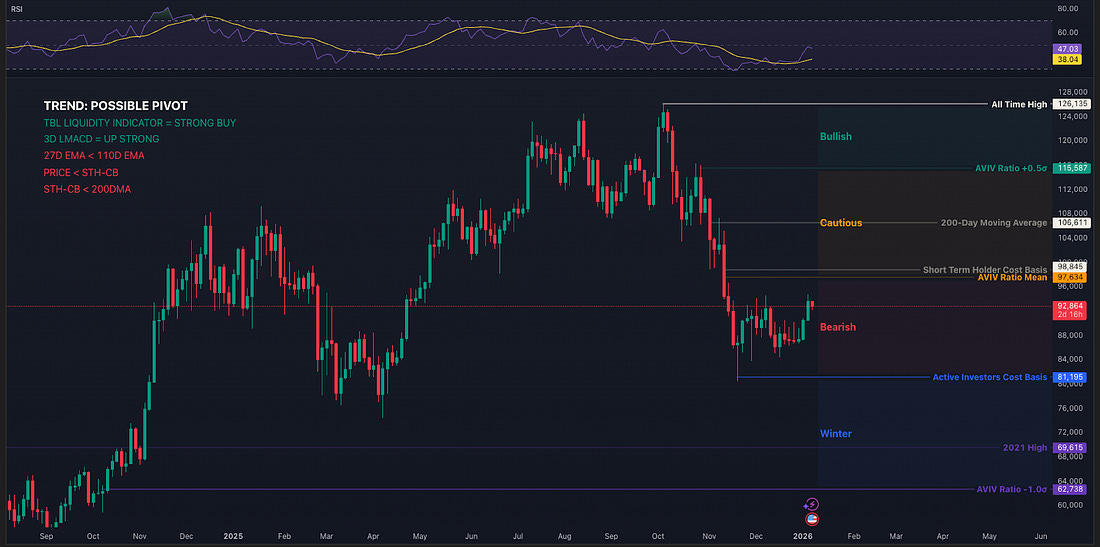

Bitcoin has been in a downtrend since October 10, 2025. This downtrend moved the price of bitcoin from the Bullish zone into the Bearish zone. The big question is whether this downtrend continues, or if price is forming a bottom and the trend pivots back up. As bitcoin’s role in the global financial landscape evolves, understanding its potential impact on your wealth becomes increasingly crucial. Whether we see measured adoption or accelerated hyperbitcoinization, being prepared for various scenarios can make the difference between merely participating and truly optimizing your position. This is why Unchained developed the Bitcoin Calculator – a sophisticated modeling tool that helps you visualize and prepare for multiple bitcoin futures. Beyond traditional retirement planning, it offers deep insight into how different adoption scenarios could transform your wealth trajectory. What sets this tool apart is its integration with the Unchained IRA – the only solution that combines the tax advantages of a retirement account with the security of self-custody. In any future state, maintaining direct control of your keys remains fundamental to your bitcoin strategy. To assess whether the trend is pivoting, we build on the framework we explored in the letter “No Holy Levels.” What matters is staying consistent with the timeframe you use to assess the trend. We’ve been using the 3-day chart for a while now. Before we dissect the trend assessment, we can see on this chart that some indicators have flipped green, pointing to a possible pivot, while others are lagging and still need to turn. The TBL Liquidity Indicator is often discussed and explained by Augustine and Nik, so I won’t go into the mechanics here. It’s an important foundation of the trend assessment, and it’s hard to ignore that it has been flashing a “Strong Buy” for a while now. We’ll discuss the other indicators further down in this letter. Price action matters most. The candle chart is a good visualization of how price behaved around certain levels. Technical indicators, while we use them because they can be useful, are ultimately derivatives of price action. Every indicator has its own trade-off, and none are perfect... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Wednesday, January 7, 2026

Trend Assessment

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Calibrating Momentum Risk and Continuation Odds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Unlocking Bitcoin's Hidden Value: Insights from Funding Rates, Sentiment, and HODLer Trends ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Let's see how they shake out... ...

-

Blockchains optimally balancing security, scalability, and decentralization is no longer a pipe dream – at least for Ethereum. ...

-

DAOs have many problems like token <> equity alignment, illusion of governance, and more. "Asset futarc...

No comments:

Post a Comment