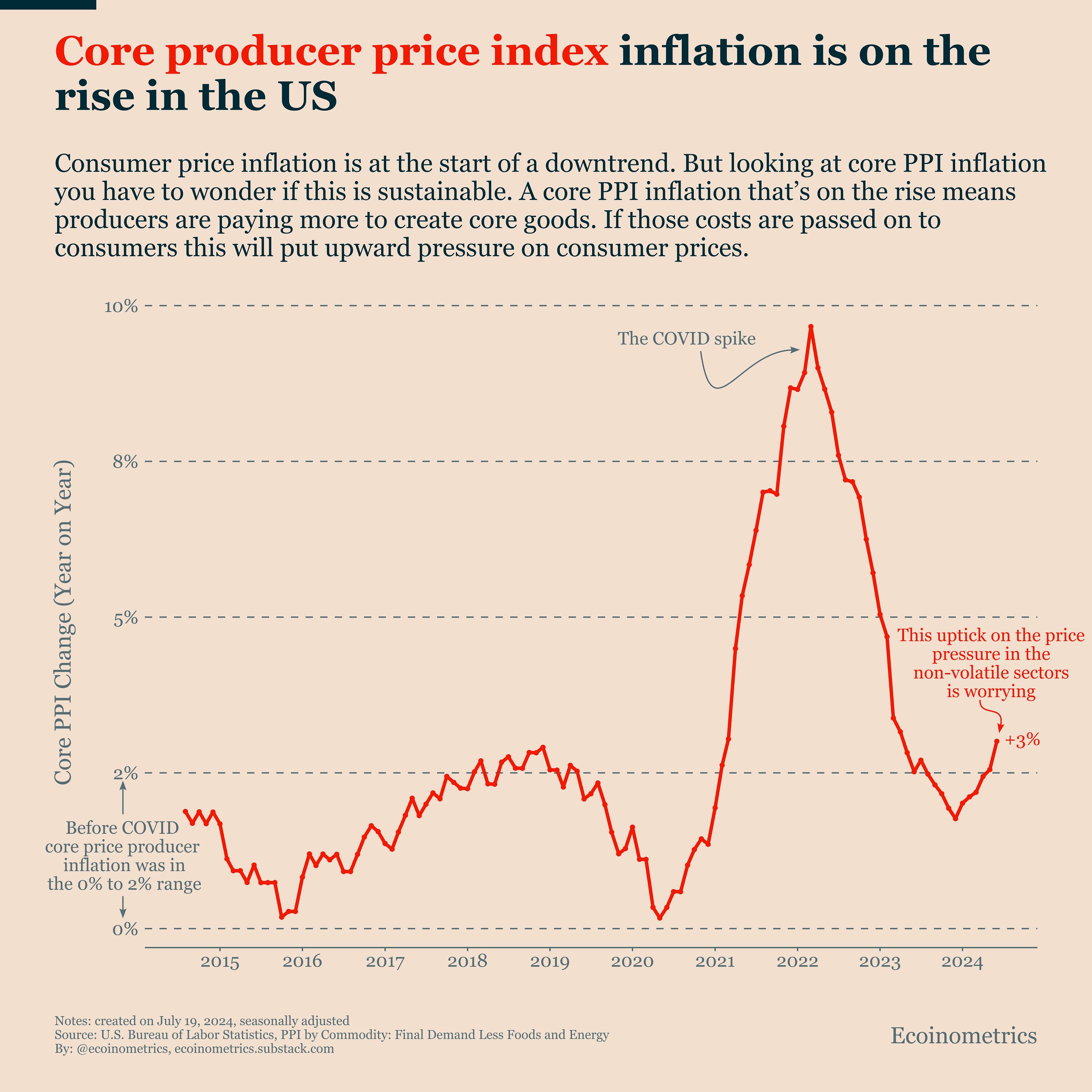

Each topic comes with a small explanation and one big chart. So let’s dive in. In case you missed it, here are the other topics we covered this week: If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox: The return of the Bitcoin minersI don't want to jinx it but the Bitcoin miners are making a comeback. After the launch of the Bitcoin ETFs the miners stocks got left behind. BTC had this giant leap to a new all-time high but the miners absolutely missed it. And it’s not like they just lagged behind. All the way until after the halving the poor performance of the miners continued. But it seems things have changed now. As we are getting away from the halving the situation for the miners becomes clearer. And in just a couple of months they have managed to close the gap. That has been our bet for a while. Now let’s see if they manage to even outperform Bitcoin on its next leg up. The rise of PolymarketIf you have been in crypto long enough you have seen everything. Like in 2017 we had the ICOs boom. In 2020 we had the rise of NFTs. And it seems that in 2024 we might be getting the year of the prediction markets. At least that's what it looks like when you plot the evolution of the monthly volume going through the Polymarket dapp (running on Ethereum). With the presidential election in the US in 2024, Polymarket is managing to ride a massive trend of political bets. So far July (which is not even done yet) is their best month ever with $134m worth of bets processed. Now, the big question is whether or not this trend will collapse after the elections are over... The obstacle to inflationIf we go by the positive data of the last couple of months, inflation seems to be on a new path. After a year of being stuck on a plateau, it looks about to start a phase of decline. Obviously, that's what everyone is waiting for, especially at the Federal Reserve. But there's a problem. The Core Producer Price Index inflation is rising sharply. This means that the cost of producing core goods and services is on the rise. Typically, when this happens, producers pass on the costs to consumers. That's why, unless consumers start to consume less (which would be bad news for the U.S. economy), they are likely to spend more. In other words, inflation could be prevented from starting a downtrend. This is something to keep an eye on. That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts. Cheers, Nick P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics. Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets. Armed with those insights you can make better investment decisions. Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, July 19, 2024

The return of the Bitcoin miners

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momen...

-

Plus $200 off! ...

-

Tweeting will now get you points from Kaito. And they'll probably airdrop tokens to the point holders. This pr...

-

Last day to take advantage of special pricing for Bankless Premium Feed and Bankless Citizenship ...

-

gm Bankless Nation, Trump has promised to fire Gary Gensler on day one. What could a pro-crypto SEC look like? ...

No comments:

Post a Comment