Bitwise’s new ETF product: Bitcoin + Treasuries RotationBreaking Barriers: Bitcoin's Fight to Surpass the 200-Day Moving AverageToday’s headlines:

$BTC is currently trying to break above technical resistance of its 200-day moving average. This follows two failed breakouts in late August and late September. Bitcoin price is currently pressing up against the 200DMA in the $63,500 area. Figure 1: Bitcoin attempting to break above the 200DMA. Should a sustained breakout occur, it would further add to the positive price action for Bitcoin over the past month, which is up +12.72% Figure 2: Bitcoin's price has been climbing in the past month. News You Need to Know

The Big StoryBitwise Futures Bitcoin ETF: Bitcoin & Treasuries Strategy Bitwise Asset Management has announced that it is going to adapt its existing Bitcoin futures ETF product, ‘Bitcoin Strategy Optimum Roll ETF’ to incorporate US Treasuries as well as Bitcoin. The adjustment is intended to help reduce volatility risk while still allowing investors to benefit from Bitcoin price appreciation. The intended strategy will involve using technical analysis to determine whether the fund should move allocation out of Bitcoin and in to US Treasuries. It will use indicators such as the 10-day exponential moving average and the 20-day exponential moving average. Strategy overview:

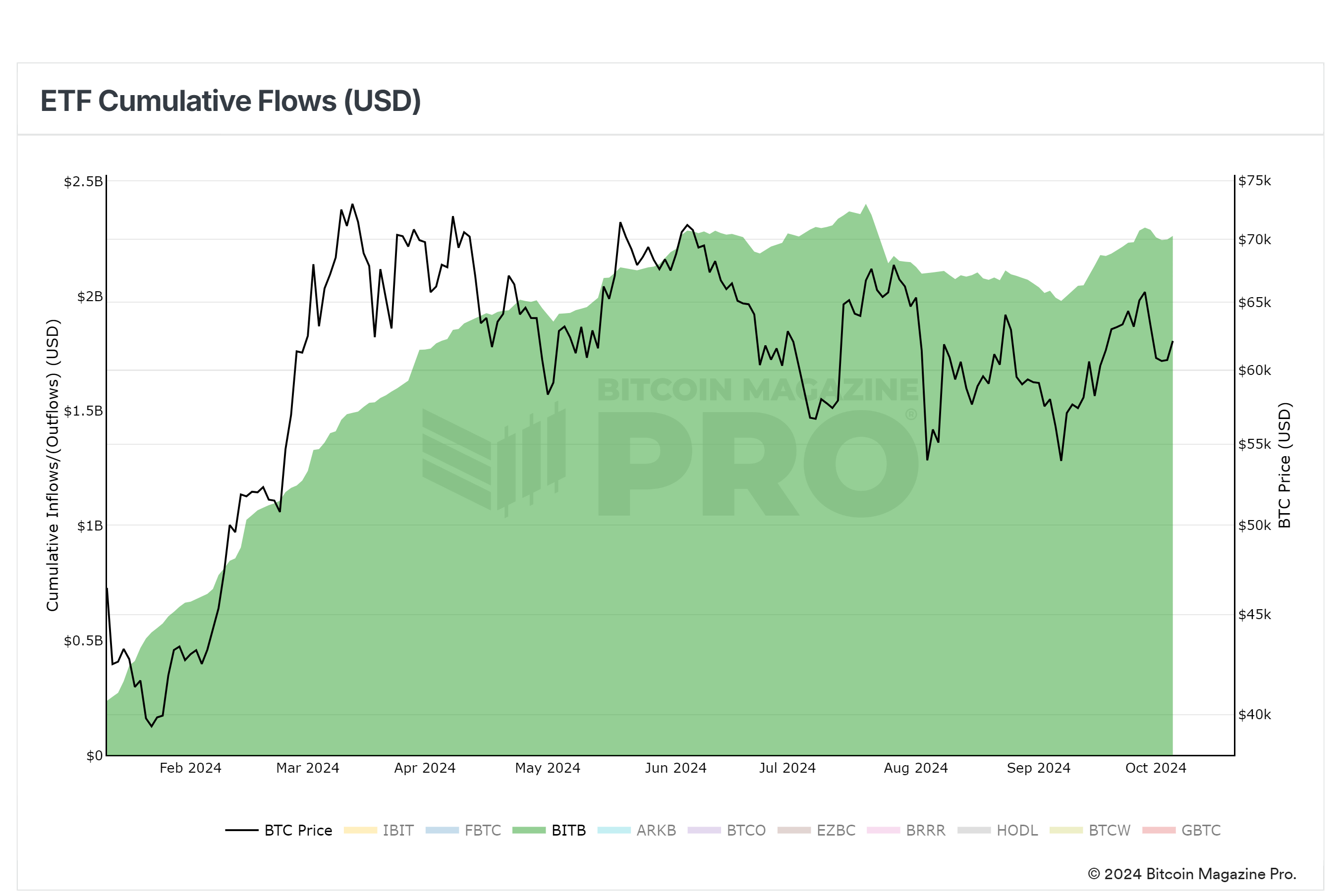

As shown in the chart below, the 10-day EMA is currently trending ABOVE the 20-day EMA. Figure 3: Bitcoin’s 10-day EMA and 20-day EMA. Bitwise will hope that this new dynamic product will provide an alternative solution to its already popular spot Bitcoin ETF product, appealing to investors who are nervous about Bitcoin’s downside risks. To date the Bitwise spot ETF has achieved more than $2.2B worth of inflows. Figure 4: Bitwise Bitcoin spot ETF ‘BITB’ inflows since launch at +$2.2B. The new futures Bitcoin ETF from Bitwise incorporating the dynamic Bitcoin and Treasuries strategy will go live on 3 December 2024. Key ChartEach week, our BM Pro Analysts hand-pick a must-see chart for you. This week: Bitcoin Block Height Figure 5: Bitcoin Block Height. What it is

Why this matters

What's happening now

This chart is available for Bitcoin Magazine Pro subscribers to view here. If you haven’t subscribed yet, you can here. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! 🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, October 7, 2024

Bitwise’s new ETF product: Bitcoin + Treasuries Rotation

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Advances in both cryptography and cryptocurrency have made possible a new kind of "techno-democracy" ...

-

Crypto's about to go mainstream in a big way this weekend ...

-

MegaETH is a performance focused L2. Last week, they flipping the script on crypto fundraising. ...

-

Dinocoins like XRP and ADA are mooning ...

-

Plus, airdrops continue to take flight in April ...

No comments:

Post a Comment