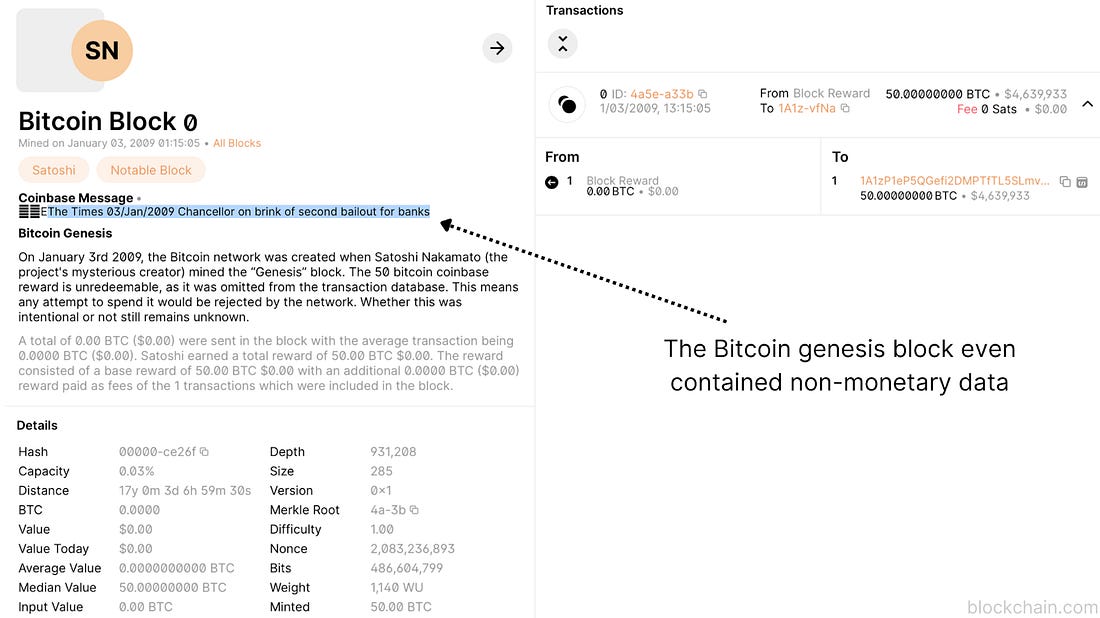

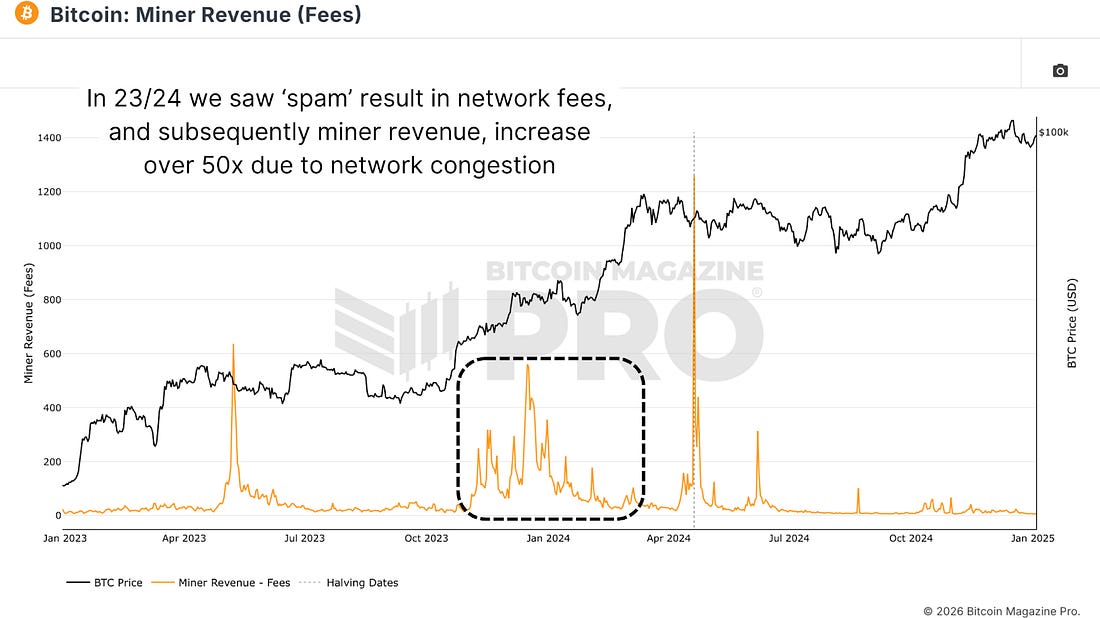

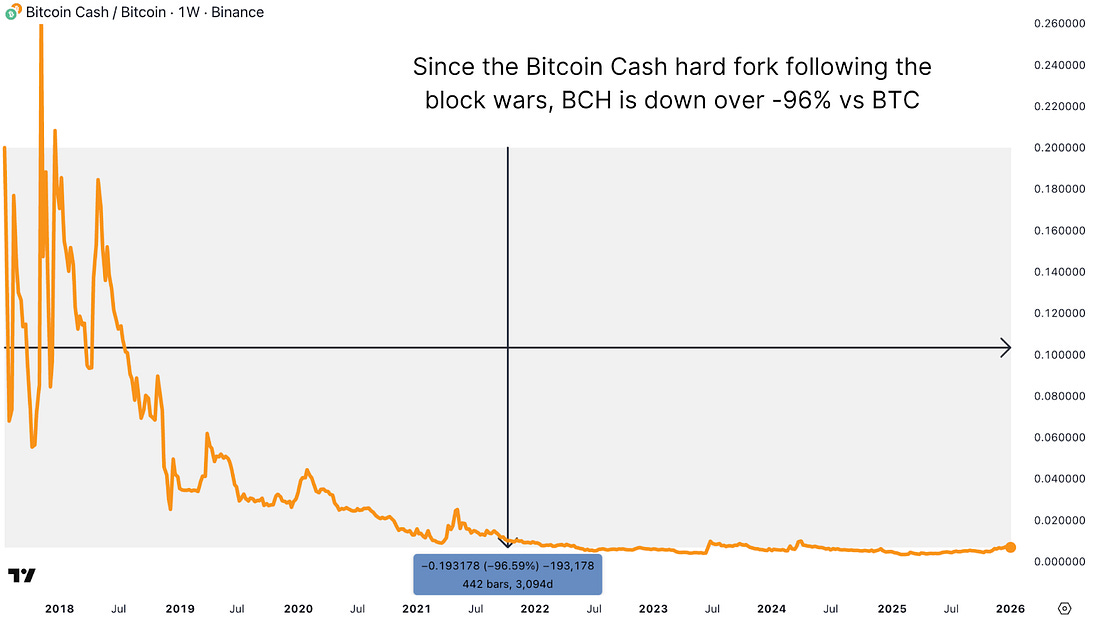

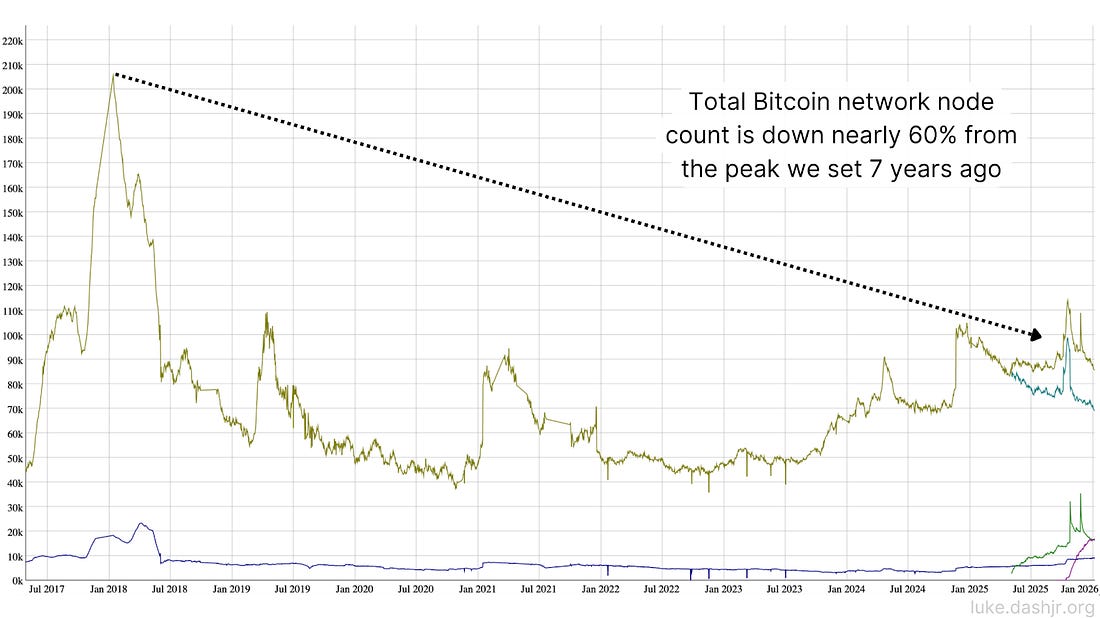

Bitcoin’s Identity Crisis And The Governance ParadoxFrom the block size wars to ordinals and node decline, Bitcoin’s identity debate exposes a deeper governance paradox at its core.Bitcoin’s Identity Crisis And The Governance ParadoxBitcoin faces a fundamental identity crisis that extends far beyond technical debates about block sizes or data storage. The question is not merely what Bitcoin is, but what it should be. Is it peer-to-peer electronic cash, a settlement layer, an immutable archive, or a store of value? This distinction matters because Bitcoin’s design choices around these questions will determine its long-term viability, decentralization, and censorship resistance. The tension between these competing visions reveals deeper governance challenges that may define Bitcoin’s future. What Is Bitcoin?At its core, Bitcoin is information. When you send Bitcoin, you are not physically moving objects across space. You are moving data; strings of numbers and letters, Unspent Transaction Outputs (UTXOs) from one address to another. Because that information represents stored energy and value, we call it money. Bitcoin is fundamentally what you use it for. Because Bitcoin is a protocol with a limited programming language and the ability to store data, it can be used for a wide variety of purposes. This flexibility is both Bitcoin’s greatest strength and source of its identity crisis. Figure 1: Bitcoin’s genesis block and its now-famed encapsulated text message. Bitcoin’s white paper opened with the declaration of “a peer-to-peer electronic cash system.” The intent was clear. Bitcoin was supposed to be about moving monetary information and value transfer. But Bitcoin has never been restricted to monetary information alone. Its protocol does not discriminate. It simply records information. For years, this was uncontroversial. Recently, we have seen more non-monetary data being stored on Bitcoin: JPEGs, videos, websites, and other unrelated information permanently added to the blockchain. Some celebrate this as uncensorability and preserved information. Others call it spam that bloats the blockchain with useless data. The Spam ParadoxThe core question is not really about the images or data being included on the blockchain. The question is fundamentally what Bitcoin is for. Is Bitcoin just a money system, a payment network designed specifically for financial transactions? Or is Bitcoin a system for storing any information permanently, an immutable ledger of whatever free market capitalism wants to include within each block? Figure 2: Network spam from late 2023 into 2024 resulted in noticeable spikes in Miner Revenue. Bitcoin’s protocol can handle arbitrary data and OP_Returns, but there is possibility for abuse. However, proof-of-work ensures it is costly to spam the network. If you want to do this type of stuff, you have to pay your price. There has not been sufficient evidence over the long term that storing non-monetary data is costly enough to the network that it threatens everyone else using it. Nor has there been sufficient evidence that participating as a node opens you up to legal liability. The Block Size WarsThis is not the first time Bitcoin has faced an identity crisis. All the way back in 2015, Bitcoin faced a genuine philosophical split. Some developers and miners said Bitcoin blocks should be bigger to fit more transactions on chain. Bitcoin could become money for everyone and truly scale to thousands of transactions per second like Visa or Mastercard. But many opposed this. They wanted to keep blocks small, stay decentralized, and use other layers for transactions to incentivize more scaling solutions. Bitcoin’s job was security and finality, not necessarily transaction speed. Figure 3: Bitcoin Cash addressed the block size and transaction speed concerns some had, but failed to capture any significant market share. These positions were incompatible. Neither side was willing to compromise. Eventually, Bitcoin fractured. Bitcoin Cash emerged as the big block vision and alternative, while Bitcoin remained the small block network. Ultimately, the people decided what should happen with Bitcoin. They chose the Bitcoin we know today. But this precedent shows that Bitcoin’s governance is fundamentally messy. It is anarchic. Anyone is free to do whatever they want with whatever code they want and try to enforce whatever governance they want. The Node ProblemHere is what becomes crucial for Bitcoin’s future. Bitcoin’s decentralization relies on node operators verifying every transaction and checking every rule. Nodes are what make Bitcoin decentralized. But the economic incentive for running nodes has always been unclear. Miners have incentives through block rewards and fees. Users have incentives through validating their own transactions. But for someone just running a node out of belief in Bitcoin’s decentralization, it is pure altruistic voluntary decision-making. Figure 4: Bitcoin’s network node count has dropped nearly 60% since its 2018 peak. This is a long-term threat. Bitcoin’s decentralization depends on regular people being willing to verify the network for free. But human nature does not work that way. Throughout history, human organization has followed patterns of centralization via specialization and outsourcing major aspects of life to trusted third parties. This is evident in Bitcoin custody. The convenient thing for people is to purchase Bitcoin from a custodian and let them handle security. But if a sufficiently large amount of the Bitcoin ecosystem goes down that path, it creates massive centralization and systemic risk to Bitcoin over the long term. ConclusionBitcoin’s identity and governance challenge is not just about code. It is about keeping everyone at least partially happy. It is about compromise. Users want cheap transactions. Node operators want a small blockchain. Developers want an easy base to build upon. And miners are businesses that need economic incentives to continue securing Bitcoin. The block size wars did not resolve this debate. The spam and ordinals debate did not resolve what Bitcoin should be. The current censorship resistance paradox will not fully resolve it either. For a more in-depth look into this topic, watch our most recent YouTube video here: Identity Crisis | The 131 Year Bitcoin #2  Matt Crosby Director of Research & Analytics - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, January 9, 2026

Bitcoin’s Identity Crisis And The Governance Paradox

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Let's see how they shake out... ...

-

DAOs have many problems like token <> equity alignment, illusion of governance, and more. "Asset futarc...

-

gm Bankless Nation, it's been a politically contentious election for Crypto, and builders are looking for some reassurance fro...

-

Don't miss the action in 2026 ...

-

As Polymarket and Kalshi go mainstream, headline-grabbing insider trading episodes can create risks for early adoption. ...

No comments:

Post a Comment