ETF Outflows Are Pulling Bitcoin LowerBitcoin Still Holds the Lion’s Share of Crypto Market Value & The Federal Reserve Stays HawkishWelcome to Ecoinometrics' Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we'll cover:

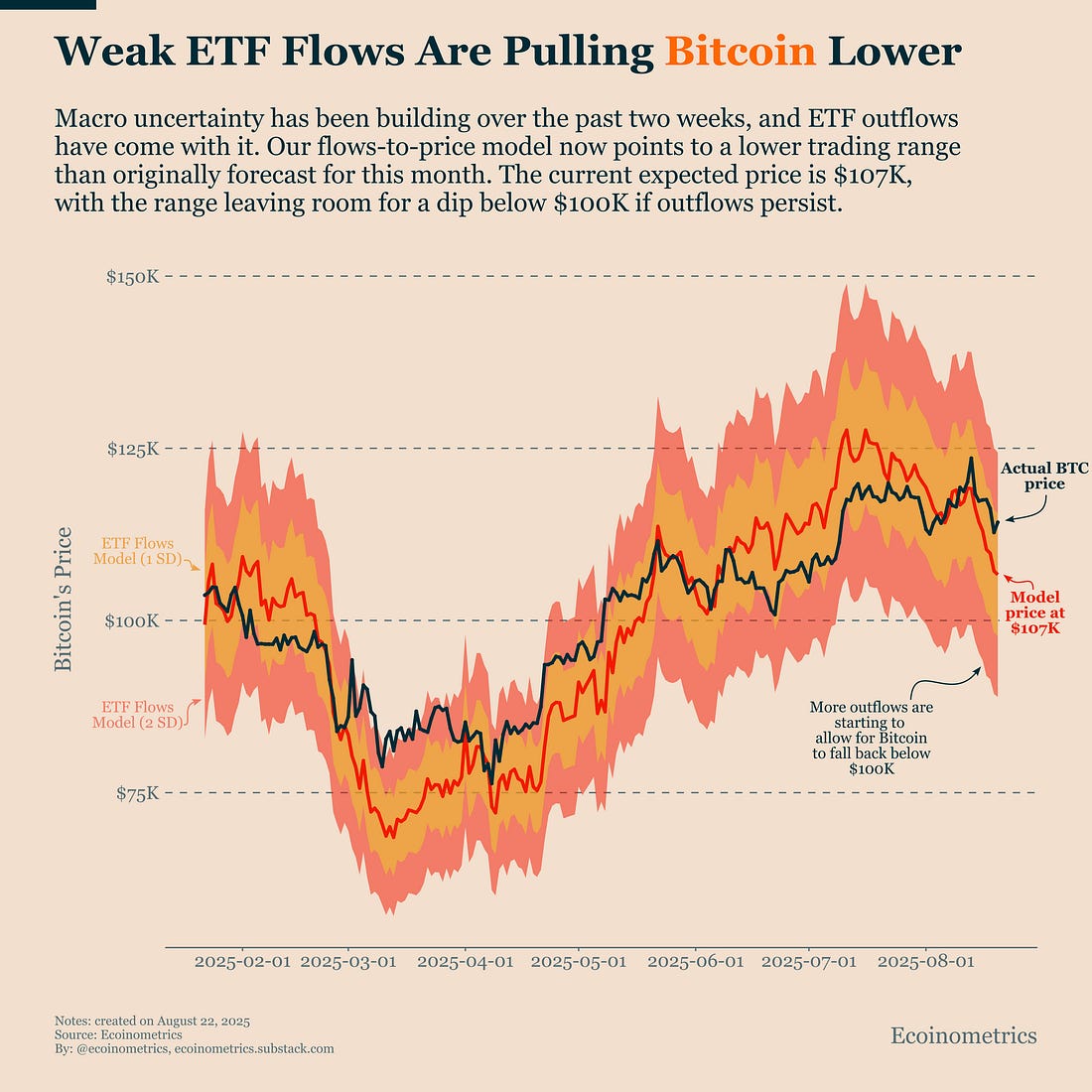

Even though these stories look unrelated at first glance, they speak to the same bigger picture. Macro uncertainty is pressuring flows, Bitcoin continues to stand apart from the rest of crypto, and the Fed is signalling it won’t ease too quickly. Together, they remind us that positioning in Bitcoin requires reading both the structural forces inside crypto and the broader policy environment shaping liquidity. In case you missed it, here are the other topics we covered this week: Essential Decision-Making Tools Bitcoin Market Monitor - Key Drivers in Five Charts: Bitcoin Market Forecast - Probability Scenarios & Risk Metrics: Get these professional-grade insights delivered to your inbox: ETF Outflows Are Pulling Bitcoin LowerMacro uncertainty is in the driver’s seat and it’s not a steady hand at the wheel. Inflation is back on the radar, while weakness in the labor market is showing up through rising continuing claims after a year of stability. The result is a confused policy outlook. Some voices, even at the Fed, are calling for faster rate cuts. The next day, it’s clear that won’t happen (see Section 3 of this newsletter). That back-and-forth is the kind of environment that erodes sentiment for risk assets. The Nasdaq 100 has been drifting lower from its peak, and Bitcoin is following suit. But the key question is whether this is just noise or something structural. That’s where ETF flows give us clarity. We’ve seen situations before where Bitcoin dipped but institutional inflows stayed strong, setting the stage for a quick rebound. This is not one of those times. Since the end of last week, ETF flows have turned negative. Enough investors are cashing out that our flows-to-price model is now pointing to a lower expected price. The model puts Bitcoin’s fair value around $107K versus the actual price of $112K. More importantly, the expected range now leaves room for dips below $100K if outflows persist. That’s slightly weaker than our forecast from last week, but the pattern remains the same:

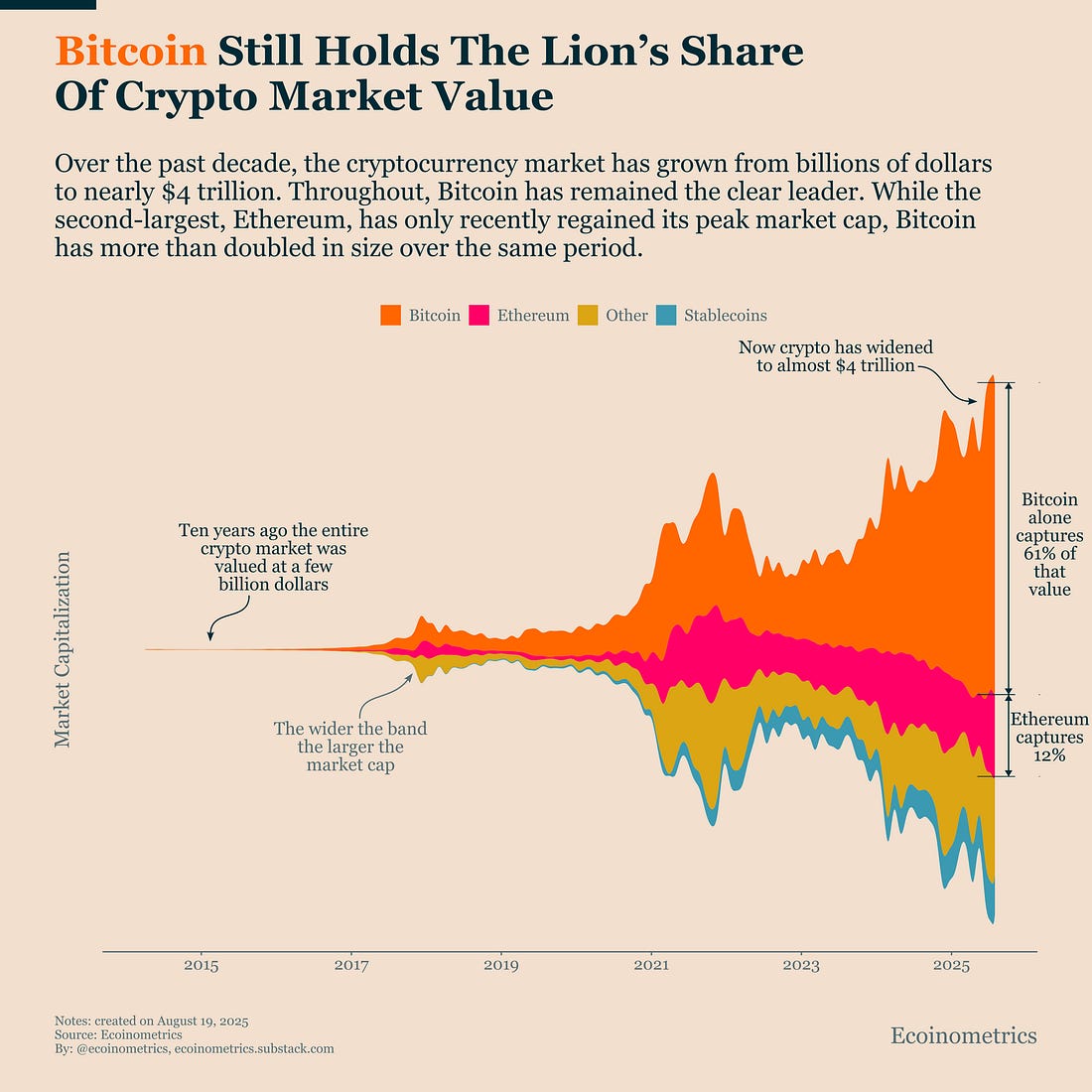

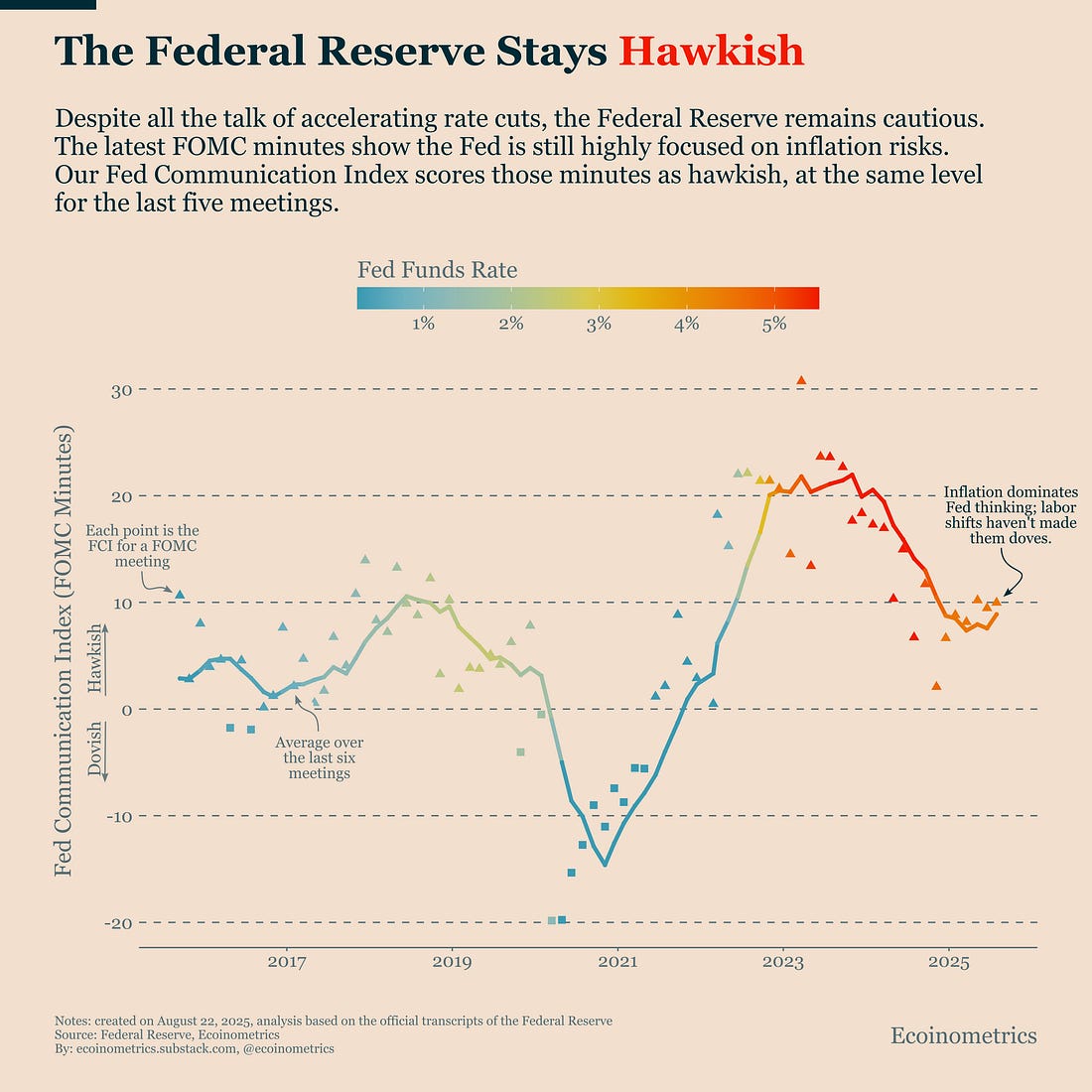

The key point is that flow-driven selling carries more weight than simple price-driven volatility. When ETF flows go negative, it signals actual capital leaving the structure, not just traders reacting to price. That’s why ETF flows, not short-term price action, are the signal to watch right now. Bitcoin Still Holds the Lion’s Share of Crypto Market ValueBitcoin’s dominance isn’t just about narrative, it’s about market structure. With a $4T crypto market, Bitcoin alone captures 61% of the value. That dominance reflects where institutional capital feels comfortable: the deepest liquidity, the clearest role, and the most direct investment case. Ethereum, at 12%, is the next in line, but its broader use case, being a decentralized smart contract platform, makes it harder to frame as a core portfolio allocation. Stablecoins, meanwhile, are essentially digital dollars: useful for transactions, not a store of value. Beyond that, most crypto assets remain niche or very speculative. The persistence of Bitcoin’s dominance matters. Despite multiple altcoin cycles and waves of hype, Bitcoin has nearly doubled its market cap since 2021 while Ethereum has only just regained its peak. This resilience shows that allocators looking for scalable exposure consistently return to Bitcoin. For investors, the implication is straightforward: Bitcoin should remain the anchor of any crypto allocation. Only venture out the risk curve when the case for superior returns is clear, but keep Bitcoin as the long-term core. The Federal Reserve Stays HawkishDespite all the speculation about the Fed accelerating the pace of rate cuts, the latest FOMC minutes show no change in tone. For the last five meetings, the committee has remained firmly hawkish. Now, two trends are pulling in opposite directions:

The Fed can tolerate some softening in jobs, given that unemployment is still historically low. What it cannot risk is inflation re-accelerating before price stability is restored. Cutting too aggressively would undermine its credibility on inflation, a mistake the committee clearly wants to avoid. Our Fed Communication Index, which quantifies the tone of FOMC minutes, has scored each of the last five meetings as hawkish. The consistency suggests the committee is committed to its current path: modest rate cuts, but no acceleration unless the data deliver a major surprise. For Bitcoin, this isn’t a negative backdrop. Financial conditions are already loose and still easing, even without faster cuts. Historically, that environment has supported steady growth in Bitcoin. The recent market pullback reflects shifting expectations more than an actual tightening of liquidity. That's it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, August 22, 2025

ETF Outflows Are Pulling Bitcoin Lower

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's no secret that ETH spent a lot of this cycle on the sidelines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

ICOs are everywhere, all of a sudden, right before the holidays. Today, we're scoping out a few noteworthy ones dropping over ...

-

HyperLiquid's HIP-3 allows outsiders to deploy perp markets on HyperLiquid. Ethena is taking advantage of that...

-

Also Bitcoin Is Trading Near Its ETF-Flows Fair Value & The Dot Plot Confirms Limited Easing and Rising Uncertainty ͏ ͏ ͏ ...

No comments:

Post a Comment