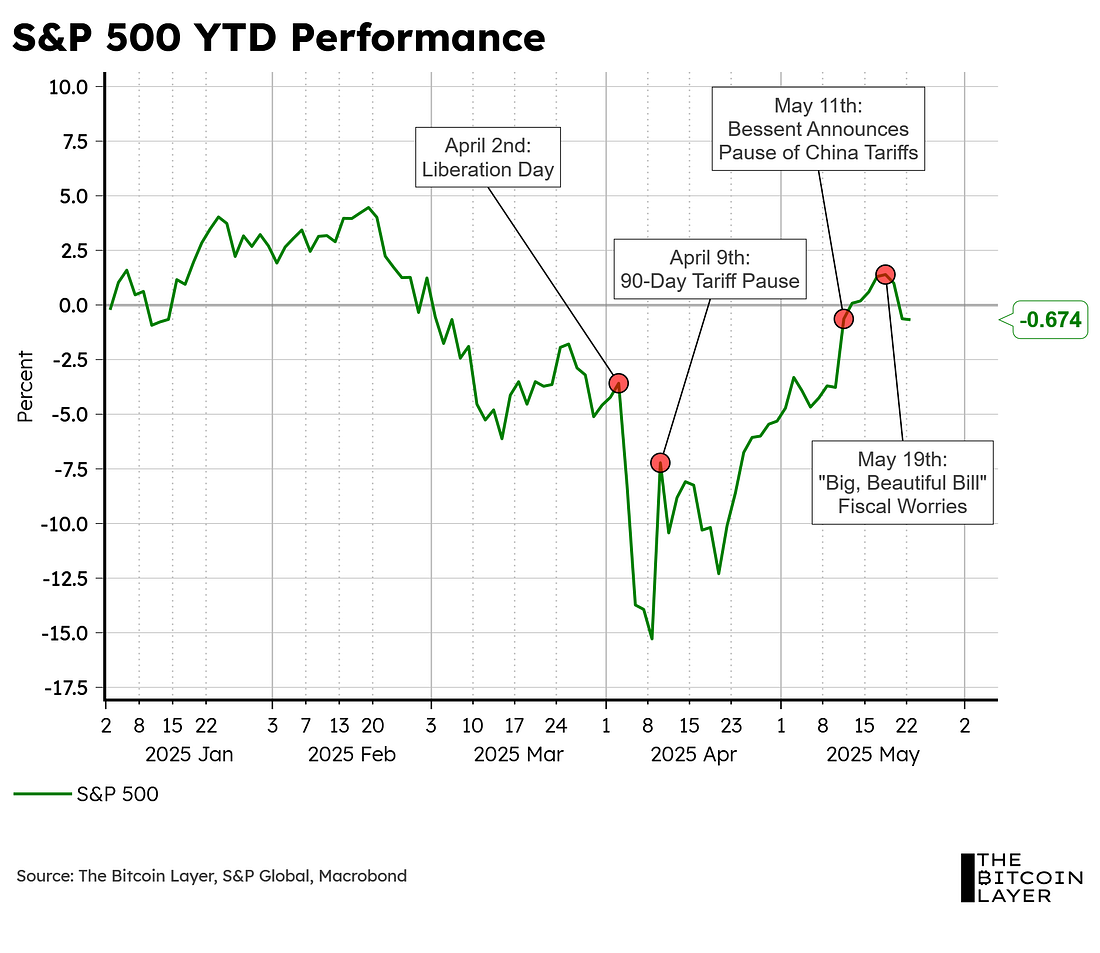

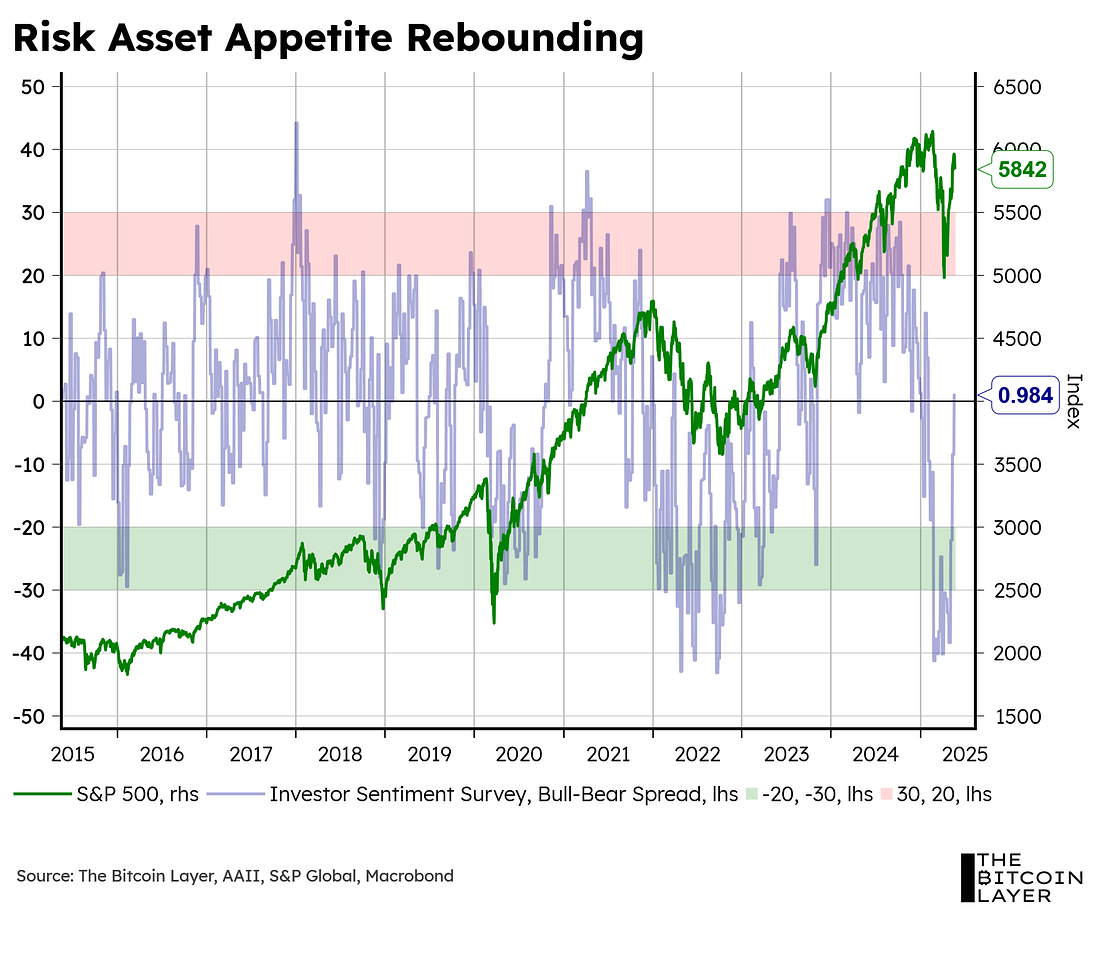

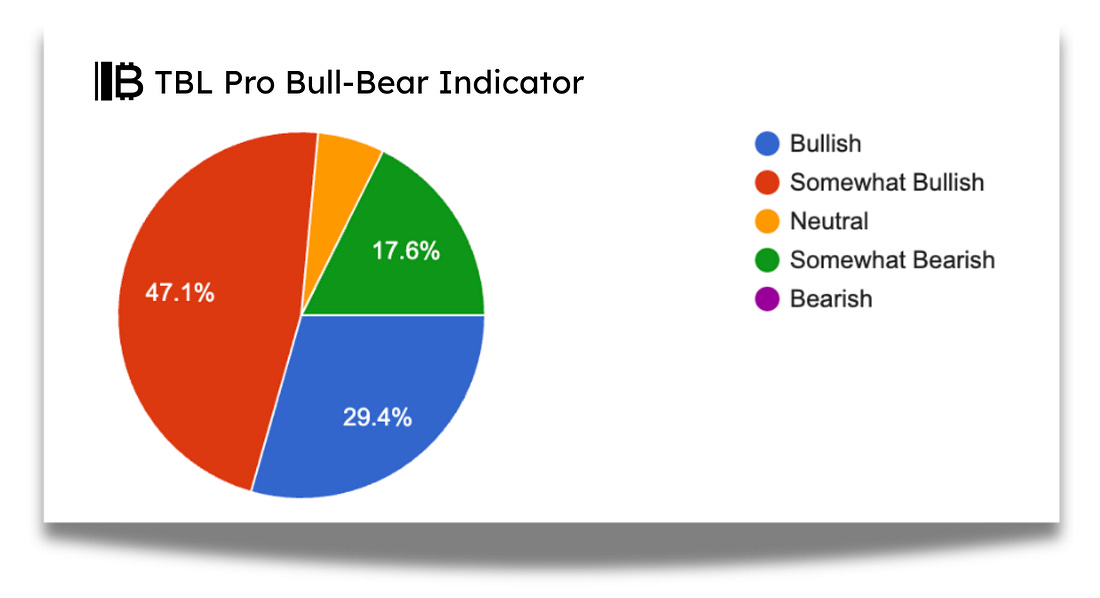

Dear Readers, After a remarkable start to May for risk assets all across the board (especially for bitcoin), the bullish pulse of the market is palpable. Here’s a chart of the S&P 500’s performance YTD as we approach the end of the first half of 2025: There are two things worth noting from this chart. Firstly, notice just how sensitive the market has been toward White House announcements, with all major apexes taking place on some type of announcement. Secondly, and perhaps most importantly, the S&P 500 managed to reclaim its positive return stance last week—that was until fiscal worries about Big-Beautiful-Bill-induced deficits started spreading. Bessent came out today and said that “as growth accelerates, [he] is not worried about the US debt dynamics.” The tune has now changed from ‘let’s reduce spending’ to ‘let’s push growth higher.’ Overall, however, risk appetite abounds. Bulls are quite evidently making a comeback. When looking at AAII bull-bear spread (a survey that asks individual investors about their market expectations six months from now), we are seeing bulls rebound. Notice from the chart that, over the past 10 years, a spread between 20 to 30% (red band) has signaled a market peak, and a reading between -20 to -30% (green band) has signaled a bottom. Since the tariff-pause correction, the survey bottomed and is now making its way back to bull territory. Another chart that we would like to show is sourced from you guys directly (go to the bottom of this article to participate in the survey)—something we are coining the TBL Pro Indicator: As you can see from the indicator, the current spread between TBL Pro bulls and bears lies at approximately 58.9% (= % of TBL Pro Bulls – % of TBL Pro Bears). Needless to say, even you guys are bullish on risk assets, and for good reason. In today’s TBL Weekly, we will look at:

So, without further ado, let’s dive into TBL Weekly #142! In the first 100 days of the new administration, pro-bitcoin rhetoric has turned into policy. A new executive order established a national strategic bitcoin reserve and directed the Treasury and Commerce departments to explore growing the reserve within a budget-neutral framework. Unchained and the Bitcoin Policy Institute are hosting a live panel with Congressman Nick Begich, BPI Executive Director Matthew Pines, and Unchained’s Joe Burnett—and releasing a full report that explains what’s happening and why it matters. In this session, you’ll learn:

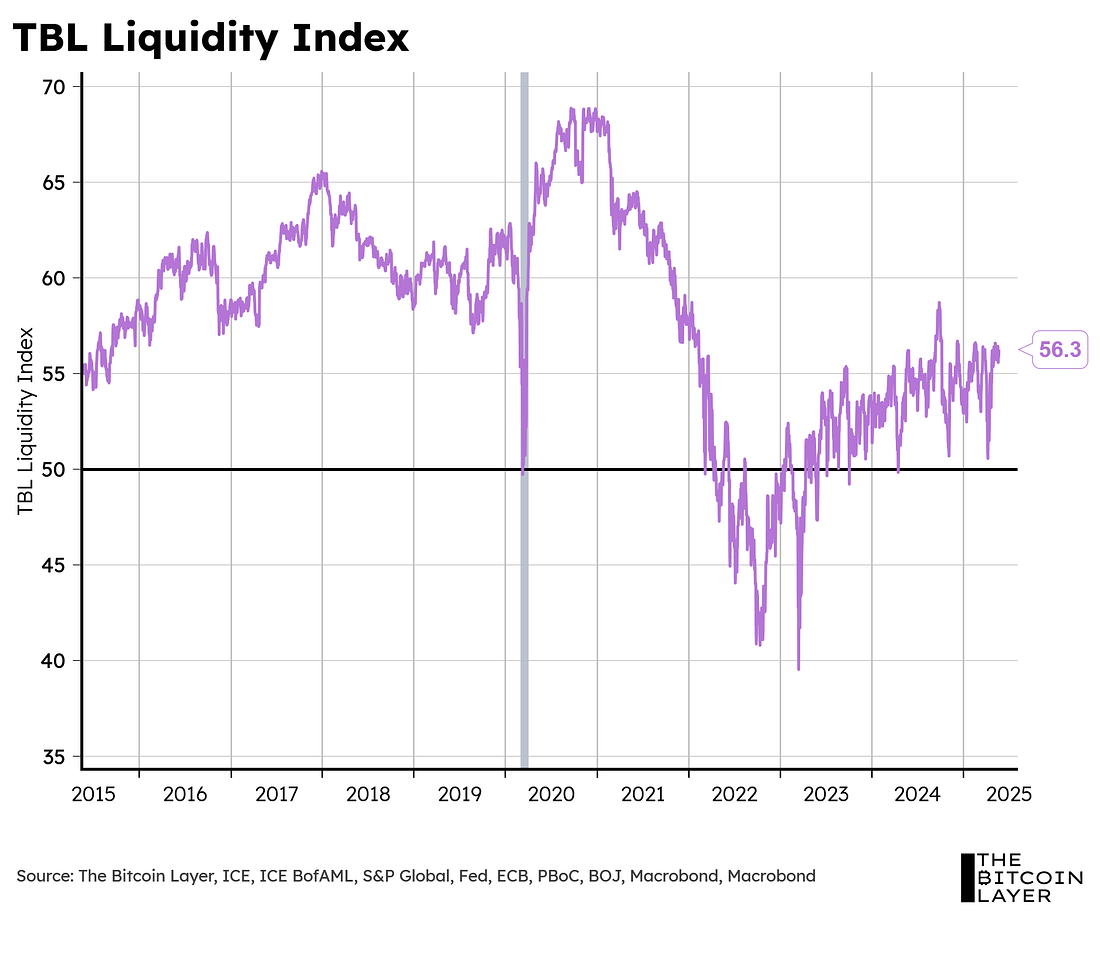

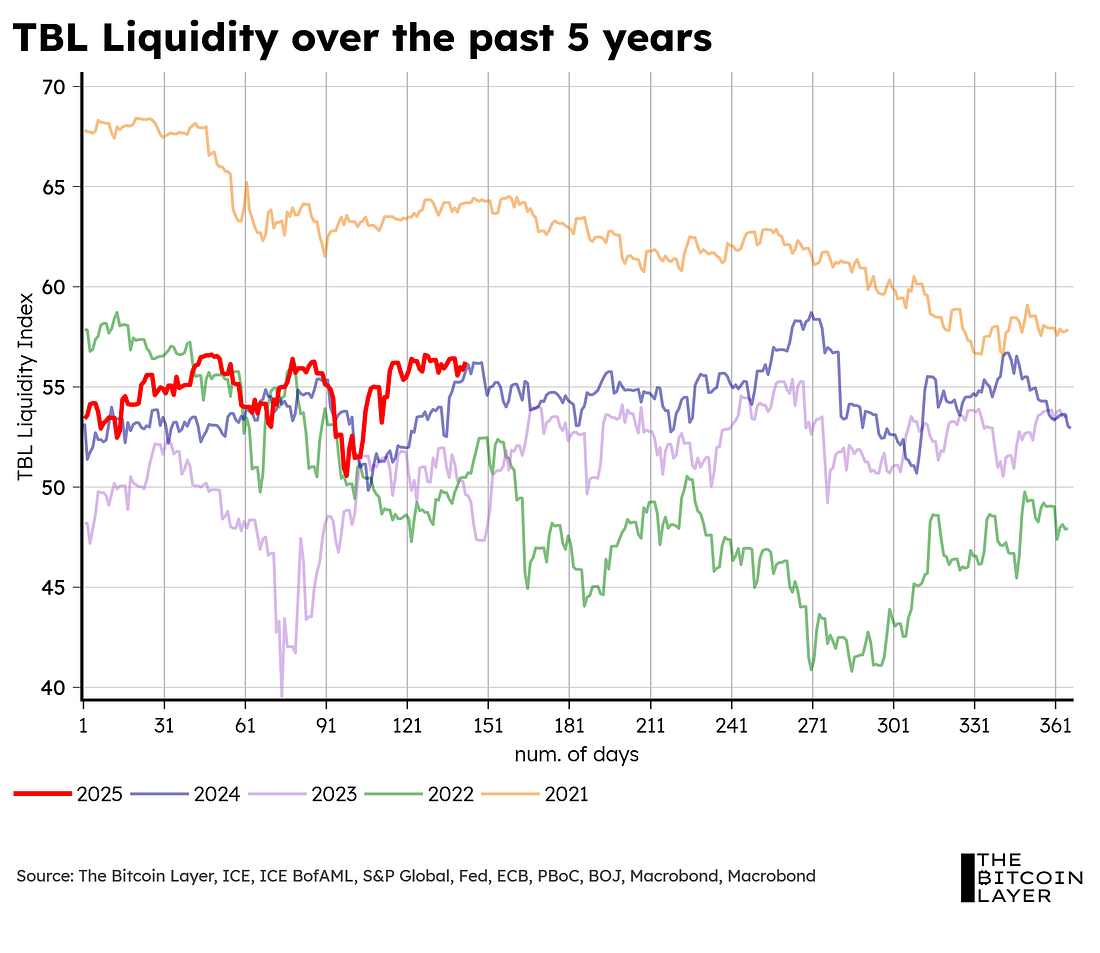

Register for the June 3 event and read the full 100 Days Brief Blockstream Jade Plus is the easiest, most secure way to protect your Bitcoin—perfect for beginners and pros alike. With a sleek design, simple setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes. Seamlessly pair with the Blockstream Green app on mobile or desktop for smooth onboarding. As your stack grows, Jade Plus grows with you—unlock features like the air-gapped JadeLink Storage Device or QR Mode for cable-free transactions using the built-in camera. Want more security? Jade Plus supports multisig wallets with apps like Blockstream Green, Electrum, Sparrow, and Specter. Protect your Bitcoin, sleep better, stack harder. Use code: TBL for 10% off. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Weekly AnalysisTBL Liquidity-Induced TailwindsAs it stands today, TBL Liquidity is at its second-highest yearly level of the past five years: And it’s only the second because 2021 was higher but decreasing: After slicing the past 5 years, we notice two extremely important things that are feeding our overall narrative for risk assets in 2025…... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, May 23, 2025

Bulls Riding the Liquidity Wave: TBL Weekly #142

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Hear why at DAS NYC ...

-

People building freedom technology across the globe are watching freedoms disappear at home. ͏ ...

-

Also Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data Distortions ͏ ͏ ͏ ...

-

Is global macro currently a headwind or tailwind for risk? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment