x402 Is The Next Big Thing gm Bankless Nation,

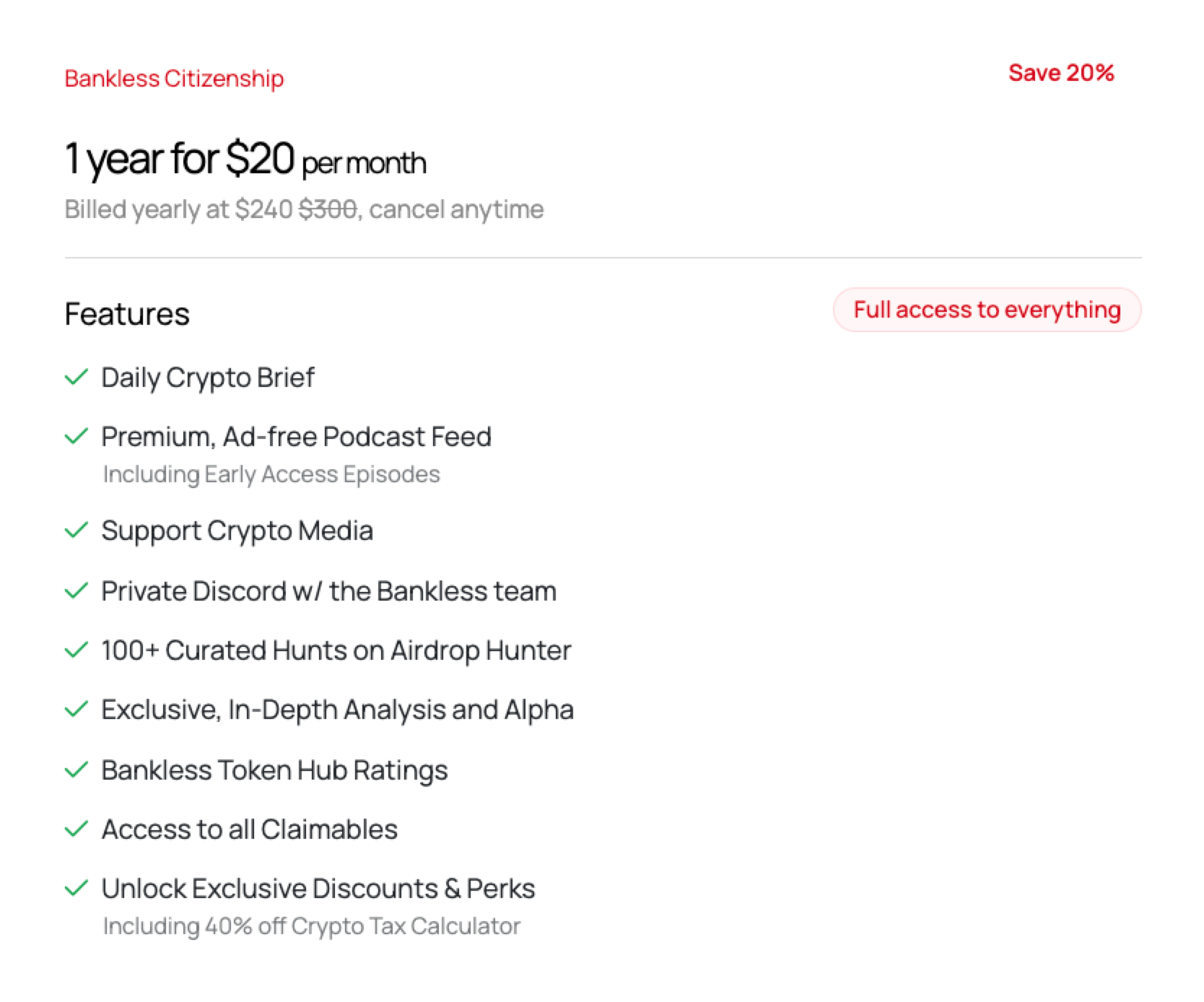

Money has always felt strangely disconnected from how we surf the web. In today’s essay, David Hoffman digs into the much-hyped potential of the x402 standard and what frictionless agent-friendly crypto payments can unlock for the Internet. Then, read on for links to happenings across the Ethereum ecosystem and our latest Weekly Rollup episode. Thanks for being a subscriber,

luma 🫡 Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3. . . . OPINION x402 Is the Next Big Thing This week, I recorded an extremely rewarding podcast episode with the founder of Merit Systems. I walked away convinced that x402 is the next big thing. (That conversation will be out on our Premium Feed very soon!) x402 is where AI and Crypto converge and create actual value together. x402 is what unlocks agents to transact as first-class citizens on the internet, and gives developers new opportunities to build products and services that cater to the needs of agents who want to purchase resources. Quick History of x402 In the early ’90s, as the Internet's founding fathers were defining the web, they reserved HTTP status 402 “Payment Required” for a future where servers could charge per request. The only problem is online payments didn’t exist yet. Credit cards and bank transfers were not the correct form factor to make this work – fees were too high and information was too sensitive – so 402 sat unused. In that vacuum, the web’s business model defaulted to advertising and subscriptions, not per-request payments. But in the year 2025, we have stablecoins, instant transaction finality, a no-chargeback form factor, and sub-second blocktimes. These are exactly the properties that fit elegantly into the x402 form factor to make native commerce on the internet a reality. The Adoption of x402 is Good for the InternetThe internet has been held back by the lack of a native commerce system. Instead, we’ve had to brute-force banking into the internet's highly adversarial environment. How many times in your life do you think you’ve entered your credit card number in a website somewhere? How many times have you logged in with Plaid or PayPal or something like that. How many times have you had to reset a password inside this context? As a result, this void that was left by a lack of small-time payments was filled with ads – and the advertising-industrial-surveillance complex was born. Sure, ads aren’t all bad – I do actually find Instagram ads highly enjoyable. But the reason why we should be sad about this dominant complex is that there is an entire sector of commerce that hasn’t been able to express itself on the internet due to the high frictions around $0.001-$1.00 micro-transactions for access to resources, provided by some developer. Additionally, x402 crypto transactions remove the entire concept of identity from internet commerce. If you’ve ever paid for something on the internet, somewhere you showed someone your identity information to do that, and so did your vendor. KYC and the internet have been inextricably linked due to the non-nativeness of banked online commerce. What are ‘resources’? Resources are the magic x-factor that the internet has been missing as a native component. ‘API Credits’ are a resource that illustrate what’s possible. After signing up with some enterprise account with some SaaS, maybe you pay $1,000 a month and are allocated an amount of credits to consume API resources. Something like that. This economic model is what it takes to make these businesses function at all. But wouldn’t it make more sense to price the API call on a per-instance basis – say, 5 cents a call in USDC on Base? A resource is the unit of value a URL sells per request – the thing you get back (or the action performed) after you pay. - Data/results: a JSON row, a price feed slice, a news article, a scraped page, a SQL query result, a weather snapshot.

- Compute/inference: one LLM completion, one image generation, one transcription, one risk score, one embed vector.

- Side-effects/actions: “post this tweet,” “enrich this lead record,” “place this order,” “spin up a VM for 10 minutes.”

- Access/priority: “skip the queue,” “priority email,” “book a 15-minute slot,” “unlock a high-rate API tier for this call.”

- Pipelines/real-world: composed steps like generate → format → checkout → print/ship a T-shirt.

The term resource is intentionally broad – it can be anything. Anything that is of value can be turned into an x402 resource to call – by humans, or robots. Robots > Humansx402 will certainly have some human-facing expressions – “Book time on my calendar for $20,” or “Send me an email that gets moved to the top of my priorities,” for example. But the real magic happens because any and all x402 resources on the internet automatically become accessible to agents that have been given instructions by humans. Not just that, but agents are free to combine any resources they need to get their task done. This is the ultimate money lego system. For the first time, we can build native resources into the internet, and these resources can be freely combined together, and we already have the LLMs that need to do the reasoning required to understand which resources to access and combine. The potential here is so large that it becomes hard to even articulate. That said, you can expect to see more x402 content on Bankless in the future. Things are already in the works! 👀 . . . WHAT YOU MISSED Institutional Buy-In 📈 The Asset🏛️ The Protocol📱 The Apps🤐 The Privacy Stack🐸 The Culture💽 The Tech . . . WEEKLY ROLLUP Markets Spooked? Markets got the treat they were waiting for with a Fed rate cut and pause on quantitative tightening, but prices still fell. Why? This week, Ryan and David break down why the markets got spooked, what Powell really said about December cuts, and what it means heading into November. We also cover MegaETH’s oversubscribed ICO, Monad’s airdrop, Polymarket’s confirmed token, and JP Morgan’s $34B Base token estimate. Plus Solana’s new ETF, Western Union’s stablecoin, Circle’s controversial L1 launch, the X402 payment boom, and the latest on Consensys and Securitize IPOs. Tune into this week’s Rollup! 👇 UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier. |

No comments:

Post a Comment