Bitcoin Needs A Few Good Weeks, Not A Few Good DaysAlso Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data DistortionsWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

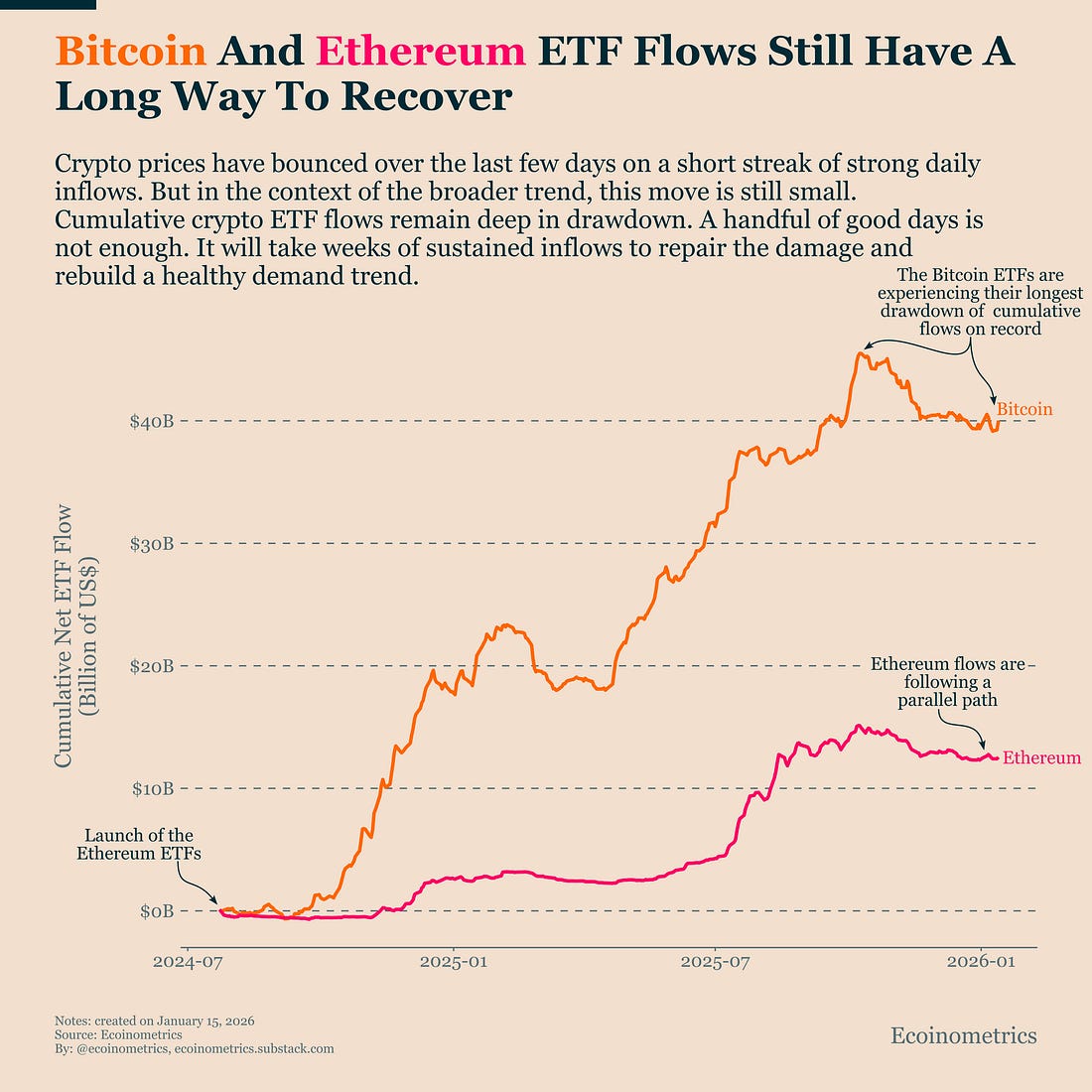

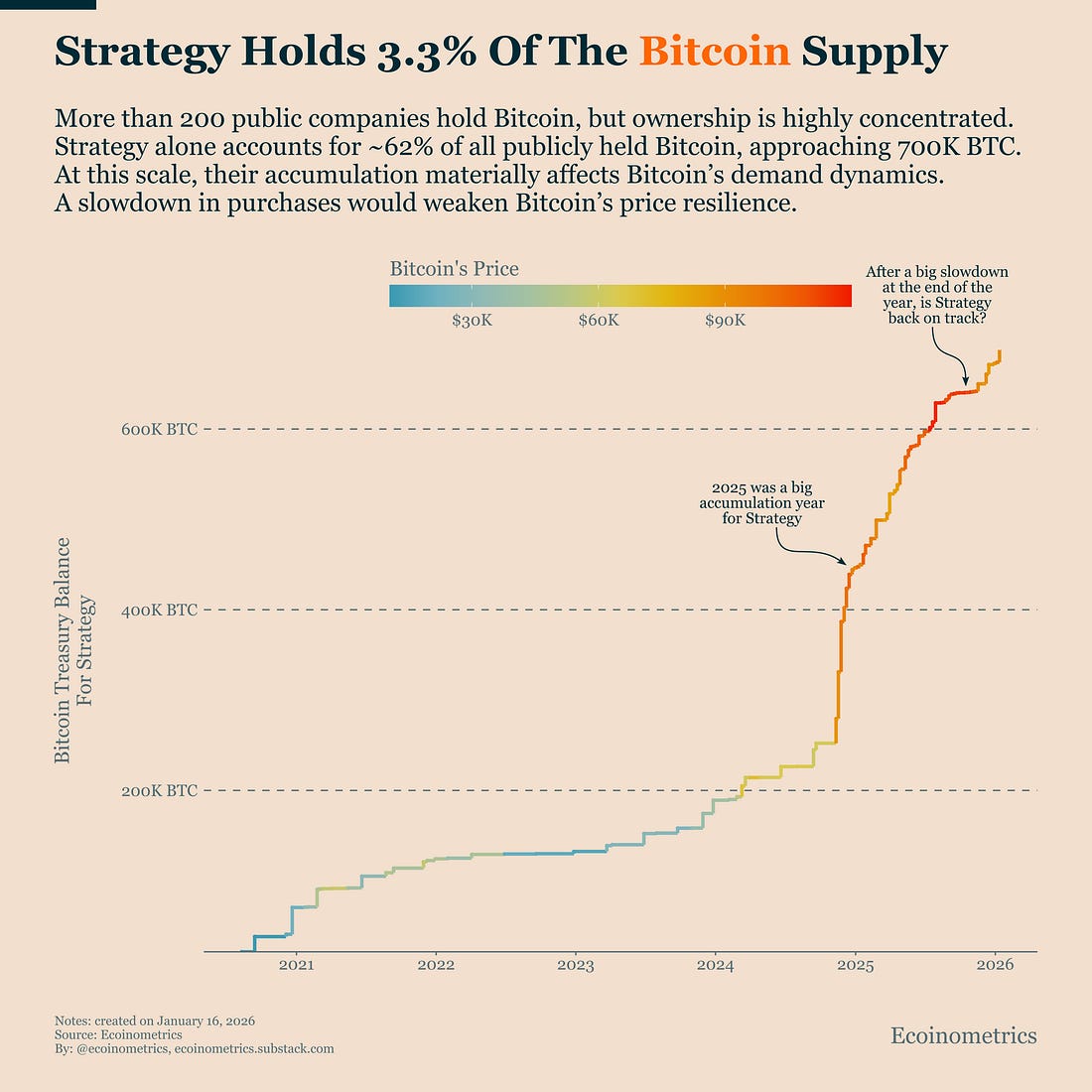

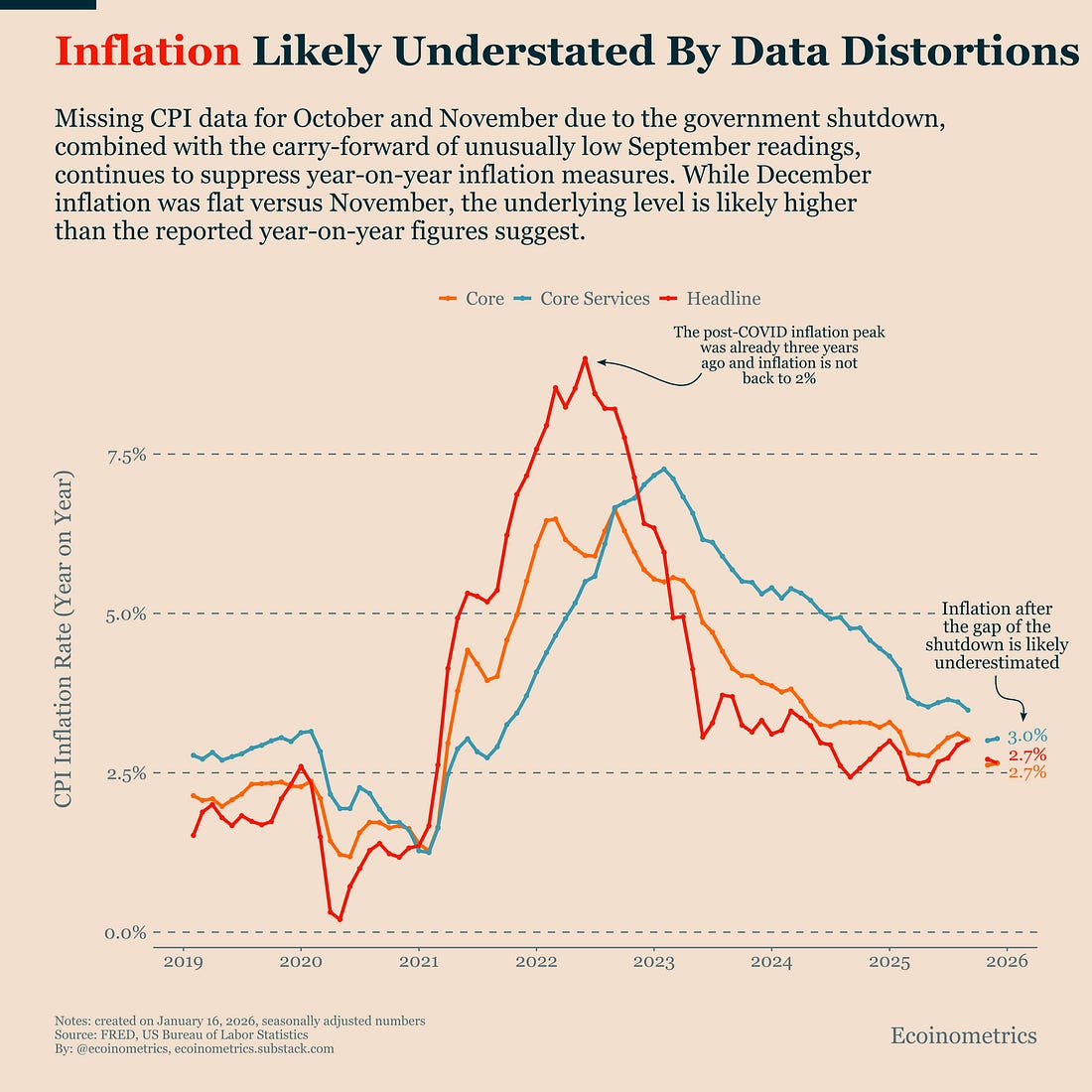

Taken together, these three charts tell a simple story: Bitcoin is no longer short of interest, but it is short of durable support. Short-term demand shows up in bursts, but long-term buyers are increasingly concentrated, and the macro backdrop may be less benign than headline data suggests. In this environment, what matters most is not momentum, but the quality and persistence of demand. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin Needs A Few Good Weeks, Not A Few Good DaysBitcoin and Ethereum prices have bounced again this week. By now, this pattern should feel familiar. We get a few good days of inflows into crypto ETFs, and prices pop. That’s a healthy sign in one sense: it tells us demand is still there when flows turn positive. But it’s also telling that these rallies keep stalling around the same area. For Bitcoin, that’s been a bit above $95K, roughly the upper end of what our ETF-flows model implies as a fair-value range under current demand conditions. The reason is scale. As the chart below shows, cumulative net flows into Bitcoin and Ethereum ETFs are still in a deep drawdown. The recent bursts of inflows barely register against the size of that pullback. In other words, a handful of strong days won’t change the trend. To make a real difference in price action, we don’t need crypto to string together a few green prints. We need a few good weeks of sustained inflows to rebuild a healthy demand trend. The current setup isn’t bad. But it still looks more like stabilization than a clean restart of an uptrend. Strategy Has Become A Key Source Of Bitcoin Price SupportBased on our ETF flows–to–returns model, every net 10K BTC absorbed by ETFs in a given month has historically been associated with roughly a 3.6% increase in Bitcoin’s monthly returns. That’s a substantial effect. But ETFs are not the only buyers operating at that scale. Public companies with Bitcoin treasuries can also accumulate large amounts on a consistent basis. When they do, those purchases act as another source of steady demand and can help limit downside pressure on price. The problem is that this buyer base has narrowed significantly. As we discussed in more detail in Wednesday’s report, only a handful of public companies still buy Bitcoin regularly and at this point, Strategy stands alone as the only buyer operating at real scale. Even Strategy has slowed at times. After an exceptionally strong accumulation phase in 2025, their purchases decelerated in the second half of the year before picking up again more recently. That concentration matters. Strategy now controls about 3.3% of Bitcoin’s total supply and are the only one buying in 10K BTC, a level where changes in their buying behaviour can materially affect market dynamics. If their purchases were to slow again, Bitcoin would lose one of its few remaining sources of consistent demand support. This doesn’t mean price would immediately break down. But it does mean resilience would increasingly depend on ETF flows or a broader return of corporate buyers, neither of which is guaranteed in the short term. Inflation Is Likely Understated By Data DistortionsIf you take the December CPI numbers at face value, inflation is close to its lowest point since 2022. It has stabilized and come down meaningfully since last year’s highs. On the surface, that suggests progress. The problem is that the data itself is distorted. Missing CPI data in October and incomplete data in November created a clear gap. Year-on-year inflation calculations now roll forward unusually low base effects from earlier readings in key categories in September, which mechanically suppress reported inflation. In that environment, pressure on the Federal Reserve is likely to increase. We have seen how the U.S. government is pushing hard the story that there is no inflation problem and that the Fed has to easer faster. We have also seen the struggle between Jerome Powell and the U.S. administration on policy decisions. The argument will be that data supports that inflation is under control and that rate cuts should come sooner rather than later. That tension, between imperfect data and policy decisions, is where fiscal dominance risk starts to matter for investors. If that risk becomes a bigger part of the macro discussion, it could revive the narrative of monetary debasement. And that is one of the few macro narratives that has historically supported sustained Bitcoin growth. It’s too early to say whether this shift is taking hold. But it would offer a cleaner path out of the current environment, where investors still struggle to find a compelling macro reason to re-engage with Bitcoin. Tactical TakeawayThe setup still favours patience. Bitcoin has avoided downside despite weak cumulative ETF flows and increasingly concentrated corporate demand, which speaks to resilience, but not to a renewed uptrend. Without sustained inflows or broader participation, rallies are more likely to stall than compound. At the same time, macro risk is becoming asymmetric. Inflation data distortions and rising political pressure on monetary policy could reintroduce debasement narratives later this year, but that remains a conditional catalyst rather than an active one. For now, policy uncertainty supports optionality, not aggressive positioning. In practical terms, this is still a market to observe demand quality, not chase price strength. Sustained ETF inflows, a broadening of corporate buyers, or a clear shift in inflation discourse would change the calculus. Until then, strength should be treated as stabilization within a range, not confirmation of a new trend. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, January 16, 2026

Bitcoin Needs A Few Good Weeks, Not A Few Good Days

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Across the globe, new technologies are enabling oppressed peoples to circumvent government controls. ...

-

gm Bankless Nation, it's been a politically contentious election for Crypto, and builders are looking for some reassurance fro...

-

Supportive markets haven’t translated into sustained inflows ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin Treasuries Report, January 2026 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Until today, Polygon looked like any another ETH L2. Today, it has became a regulated payments platform in the U.S...

No comments:

Post a Comment