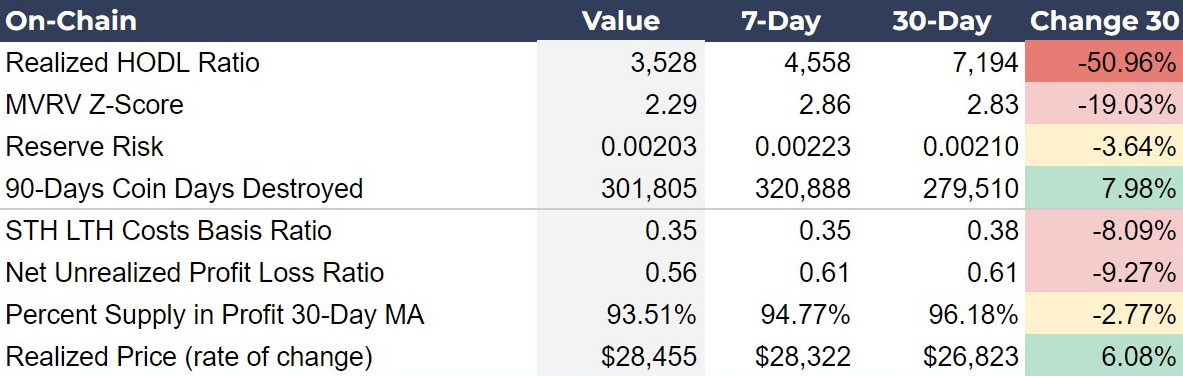

Is Bitcoin's Market Correction Peaking?A look at on-chain data, price trends, derivatives insights, and global economic indicators as we approach the critical halving event.IntroductionAs we've observed since the launch of the recent spot ETF, the Bitcoin market experienced an intense heat-up, necessitating a period of correction and consolidation to stabilize from speculative excess. Today, we discuss the nuances of this adjustment phase, signaling what appears to be a climax in the market's correction. This analysis not only elucidates the current state of affairs following the ETF-induced fervor but also forecasts the potential paths ahead as we edge closer to critical events like Bitcoin's halving. On-Chain Data SummaryThe on-chain data for Bitcoin indicates increased market activity and movement of older coins, alongside a slight decrease in long-term holder confidence and profit margins, suggesting a period of market adjustment and potential volatility. Realized HODL Ratio’s sharp decrease suggests a lower conviction in holding Bitcoin, indicating that older coins are moving, which can imply selling pressure or redistribution. MVRV Z-Score, which measures market value against realized value, declined slightly implying that Bitcoin is cooling off after a possibly overheated market. This matches our previous forecasts. Reserve Risk decreased marginally to 0.00200 from 0.00214. This suggests that the conviction of long-term holders has weakened slightly. 90-Days Coin Days Destroyed increased to 319,196 from 280,815 over 30 days, but has decreased slightly week-over-week, indicating that older coins, previously dormant, are still moving, but the early flush has subsided somewhat. This is consistent with distribution in a bull market correction. STH LTH Costs Basis Ratio shows a slight decrease from 0.38 to 0.35 suggesting that the cost basis of short-term holders relative to long-term holders is decreasing. This indicates net short-term selling relative to buying, and signals a bottoming process in any correction. Investor Insights

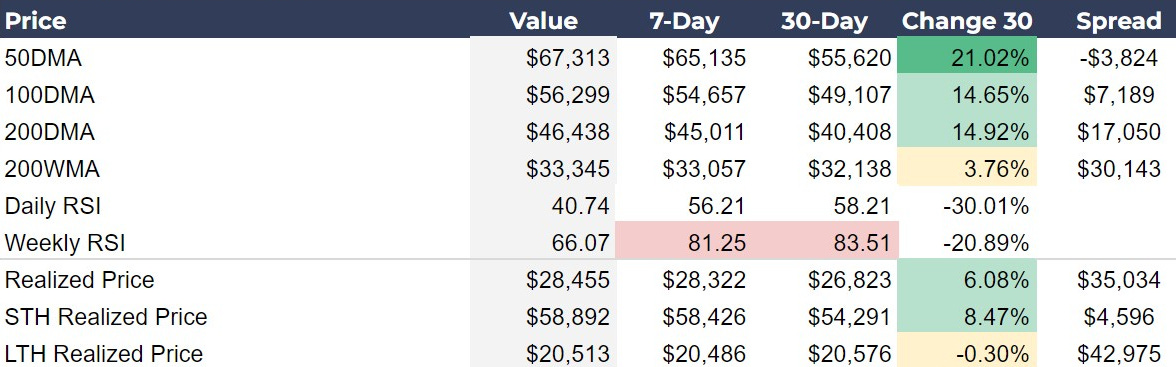

Bitcoin Price Trends and ReversalsThe data shows a robust upward trend in Bitcoin's short to medium-term moving averages, with significant increases in the 50-day and 100-day. However, the recent drop of the spot price below the 50DMA suggests a potential short-term reversal and warrants a cautious approach to recognizing the bottom of the correction...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Tuesday, April 16, 2024

Is Bitcoin's Market Correction Peaking?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment