| gm Bankless Nation,

The massive DeFi exploit led some chains to take aggressive, even controversial, actions to prevent losses. Today's Issue ⬇️ - ☀️ Need to Know: CZ, Who?

Trump insists he doesn't even know CZ. - 🗣️ Analysis: Balancer V2 Fallout

The DEX fell victim to a major exploit.

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3. . . . - 💸 Trump on CZ Pardon: "I Don't Know Who He Is." The denial comes amid growing scrutiny over Trump-linked crypto ventures and his family’s deepening ties to Binance via World Liberty Financial.

- 🐙 Kraken Integrates Crypto Collateral for European Derivatives. Kraken now allows EU traders to post crypto as margin.

- 😤 Nasdaq Warns TON Strategy Over +$550M Crypto Stock Sale. Nasdaq issued a formal warning to TON Strategy after the firm raised $558M in a private stock sale to buy Toncoin without shareholder approval.

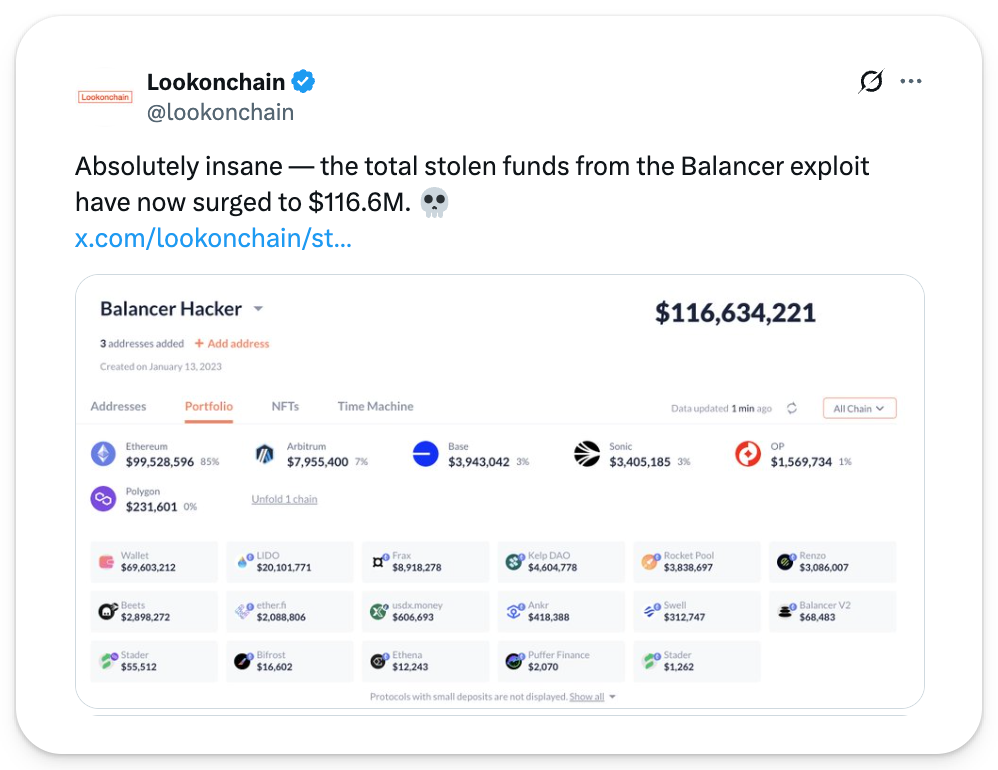

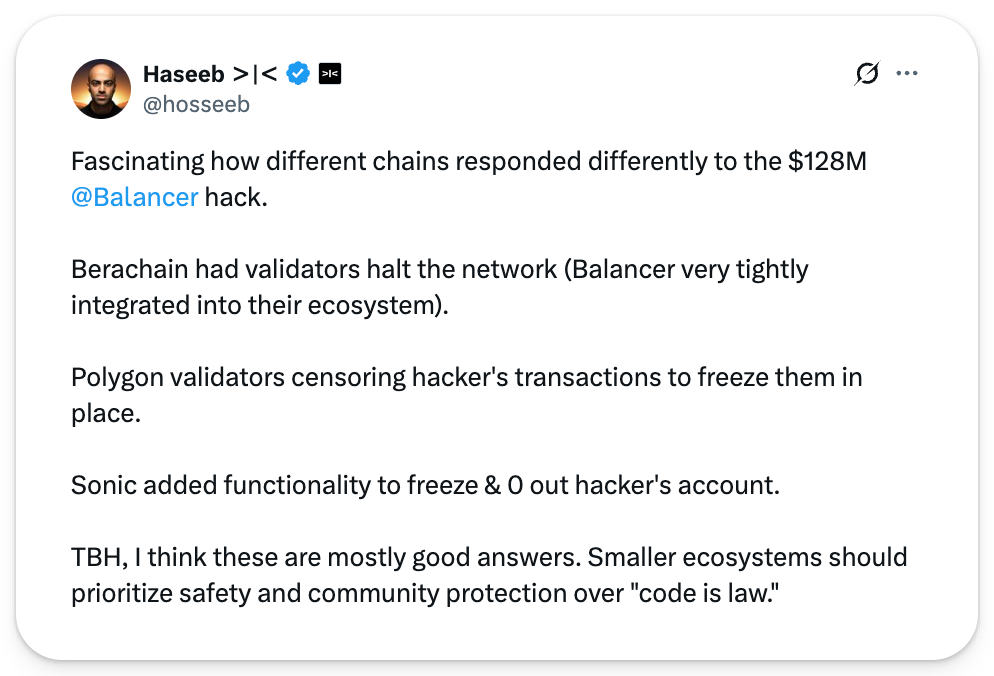

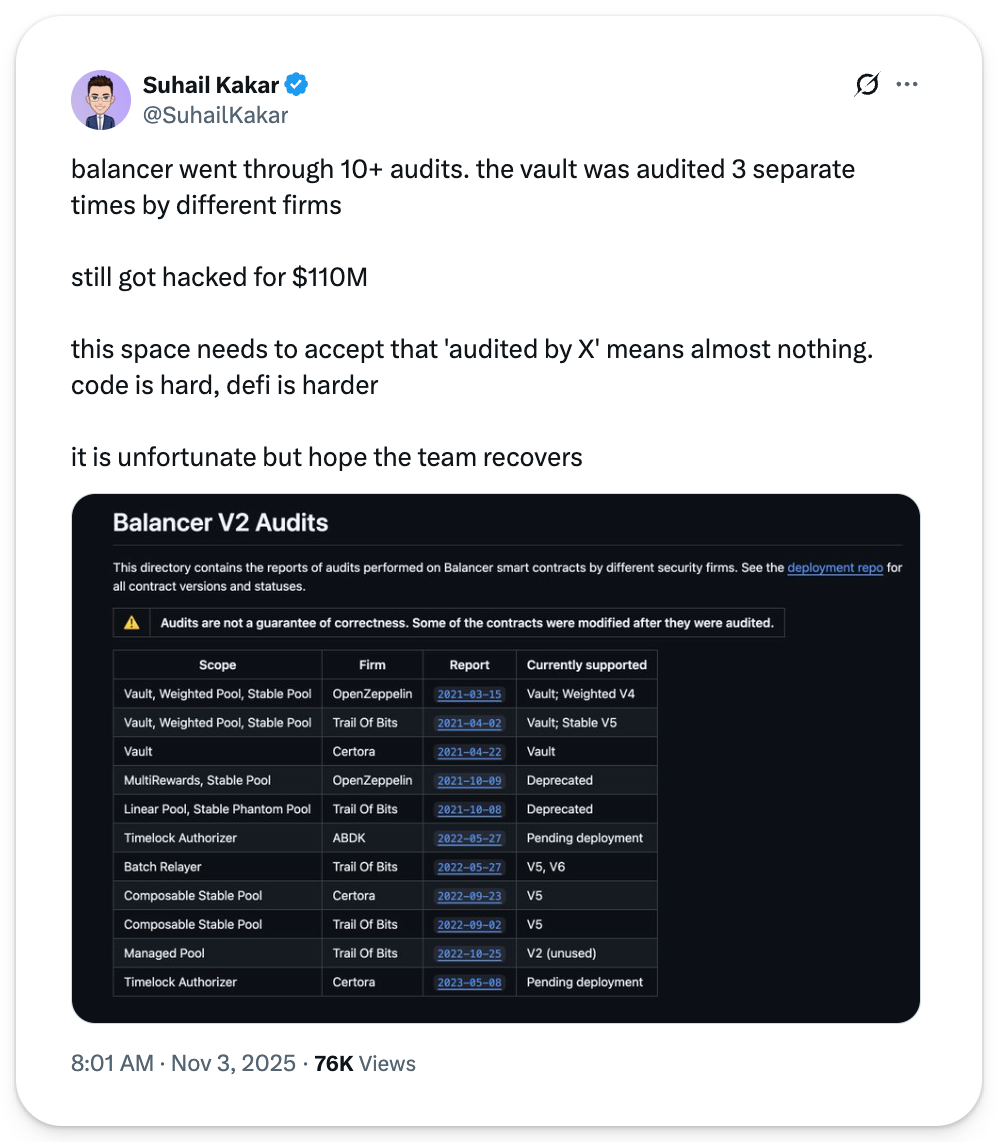

📸 Daily Market Snapshot: Even as tech stocks continued to push the Nasdaq higher, crypto prices took another hard hit, with ETH now down 13% on the week and BTC coming close to dipping below $105K. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $3.53T | ↘ 4.6% | ↘ 6.8% |  | BTC $106,492 | ↘ 3.0% | ↘ 6.8% |  | ETH $3,593 | ↘ 6.7% | ↘ 13.0% | . . . ANALYSIS Unpacking the Balancer V2 Exploit Fallout Balancer, a decentralized exchange popular for its self-rebalancing liquidity pools and token-incentivized liquidity rewards, just had tens of millions of dollars stolen from its V2 liquidity vaults. Many forked versions of Balancer V2 (alternative exchanges that recycle Balancer's code) were also impacted, and numerous affected blockchains have taken drastic actions to mitigate fallout. Here's why fallout is rippling across the crypto industry. 👇 😭 Balancer BlunderBalancer's V2 vaults across Ethereum, Base, Polygon, and Arbitrum were exploited for nearly $80M in the early morning hours of Monday, November 3. The issue was isolated to V2 "Composable Stable Pools" and did not impact Balancer V3 or other Balancer pools. Analytics platform DeFiLlama lists 27 distinct forks of Balancer V2. While the majority of these protocols hold immaterial amounts of TVL, the exploiters drained $3.4M from Sonic's Beets and $283k from Optimism's Beethoven. Roughly $12M of user funds were also exposed on Berachain's Balancer-based BEX. Although Balancer had yet to release an official post-mortem at the time of writing, some suggested the root cause was a faulty access check in the "manageUserBalance" function, while others speculated it was an "invariant manipulation" of Balancer pool token (BPT) prices. Users of Balancer and its forks rushed for the exits in the immediate aftermath to protect their positions. One whale woke up from a three-year nap to withdraw the entirety of their $6.5M GNO-WETH from Balancer in a single transaction within thirty minutes of the exploit. To stop the bleeding, some chains went nuclear, taking radical steps that blurred the line between crisis response and central control. Polygon – which had a relatively minor $100k stolen from its Balancer V2 deployment – saw network validators censor the hacker's transactions, effectively freezing the stolen digital assets in place. Sonic chose to alter the logic for its native "S" token, enabling the Sonic Foundation to unilaterally blacklist wallet addresses from holding native token balances and draining the attacker's S token balance. Meanwhile, the Berachain network came to a full stop, entirely halting the production of blocks to prevent any theft from BEX, the official Berachain native exchange. 🧐 Balancer’s Big QuestionsThe Balancer exploit raises two critical questions for the broader crypto industry. First, if Balancer V2 – a battle-tested protocol that has existed for over four years and received smart contract audits from multiple independent firms – can be so easily exploited, which DeFi protocols are safe? Crypto users no doubt enjoy using the blockchain, but when exploit vulnerabilities go unnoticed by countless auditing experts for multiple years in a cornerstone DeFi protocol, it becomes increasingly difficult to swear by the security of any permissionless smart contract-based application. Second, if certain blockchains (i.e., Polygon, Sonic, and Berachain) had the ability to freeze this exploiter's funds, what is stopping financial regulators from forcing these blockchains (and others with similar levels of centralization) from freezing all activity they consider illegal? In March 2023, MakerDAO vault frontend Oasis.app (now Summer.fi) complied with an order from the High Court of England and Wales to backdoor its own smart contracts via admin key and retrieve $225M of crypto from the Wormhole bridge hack. That incident revealed the amount of power that traditional legal systems have to force "decentralized" protocols into taking specific actions under the threat of arrest or other legal consequences. Might regulators now use the same playbook to target behaviors they view as undesirable (like transacting without government oversight or identification) across multiple blockchains with a single court order? UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier. |

No comments:

Post a Comment