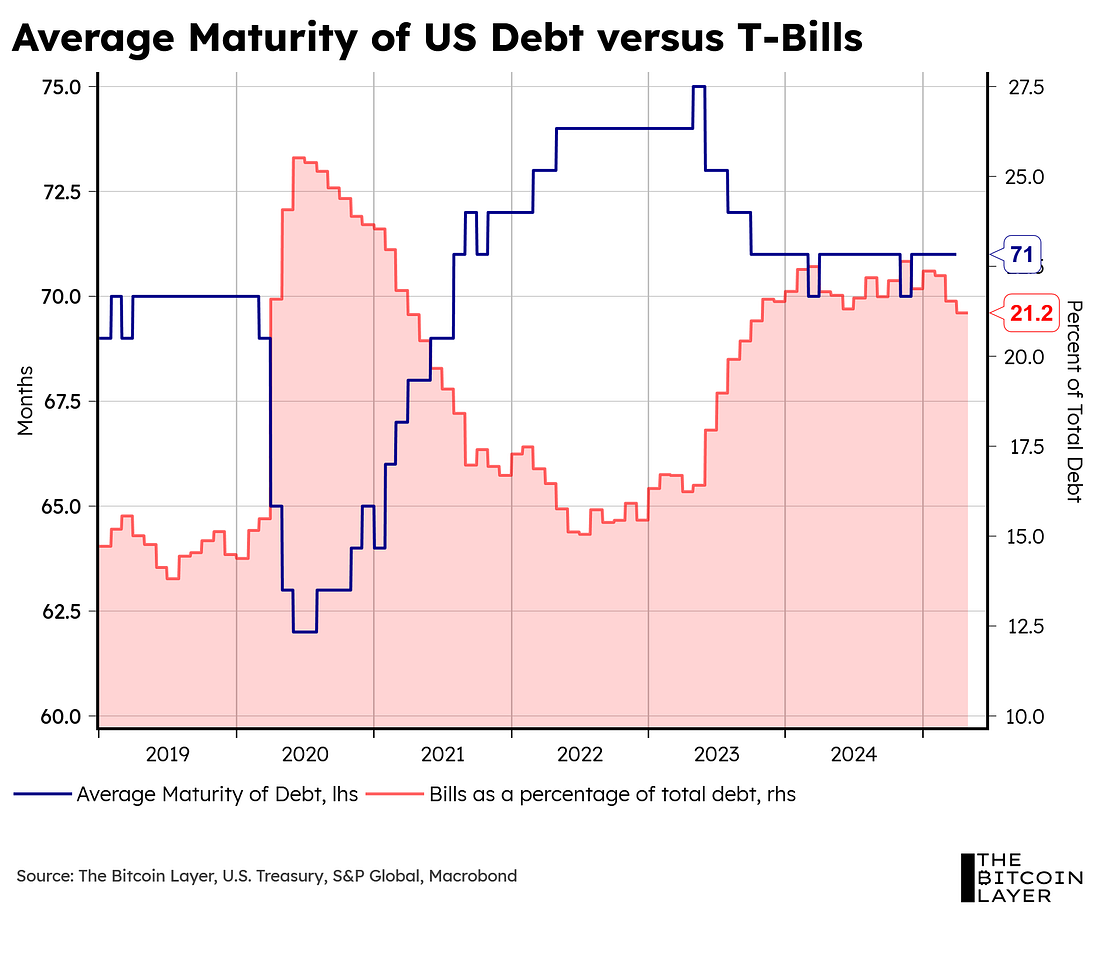

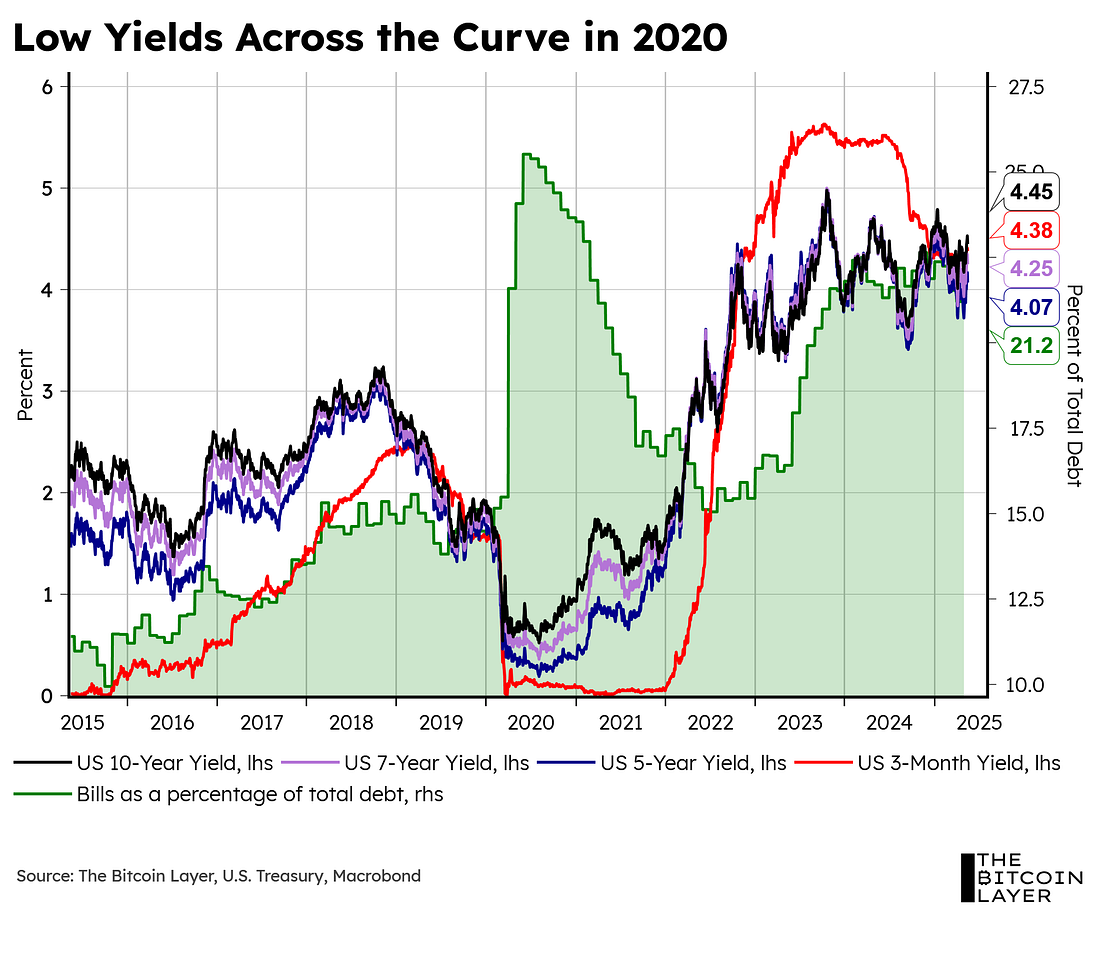

Dear Readers, As many of you already know, back in 2020, amidst the world coming to a complete halt, the US Treasury began shortening the maturity of the government’s debt. It did so by issuing an immense amount of short-term Treasury bills (which have a maturity of one year or less): They did so during a time when interest rates were at all-time lows across the curve: Unlike any other private entity, this somewhat goes against conventional debt management practices, which is to issue long-term debt when interest rates are low to lock in better rates, and issue short-term debt when interest rates are expected to decrease in order to lock in better refinancing rates later on (all this ignoring the ease with which an entity can issue short due to a liquidity premium, but more on this later). So, what gives? Why does the US Treasury seem to act differently than a common debt manager? And most importantly, what’s behind their choices of debt issuance across different maturities? In this article, we go over:

So, without further ado, let’s dive into TBL Weekly #141. Stop asking how to value bitcoin. Start asking how to value everything else in bitcoin. A new report from Unchained and Strive shows why companies and investors should shift their lens—and start benchmarking performance in bitcoin. ❌ DON’T WRITE YOUR SEED ON PAPER 📝 It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Take 15% off with code: TBL. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Weekly AnalysisThe Treasury’s Debt Management JobOptimal (or theoretical) debt management policy by the US Treasury juggles a plethora of things. In the 2016 book, “The $13 Trillion Dollar Question: How America Manages Its Debt,” the authors argue that government debt management consists of three main objectives:

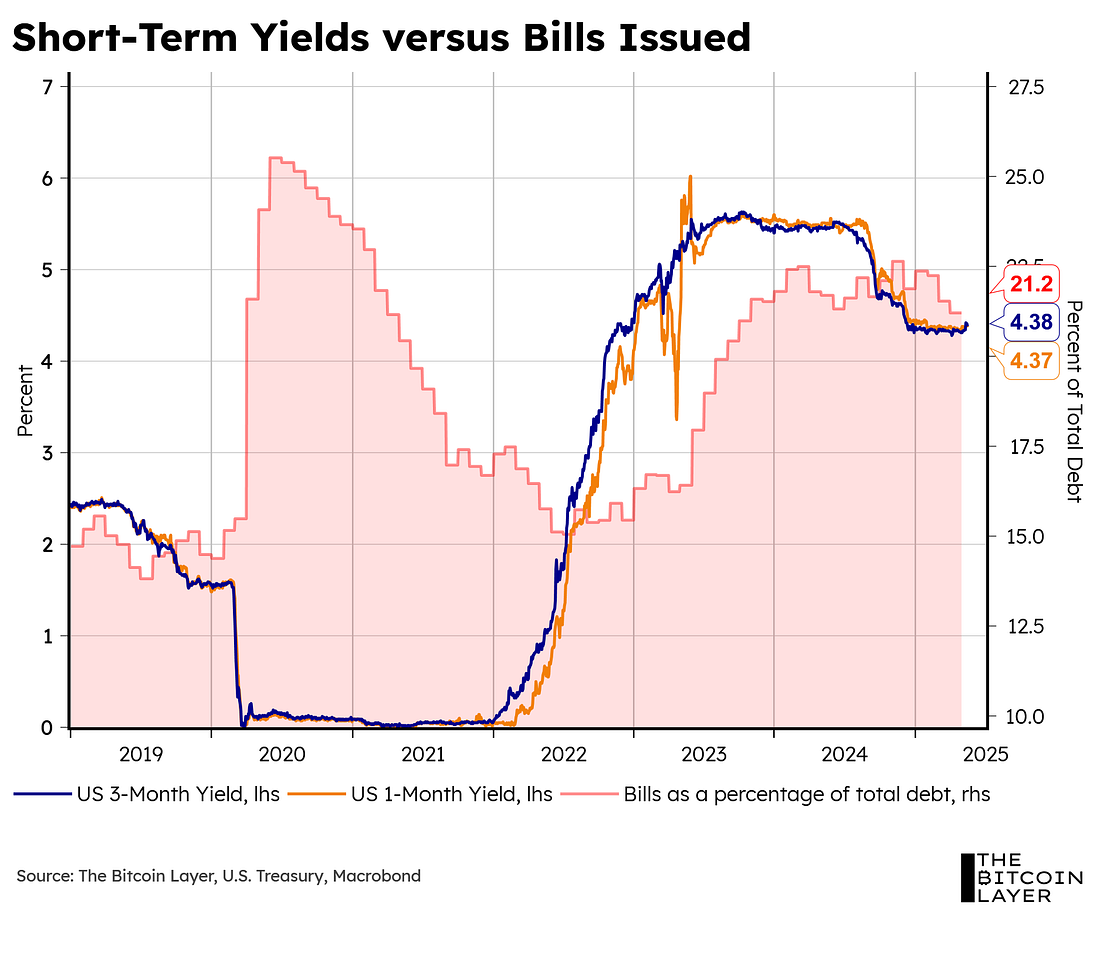

Needless to say, the shoes of a Treasury Secretary are hard to fill. Nevertheless, the job must get done, so let’s talk about each of these components. One BIG CAVEAT before reading this article: The US Treasury’s mandate is not to time the market. What we review below comes mainly from a traditional debt-management lens, which is not what the US Treasury does. The US Treasury isn’t in the business of calling tops and bottoms in US rates markets. Objective #1: Keeping the Cost of Financing LowGenerally speaking, the shorter the maturity of debt instruments, the more money-like the asset, meaning that shorter-term debt carries an inherent ‘liquidity premium.’ Given the ease with which one can transform these instruments into cash, this raises the price of short-term Treasuries, leading to lower risk and, therefore, lower yields. Accordingly, one could naively suggest that issuing at the front end of the curve is a no-brainer. However, two issues arise with such a suggestion. Firstly, flooding the market with only T-Bills would completely erase this liquidity premium and force the Fed to step in and buy all this supply if they want to maintain their targets for overnight rates. Secondly, you effectively compromise the second objective of debt management policy mentioned above—that is, you expose the future taxpayer to an incredible amount of refinancing risk as these T-Bills mature, which leads us to the next part. Objective #2: Reducing The Risk of Future High TaxesAs mentioned at the start of his article, in 2020, amidst the pandemic, the US Treasury issued loads of short-term debt. At pure face value, we can see why they would want to do that. Just look at this next chart, where we keep only short T-Bill rates: At the time, the Federal Reserve brought interest rates down to near zero, which meant that financing at the short end of the curve cost almost nothing (ignoring future refinancing risks). However, the following years got a bit more interesting…... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, May 16, 2025

The Clock is Ticking: Bessent, US Treasury, and the Debt Dilemma - TBL Weekly #141

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hear why at DAS NYC ...

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Opinion markets have arrived. Unlike Polymarket and Kalshi, there are no wrong answers here. ͏ ...

-

Until today, Polygon looked like any another ETH L2. Today, it has became a regulated payments platform in the U.S...

-

The New York Stock Exchange is ready to embrace blockchains in a massive way. ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment