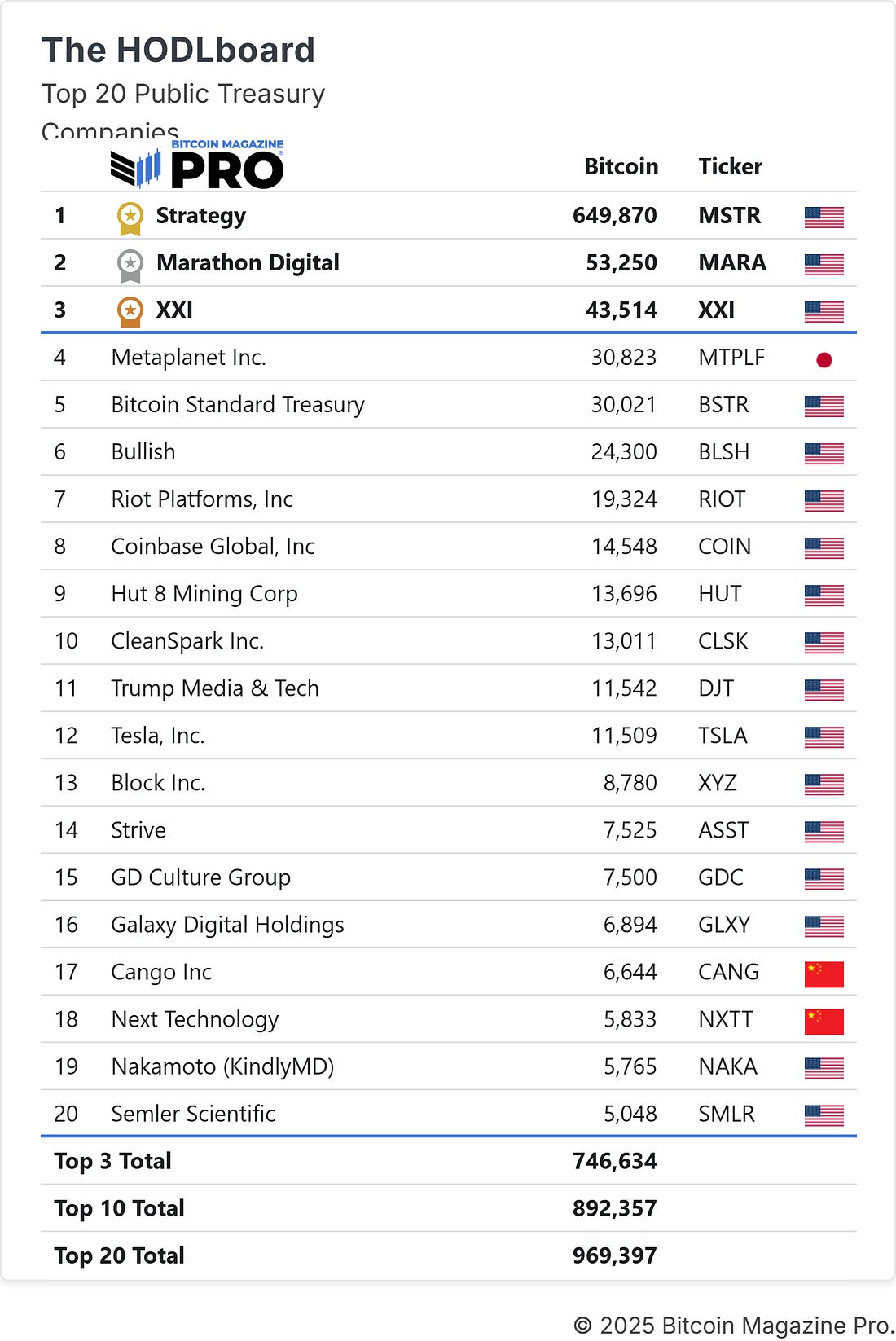

Pressure on StrategyMichael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global BenchmarksWhat’s HappeningPrice ActionLast week was another tough week for BTC as markets continued to sell off. There has been some relief over the weekend as BTC has stabilized in the $80k - $90k area. In total Bitcoin is down -21.26% over the past month. Figure 1: BTC price significantly down over the past month. As we have discussed in many Weekly Alpha updates, the 1yr moving average for Bitcoin has proven to be a key bull / bear line in the sand. If Bitcoin fails to trend above it, then conditions turn bearish. We saw this play out over the past couple of weeks. As soon as BTC price could not hold above the 1yr MA, it tumbled rapidly down towards $80,000. In last week’s Weekly Alpha, we highlighted two areas of potential support. BTC has now hit both of those areas, with the lower area holding for now, at least. It remains to be seen whether that is a bottom forming or just a local low. Figure 1: BTC bouncing off our key support level. The Big Story: Pressure on StrategyThe largest corporate holder of Bitcoin, Strategy, is standing firm amid mounting scrutiny from index provider MSCI Inc. over how such firms should be classified. MSCI is one of the world’s most influential index and analytics providers. What they say matters because trillions of dollars in global investment funds track their benchmarks, meaning their classification decisions can directly move markets. MSCI initiated a consultation in October 2025 on whether companies whose primary activities involve holding digital assets should remain eligible for inclusion in its global investable market indexes. The proposed rule signals that firms with 50% or more of total assets in digital-asset treasuries could be excluded. Analysts warn such a move could trigger forced outflows of billions of dollars from index-tracking funds and reshape how markets view the overlap between crypto strategies and conventional equities. Such a shift would impact many of the top Bitcoin Treasury Companies who have been working hard over the past 18 months to accumulate more Bitcoin. Figure 2: Bitcoin Treasury Leaderboard. Strategy CEO, Michael Saylor, insisted that the business is more than a “treasury vehicle,” noting it operates a substantial software division in addition to holding roughly 650,000 BTC on its balance sheet. The markets appear spooked as Strategy stock has been tumbling in recent weeks ever since it too lost its 1-year Moving Average, highlighting bearish conditions for Strategy. Figure 3: MSTR Stock Price and 1yr MA. The pullback means that despite an impressive performance since adopting its Bitcoin standard, the level of gains during that time is now lower compared to other stocks such as Nvidia. Figure 4: Strategy relative performance since its adoption of Bitcoin treasury strategy. Even though Strategy is currently included in indexes such as the NASDAQ: MSTR and MSCI USA/World benchmarks, in this climate, Strategy may face exposure to re-classification risk. The outcome will influence not only its stock but also the broader landscape of how companies with large Bitcoin holdings are regarded in mainstream indices. Treasury companies around the world will be watching the next moves of this situation very closely over the coming weeks and months. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, November 24, 2025

Pressure on Strategy

Subscribe to:

Post Comments (Atom)

Popular Posts

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment