| gm Bankless Nation,

It was a brutal day for just about every top-100 token except Plasma's newly launched XPL token. Let's dig into its bull case. Today's Issue ⬇️ - ☀️ Need to Know: Market Slide

ETH below $4K, BTC below $110K. - 🗣️ Opinion: Bull Case for Plasma

Can Plasma beat out Tempo?

p.s. Thanks to 0G. Build together with Google or Optimism on the first scalable, verifiable AI L1. Testnet v3 is here. Mainnet + token coming in Q3 2025. Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet. . . . NEED TO KNOW Market Slide - 💸 Plasma Launches Mainnet Beta with Surprise $10k Bonus. The stablecoin-centric Plasma mainnet beta is live, and early investors just got a surprise 9,304 XPL.

- 🔥 Cloudflare Unveils NET Dollar to Power Payments for the AI Internet. The internet services giant is jumping into stablecoins with the NET Dollar.

- ⛓️ SharpLink Partners with Superstate to Launch Tokenized SBET on Ethereum. SharpLink Gaming to become the first Digital Asset Treasury company with shares listed on the Ethereum blockchain.

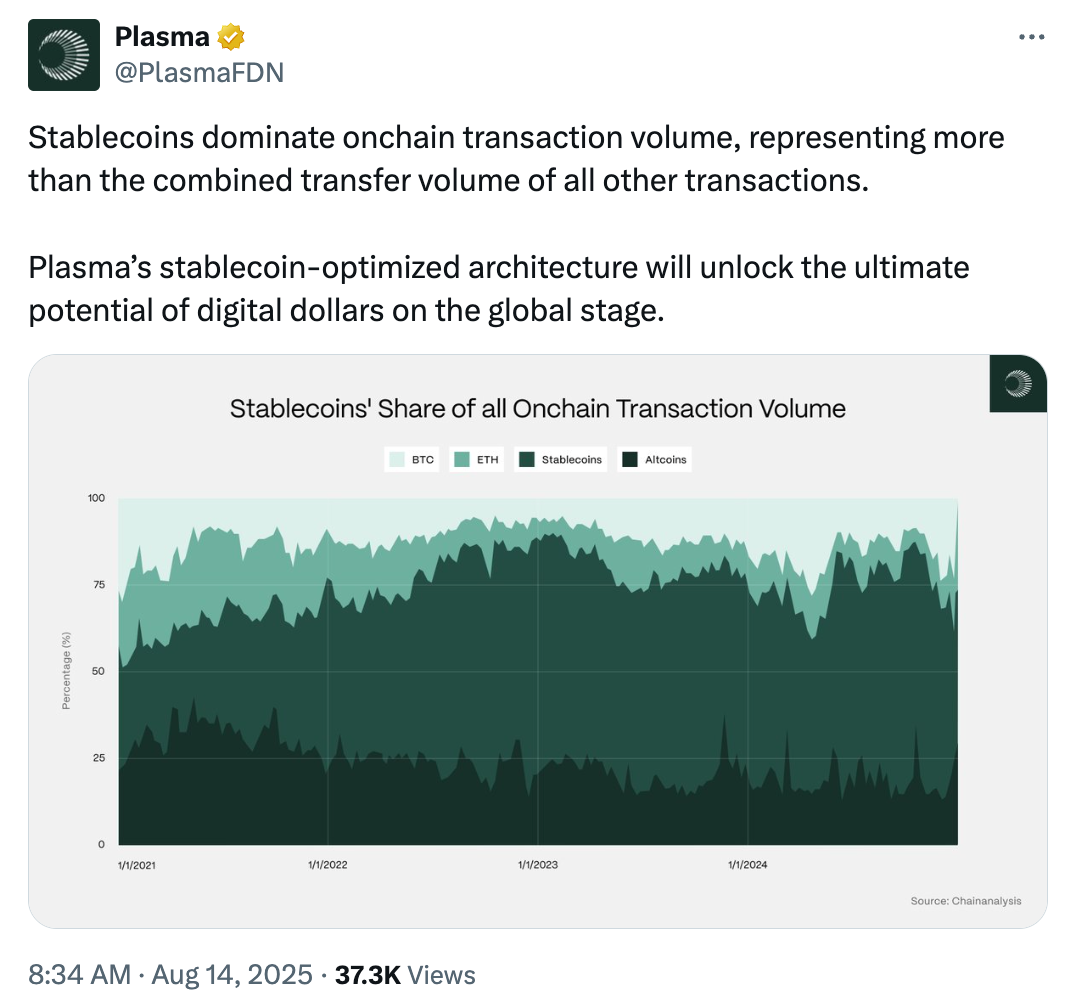

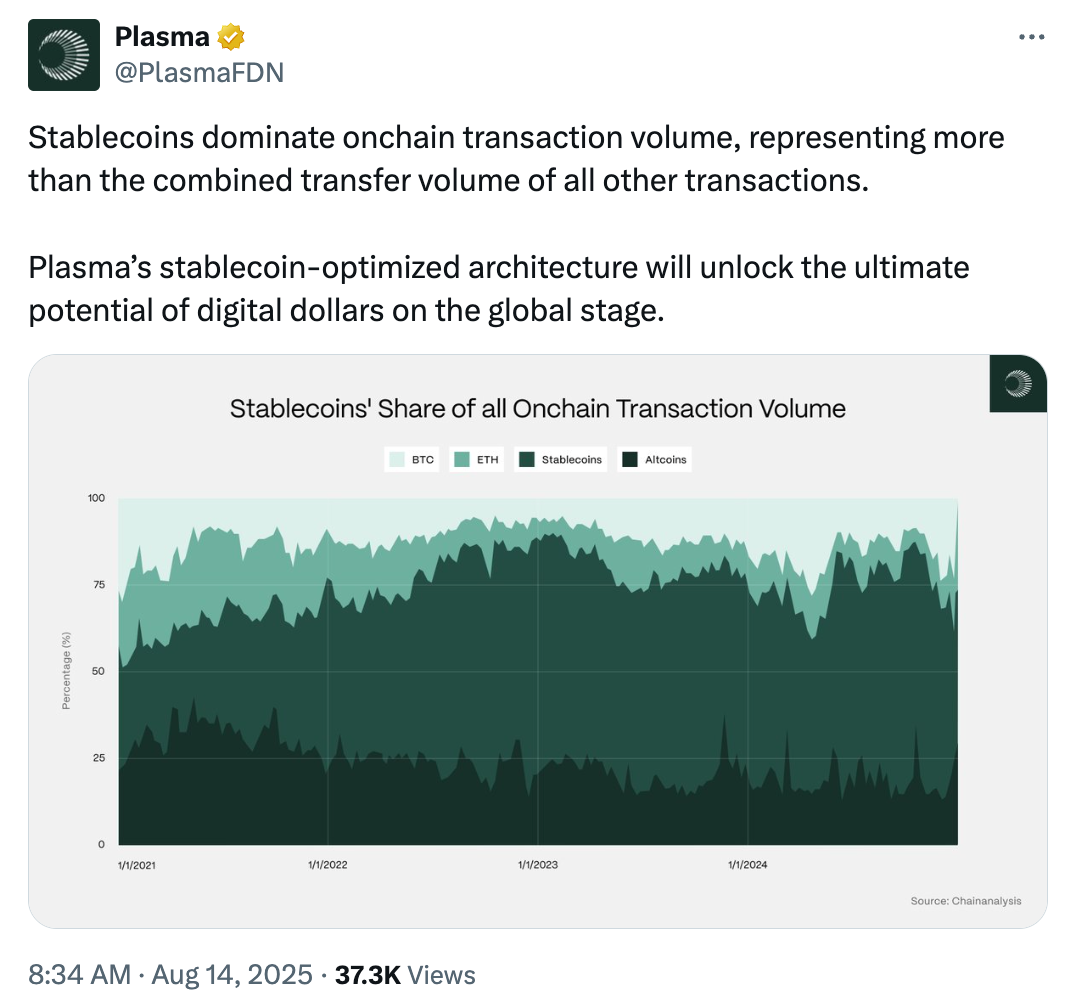

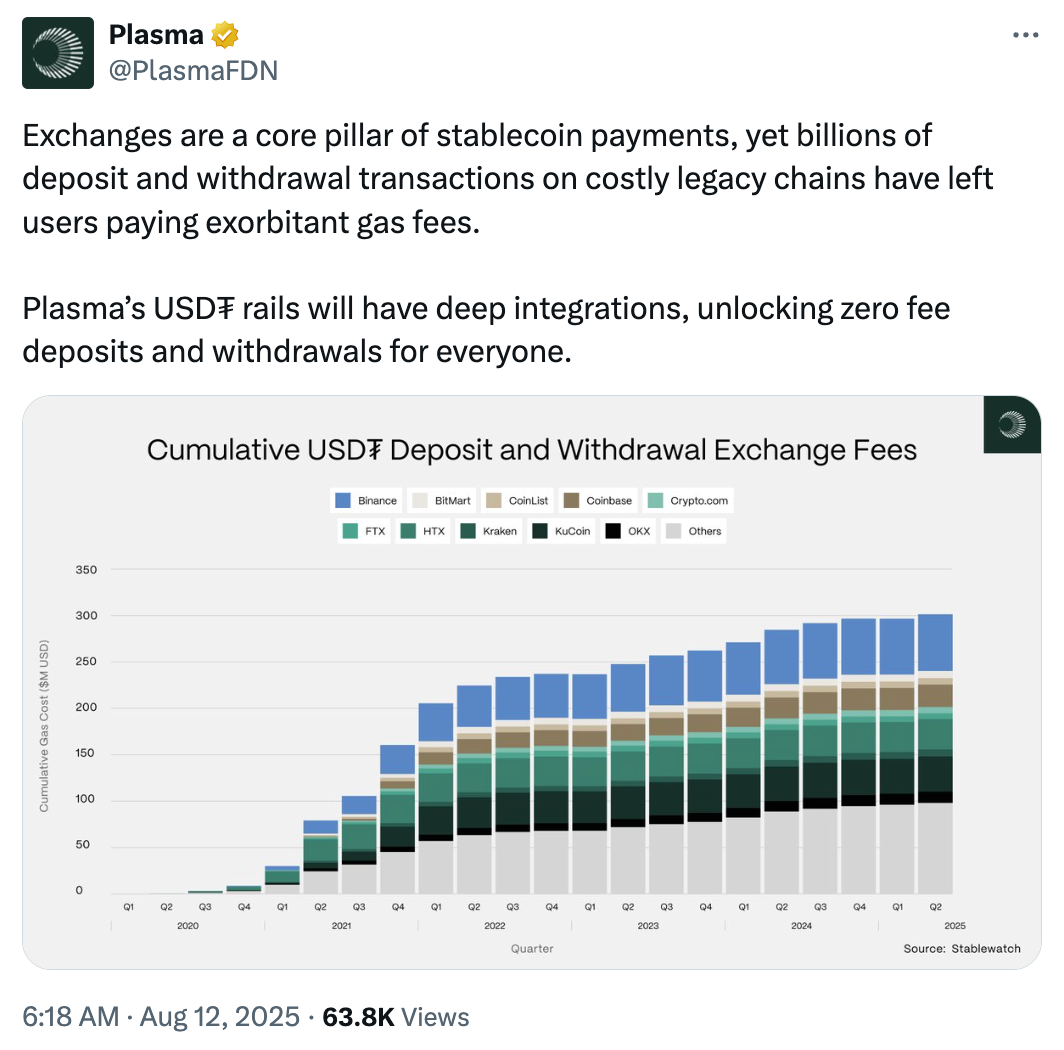

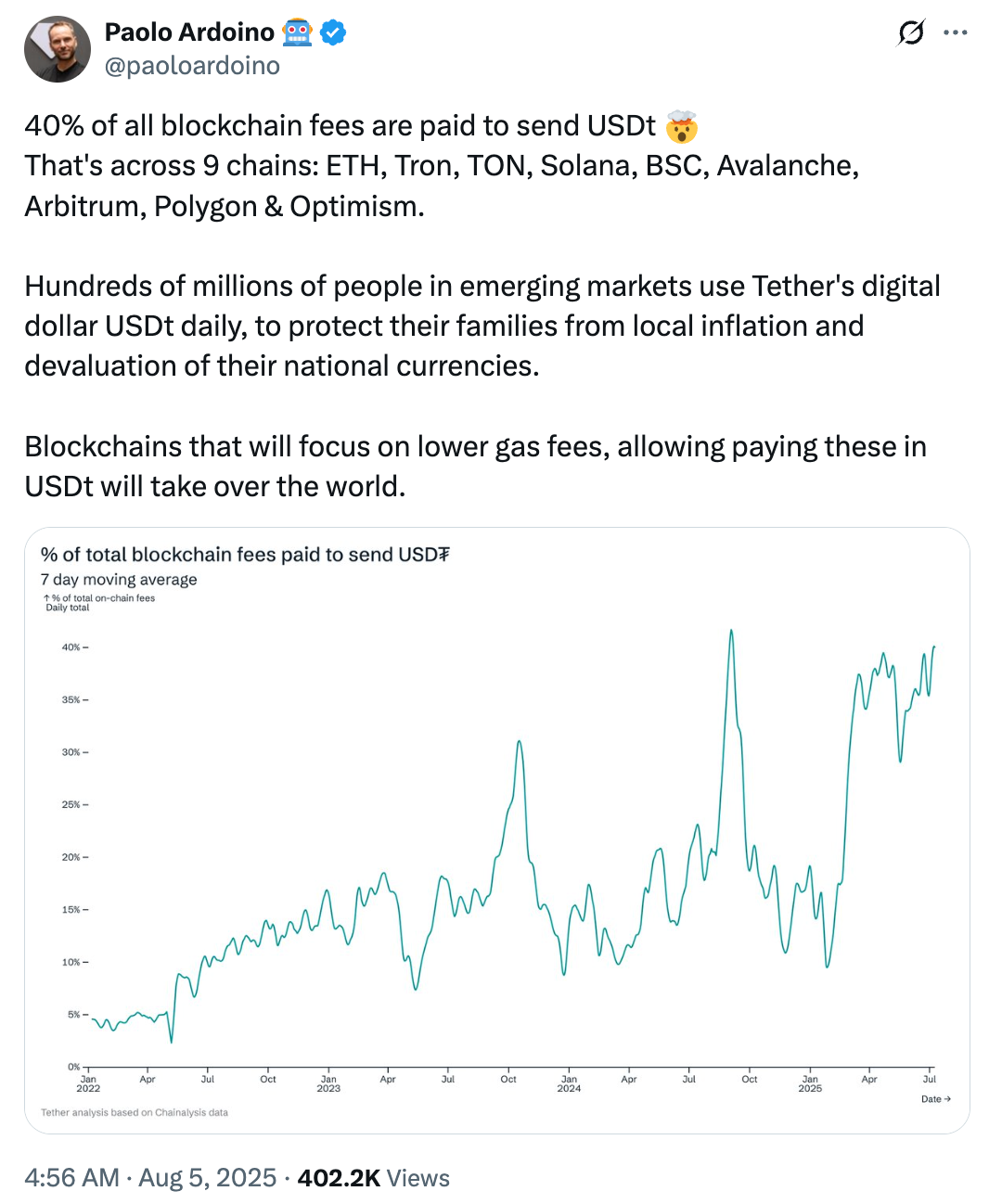

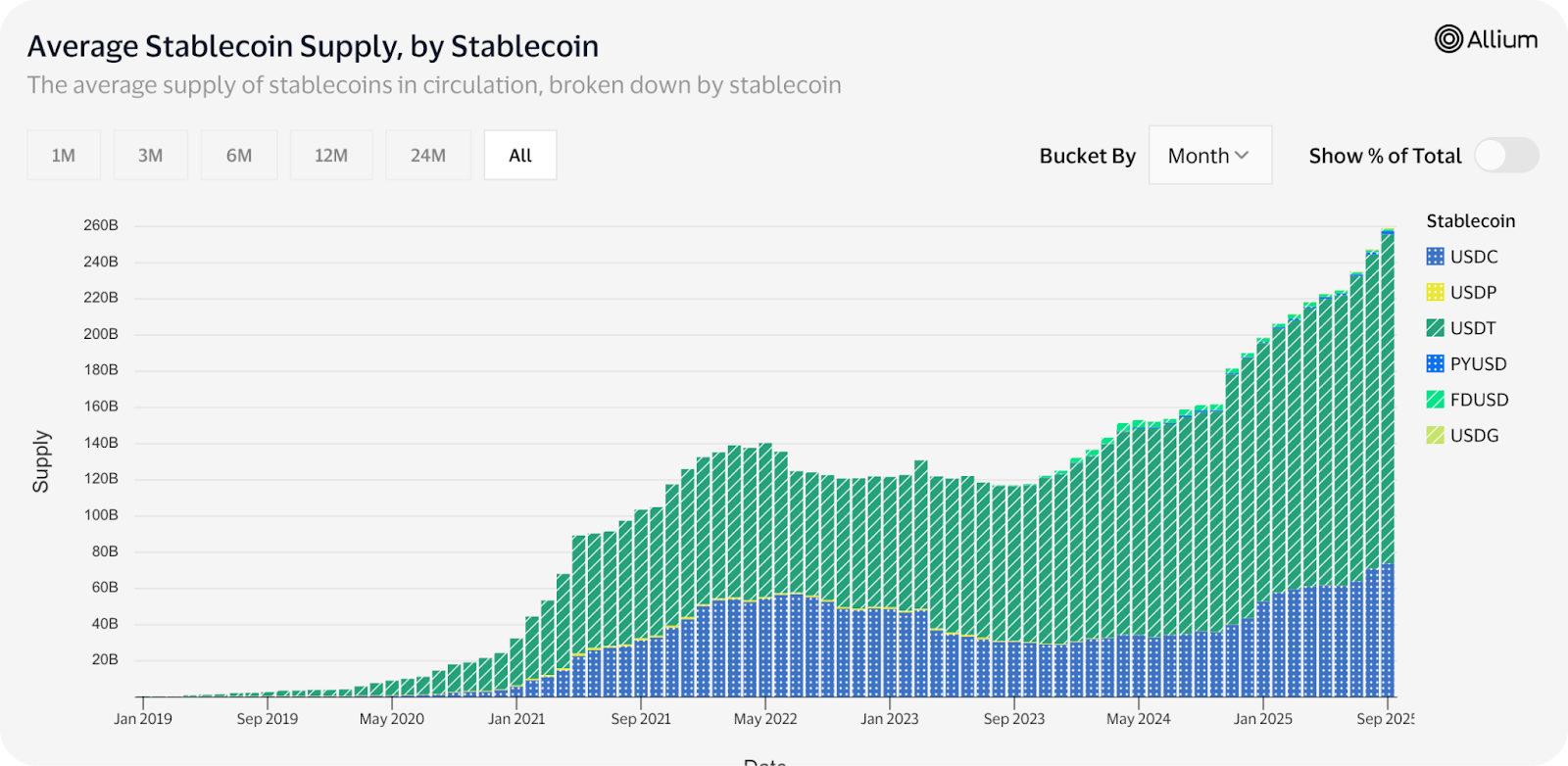

📸 Daily Market Snapshot: A rough day for crypto markets took high-flying ETH back below $4K, BTC back below $110K, and SOL below $200. The day's biggest loser was Story's IP token which crashed 31%. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $3.75T | ↘ 4.3% | ↘ 8.5% |  | BTC $109,142 | ↘ 3.9% | ↘ 7.2% |  | ETH $3,905 | ↘ 6.9% | ↘ 15.5% | . . . OPINION The Bull Case for Plasma Stablecoins settled $18 trillion onchain this year, surpassing Visa and Mastercard. Yet despite this scale, stablecoin infrastructure remains immature — fragmented across dozens of chains with different fee structures, compliance requirements, and liquidity pools. Recently, we've seen multiple "stablecoin" chains emerge to solve these issues. Two in particular have excited the industry: Tempo and Plasma. This morning, Plasma's token and mainnet beta went live, marking the arrival of what many consider the more controversial, yet simultaneously more "beloved by CT," of the two. While Tempo plays it safe with regulatory compliance and Stripe's backing, Plasma has chosen a different path, building explicitly around USDT and Tether's global dominance. This choice, though contentious due to all of the skepticism around Tether, reveals a deeper strategic truth: Plasma is capturing the flows that already exist — both in DeFi where USDT anchors liquidity, and in emerging markets where it functions as actual money — positioning it to evolve into the issuer-neutral chain for all stablecoins. Building the Ultimate Stablecoin InfrastructureI've written about Plasma previously, but to summarize: the EVM-compatible, fast finality chain positions itself as infrastructure where stablecoins, "starting with Tether (USDT), and expanding to others," are first-class citizens rather than secondary assets. This means stables benefit from superior liquidity, optimized fees, and customizable features developers can configure for remittances, payments, DeFi, or institutional flows. To do this, Plasma provides out-of-the-box tools like: - Low-Cost and Free Transactions: Plasma’s consensus mechanism confirms transactions in under a second at low cost, while gasless USDT transfers allow free wallet-to-wallet transfers, aiming to capture Tron's USDT market.

- Custom Gas Tokens: Users pay fees with stablecoins or BTC — users won't need the chain’s token, XPL, to transact.

- Confidential Transactions: Private transfers hide amounts and parties, with selective disclosure for compliance.

- Integrated Merchant Connections: Can link to real-world payments via Yellow Card (Africa remittances) and BiLira (Turkey ramps), plus on/off-ramp tools.

- Bitcoin Bridge: Plasma anchors state to Bitcoin for the immutable finality so hotly demanded by the market, positioning itself where BTC and stablecoins converge.

To borrow an analogy from Decentralised, Plasma aims to do for stablecoins what Stripe did for ecommerce: collapse fragmented rails, compliance hurdles, and liquidity gaps into a single layer. Why Not Tempo?The question is, then, why wouldn't Stripe's own blockchain initiative, Tempo, be better suited to capture this opportunity? The bull case for Plasma perhaps lies less in what Tempo can't do and more in what it won't do. While Tempo could theoretically build a new hub for stablecoins to pass through, their approach is geared toward enabling others to launch their own — via Bridge, Stripe's acquisition that commoditizes stablecoin deployment for banks and brands — rather than rallying around any existing one. In other words, Stripe appears committed to remaining neutral, providing tools and rails for these new entrants to exchange and flow, rather than picking or pursuing winners from today's market. This is where Plasma's strategy diverges. Instead of waiting for markets to materialize, Plasma plugs directly into existing infrastructure by building around USDT — using Tether as both growth driver and trojan horse to capture flows and sidestep the cold-start problem. Many will argue that Stripe's brand could overcome this issue, but according to Allium, half of all stablecoin transactions occur on exchanges, with these venues holding the majority of supply. Only 0.6% of volume comes from retail users. This reality fundamentally favors Plasma's approach. While Tempo's partners focus on integrating stablecoins into traditional payment networks — a market that barely exists today — Plasma builds where volume already lives: exchanges and DeFi via USDT.  Moreover, USDT dominates precisely where stablecoins matter most. As Plasma CEO Paul Faecks emphasizes, in Turkey, Thailand, Argentina, and Nigeria, USDT functions as actual money, not financial middleware. People use it for remittances, savings, and daily transactions — the real-world use cases that define stablecoins' ultimate value. Tether delivers worldwide dollar access unconstrained by domestic banking, which many users prioritize over yield promises. Plasma's strategy directly targets both these flows: the deep liquidity pools where USDT anchors crypto markets, and the emerging economies where it operates as functional currency. The Path to Issuer Neutrality Through DominanceTo become the "ultimate stablecoin infrastructure," Plasma must eventually become issuer neutral — serving all stablecoins equally, not just USDT. While clearly specifying it's "starting with Tether (USDT)," the chain's profile of building around USDT from day one, backed by Tether-adjacent capital, makes this neutral future seem untenable. But this contradiction isn't a flaw — it's the strategy. To achieve true neutrality, a new network must first capture dominant flows. And the only way is by locking in the undisputed leader: USDT. Beyond its status as the longest-standing stablecoin — enduring endless FUD without major failure — USDT commands 62% of total stablecoin supply, 60% of trading volume, and 75% of unique active stablecoin wallets. This dominance creates a gravity well pulling everything else in. To claim stablecoin liquidity's throne, Plasma must first conquer USDT's, as any stablecoin issuer seeking the best prices for their own digital dollar will need its pairings which, if Plasma succeeds, will exist on its chain. Thus, other stablecoins follow by necessity, concentrating around USDT on Plasma while accessing the chain's tools — gasless transfers, confidential transactions, merchant integration — built specifically for stablecoins. Starting with USDT also lets Plasma leverage Tether's unencumbered structure. Operating offshore, free from U.S. or EU regulatory overreach, with immense profits and “sovereign” reserves in Treasuries, gold, and Bitcoin, Tether’s granted financial and regulatory sovereignty to innovate without external strings. Circle's USDC, by contrast, depends on U.S. interest rates and funnels half its revenue to Coinbase, potentially hindering it through resource constraints and external priorities. This profile — widely adopted, structurally independent, financially sovereign, globally distributed — renders Tether the least encumbered stablecoin. Plasma's bet may seem to undermine issuer neutrality upfront, but it's the only viable path to delivering it long term. By dominating USDT flows first, Plasma builds the liquidity density that magnetizes every other stablecoin, evolving from a Tether-centric launchpad into the neutral operating system for all. Plasma's launch tests whether the market agrees with a simple premise: winning stablecoin infrastructure must handle existing flows, not wait for compliant volume to materialize. While, given its financial ties to Tether it will always likely somewhat favor USDT, Plasma bets it can evolve from predominantly Tether-centric to becoming the operating system for stablecoins overall, decentralizing along the way. As stablecoin volume continues exponential growth and crypto finally bridges legacy finance, the chain that captures these flows will define the next era of digital money. Plasma's bet is that building with the market leader, rather than against it, provides the fastest path to becoming that definitive layer. Today’s launch of Plasma mainnet begins to put that theory to the test. FRIEND & SPONSOR: UNICHAIN Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today. |

No comments:

Post a Comment