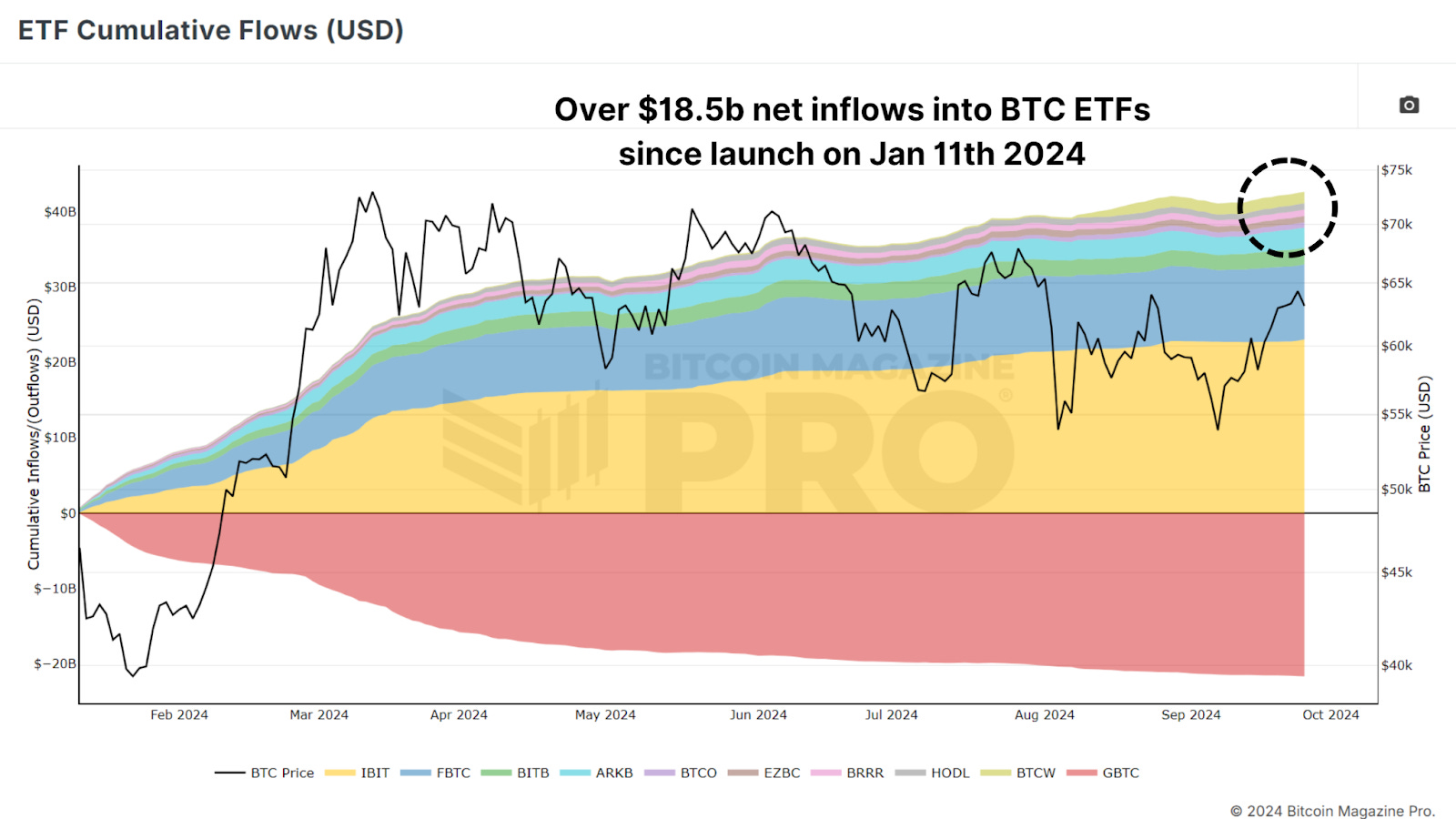

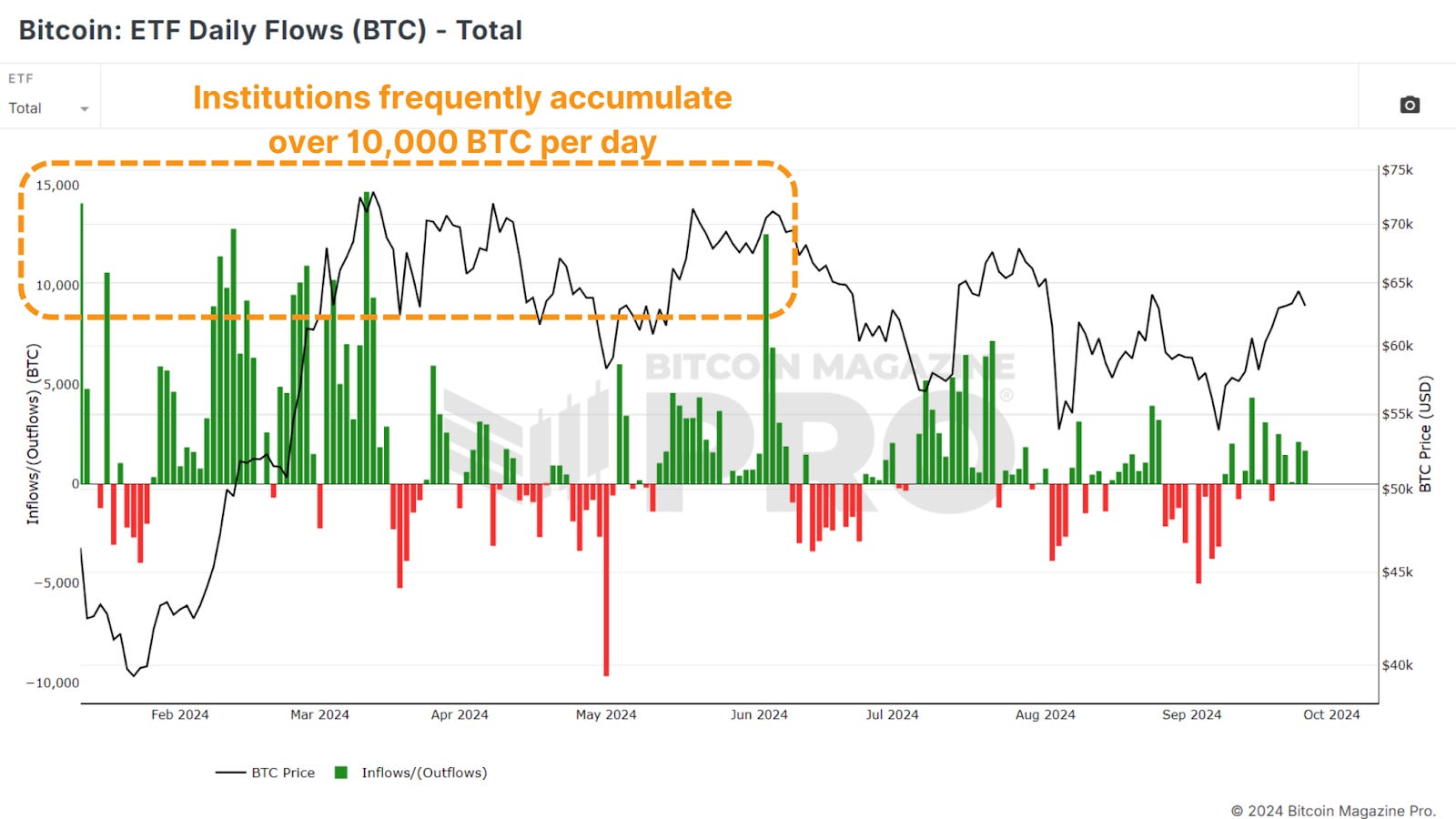

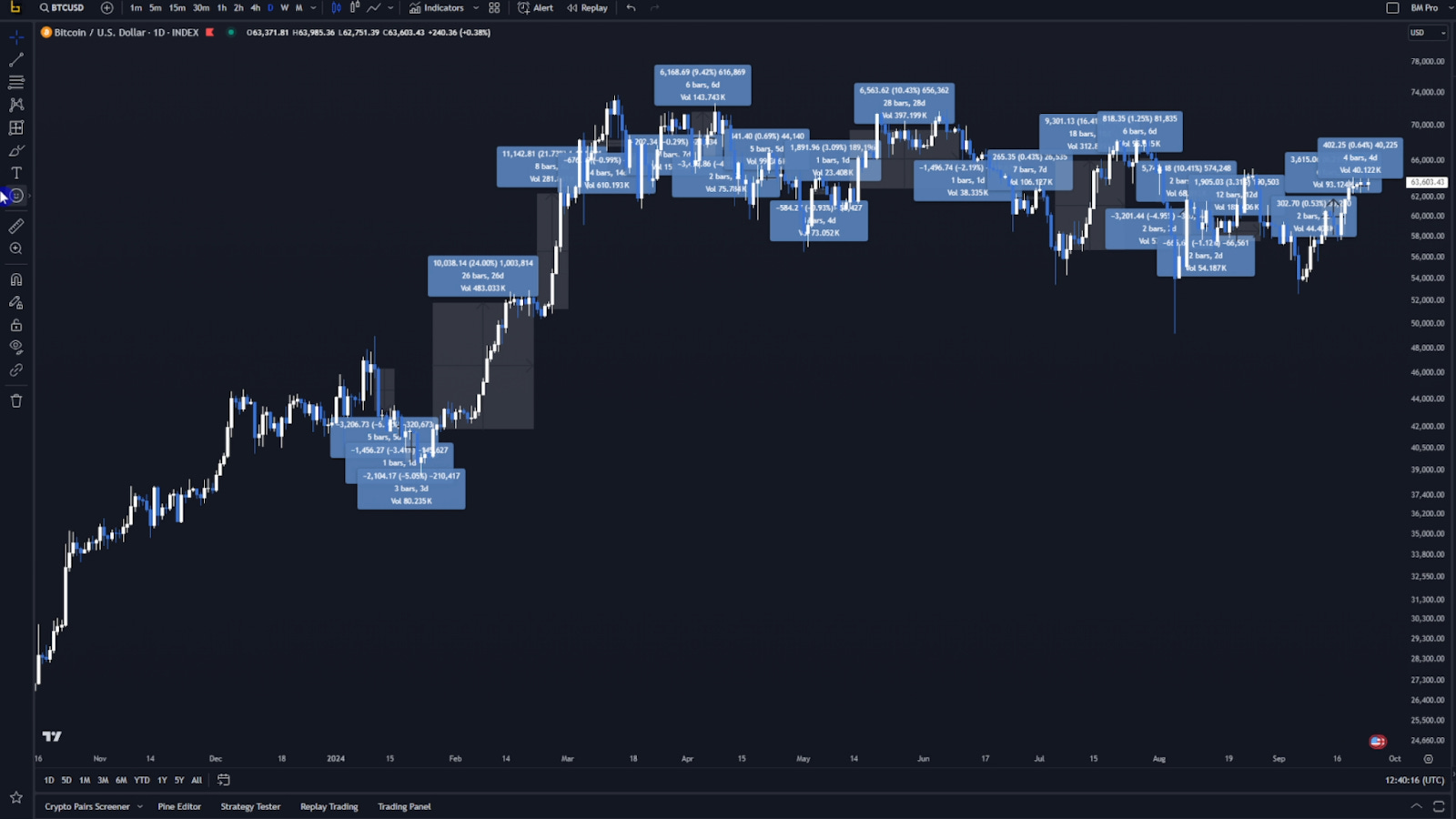

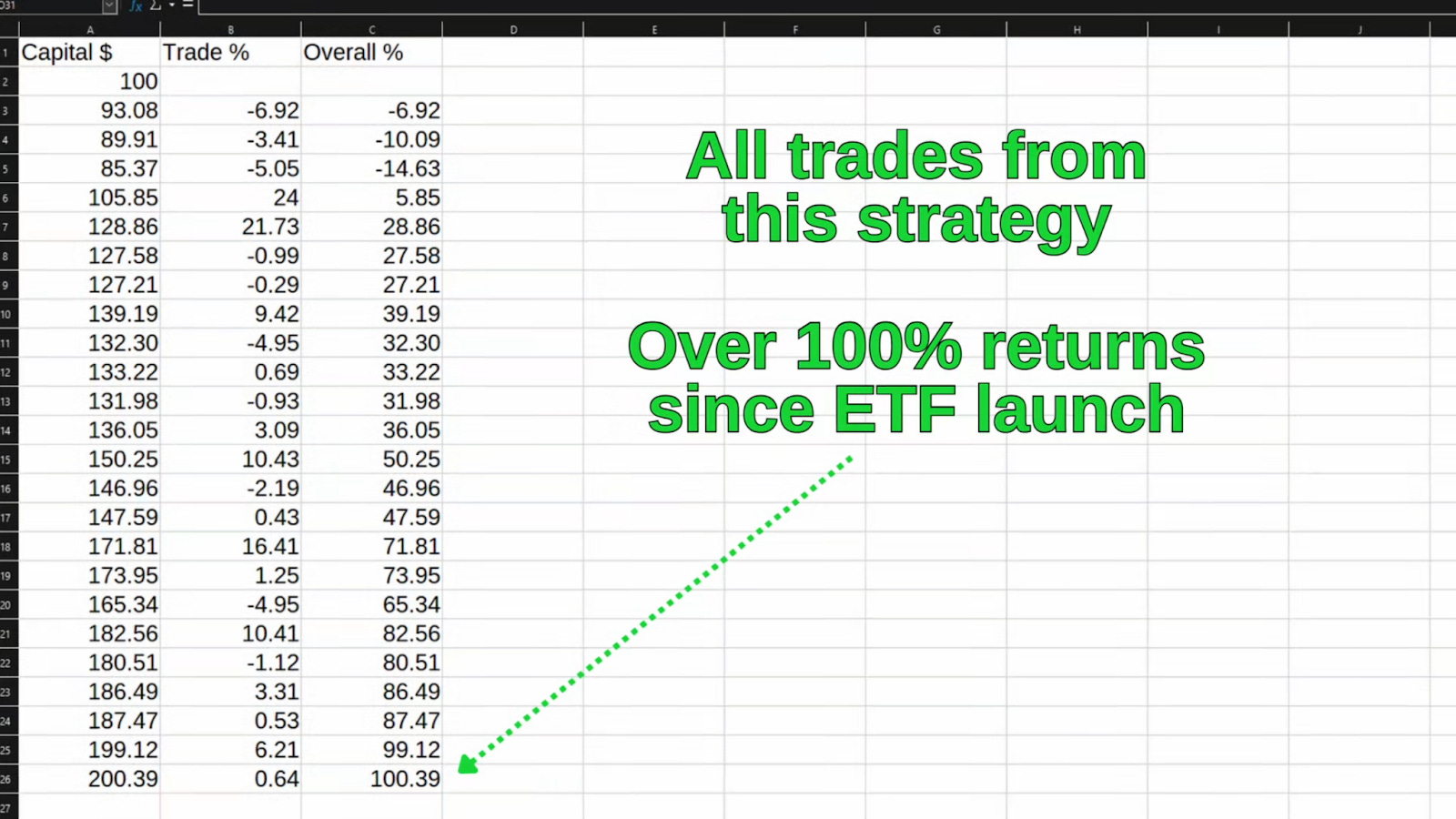

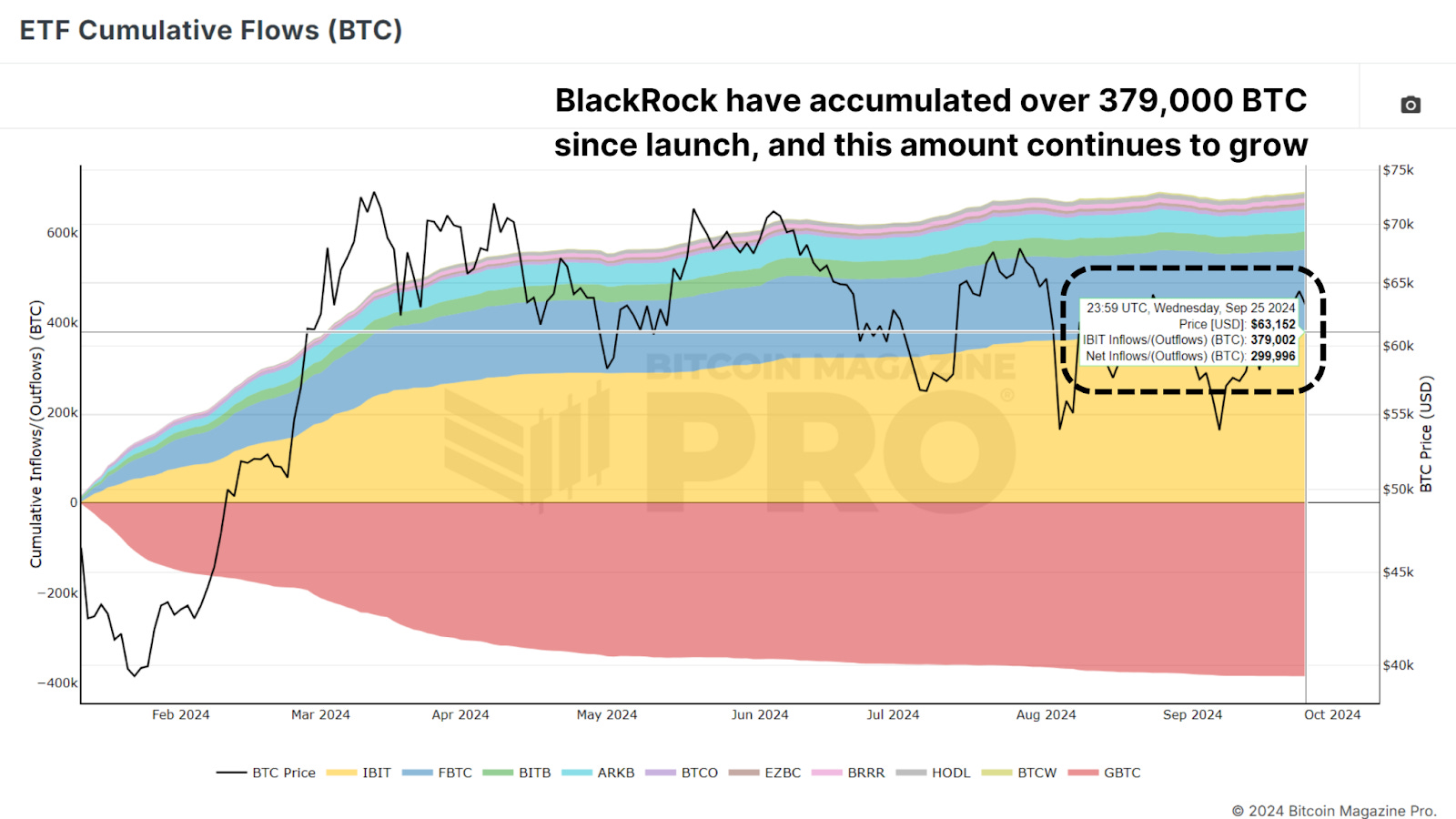

Maximizing Bitcoin Gains with ETF DataOutperforming Bitcoin: A Simple ETF Data Strategy for Higher Returns 🚀Maximizing Bitcoin Gains with ETF DataSince the introduction of Bitcoin Exchange Traded Funds (ETFs) in early 2024, Bitcoin has reached new all-time highs, with multiple months of double-digit gains. However, as impressive as this performance is, there's a way to significantly outperform Bitcoin's returns by utilizing ETF data to guide your trading decisions. Bitcoin ETFs and Their InfluenceBitcoin ETFs, launched in January 2024, have quickly amassed large amounts of Bitcoin. These ETFs, tracked by various funds, allow institutional and retail investors to gain exposure to Bitcoin without directly owning it. These ETFs have accumulated billions of USD worth of BTC, and tracking this cumulative flow is essential for monitoring institutional activity in Bitcoin markets, helping us gauge whether institutional players are buying or selling. Figure 1: BTC ETF Cumulative Flows (USD) have surpassed $18.5b. ETF daily inflows denominated in BTC indicate that large-scale investors are accumulating Bitcoin, while daily outflows suggest they are exiting positions during that trading period. For those looking to outperform Bitcoin's already strong 2024 performance, this ETF data offers a strategic entry and exit point for Bitcoin trades. Figure 2: BTC ETF Daily Flows (BTC) show regular accumulation of over 10,000 BTC per day. A Simple Strategy Based on ETF DataThe strategy is relatively straightforward: buy Bitcoin when ETF inflows are positive (green bars) and sell when outflows occur (red bars). Surprisingly, this method allows you to outperform even during Bitcoin's bullish periods. This strategy, while simple, has consistently outperformed the broader Bitcoin market by capturing price momentum at the right moments and avoiding potential downturns by following institutional trends. Figure 3: Each trade following this institutional inflow/outflow strategy. The Power of CompoundingThe real secret to this strategy lies in compounding. Compounding gains over time significantly boosts your returns, even during periods of consolidation or minor volatility. Imagine starting with $100 in capital. If your first trade yields a 10% return, you now have $110. On the next trade, another 10% gain on $110 brings your total to $121. Compounding these gains over time, even modest wins, accumulate into significant profits. Losses are inevitable, but compounding wins far outweigh the occasional dip. Since the launch of the Bitcoin ETFs, this strategy has provided over 100% returns during a period in which just holding BTC has returned roughly 37%, or even compared to buying Bitcoin on the ETF launch day and selling at the exact all-time high, which would have returned approximately 59%. Figure 4: Over 100% compounded gains since ETF launch following this strategy. Can Further Upside Be Expected?Recently, we’ve begun to see a sustained trend of positive ETF inflows, suggesting that institutions are once again heavily accumulating Bitcoin. Since September 19th, every day has seen positive inflows, which, as we can see, have often preceded price rallies. BlackRock and their IBIT ETF alone have accumulated over 379,000 BTC since inception. Figure 5: BlackRock alone has accumulated over 379,000 BTC in just a few months. ConclusionMarket conditions can change, and there will inevitably be periods of volatility. However, the consistent historical correlation between ETF inflows and Bitcoin price increases makes this a valuable tool for those looking to maximize their Bitcoin gains. If you’re looking for a low-effort, set-it-and-forget-it approach, buy-and-hold may still be suitable. However, if you want to try and actively increase your returns by leveraging institutional data, tracking Bitcoin ETF inflows and outflows could be a game-changer. For a more in-depth look into this topic, check out a recent YouTube video here: Using ETF Data to Outperform Bitcoin [Must Watch] Matt Lead Analyst Bitcoin Magazine Pro.  Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! 🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, September 27, 2024

Maximizing Bitcoin Gains with ETF Data

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hello guys and welcome to my blog, I tried to find one working faucet collector crack and here it is. Just download this crack, install d...

-

Advances in both cryptography and cryptocurrency have made possible a new kind of "techno-democracy" ...

-

Zoomers' retirement accounts may be in trouble ...

-

Bitcoin On-Chain Activity Report, November 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

The Paris Olympics start today, but the AI Olympics have been in full-swing all week. ...

No comments:

Post a Comment