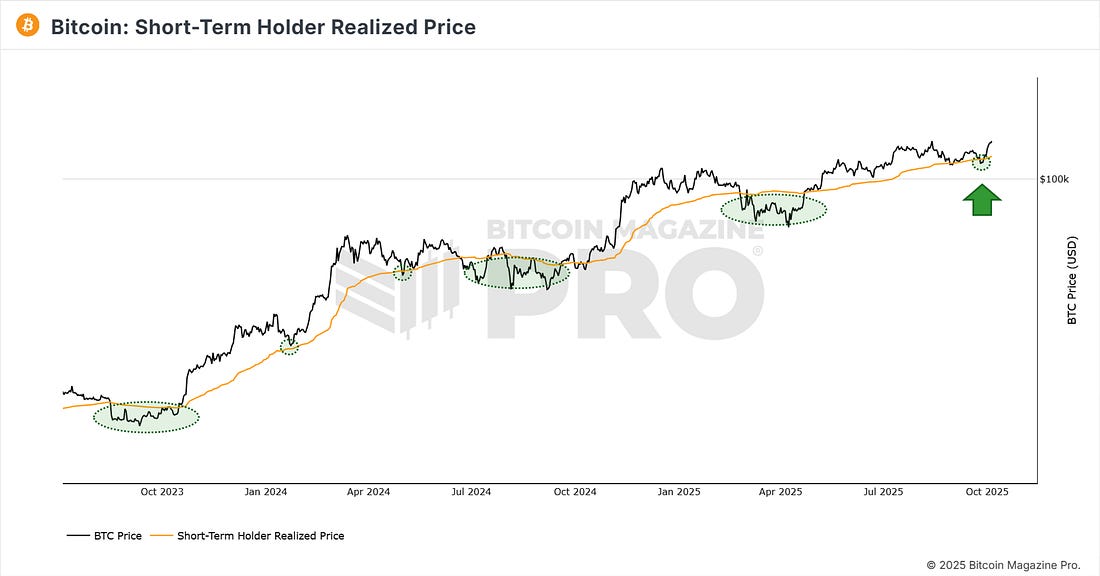

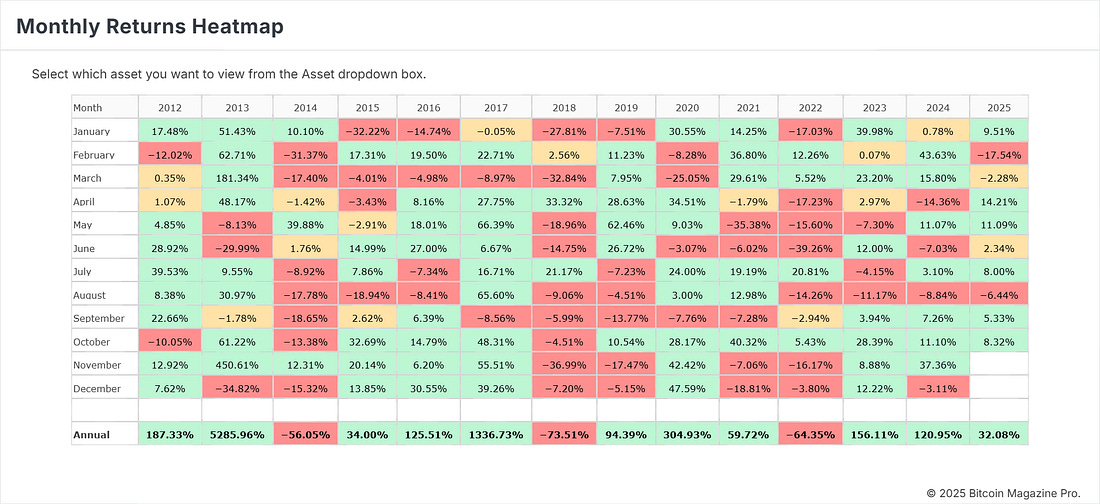

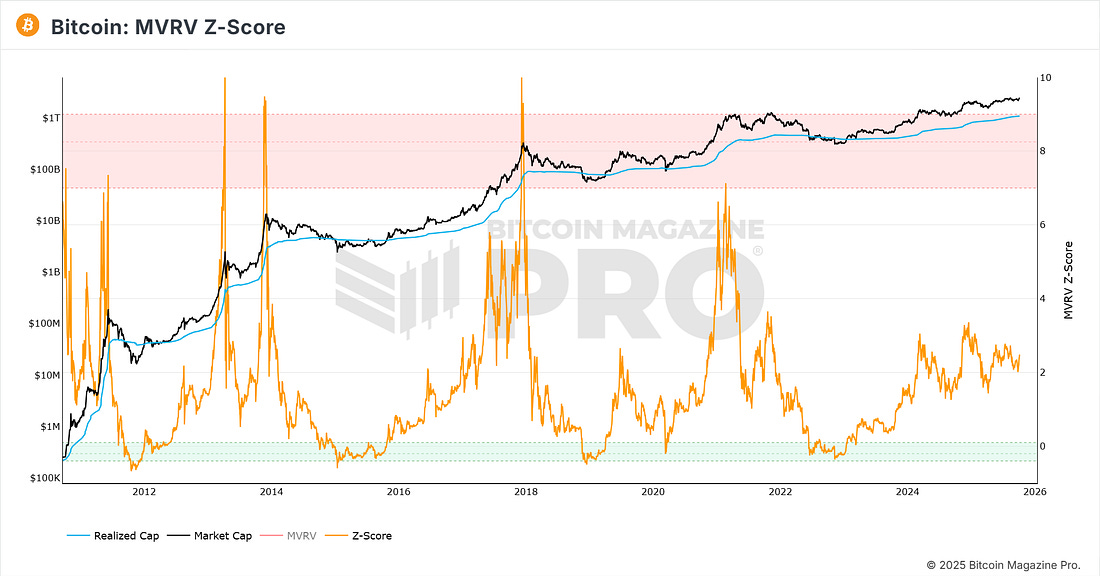

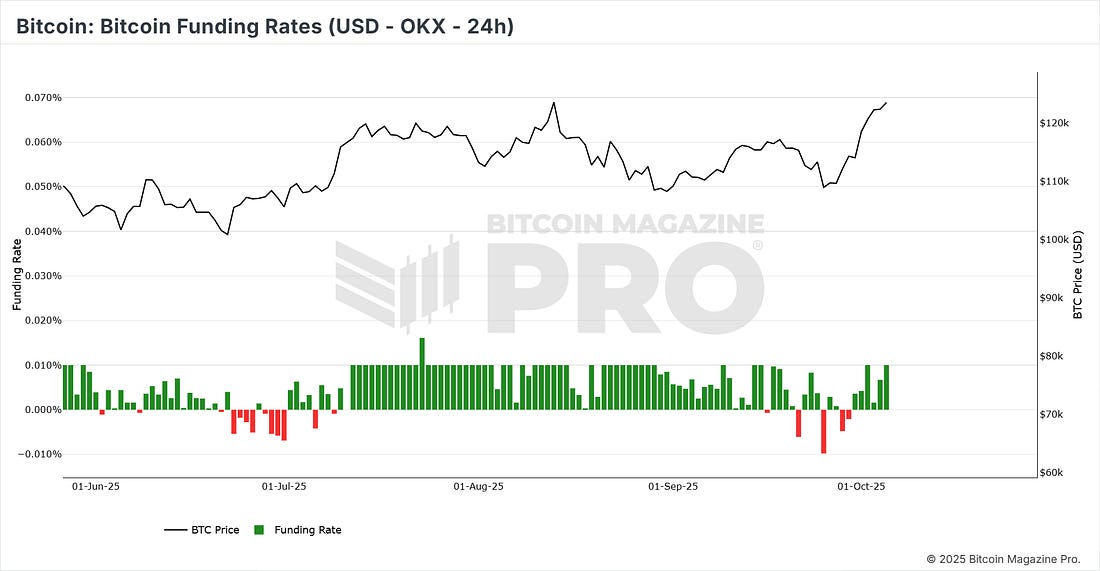

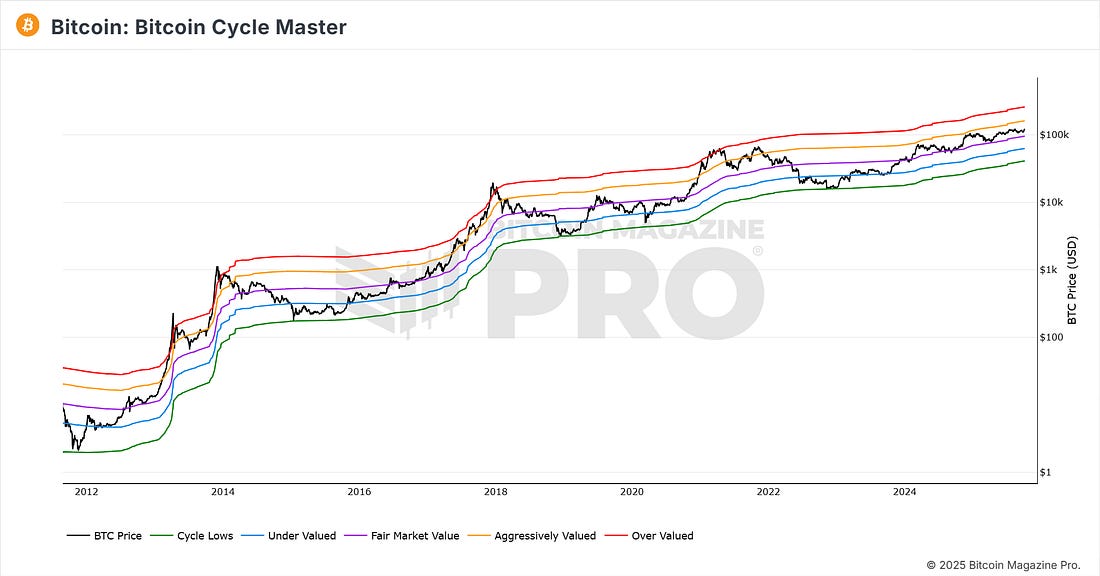

Bitcoin MVRV Z-Score RalliesBitcoin Blasts to $125K ATH: MARA's $6B Hoard, Walmart's BTC App, & Bullish Q4 Signals Ignite the Rally!What’s HappeningPrice ActionBitcoin has just made a new all-time high! Yesterday price briefly pierced above $125,000 for the first time ever. Currently, it is trading at $123,500 and is up +10% versus this time last week. The market remains very bullish for Bitcoin as we have been forecasting for some time. Figure 1: BTC making fresh all-time highs. After the brief fakeouts below the 128-day moving average, which we warned at the time were potential fake-outs, BTC has rallied strongly up to current price levels. Figure 2: BTC has rallied away from the 128 day moving average. Examining a key onchain metric we have been tracking for a possible reversal is the Short Term Holder Realised Price. Once again it broadly held up BTC and then price rallied off it over the past week. Here is a zoomed-in view of the indicator, which has continued to hold up BTC throughout this entire bull market. Figure 3: Short-Term Holder Realized Price. In last week’s Alpha update ‘Is Uptober about to deliver’ we laid out the case for a bullish Q4 being led by a strong October. We are less than a week in, but already the case for this bullish outlook is looking strong. So far, BTC is up over +8% this month. Let’s check back and see how it has performed at the end of the month! Figure 4: Monthly Returns for Bitcoin. The Big Story: MVRV Z-Score RalliesBitcoin has roared back this week, showing strength across both price and onchain indicators. One of the clearest signs of renewed momentum comes from the MVRV Z-Score, which has just bounced from the 2.0 level. Figure 5: MVRV Z-Score The MVRV Z-Score measures how far Bitcoin’s market value has diverged from its realized value, which is essentially the aggregate cost basis of all bitcoins. When the Z-Score rises sharply, it signals exuberance; when it dips low, it indicates undervaluation. The recent rally off 2 suggests Bitcoin may be entering the acceleration phase of the cycle, where previous rallies have multiplied rapidly as new money rushes into the market pushing up market value relative to realized value. Reinforcing this setup, funding rates on retail-heavy exchanges like OKX briefly turned negative at the recent price lows last week, a pattern that often marks local bottoms during bull markets, as leveraged longs are flushed out before a rebound. That reversal is now playing out. Figure 6: OKX Funding Rates chart Finally, the Bitcoin Cycle Master. This tool blends on-chain valuation metrics such as Delta Top and Terminal Price that have successfully identified cycle tops throughout Bitcoin’s history. It then shows whether, on a historical basis, BTC is under- or over-valued relative to the valuation metrics by using coloured valuation bands. Currently, it places the Aggressively Valued (orange) band at $161,986 and the Overvalued (red) band at $260,771. Both of which are still trending higher. Figure 7: Bitcoin Cycle Master. ConclusionBitcoin’s onchain, technical, and derivatives indicators are aligning again. These valuable metrics will be critical to watch over the coming weeks and months as BTC trends higher. Could we reach the orange band, or even the red band of the Cycle Master for this cycle as we have seen in each of Bitcoin’s previous cycles? To check out more Bitcoin metrics like the ones in this newsletter and receive alerts for key Bitcoin charts to stay ahead of the crowd, subscribe here. The Bitcoin Magazine Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, October 6, 2025

Bitcoin MVRV Z-Score Rallies

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Market Jitters or Strategic Buying? Decoding Bitcoin's Price Retracement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From Panic to Power: Bitcoin's Swift Rebound After the $19B Wipeout ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Crypto isn’t just speed-running finance’s past – it’s rewriting it with math instead of lawyers. ...

-

London's Can't-Miss Event ...

-

Taking the pulse of Mantle, one of the hottest Ethereum L2s in recent months. ...

No comments:

Post a Comment