Dear Readers, It’s Thinking Time! This week, we cover the post-pandemic effects on student loans and housing. We analyze student loan delinquencies as pandemic forbearance measures are lifted, leaving two million borrowers at risk of docked pay this summer. We also cover underwater mortgages and their rising numbers in pandemic boomtowns. TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy. Stop treating bitcoin like any other asset. It’s time to build a long-term strategy and declare your financial independence. Unchained’s Financial Freedom Bundle is designed to help serious bitcoin holders secure their future by taking control of their generational wealth. Request the bundle to get:

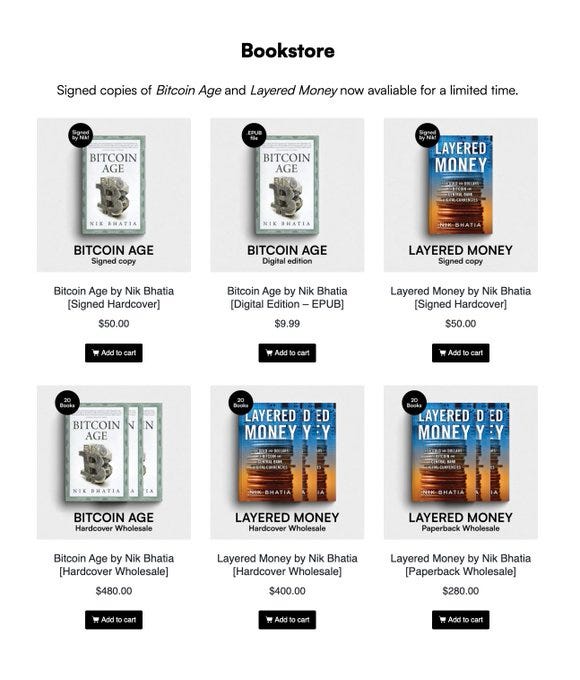

First 100 to request a bundle receive a physical copy of Foundations. The Financial Freedom Report is a weekly newsletter from the Human Rights Foundation (HRF) that tracks how authoritarian regimes weaponize money to control their populations and suppress dissent. It also spotlights how freedom technologies like Bitcoin are helping everyday people reclaim their financial independence and freedom. A one-of-a-kind newsletter connecting the dots between financial repression, geopolitics, and emerging tech. Smart macro analysts don’t just watch the Fed. They watch the world. JUST IN: We have added wholesale book offerings of Layered Money and Bitcoin Age to our website. Each wholesale order includes 20 copies priced accordingly:

Student Loan Woes for MillionsFederal student loan borrowers are missing payments at the highest rate on record, Bloomberg reports. Almost 6 million people (a third of the borrowers) have not made a payment in 90 days. This highest rate in delinquencies since TransUnion began collecting data in 2012 is driven by the US Department of Education restarting collections on defaulted loans after five years and elevated inflation. Borrowers missing payments are once again being reported to credit agencies and affecting the credit scores of millions of people, with delinquent borrowers losing an average of 60 points from their credit scores... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Tuesday, June 24, 2025

TBL Thinks: Student Loan Delinquencies and Underwater Mortgages

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

No comments:

Post a Comment