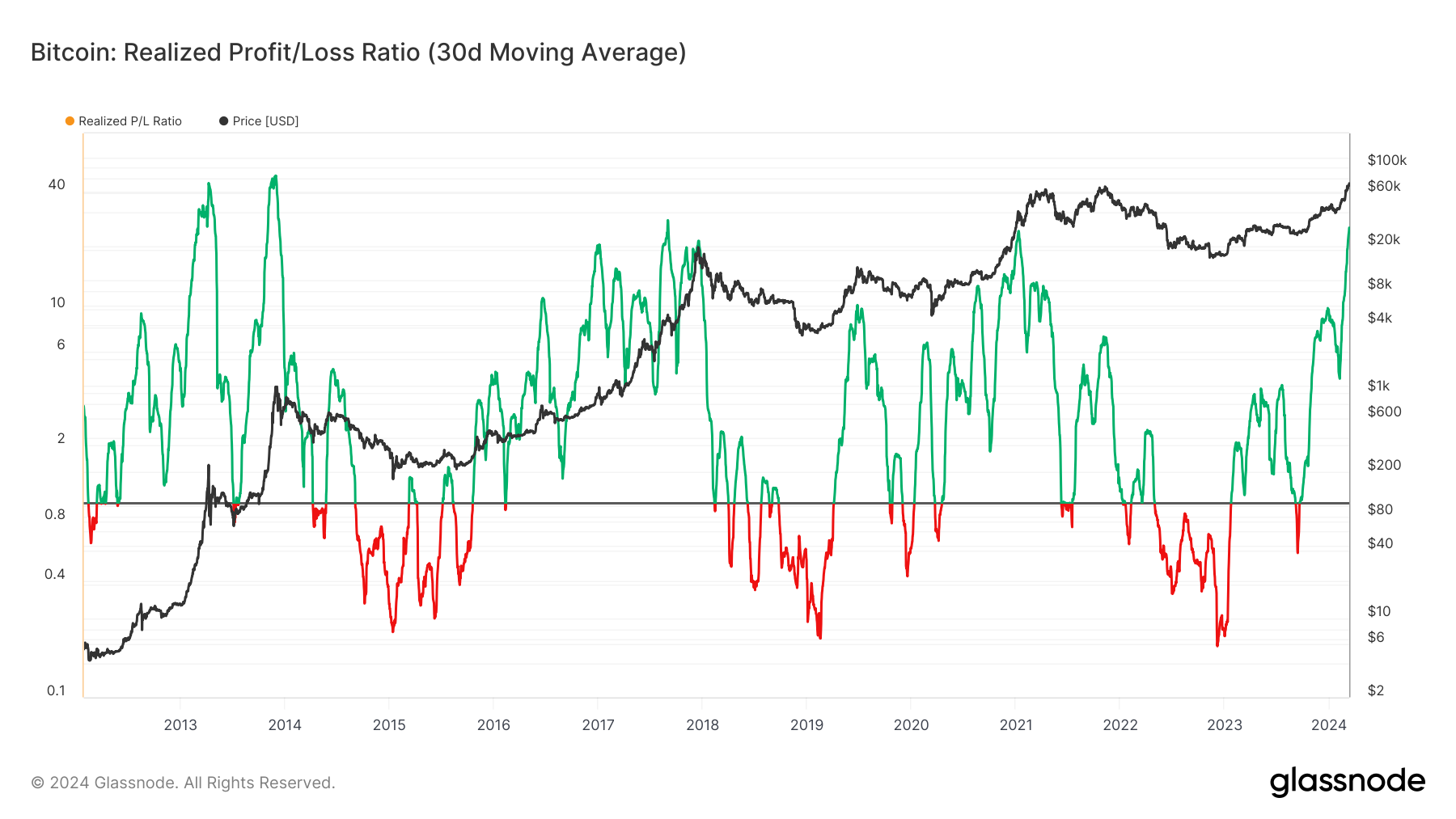

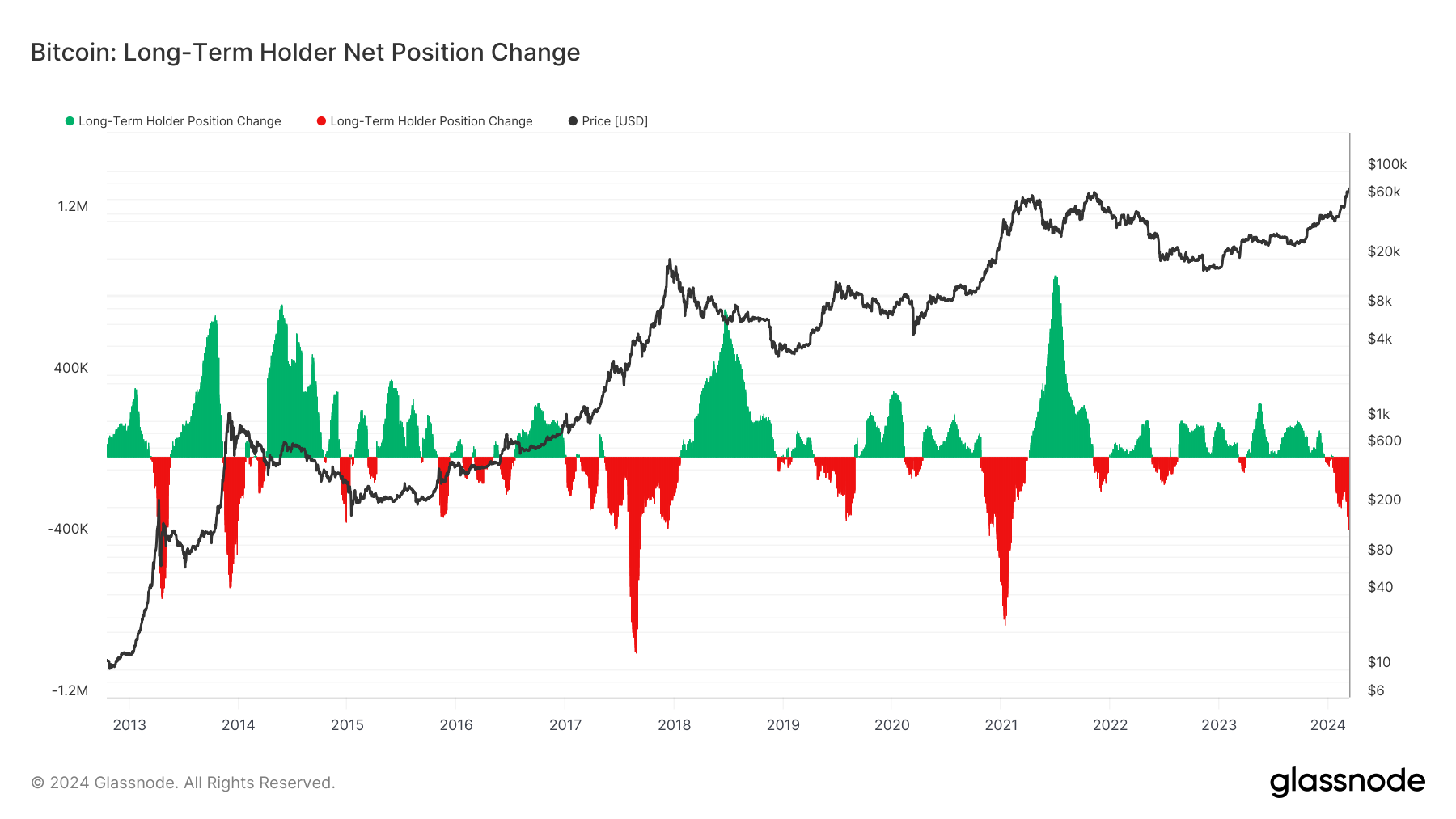

The full post is available to paid members — enjoy a free preview of today’s content! Long-Term Holders Say BTC Is Nowhere Near The Top: On-Chain UpdateBitcoin is still less than halfway to its cycle top, according to past cycles.River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Before we dive in, check out Nik’s explainer on realized price—it is a perfect primer for today’s post! Without further ado, let’s get into it. The movement of bitcoin on its blockchain clues us into investor behavior, from which we can determine where we are in the cycle relative to historical norms. Bitcoin has a relatively short history, but today we will rely on that history for guidance and conclude with four charts to speculate on this cycle’s peak. The realized profit/loss ratio is the ratio of coins moved (think sold) in profit to coins moved at a loss—this tells us whether the majority of the network is selling at a profit or selling at a loss. Unsurprisingly, the coins that have been sold are overwhelmingly in profit, sitting at a realized profit/loss ratio of 26.15, which is more profitable than the peak of the prior bull, and is approaching the profitability of the 2017-18 bull: This also comes at a time of supply distribution from the old guard to the new guard. Long-term holders (LTH), classified as bitcoin UTXOs not moved for 155 days, are selling as bitcoin breaches all-time highs. This is characteristic of the start of each bitcoin bull run. Long-term holders have likely sold 369,551 BTC over the last 30 days to new, short-term holders. This is a combination of 2021 top-buyers breaking even and leaving, bear market investors taking profits, ETF issuers buying coins from long-term holders who are parting ways with their coins, and countless other cohorts who are, for one reason or another, giving their bitcoin to a more wishy-washy investing class that is looking to ride the momentum of the bitcoin bull market as LTH net position change declines: Zooming in to just the last 5 years, note the depth of last cycle’s LTH supply distribution compared to this one, which is still relatively shallow. The phase of LTH selling begins at the start of bitcoin’s price run-up and grows larger until we approach the cycle top, which was last observed when long-term holders had sold roughly ~800,000 BTC in the preceding 30-day period. Said differently: despite notching a new all-time high, we are less than half of the way to the cycle top from a long-term holder supply distribution perspective. Long-term holders are growing more price inelastic, and the price at which they part with their coins grows higher each cycle, making for a more solidified bitcoin holder base that acts as a natural tailwind as more demand comes online:... Subscribe to The Bitcoin Layer to read the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Tuesday, March 12, 2024

Long-Term Holders Say BTC Is Nowhere Near The Top: On-Chain Update

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

No comments:

Post a Comment