|

|

"When I see a bubble forming, I rush in to buy, adding fuel to the fire." |

— George Soros |

|

|

A new crypto bubble inflates: AI agents |

The first thing to know about the current craze for crypto AI agents is that they're not agents. |

By Google's definition, an AI agent is "an application that attempts to achieve a goal by observing the world and acting upon it." |

With a couple of possible exceptions, crypto AI agents do not meet that standard. |

Instead, they're more like "wrapped LLMs," "chatbots with memecoins attached," or just plain "slop," as they've justifiably been described by critics — there's nothing particularly revolutionary about an AI that posts on X (often with human curation). |

But when did facts ever get in the way of a good story? |

Especially when it's a good crypto story: Bitcoin isn't really money, Ethereum isn't really a world computer, most of DeFi isn't really decentralized and few DAOs are either decentralized, autonomous or even organized. |

But the opportunity cost of being persnickety about these things has been high — historically, the way to make money in crypto has been to suspend disbelief and buy into the current narrative (or "meta," as the kids say). |

This is nicely summed up in the crypto catchphrase: "Believe in something." |

In 2020, for example, people who believed that DeFi would disintermediate the entire financial sector made out like bandits in the tokens of early DeFi protocols. |

They were wrong, of course — DeFi has turned out to be a niche activity and no threat to TradFi at all (so far). |

But if they were early enough buying in and then prescient enough to sell out at any point during DeFi's run from 0% to 5% of crypto's total market cap, they were also rich. |

Today, AI agents are near 0% of crypto's market cap (just $15 billion currently) and if crypto history is any guide, it's easy to see why they might get to 5%. |

Or bigger, even: In 2021 we could tell a story about DeFi replacing the financial system, but in 2025 we can tell a story about AI replacing pretty much every system. |

This is why the crypto investor Ejaaz Ahamadeen is taking a page out of the Soros playbook by rushing in to buy the crypto AI agent bubble: "Over the long term, this sector is going to [hundreds] of billions of dollars," he told Bankless. "And secretly I think it's going way higher than that." |

Ejaaz concedes that his numbers are "boy math," but that's no reason to dismiss them — at this point, we're not betting on how useful AI agents will ultimately be, but how useful people might think they'll be. |

Which is to say, we're betting on how big the story might get. |

Ejaaz thinks it will get unprecedentedly big: "The AI-agent meta is going to form potentially the biggest bubble we've ever seen in crypto." |

It's not just a story, however. |

Like any good investing bubble, this one has a core element of truth to it. |

In a blog post yesterday, Sam Altman predicted that "in 2025, we may see the first AI agents 'join the workforce' and materially change the output of companies." |

With that in mind, seeing that the DeFi bubble got as big as it did without anyone outside of crypto having ever heard of it, how big do you think a bubble in AI agents could get if they're everyone's co-workers? |

VanEck predicts over one million of these agents will be onchain in 2025 and some of these might make money by selling services to us — or to each other, even. |

But crypto "investors" (aka, traders) think the real money will be in the picks and shovels of the AI agent ecosystem — the two largest tokens are infrastructure plays: ai16z, worth $2.4 billion, and Virtuals, worth $4.1 billion. |

It's easy to see why: If AI agents do start paying each other, they may do so through ai16z's Eliza framework, with fees being returned to tokenholders — and Virtuals tokenholders are already benefiting from fees paid on the Virtuals launchpad, some of which are used to buy back tokens. |

Traditionally minded investors might not value those earnings too highly, because it seems unlikely that either of those businesses have much of a moat — the proliferation of launchpads suggests that businesses like Virtuals might already be commoditized and the founder of Virtuals, Jeffy Yu, says frameworks like Eliza will be commoditized "very, very quickly." |

But I don't know what Solana's business moat is either, and Solana seems to be unbothered by its proliferating competitors (so far, at least) — so it's reasonable to think that the token of an agent platform like ai16z has a chance at becoming as big as SOL. |

This is part of Ejaaz Ahamadeen's investment case for AI agents, as well: He thinks ai16z and Virtuals "can (and will) be priced as L1s this cycle." |

We might even be able to dream bigger than that. |

Ai16z founder Shaw Walters thinks that "AI agents basically replace websites in the social media age" — and that sounds to me like a bigger story than the 2020 narrative of DeFi replacing TradFi (or the 2021 bubble in proliferating L1 blockchains). |

Shaw, currently the main character in the AI agent story, is a technologist who wants to build real things: "Any AI agent whose only functionality is shilling a memecoin is probably going to zero," he told Laura Shin. "It's going to require a lot more focus on actual capability." |

Better yet, he wants those capabilities to benefit everyone: "I'm not rich until everybody's rich." |

By "everybody," Shaw means everyone in the world, but he's starting with ai16z's tokenholders: "The profits that we make from various things will be going into the Treasury to reward tokenholders and we're also doing a lot of things outside of that for buy pressure." |

One of those things is to start a Shark Tank-like incubator where ai16z is "investing into things that we're then kind of blowing up with attention." |

I don't know how to value something like that, but I can't think of anything more likely to inflate a crypto bubble. |

Should you be adding fuel to that fire? |

I truly have no idea — but don't be surprised if the fire gets a lot bigger. |

— Byron Gilliam |

|

|

|

|

|

Looking Back on 2024 |

|

0xResearch analysts discuss their biggest mistakes and what they would have done differently over the year. Tune in for their commentary on airdrop feedback loops and chasing beta. |

Listen to 0xResearch on Spotify, Apple Podcasts or YouTube. |

|

|

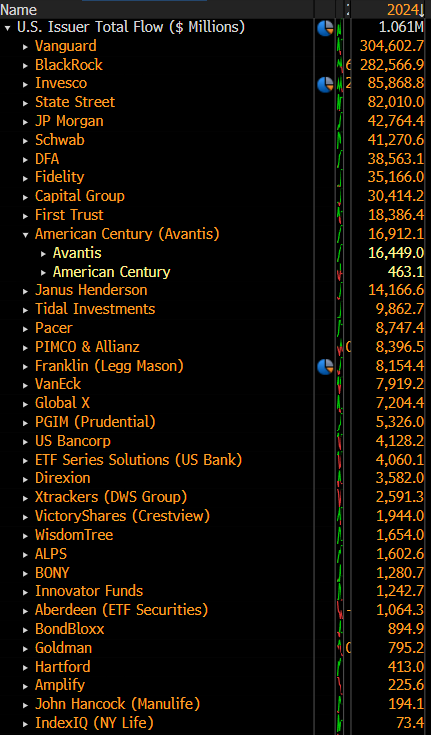

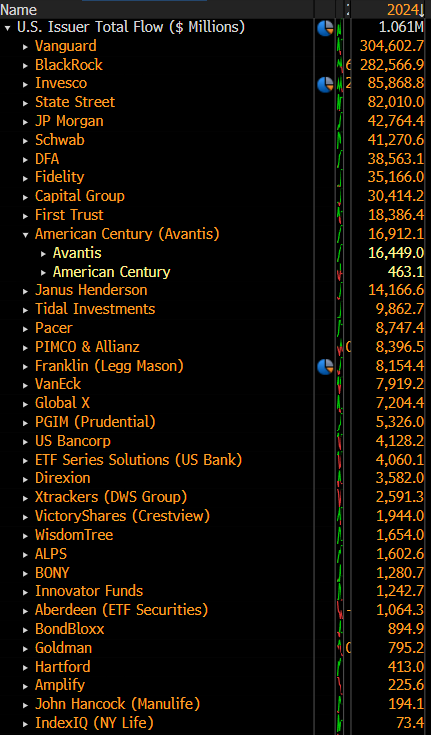

| Eric Balchunas @EricBalchunas |  |

| |

US ETF issuers by 2024 flows.. Vanguard on top for 5th straight year. BlackRock no slouch tho, more than doubled last yr haul. The Big Two = 55% of all cash intake. Invesco, Fidelity, CapGp, Janus, Tidal had amazing years, smashed old records. | |  | | | 4:20 PM • Jan 6, 2025 | | | | | | 79 Likes 6 Retweets | 7 Replies |

|

|

| Noelle Acheson @NoelleInMadrid |  |

| |

The details in the FDIC letters are shocking on 3 fronts: 💣They confirm a coordinated agency attack on an entire industry, violating the APA. 💣They reveal an attempt to keep the overreach hidden. 💣They suggest the FDIC assumed it would get away with it. Good thread 👇 |  Nick Anthony @EconWithNick Nick Anthony @EconWithNick

With @iampaulgrewal's latest FOIA requests out, there's a ton of new information to go through. The most shocking finding across the letters is still the repeated instructions to "pause" cryptocurrency-related activity. But the problems go deeper.🧵 |

| | | 5:18 PM • Jan 6, 2025 | | | | | | 10 Likes 4 Retweets | 0 Replies |

|

|

|

|

No comments:

Post a Comment