Bitcoin cycles & gauging market temperature: TBL Weekly #120Welcome to TBL Weekly #120 — grab a coffee, and let’s dive in.Good morning Readers! Welcome to TBL Weekly #120 — grab a coffee, and let’s dive in. From now until November 27th, get 30% off your first year as a TBL Pro member and enjoy:

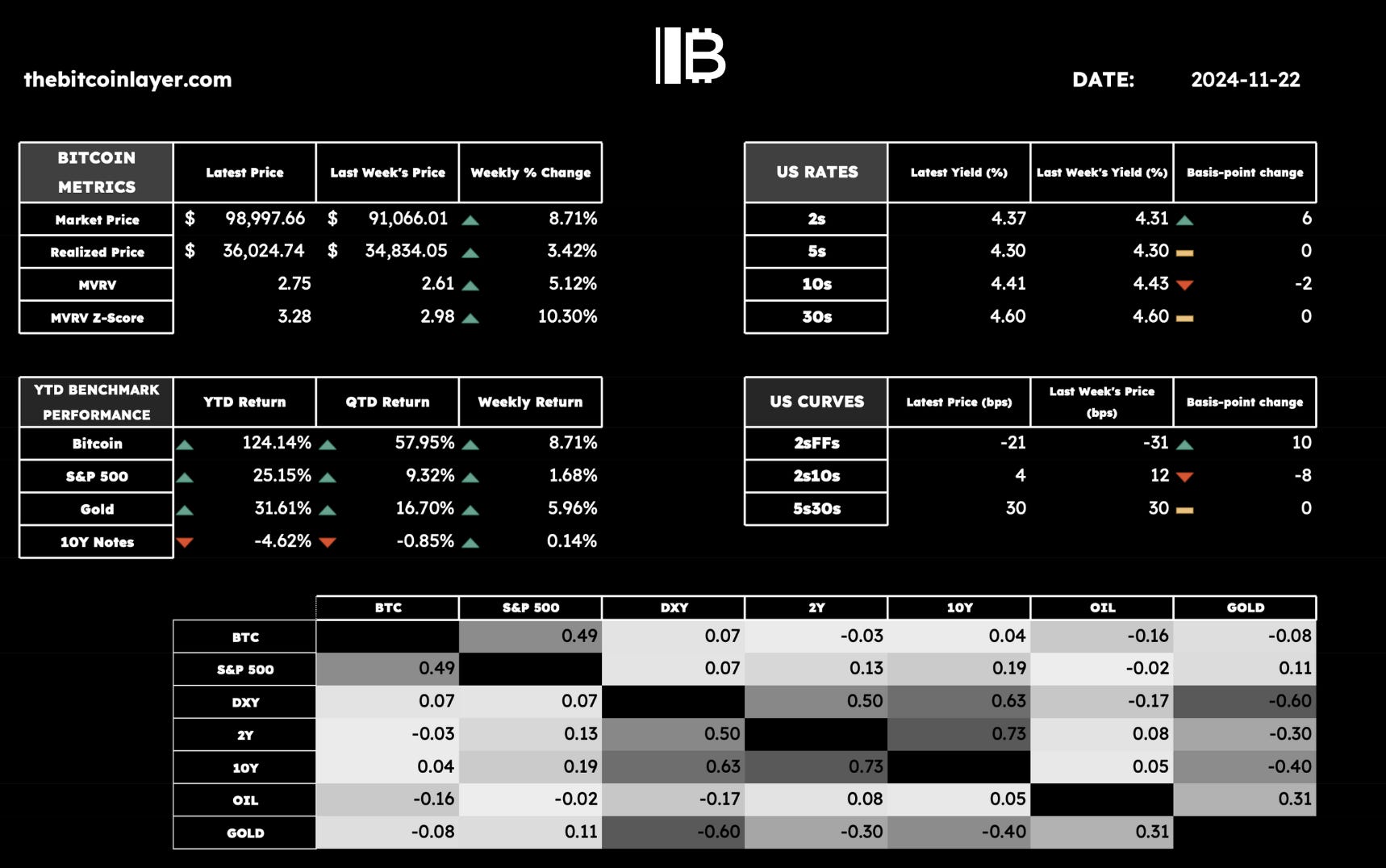

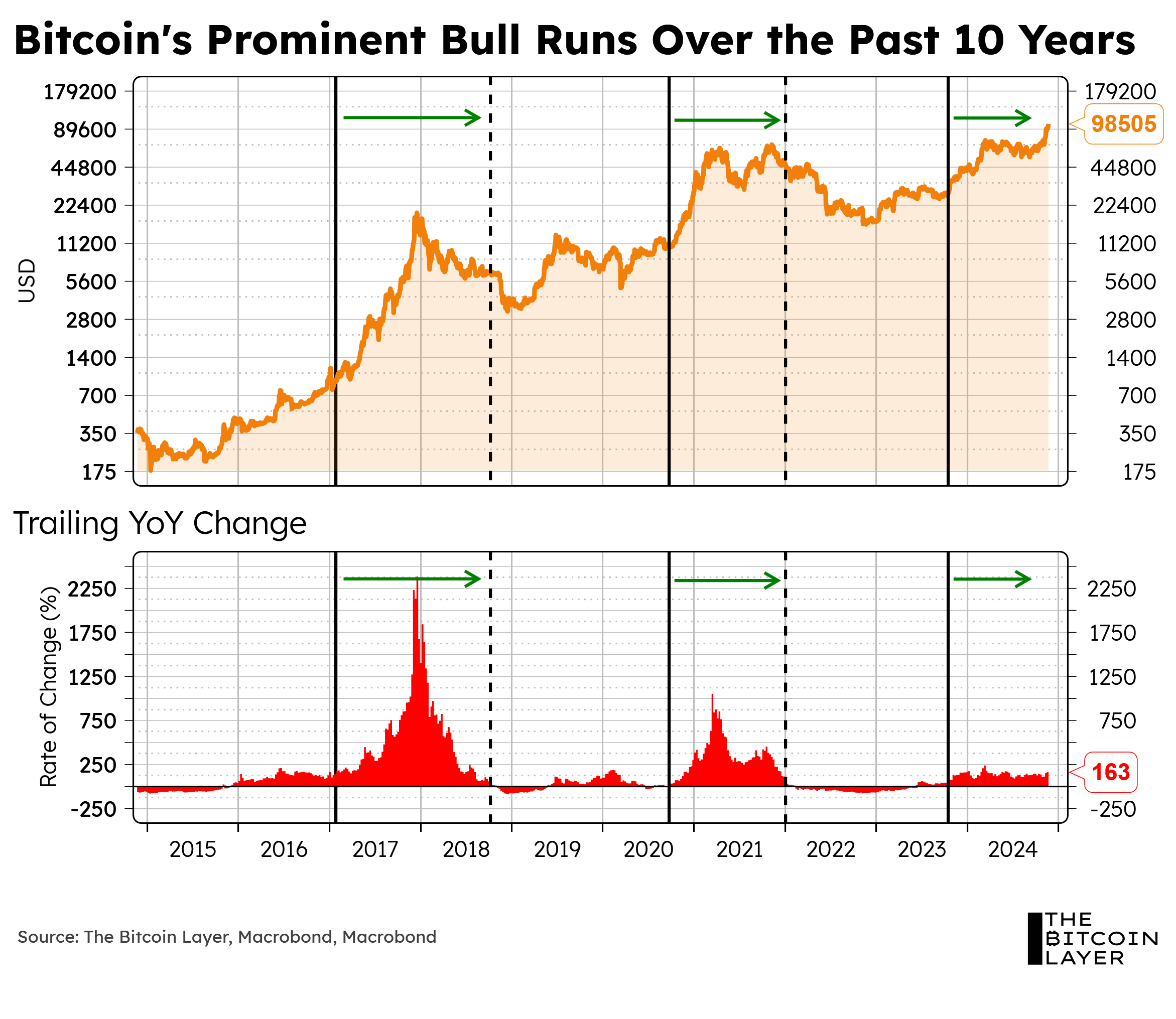

Looking forward to meeting all our new TBL Pro members! Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year. Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order? If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul. Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way. With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: Weekly MonitorWeekly AnalysisAs bitcoin’s latest—and incredibly majestic—bull run keeps pushing our own psychological and greedy limits, everyone in your family is probably asking you, “Should I sell now and wait for the next pull-back to buy some more?” In today’s Weekly, we travel backward in time to see how today’s bull-run environment compares to previous ones, and perhaps gain some understanding that enables us to remain cool amidst this seemingly hot hand we all find ourselves experiencing. Let’s start with a chart: Looking at the chart above, we used a trailing YoY change in bitcoin’s price to identify bull runs. In the bottom pane of the chart, we visually selected periods where red mountains were most prominent, meaning YoY growth was strong. Having found at least two candidate periods for this comparative analysis (2017 – 2018 & 2020 – 2021), we can now look at the usual TBL points of analysis at each point in time:

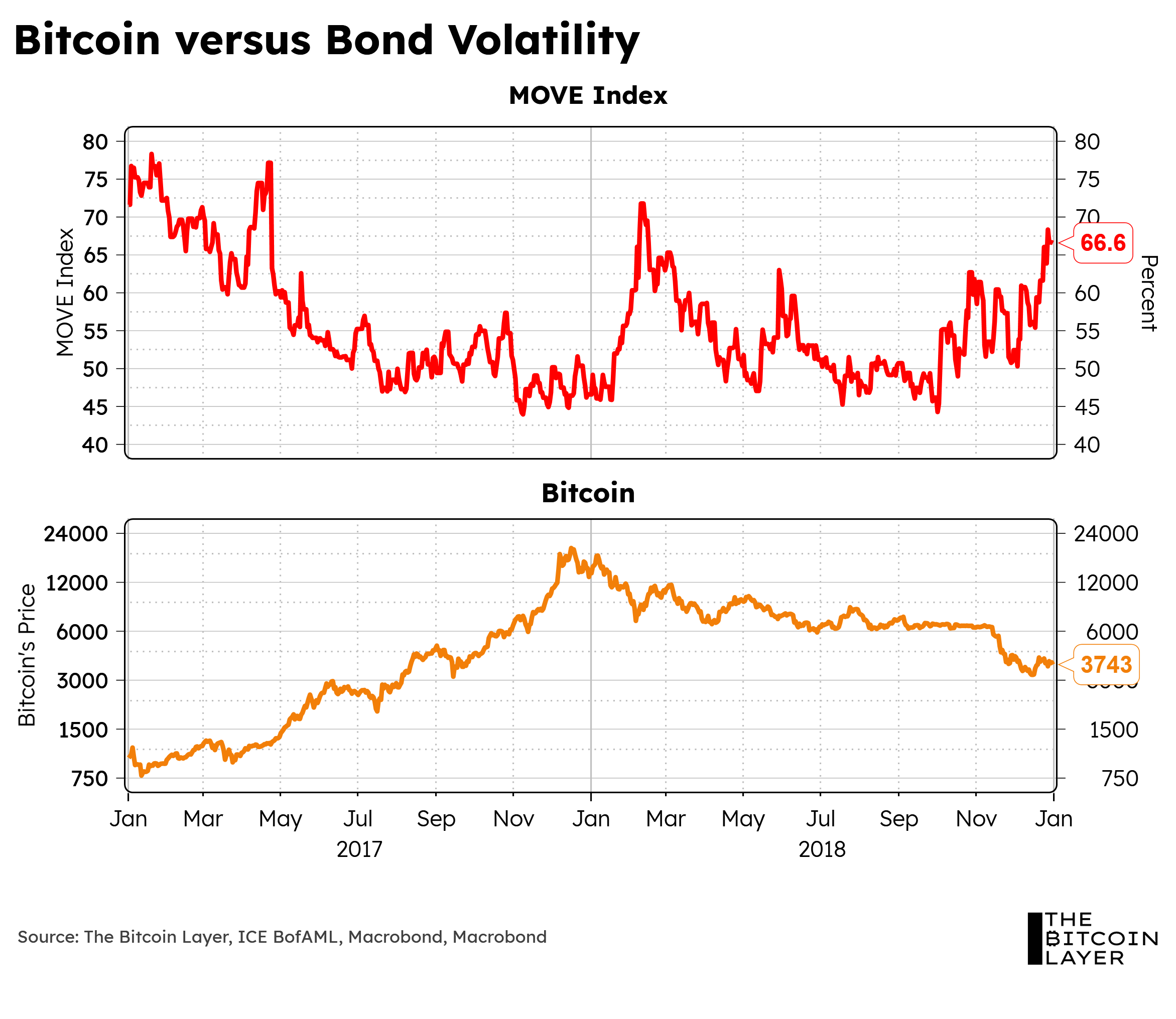

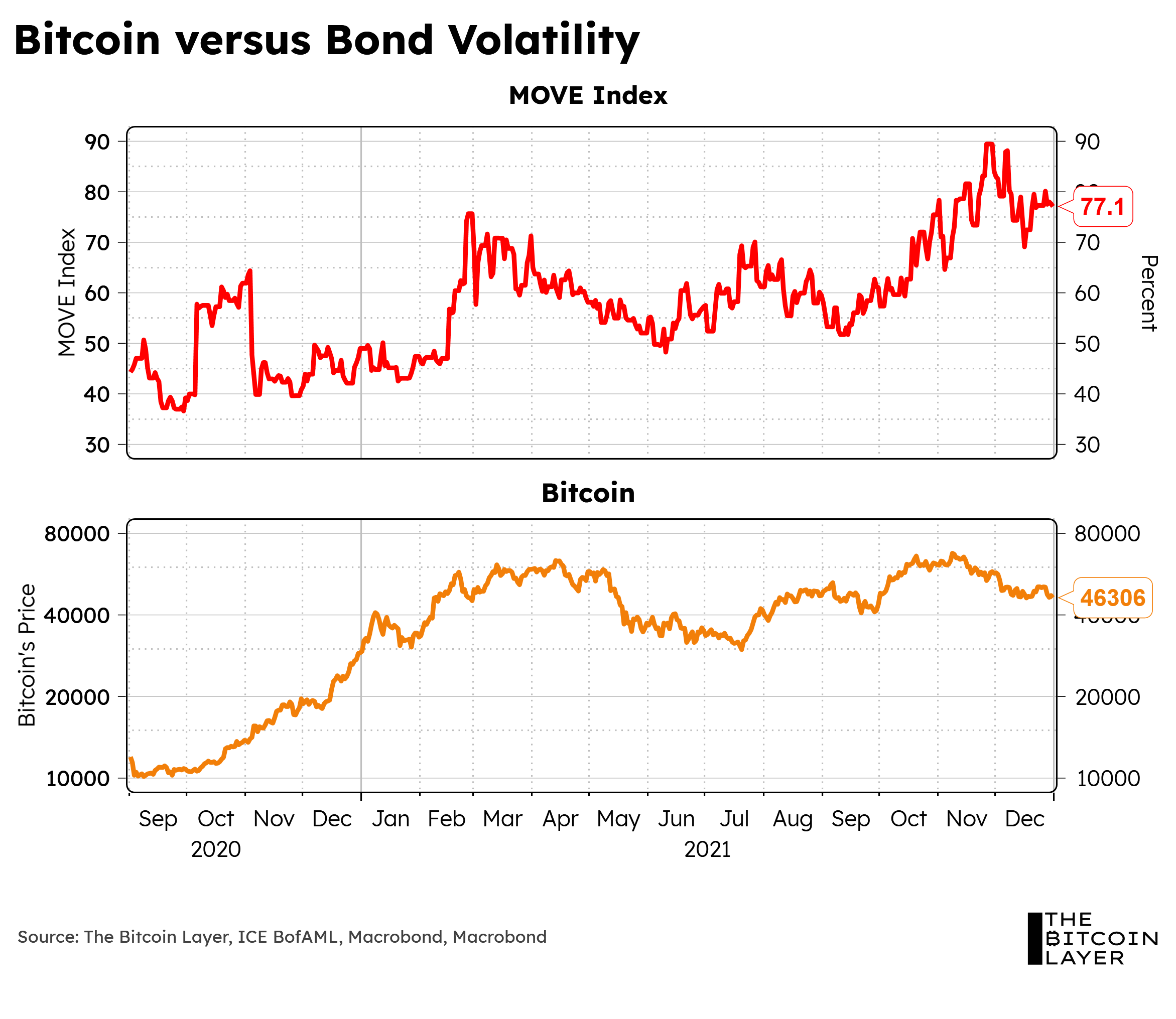

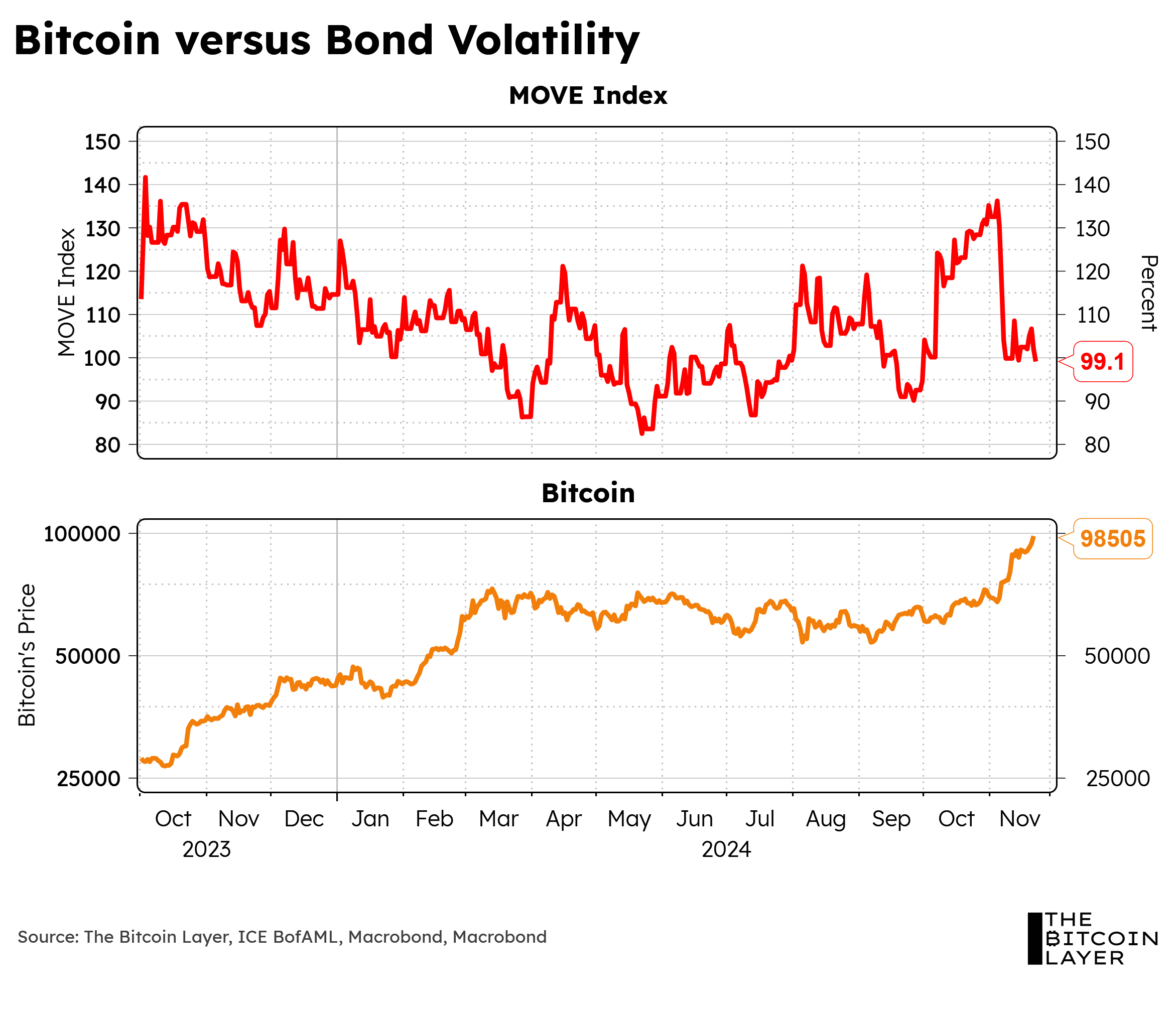

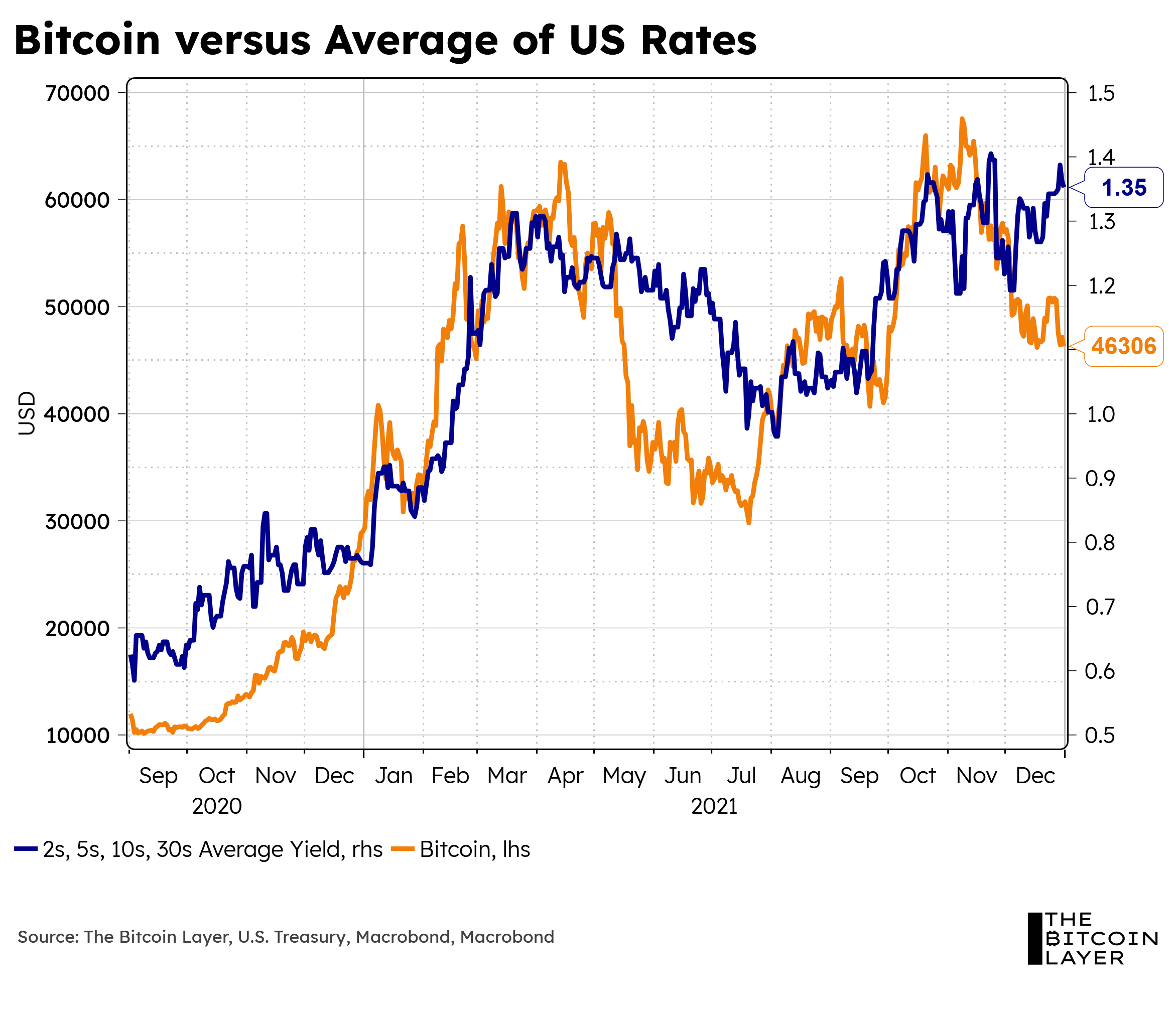

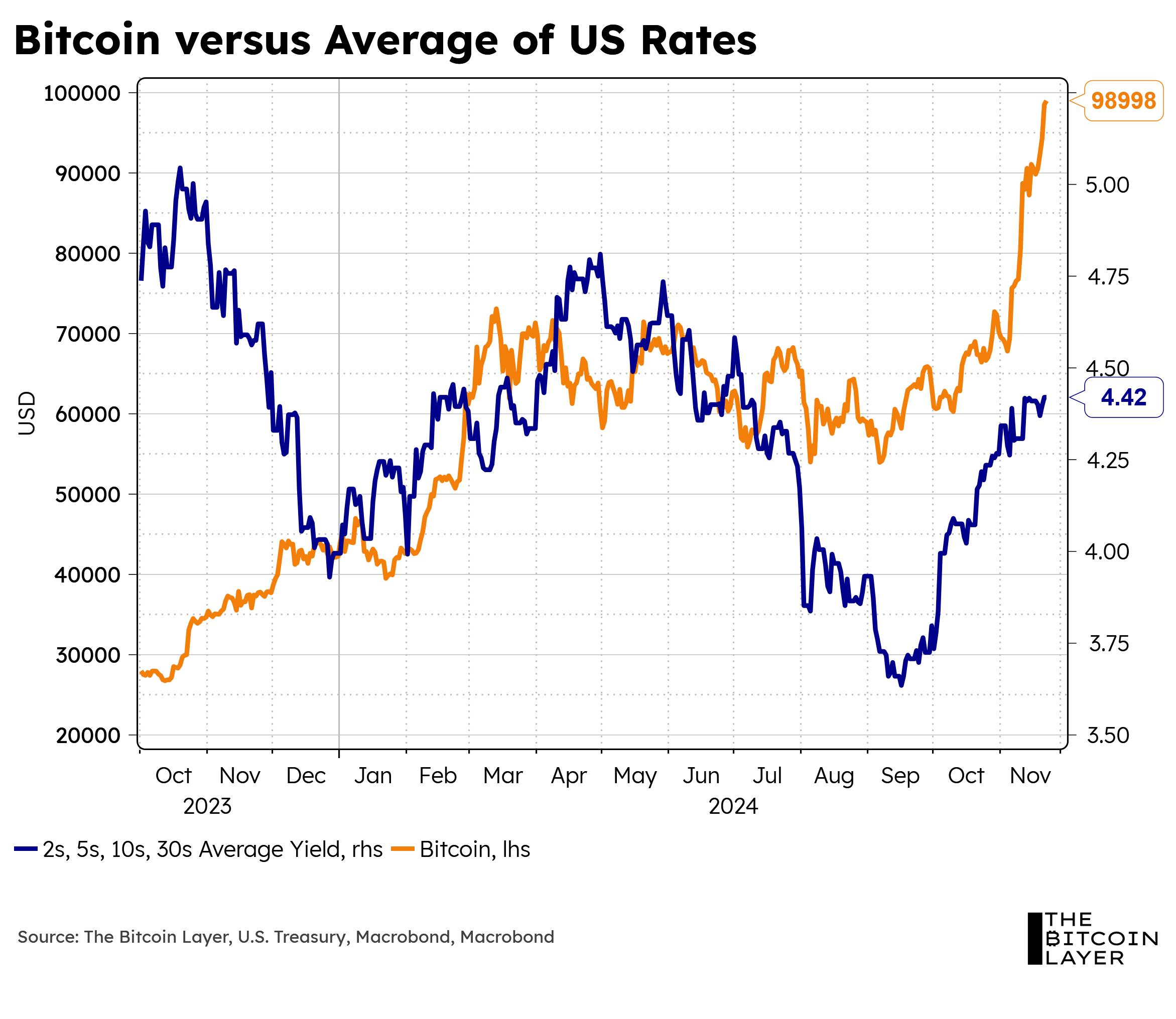

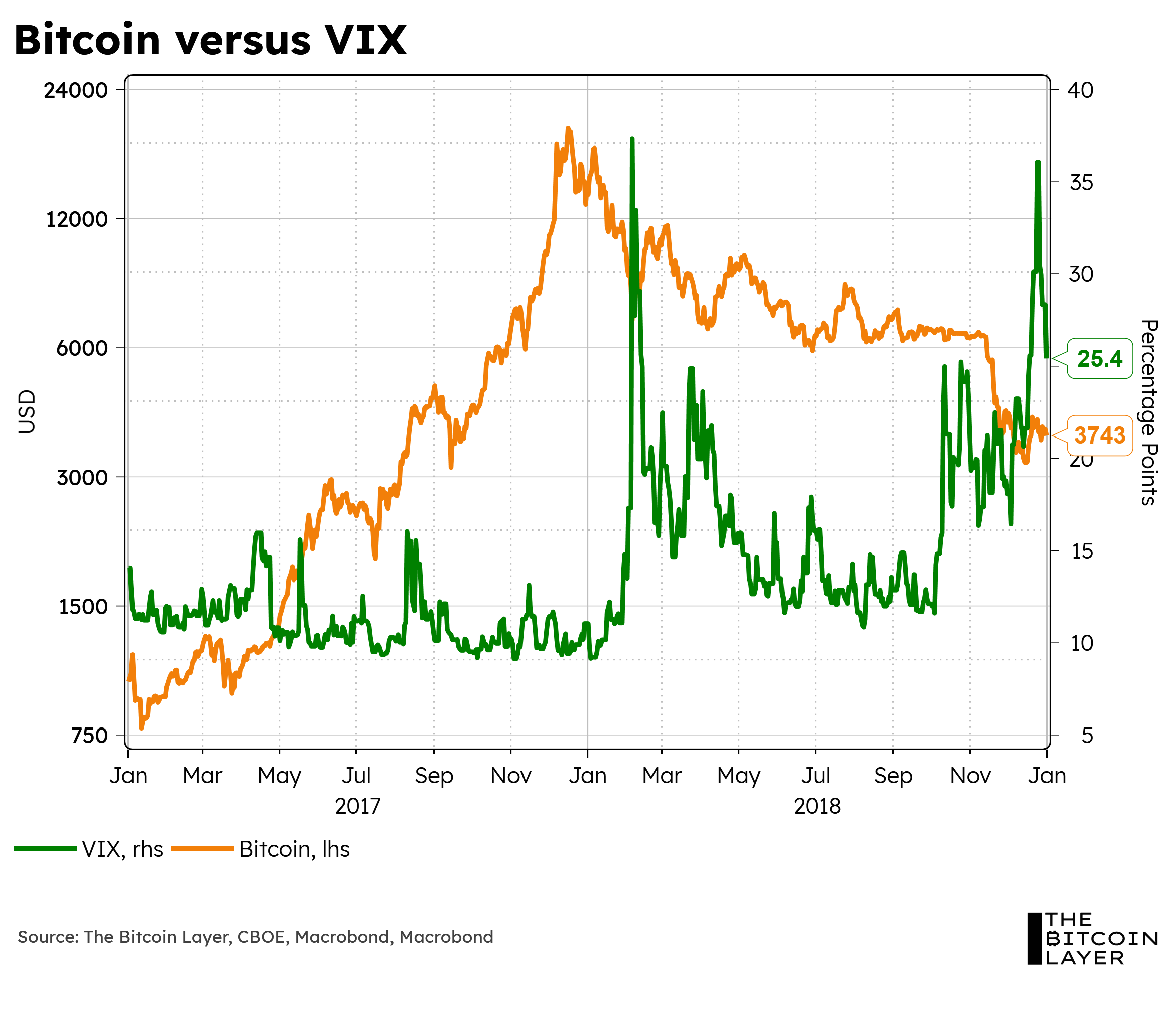

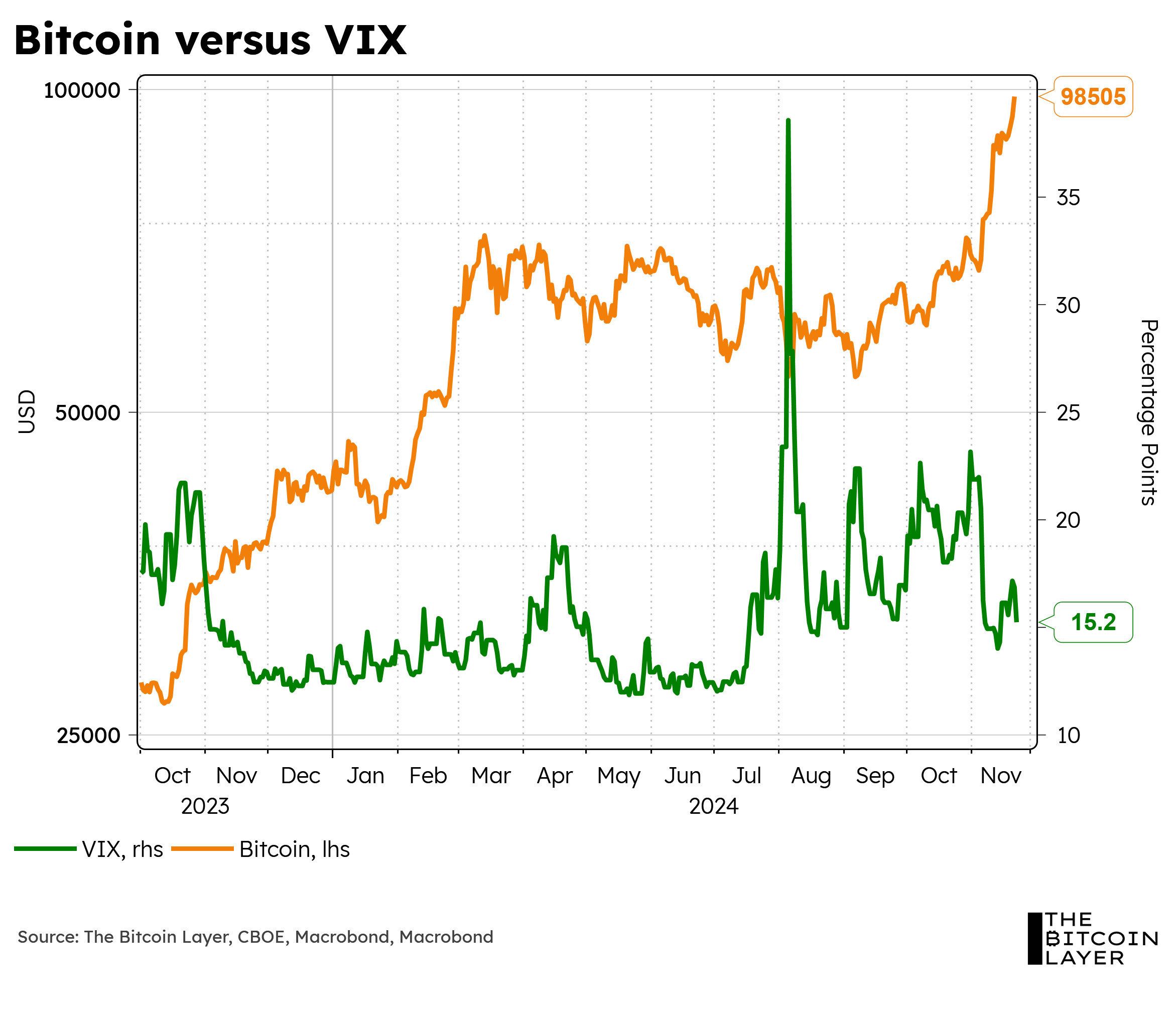

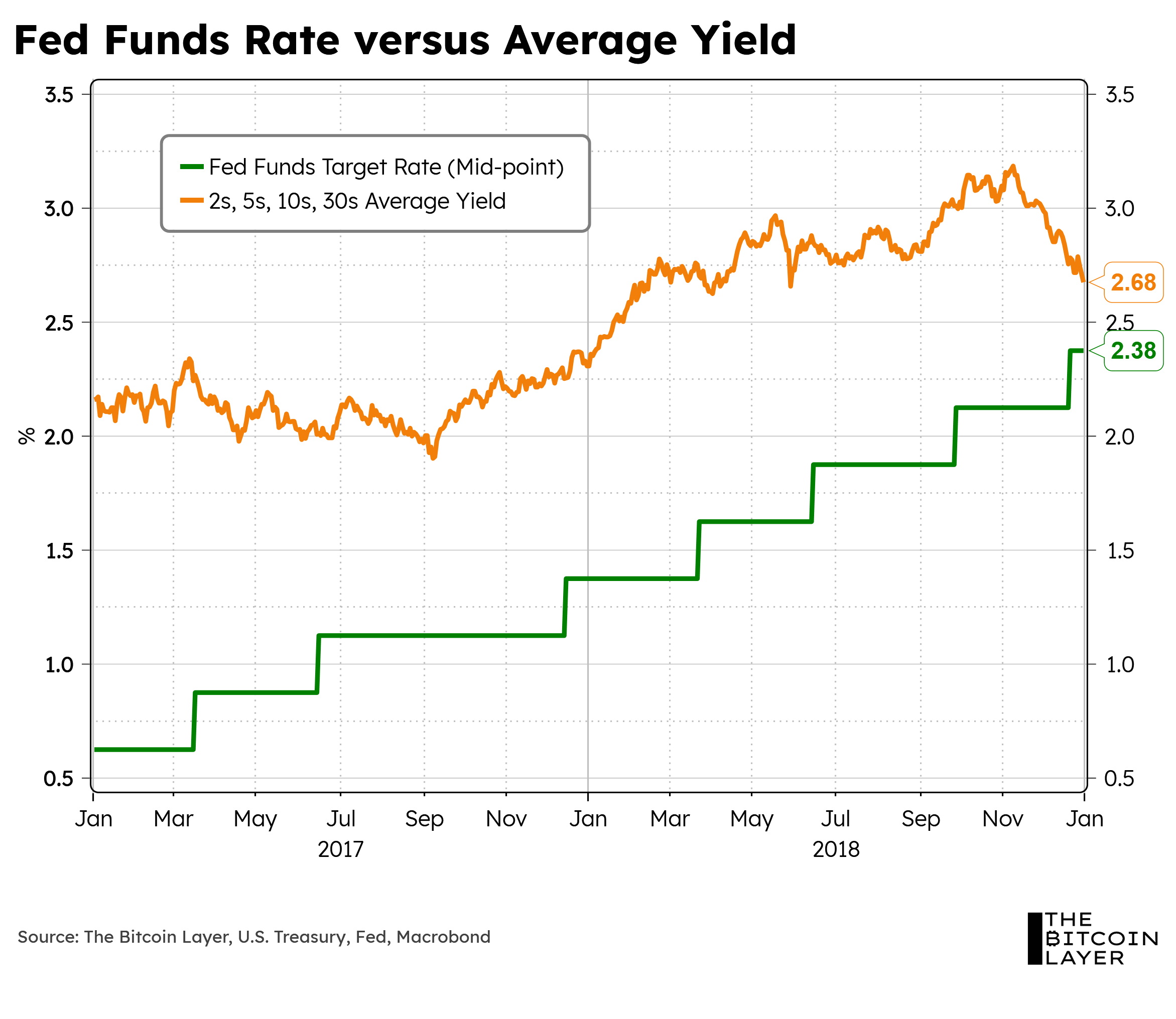

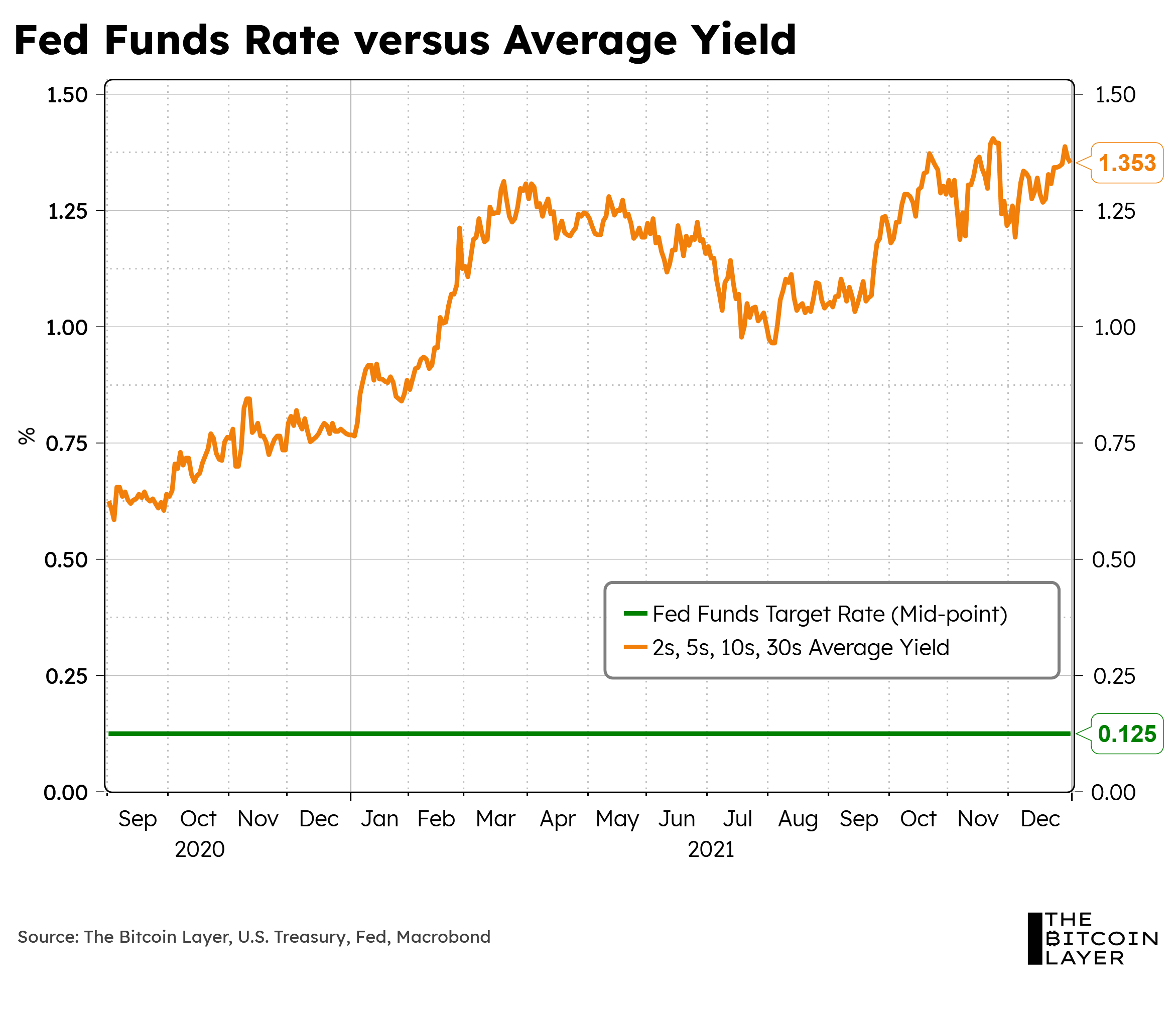

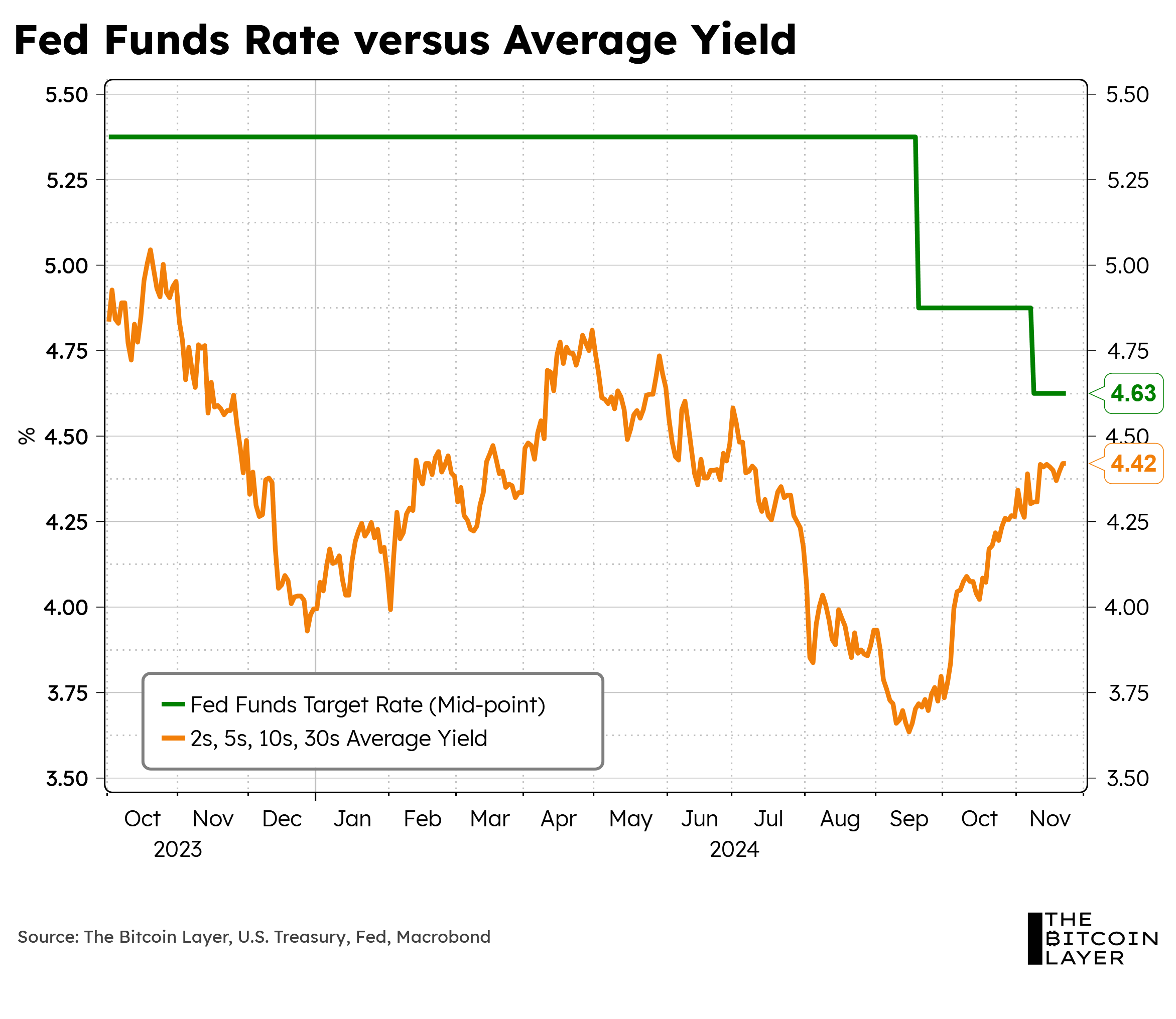

Bond Volatility:Early 2017 – Late 2018:In the 2017 – 2018 bull run, bitcoin ran almost counter to bond volatility. Looking the two panes, you see the MOVE Index with a giant smile while bitcoin carries a frown. This reflects our TBL liquidity narrative that the less volatile the bond market, the greater the collateral value, and the more liquidity. As you can see, In bitcoin’s peak during this time period, bond volatility reached a period-low. 2020-2021The pandemic is obviously a difficult time period to use in a comparative analysis, as governments used extraordinary measures nominally beyond anything we’d ever seen; nevertheless, we can still derive some information from it. Looking at the chart during this time period, despite both panes displaying very similar trends in their respective lines, notice how the majority of bitcoin’s run-up (i.e., from September 2020 to January 2021) took place at a MOVE Index level of 40 (similar to 2017’s bull run). Once again, low bond volatility boosted bitcoin’s conditions. TodayLooking at the same two panes in today’s run-up, we see that despite the high levels at which the MOVE index lies, bitcoin’s price has accelerated upwards—especially during times when bond volatility is the lowest within this time period. From October 2023 to March 2024, bond volatility decreased while bitcoin rose. This was then followed by almost 8 months of consolidation in both of these charts. Then, bond volatility increased to period highs, only to massively dip in November, where bitcoin’s current bull run is taking place. In short, historically speaking, bond volatility provides pretty decent clues for overheated markets, and right now, bond volatility seems to be on its way down. We believe that light bond volatility today suggests, by itself, there is no broad macro overheating condition on risk markets. US Rates:Early 2017 – Late 2018:Our next piece of framework lies in nominal interest rate levels, instead of rate volatility, which takes pricing from options on Treasury securities. In the 2017 bull run period, during period lows (interest rates at 2%), bitcoin had a massive bull run. Then, 2018 saw rates rise above 3%, which was paired with a huge drop in bitcoin’s price. Although bitcoin ended the period in positive territory, make a mental note that the pattern seems to be that low interest rates are good for bitcoin—makes sense. 2020-2021During the period following the pandemic, US Treasuries sold off from historical lows, which explains why higher interest rates did not really affect bitcoin. Going from a 0% interest rate to a 1.3% interest rate doesn’t necessarily mean tighter times—we were still at historically low levels despite the increase. Pair that up with low bond volatility to start this time period (as highlighted above), and you get pretty decent conditions for a bull run. TodayToday, we lie at higher rate levels than the previous two bull runs—a high-interest rate environment that bitcoin has not seen before. Accordingly, this marks a new data point for all of us when we compare this time period to our future analyses. That being said, drawing a general conclusion from the previous two bull runs, we can see the same trend: US rates are on the decline—making lower highs each time—while bitcoin is on the rise. Again, low interest rates seem to be a common theme during bull runs. Stock Volatility:Early 2017 – Late 2018:Seeing as bitcoin trades like a risk asset, it is fair to establish the assumption that high stock volatility is bad for bitcoin, and this chart showcases just that. During period lows in stock volatility, we saw a rise in bitcoin. Then, during high stock volatility, we started seeing a decline in bitcoin. 2020-2021Similarly, in the 2021 period, stock volatility was generally in a decline, which saw higher bitcoin prices. Volatility then started to increase as rates increased and the stock market started to wobble heading into 2022, which was a bad year for both stocks and bitcoin. TodayDuring this bull run, stock volatility has been, on average, at lower levels than the previous two bull runs, resulting in positive risk asset conditions during this bull run. The appetite for equities is unquestionable, stemming from a combination of rate cuts, the prospect of tax cuts, a pro-energy incoming administration, and a President who will be focused on the stock market more than any other politician in American history. It doesn’t mean he’ll be successful, but it does get investors hungry for those uncapped returns. Federal Reserve:Early 2017 – Late 2018:During this time period, we had a hawkish Fed trying to catch up with the rates market. However, as is usually the case for Powell, his hawkishness blew up on his face during the 2019 repo crisis, but that’s a story for another time. All we are trying to point out here is what the Fed’s sentiment was during this bull run. 2020-2021After the pandemic, the Fed’s drastic measures pushed policy rates to near zero, and as established earlier, this is positive for bitcoin. TodayDespite the Fed funds rate being at higher levels than the previous two periods, this is the only time within these three bull runs that US rates lie below the Fed funds rate. This is simply not sustainable, and as the Fed tries to close this gap by cutting rates, bitcoin rises. In Summary:To summarize all of our points, bitcoin bull runs can generally be associated with an environment where both stock and bond volatility are low (in their respective time periods), and interest rates are declining. That is what today’s environment can be characterized as. As such, through the use of TBL’s foundational framework, we remain bullish on the asset. $100,000 bitcoin…see you soon! 🏷️ CYBER SALE! From November 23rd to December 3rd this year, enjoy 21% off your next purchase by using the code: TBL. Get your Stamp Seed today! In case you missed it: TBL on YouTubeThe Bitcoin Classroom Part 1: Challenging a Bitcoin Professor on Monetary PolicyIn this episode, USC professor Nik Bhatia answers questions from economics student Demian Schatt, exploring how Bitcoin could fit within modern fiscal and monetary policy frameworks. Demian asks thought-provoking questions about operating under a Bitcoin standard during recessions, such as how governments could stimulate the economy without increasing the money supply. Nik explains the role of fiscal policy, free markets, and Bitcoin’s deflationary nature in supporting sustainable growth, while contrasting it with traditional monetary systems. He also addresses inflation, quantitative easing, liquidity, and Bitcoin’s potential as a reserve currency, demonstrating how Bitcoin could transform the future of finance.  Here are some of the key insights:

Bitcoin Nears $100,000: How High Can It Go?In this episode, Nik delivers a global macro update as Bitcoin surges to $99,000, nearing six figures after a major breakout. He analyzes the drivers behind this rally, including institutional demand, market cycles, and Bitcoin’s dominance over Ethereum. Nik reveals why recession fears are fading, with resilient housing and labor markets, booming corporate bond issuance, and anticipated Trump-era fiscal policies like tax cuts and infrastructure spending. Wrapping up, he explores Bitcoin’s path to multi-trillion-dollar valuation, its halving cycle, and the roadmap to $1 million Bitcoin, uncovering the critical dynamics driving this extraordinary moment.  Here are some of the key insights:

TBL on SubstackEvery week, we bring you our global events recap TBL Thinks. This week we talk about how Democrats political plans backfired, as well as investments in the future of AI in the US. Check out TBL Thinks here: What TBL Pro Is ReadingNik published his weekly letter, this time delivering his popular “Trader Notes” as we goes through resistance/support levels and directional bias across bitcoin, rates, and equities. Active traders and investors will enjoy this more technical post. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year. Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order? If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul. Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way. With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, November 23, 2024

Bitcoin cycles & gauging market temperature: TBL Weekly #120

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momen...

-

Plus $200 off! ...

-

Tweeting will now get you points from Kaito. And they'll probably airdrop tokens to the point holders. This pr...

-

Last day to take advantage of special pricing for Bankless Premium Feed and Bankless Citizenship ...

-

gm Bankless Nation, Trump has promised to fire Gary Gensler on day one. What could a pro-crypto SEC look like? ...

No comments:

Post a Comment