A Fresh Start for Tokenomics gm Bankless Nation,

There are plenty of macro problems framing this rough market for crypto, but one of the intrinsic issues is a simple lack of good coins for investors to buy. Today, David highlights a couple of token design evolutions in upcoming launches that are giving him hope. Thanks for being a subscriber,

luma 🫡 p.s. Starting next week, we'll start gating access to David's full essays to Bankless Premium subscribers only. It's a big change, so expect some extra gated goodies in this newsletter to sweeten the deal 👀. See everything else a Bankless Premium subscription gets you here. Sponsor: Bitget — Trade Stock Perps and win a share of 1,551,000 USDT.

. . . ANALYSIS A Fresh Start for Tokenomics in 2026 We’re all already well aware of the sad state of tokens in crypto. Fundamentally, most tokens do not represent the same kind of investor upside exposure to projects that you find in the traditional stock market. Tokens are a brand new form factor for investment, and we’ve learned that form factor has not been favorable to investors versus what they can find elsewhere. As Threadguy put it: There’s a good coins problem. There are two bits of data that I’d like to share today with you that are giving me some optimism for the state of tokens in 2026 and beyond: - MegaETH’s KPI program

- Cap’s stabledrop

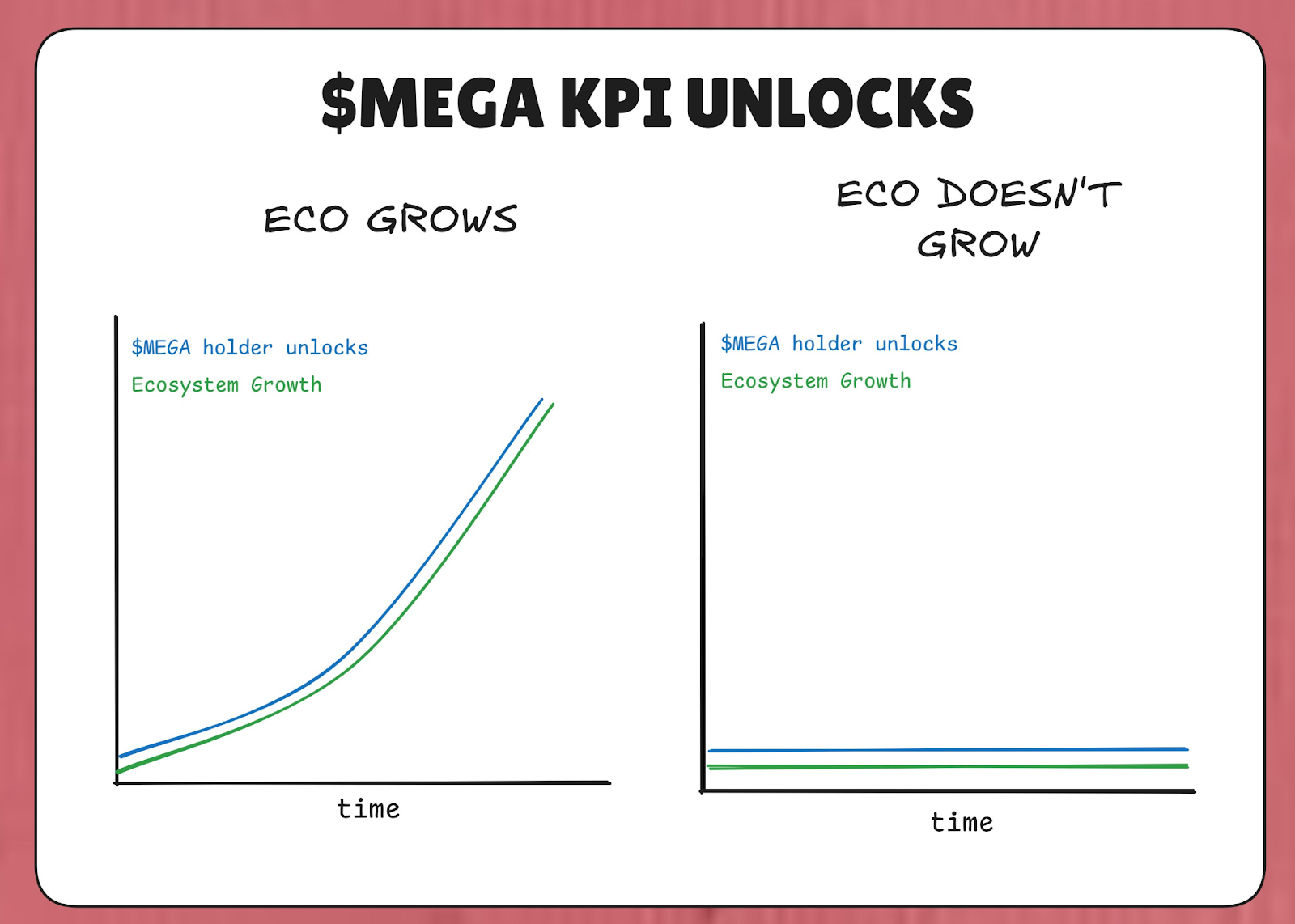

Making Token Supply ConditionalMegaETH has put 53% of the total supply of MEGA tokens locked behind a “KPI Program.” The thought is: if MegaETH doesn’t hit their KPIs [Key Performance Indicators], those tokens don’t get unlocked. So, in the bearish case, where the ecosystem isn’t growing, at least more tokens aren't also coming in and diluting holders. MEGA tokens only come into the market if the MegaETH ecosystem is actually achieving growth (as defined by the KPIs). The KPIs for this program are grouped into 4 scoreboards: - Ecosystem Growth (TVL, USDM supply)

- MegaETH Decentralization (Progression on L2Beat Stages)

- MegaETH Performance (IBRL)

- Ethereum Decentralization

So, in theory, as MegaETH hits its KPI goals, the value of MegaETH should be increasing commensurately, dampening the negative price impact of the MEGA dilution onto the market. This strategy feels a lot like Tesla’s “only-get-paid-if-you-deliver” compensation philosophy for Elon Musk. In 2018, Tesla granted Musk an equity compensation package split into tranches that vested only if Tesla hit both escalating market-cap targets and revenue targets. Elon Musk only received $TSLA if Tesla was increasing revenues and increasing in market cap. MegaETH is trying to port some of that same logic into their tokenomics. “More supply” is not a given – it’s something the protocol has to earn by putting real points on a meaningful scoreboard. Unlike Musk's Tesla benchmarks, I don’t see anything in Namik’s KPI targets about having the market cap of MEGA be a KPI target – maybe for legal reasons. But as a public-sale MEGA investor, that KPI is certainly interesting to me. 👀

Who Receives New Supply MattersThe other interesting factor in this KPI program is which investors are getting MEGA when KPIs are hit. According to Namik’s tweet, the people who get the MEGA unlocks are those who stake MEGA to a locking contract. Those who lock more MEGA for longer, get access to 53% of MEGA tokens that come into the market. The logic behind this is simple: Put the MEGA dilution into the hands of those who have already proven to be MEGA holders and are interested in holding even more MEGA – the people who are the least inclined to be MEGA sellers. The Alignment TradeoffsIt’s worth highlighting the risks that this also presents. We’ve already seen historical examples of similar structures go terribly wrong. See this excerpt from a Cobie article: “ApeCoin & the death of staking” If you’re a token pessimist, a crypto-nihilist, or just bearish, this alignment issue is the concern you have. Alternatively, from the same article: “Staking mechanisms should be designed to support the goals of the ecosystem” Gating token dilution behind the KPIs that are actually supposed to be reflected in the increasing value of the MegaETH ecosystem is a far better mechanism than any vanilla staking mechanism that we saw during the 2020-2022 era of yield farming. In that era, tokens were being issued no matter what – regardless of any fundamental progress from the team or growth in the ecosystem. So, the net-net is that MEGA dilution is: - Commensurately constrained by the growth of the MegaETH ecosystem

- Diluted into the hands of people who are the least inclined to sell MEGA

This is no guarantee that MEGA simply goes up in value as a result – the market will do whatever the market wants. But, it is a valid and honest attempt at fixing the core underlying malaise that seemingly impacts the whole token industrial complex of crypto. Separating Rewards From Governance TokensInstead of a traditional airdrop, stablecoin protocol Cap is introducing a "stabledrop." Rather than airdropping their native governance token CAP, they're distributing their native stablecoin cUSD to users who farmed Cap points. This approach rewards point farmers with real value, and thus fulfills their social contract. Users who deposited USDC into Cap's supply side accepted both smart contract risk and opportunity cost, and the stabledrop compensates them accordingly. For those who want CAP itself, Cap is doing a token sale via a Uniswap CCA. Anyone seeking CAP tokens must become a real investor and invest real capital. Filtering for Committed HoldersThe stabledrop-plus-token-sale combination filters for committed holders. A traditional CAP airdrop would have gone to speculative farmers likely to sell immediately. By requiring capital investment through the token sale, Cap ensures CAP goes to participants willing to accept full downside risk for upside potential – a group far more likely to hold long-term. The theory is that this structure gives CAP a higher probability of success by creating a concentrated holder base aligned with the protocol's long-term vision, as opposed to a less-precise airdrop mechanism that puts hands in those exclusively focused on short-term profits. Token Design Is Growing UpProtocols are getting smarter and more precise about their token distribution mechanisms. No more shotgun-style, spray-and-pray token emissions – MegaETH and Cap are choosing to be highly discriminating in who gets their hands on their tokens. “Optimizing for distribution” is no longer a thing – perhaps a toxic hangover leftover from the Gensler era. Instead, these two teams are optimizing for concentration, in order to provide a stronger fundamental base of holders. I hope as more apps come online in 2026, they can watch and learn from some of these strategies, and even improve upon them, so the “good coins problem” is no longer a problem, and we are instead just left with “good coins.” FRIEND & SPONSOR: BITGET Bitget’s stock futures trading competition is in its final stretch, offering a total prize pool of 1,551,000 USDT. Trade 24/5 as markets move, with up to 25x leverage for capital efficiency. Get 90% off trading fees through April 2026, plus cross margin that shares your full balance across positions — all in one app for active traders . . . WHAT YOU MISSED MegaETH Soon 📈 The Asset🏛️ The Protocol📱 The Apps🤫 The Privacy Stack🐸 The Culture💽 The Tech . . . WEEKLY ROLLUP What Comes Next for Crypto? Markets are wobbling as gold and silver hit all-time highs, raising the big question of what comes next for crypto. Ryan and David unpack the macro shock driving the move, from Fed independence and shutdown risk to a weaker dollar narrative, and why Tether is quietly becoming one of the world’s largest gold holders. They make the case for Ethereum’s comeback, from surging usage to serious quantum resistance efforts, break down Fidelity’s new onchain dollar, and dig into MegaETH’s eye-popping stress test. Plus: prediction markets go mainstream, a bizarre $40 million government crypto theft, and a new Vitalik meme to close it out. Tune into this week’s Rollup! 👇 |

No comments:

Post a Comment