| gm Bankless Nation,

Tether is seeking a raise that could value the company at a whopping $500B, vaulting it past Goldman Sachs and putting it in JPMorgan’s shadow. Let’s unpack this unprecedented play. Today's Issue ⬇️ - ☀️ Need to Know: Swift Chain

The payments giant goes onchain. - 🗣️ Analysis: Tether's Massive Raise

Digging into the numbers.

p.s. Thanks to 0G. Build together with Google or Optimism on the first scalable, verifiable AI L1. 0G v3 mainnet and token just went live! Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet. . . . - 🌐 Swift to Develop Blockchain Ledger for Global Cross-Border Payments. The company announced that it will integrate a blockchain-based shared ledger into its global payments infrastructure.

- 💰 Another Week, Another Buy: BitMine Stacks 234k ETH. BitMine scooped up a quarter of SharpLink's ETH reserves in one week, with its holdings now tripling those of its closest competitor.

- 🌷 Andre Cronje’s Flying Tulip Raises $200M at $1B Token Valuation. The project intends to raise up to $800M more in an upcoming FT token public sale.

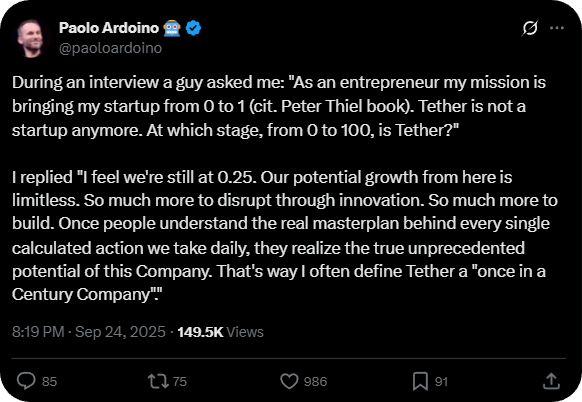

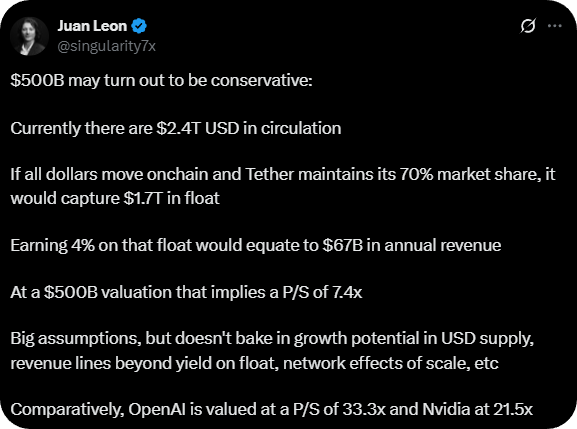

📸 Daily Market Snapshot: With the cryptoeconomy's market cap back over $4T, virtually every top 100 coin was in the green on the day, with both BTC and ETH boasting +3% gains. | Prices as of 2pm ET | 24hr | 7d |  | Crypto $4.00T | ↗ 2.7% | ↘ 2.6% |  | BTC $114,080 | ↗ 3.6% | ↗ 1.2% |  | ETH $4,145 | ↗ 3.1% | ↘ 0.4% | . . . ANALYSIS Tether: Bigger Than Goldman, Chasing JPMorgan? Tether is gunning to become one of the most valuable venture-stage companies in the world with a fresh raise that reportedly values the company on par with OpenAI. Already the world’s largest stablecoin issuer, responsible for safeguarding more than $170B of USDT reserves, Tether is now rumored to be chasing a jaw-dropping $500B valuation, which – if completed – will mark a record-setting first for the crypto industry and make Tether the most valuable company in crypto! Today, we’re unpacking Tether’s monumental raise and exploring how investors might support such a sky-high valuation. 👇 🪙 Tether’s TimeAccording to a Bloomberg News report released last Wednesday, crypto stablecoin issuer Tether is seeking to raise between $15B and $20B from private investors in exchange for a roughly 3% stake in the company. While the exact figures and terms of this deal remain unconfirmed, the raise allegedly values Tether north of $500B and will reportedly involve the issuance of new equity, rather than affording existing investors liquidity to sell their stakes. Shortly following publication, Tether CEO Paolo Ardoino confirmed the raise rumors in a post to X, noting that the capital infusion is intended to support Tether’s expansion across existing and new business lines – including stablecoins, distribution ubiquity, AI, commodity trading, energy, communications, and media – by “several orders of magnitude.” Just months ago, many crypto commentators were questioning USDC stablecoin issuer Circle’s seemingly aggressive IPO target of $4-5B; that offering ended up 25x oversubscribed and CRCL shares handily soared past a $20B valuation on listing day. Now, Tether’s hypothetical half a trillion dollar valuation seeks not only to eclipse that of leading crypto corporates like Coinbase and Circle, but to make the company more valuable than any blockchain existence, save for Bitcoin itself! 📊 Valuation MathIn comparison to Circle – Tether’s closest publicly traded competitor which trades at a market capitalization of $29B – Tether has issued approximately 2.3 times as many stablecoins. While this slight stablecoin multiple does not bode well for Tether’s ambitious $500B raise on first glance, the devil is in the details to justify this 17x valuation discrepancy. Unfortunately, as Tether does not publish an income statement as part of its quarterly reserve attestations, it is somewhat difficult to contrast the financials of these two companies. In the first six months of 2025, Circle’s Q2 financial audit reported $1.2B of gross interest income from its stablecoin reserves. Adjusting these revenues for circulating USDT supply, we can approximate that Tether’s reserve interest income amounted to around $2.7B for the first six months of 2025. Holding all variables constant (like circulating stablecoin supply and interest rates), this translates to $2.4 and $5.5B of annualized core stablecoin reserve revenues for Circle and Tether, respectively. Beyond stablecoin reserve revenues, both Circle and Tether make money from sources. For Circle, its other income consists primarily of subscription services contracts and gains (or losses) on digital asset holdings. These two line items produced $50M in the first six months of 2025, producing gross Circle revenues of approximately $2.5B on an annualized basis. The lack of a Tether income statement makes it impossible to know precisely how much revenue it derived from operations, but the stablecoin issuer reported $2.6B in gains on gold and bitcoin holdings, and $3.1B in "recurrent profit” in the first six months of 2025. This yields net Tether profits of $11.4B on an annualized basis. Additionally, it is crucial to note that Circle’s “Stablecoin Ecosystem Agreement” forces it to divert nearly half of all USDC stablecoin reserve revenues to Coinbase, meaning Tether earns twice as much revenue for every dollar of stablecoin reserves. Therefore, using the comparable method, we can adjust Circle’s current market capitalization ($29B) with a multiple for USDT supply (2.3) and double the value (to compensate for Coinbase’s USDC revenue share) to arrive at an already mind-boggling estimated $133B valuation ($29B x 2.3 x 2) for Tether. Although the rumored $500B Tether valuation may be less grounded in fundamentals, it is clear this cash-flush tokenized dollar issuer is operating on a completely different footing than its competitors, and at a much larger scale. Tether enjoys much lower compliance costs than Circle and utilizes regulatory arbitrage to pay low/no tax, advantages that allow it to produce unimaginably high profit margins at scale. CEO Paolo Ardoino has even claimed that Tether operates with a staggering 99% profit margin. Moreover, Ardoino emphasizes that his company is only at the very beginning of its journey, framing Tether as a “once in a century company” with virtually limitless potential to unlock new financial services and digital asset innovations. 🧐 ConclusionWhile the $100B valuation range for Tether is easily supported through comparables, the leap to $500B+ is decidedly more difficult to justify. At $500B, Tether would rank as the second most valuable “bank” in the world, worth two times more than Goldman Sachs and second only to JPMorgan Chase. Still, some Tether bulls manage to make sense of the number. They rationalize $500B as conservative if U.S. Treasury Secretary Scott Bessent’s near-term projections for stablecoin demand materialize, interest rates remain elevated, and Tether retains stablecoin sector dominance. For now, though, the ball’s in the market’s court. FRIEND & SPONSOR: UNICHAIN Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today. |

No comments:

Post a Comment