| gm Bankless Nation,

The most scrutinized protocol of 2024 has become a DeFi powerhouse. With USDe’s yield, Ethena is becoming the top trading collateral while opening institutional access through USDtb. Today, we break down its strategy. Today's Issue ⬇️ - ☀️ Need to Know: Phantom CASH

The leading wallet launches its new stablecoin. - 🗣️ Analysis: Ethena's Expansion

USDe sets up to be the best perps collateral.

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet. . . . NEED TO KNOW Phantom's New CASH Stablecoin - ⚖️ SEC Clears DoubleZero’s Token Distribution. The SEC’s Division of Corporation Finance issued a no-action letter confirming it won’t recommend enforcement against DoubleZero’s programmatic 2Z token transfers, with the mainnet-beta launch scheduled for October 2.

- 🏛️ U.S. Government Nears Shutdown. Funding runs out at 12:01 A.M. EST on Wednesday unless Congress passes new legislation, a lapse that would furlough hundreds of thousands of workers and halt services from SBA loans to national park operations.

- 💳 Phantom Launches CASH Stablecoin. Phantom introduced Phantom Cash, a USD-pegged Solana stablecoin with banking-style features like debit cards, peer-to-peer transfers, and plans for Stripe merchant integration.

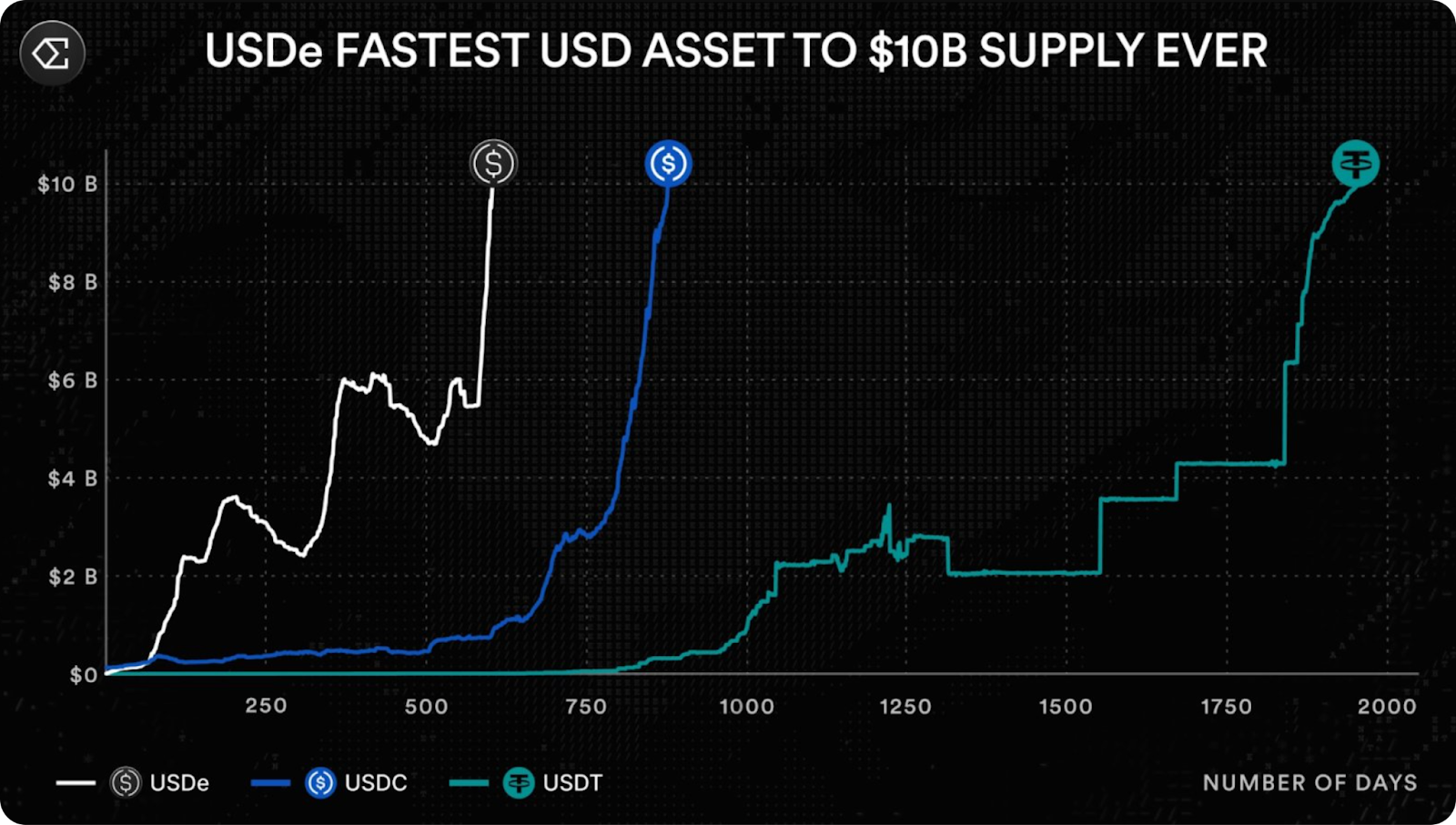

📸 Daily Market Snapshot: After Monday's green, the market leveled out, giving back some of its gains but with Bitcoin retaining the pivotal 113.5K mark, at least for now. Overall, it remains in a holding period. | Prices as of 2pm ET | 24hr | 7d |  | Crypto $3.97T | ↘ 0.9% | ↘ 0.0% |  | BTC $113,521 | ↘ 0.5% | ↗ 1.4% |  | ETH $4,114 | ↘ 1.2% | ↘ 0.9% | . . . ANALYSIS Ethena's Play for Perps The most critically scrutinized protocol of last year has been hard at work, evolving from an experiment into a DeFi behemoth with a surprisingly clear vision for the future. While most stablecoin projects chase a single strategy, Ethena is executing on two fronts simultaneously: creating the perfect collateral for crypto traders with USDe, while hedging its bets with the regulatory-compliant USDtb. It's a dual-path approach that's proving remarkably effective. Consider some of what Ethena has accomplished so far this year: - USDe became the fastest growing USD asset to $10B supply ever — surpassing the growth trajectories of both USDC and USDT and becoming the third largest stablecoin by marketcap at $14B

- Achieved capital retention levels above 75% — maintaining user deposits even during market volatility

- Integrated as yield-bearing collateral across major exchanges — Bybit, Deribit, MEXC, and now Binance (where supply crossed $2B in first four days after USDe Earn went live) allow traders to earn while trading

- Generated over $500M in protocol revenue — with 100% of net revenue passed directly to USDe/sUSDe holders

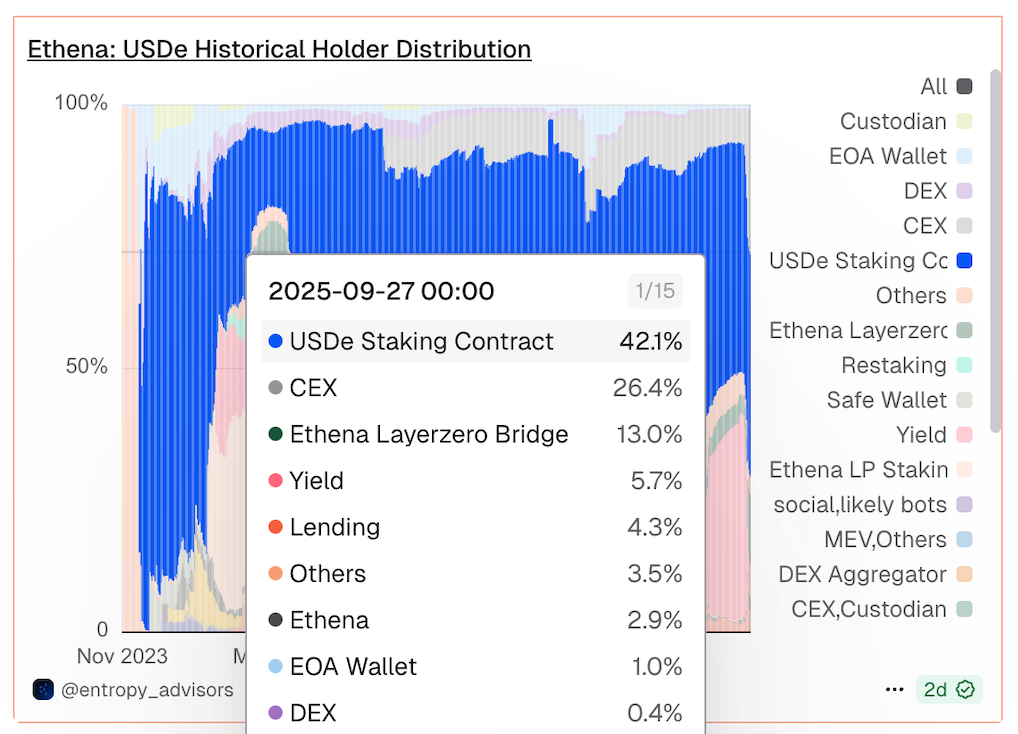

- Launched USDtb — a fully-backed companion stablecoin designed to capture traditional, compliance-focused market share

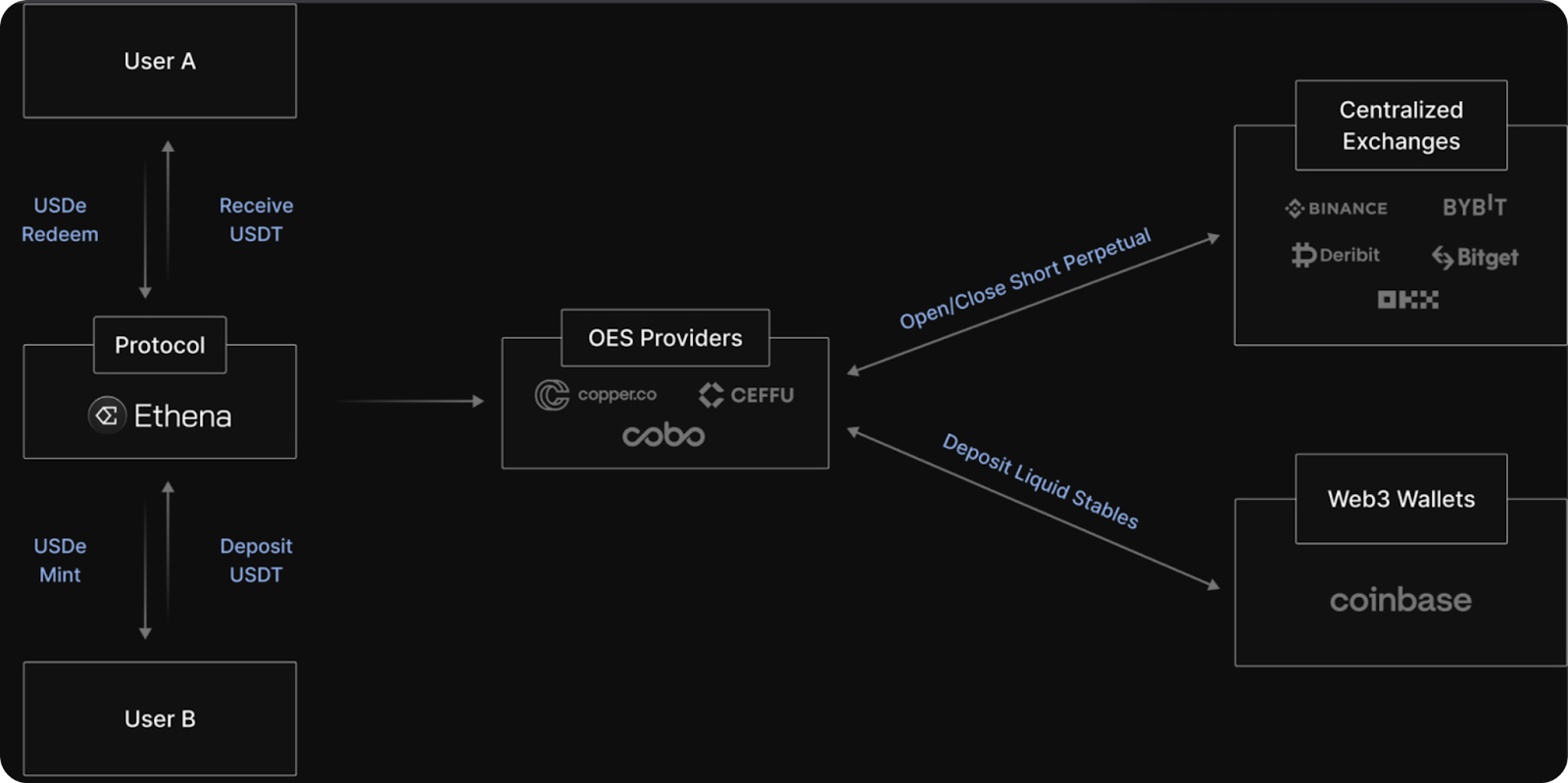

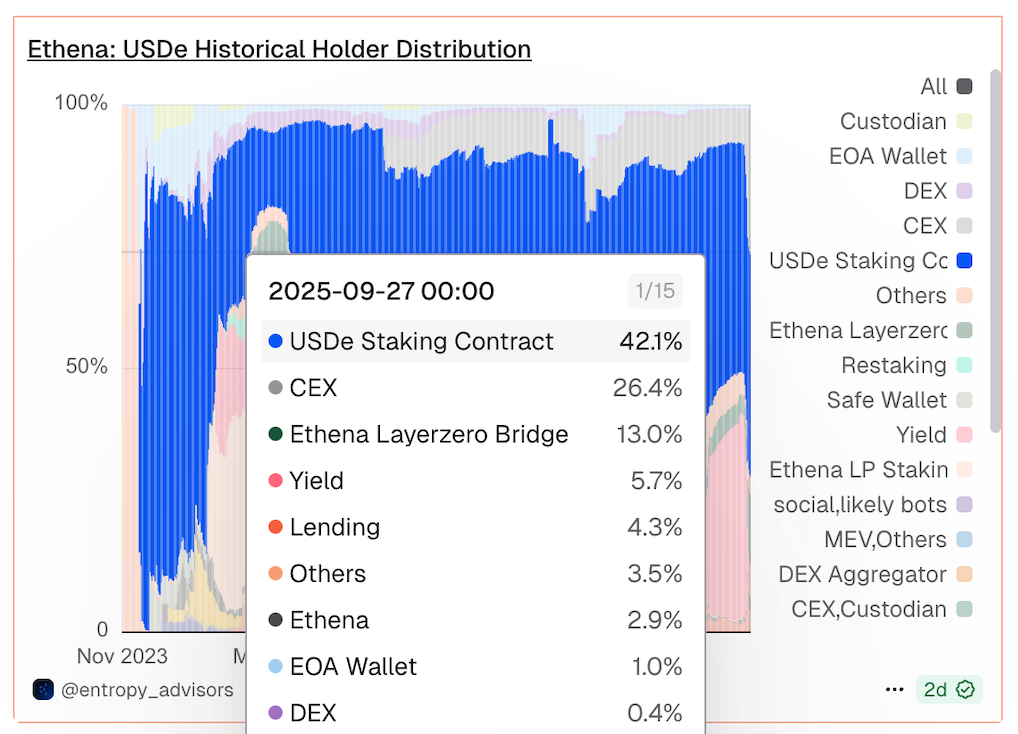

Perhaps most telling, Ethena recently announced progress on implementing its fee switch for holders of its native token, ENA — a move signalling confidence about the protocol's maturity and sustainable revenue generation. But to understand where Ethena is heading, we need to first grasp what makes it fundamentally different from every other stablecoin in the market. The Delta-Neutral MachineInspired by Bitmex co-founder Arthur Hayes' 2023 piece "Dust on Crust," which envisioned a synthetic dollar using crypto collateral and derivatives, Ethena’s flagship product is USDe — a stablecoin designed to generate superior yields through what's called a delta-neutral strategy. Put simply, Ethena holds diverse, “bluechip” crypto collateral (BTC, liquid staked ETH, SOL), which, as we know, can be volatile. To counteract this volatility, it takes short positions on these assets using perpetuals. Thus, if their prices rise, collateral gains offset short losses; if prices drop, short profits offset collateral losses. This keeps USDe pegged at $1 in most market conditions, as it is backed by approximately $1 worth of collateral, though temporary deviations can occur during extreme conditions. But, more importantly, it generates yield for the protocol from funding rates (small payments between traders that keep futures prices aligned with spot prices), while the liquid staked collateral produces staking rewards. Ethena then passes on these rewards to holders of USDe/sUSDe (USDe must be staked for sUSDe to earn these yields). In 2024, this delivered a 19% average return to sUSDe holders, far outpacing traditional stablecoins. A Different Kind of StablecoinDespite its success, USDe behaves nothing like USDT or USDC. While those stablecoins thrive on velocity — changing hands constantly for payments and transfers — USDe does not, existing in opposition to the typical profile of a “successful” stablecoin. For example, despite USDT having only 18x the supply of USDe, it has 1,700x the yearly transfer count, as Nishal Jain points out — a discrepancy that would raise alarms for most stablecoins. But USDe is simply different. Because it must be staked to earn yield, the overwhelming majority of its on-chain activity is tied to lending and yield rather than transfers. Of the ~$13.6B supply, about 42% sits in the sUSDe staking contract, ~26% in centralized exchanges (presumably earning yield like that offered by Binance Earn), and another 10% in yield or lending, meaning roughly 78% of USDe is positioned to earn yield in some form. And it doesn’t stop there — over half of sUSDe itself has been lent out again for additional returns, showing how the token’s core uses compounds around yield rather than simple payments.  What is more telling of its success is the fact that, during market crashes, Ethena retained an average of 76.2% of its TVL, far exceeding even blue-chip lending protocols like Aave at ~62%, according to A1 Research. In other words, USDe just isn’t designed for payments, both in and out of crypto, as other stables are, it’s designed to maximize capital efficiency within our onchain landscape. Users aren't transferring USDe to buy coffee; they're holding it to earn yield and, increasingly, using it as the ultimate trading collateral. The Perfect Trading CollateralRecently, Ethena announced it had partnered with Binance to allow its USDe to be used as trading collateral and that, opposed to onchain, all users had to do to qualify for yield was hold USDe, not stake it. This marks the fifth integration of USDe into “offchain” trading venues, making clear that Ethena's primary growth strategy for USDe is becoming the default collateral for derivatives trading, which is by far the largest market for cryptocurrency trading — accounting for 68% of all trading in 2024 and seeing triple digit growth year over year. It's a brilliant play that benefits both traders and the protocol itself. Why would using USDe be more attractive for traders than USDT or USDC? Put simply, USDe provides unmatched capital efficiency. Posting USDe as collateral for a perpetual futures position means traders can: - Cover trading costs with yield — the ~10-20% annual returns from sUSDe offsets funding costs on their leveraged positions

- Build collateral buffers automatically — yield compounds over time, increasing the margin of safety against liquidations

Further, for Ethena, becoming the defacto asset here goes beyond just solidifying the protocol’s place in one of the fastest growing verticals in crypto. It would also: - Help the revenue engine — since each newly minted USDe means another dollar deployed in Ethena’s basis trade, generating more protocol revenue

- Keep capital sticky — as traders would have to close the trade to withdraw their USDe, which they have low reason to do since using USDe helps offset funding rates and even grow their underlying collateral

The integrations speak to this strategy's success. Bybit, Deribit, MEXC, Gate, and Binance (now with Earn at 12% APR and over $2B supply), Kraken, and Korean exchange, Coinone, have all enabled USDe as collateral that continues earning yield. Against this backdrop, Ethena's excitement about Hyperliquid — from the recent USDH pitch to its expanding ecosystem involvement — feels like a natural next step for the protocol’s growth. The Regulatory Hedge: USDtbWhile USDe targets the derivatives market, Ethena's also looking to build on its inroads with TradFi through USDtb. With regulations like the GENIUS Act progressing, mandating full backing by high-quality liquid assets and restricting yield passthrough to retail holders, USDe's algorithmic structure faces potential headwinds. We're already seeing this play out, with Germany's BaFin restricting USDe over MiCA compliance concerns. Launched at the end of last year, USDtb offers an alternative. Backed by BlackRock's USD Institutional Digital Liquidity Fund Token (BUIDL) — essentially tokenized U.S. Treasuries — it provides the regulatory clarity that institutional players demand. No complex derivatives strategies, no algorithmic mechanisms, just straightforward treasury backing that meets both current and proposed regulatory standards. Already responsible for ~12.5% of Ethena's total stablecoin supply (with ~$2B supply amid $16B combined TVL), USDtb serves as Ethena's bridge to traditional finance. It gives risk-averse institutions and conservative users a way to enter the Ethena ecosystem without touching the more complex USDe. More importantly, it positions Ethena to compete directly with USDC and USDT for institutional flows — a market that increasingly values regulatory compliance above yield. While a dual approach like this might divide and hinder focus for some, it’s worked quite well for Ethena. Rather than betting everything on one model, they've built optionality into their growth strategy. USDe captures the crypto-native market seeking yield and capital efficiency, while USDtb pursues institutional adoption through regulatory alignment. Overall, it’s simply been a tremendous year for Ethena, which has gone from a protocol many were skeptical and even suspicious of to a true DeFi cornerstone. With USDe, Ethena has created the perfect stablecoin for crypto's internal economy — a yield-generating, capital-efficient collateral that makes every dollar work harder. With USDtb, it's built a bridge to traditional finance and regulatory acceptance. Together, they position Ethena to capture value regardless of how the stablecoin market evolves. As the protocol implements its fee switch and continues expanding exchange integrations, one thing becomes clear: Ethena’s demonstrating the range of possibilities for what stablecoins can be — productive assets that thrive by focusing on one particular use case, rather than being simply general purpose. Whether that happens through innovative derivatives strategies or traditional treasury backing, Ethena seems determined, and well positioned, to win either way. FRIEND & SPONSOR: UNICHAIN Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today. |

No comments:

Post a Comment