River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Good morning TBL Readers, You can read the title, and you can probably feel it in your bones. Bitcoin has gone through a 3-month consolidation phase in a tight range between the high $50k and low $70k range, and it finally looks primed to break out. Pending further macro data that shows a cooling off in the economy, bitcoin in and of itself looks primed to explode if this is the beginning of the bull market, which is still our belief here at TBL. Today we make the case:

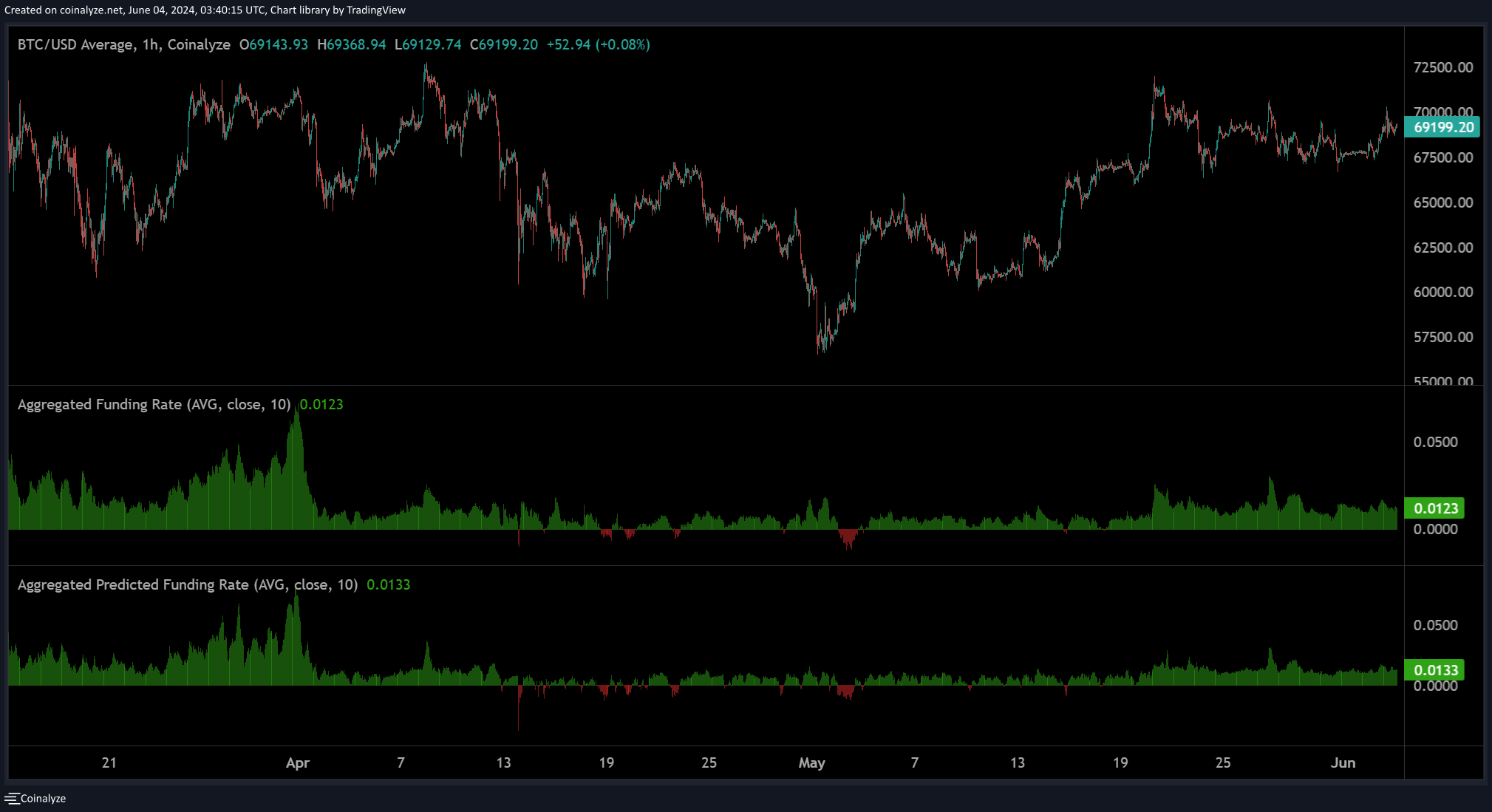

We’ve been consolidating in a tight range for 3 months. The initial ETF launch bonanza flows have subdued and cooled to a steady pace of $150-$200 million in net buying per day, about $500 million per week. Passive flows are a new thing for bitcoin. Previously, GBTC inflows were extremely muted given its inferiority as an investment vehicle, making it incapable of tracking bitcoin accurately. Institutional investors now have a suite of reliable vehicles to track spot BTC with close accuracy. As the bull market persists and BTC proves to have great beta and superior risk-adjusted returns, we expect this passive bid to hold steady, if not rise even further. A great constant tailwind as we head into what we believe is just the beginning of the bulk of the bull market. Also, the post-halving dust has settled. Miners have adjusted to the lower block reward and have not had to go through a capitulation phase of selling BTC to keep the lights on. The constant fear of selling pressure that is present on the cusp of bear markets is not present. Bitcoin has retested all-time highs in this descending channel I’ve earmarked in light blue at the top. Price action is constructive, in the words of Caleb Franzen on X, one of my favorite analysts for unbiased bitcoin PA analysis and commentary. Look at how bitcoin’s price made lower lows for a 4-6-week period marked by the blue line below, and how it has now flipped into making higher highs marked by the red line. This mighty consolidation is nearing its end, and a breakout is approaching as we have once again bounced off of that bottom red line and are touching the bottom of the descending channel in light blue: The futures market is also positioned very well, with little flighty capital underlying bitcoin’s price action. The funding rate in bitcoin’s perpetual futures market is low, meaning that longs aren’t paying huge premiums to shorts to enter into leveraged futures positions. This means that at current price levels, spot buyers make up the lion’s share of buying and selling activity. Way less of a risk of big upside and downside swings. Currently, the dominant cohort in bitcoin are people who are buying bitcoin and holding it, for however long. A firm launchpad for the rocketship, per se. We’re not taking off from a landing pad on the ocean—with little froth in the futures market, we’re shaping up to take off from a pad on Cape Canaveral:

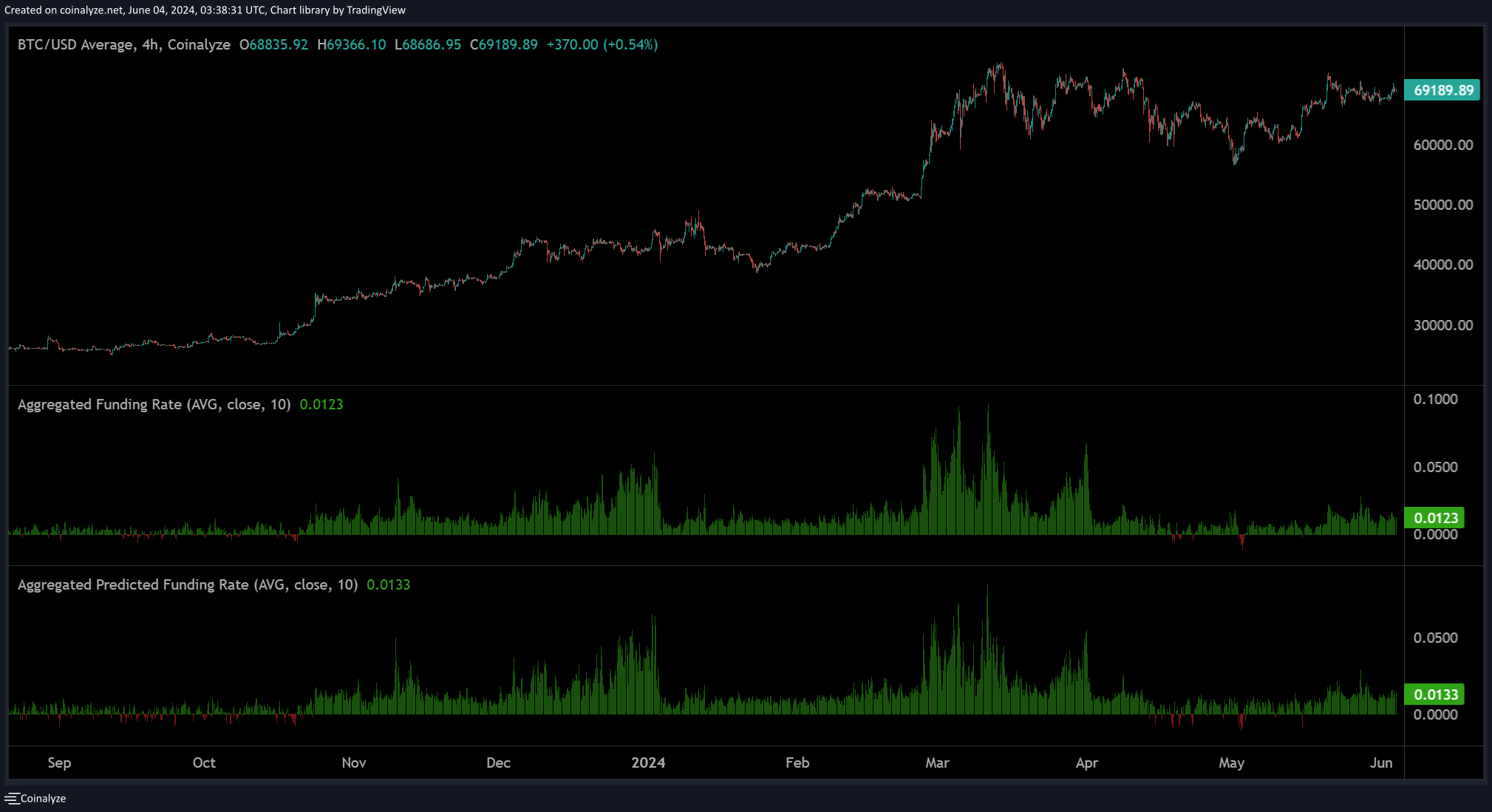

Zooming out further, note the behavior over the last 9 months during the current bull market. Funding rate is low when bitcoin is building a base to make its next leg higher, it rises and reaches a zenith when the move makes a local top, cools off as bitcoin’s price takes a breather and rebuilds its base for the next move, rinse and repeat. Low green bars, then rising green bars as the leg higher in bitcoin’s spot price takes place and leverage enters the market, and then green bars come back down as leverage declines. We’re nearing the end of this base-building period:

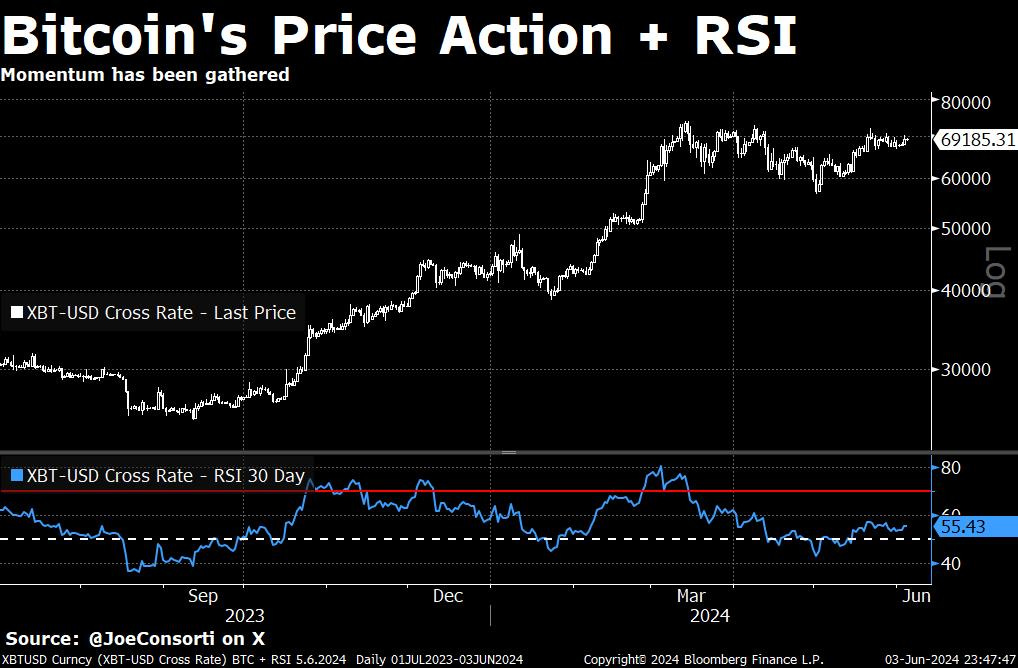

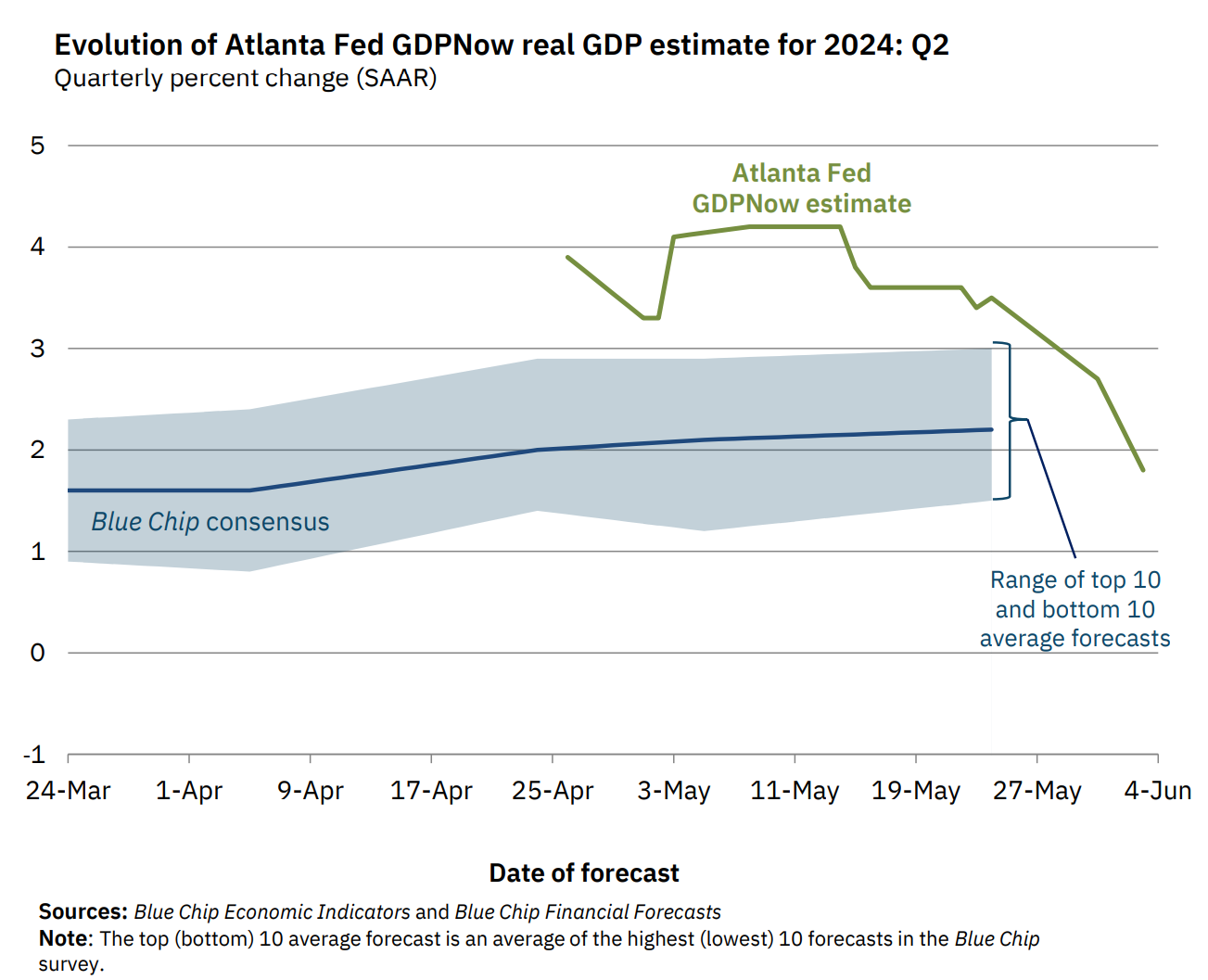

The last bitcoin chart is a look at bitcoin’s price action overlaid with RSI, a momentum indicator. At the end of the aforementioned period where BTC is building its base for the next move higher, RSI creeps into overbought territory but doesn’t explode above it—a slow creep above before the move commences, and then the move commences. Bitcoin’s RSI has moved above this upward momentum threshold and held here for a few weeks now. Another view of the launchpad I see being built underneath BTC: Switching up the board to macro. The month of June has gotten off to a rocky start with economic data. The Atlanta Fed GDPNow Forecast for Q2 real GDP is getting demolished. It has been revised down repeatedly from 4.1% just two weeks ago, to 1.8% as of yesterday. Note that this is a real GDP forecast, so nominal GDP is much higher. There isn’t necessarily any room for the Fed to cut rates here yet. What I am pointing out is the rapid shift in forecasting for the next several months in the economic cycle. Where there was strength, the tone is now shifting to a rapid cooling in economic activity:

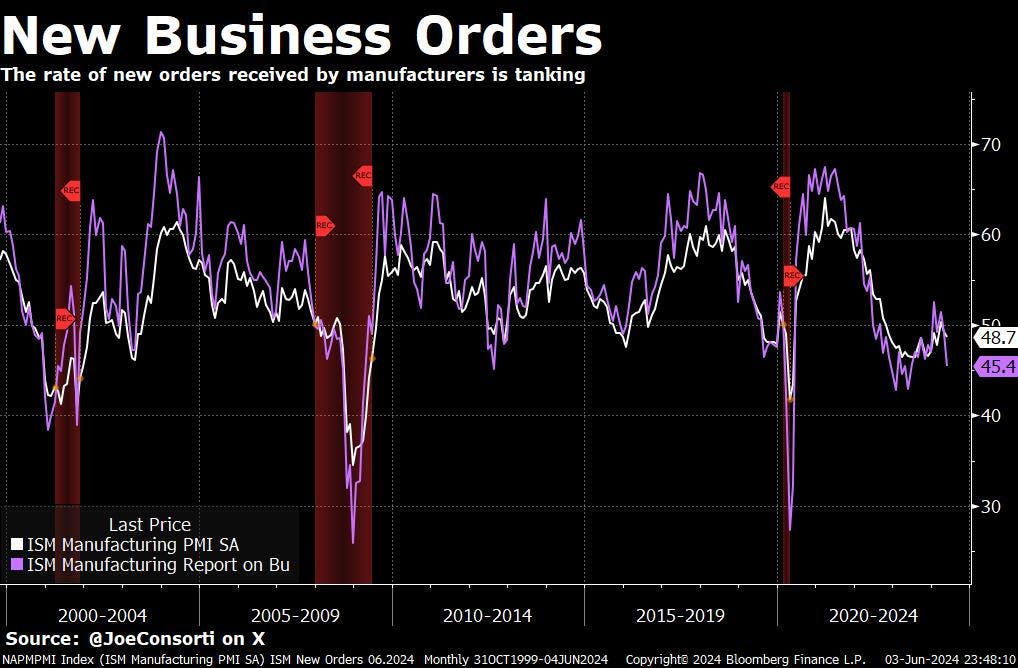

PMIs are signaling the same. The ISM Manufacturing survey for May was released yesterday, too, and it was cool as a cucumber.

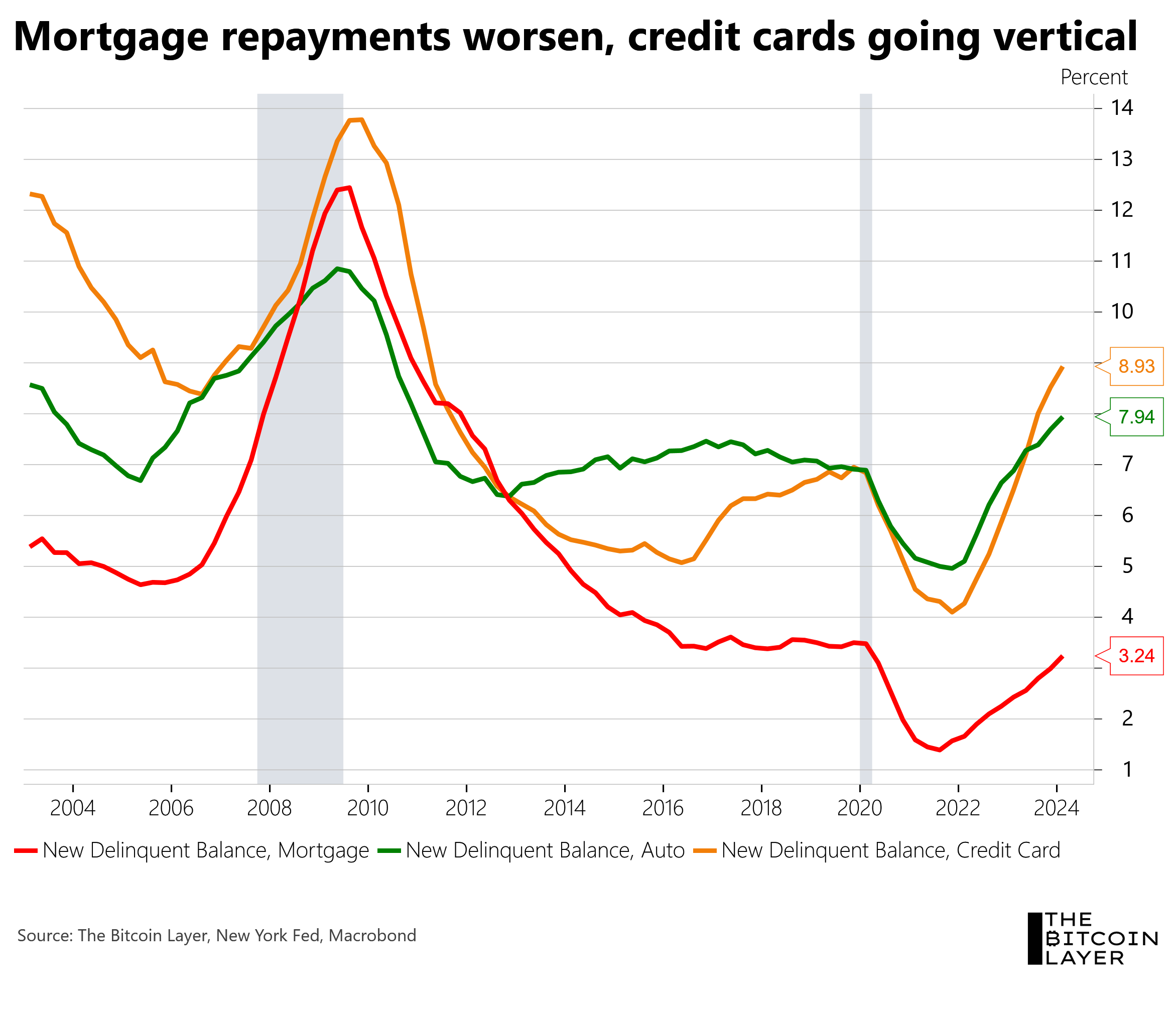

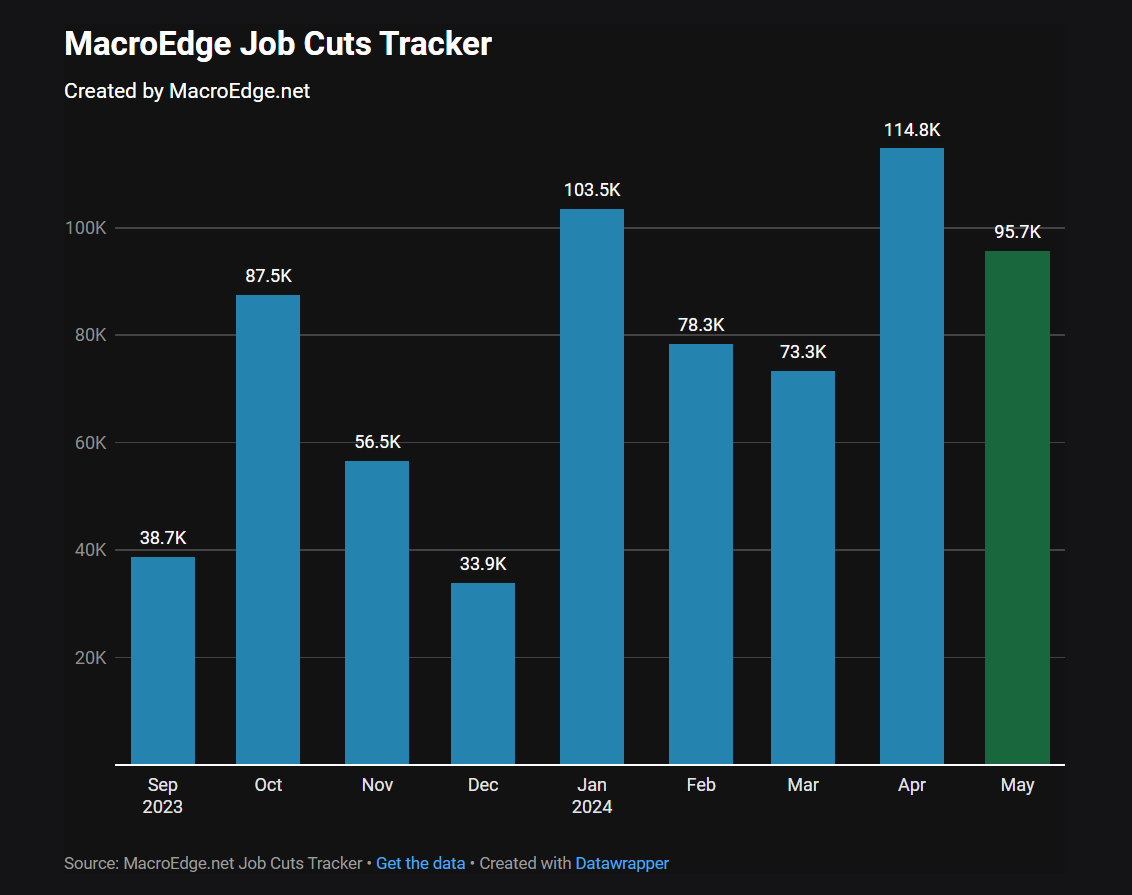

The new orders print was abysmal. New orders, in pink below, having such a huge miss below the 50-contraction level has historically indicated a cycle shift toward recession—look how it lines up with prior recessions marked in red: Check out Nik’s video from yesterday in case you haven’t yet for more on this:  The tide has shifted from the totality of data being hot/warm to neutral if not rapidly cooling in the consumption-related data sets. Construction spending data released yesterday also cooled month-over-month in May. Consumers have run out of cash, with post-COVID stimulus money that was stockpiled all the way up to $2.1 trillion in August, 2021 now completely drained at -$72 billion. People are taking on more credit cards and dipping into their savings in order to keep up their same level of spending, something that happens late in the economic cycle. Next up to bat, if this is a secular shift in the cycle and not a small cyclical hiccup, is job cuts beginning to accelerate. Megacap companies like Microsoft announced more layoffs, per MacroEdge, only yesterday. Economy-wide job cuts are already elevated to start the month, in line with the cooling official data we’ve received, sitting at 4,000 job cuts so far in June according to MacroEdge’s Job Cuts Tracker. Note the rising upward trend in monthly total job cuts over the last 9 months:

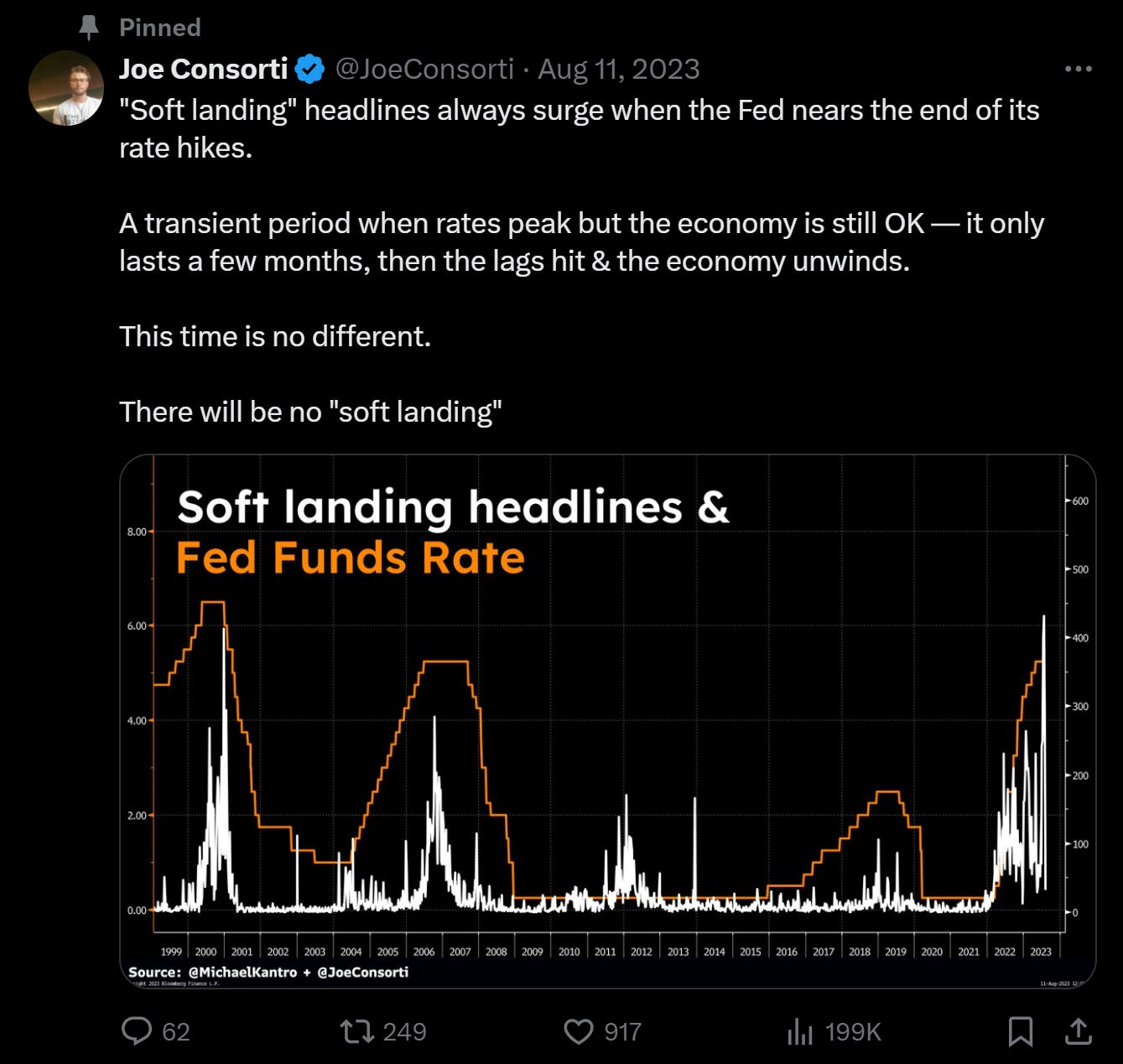

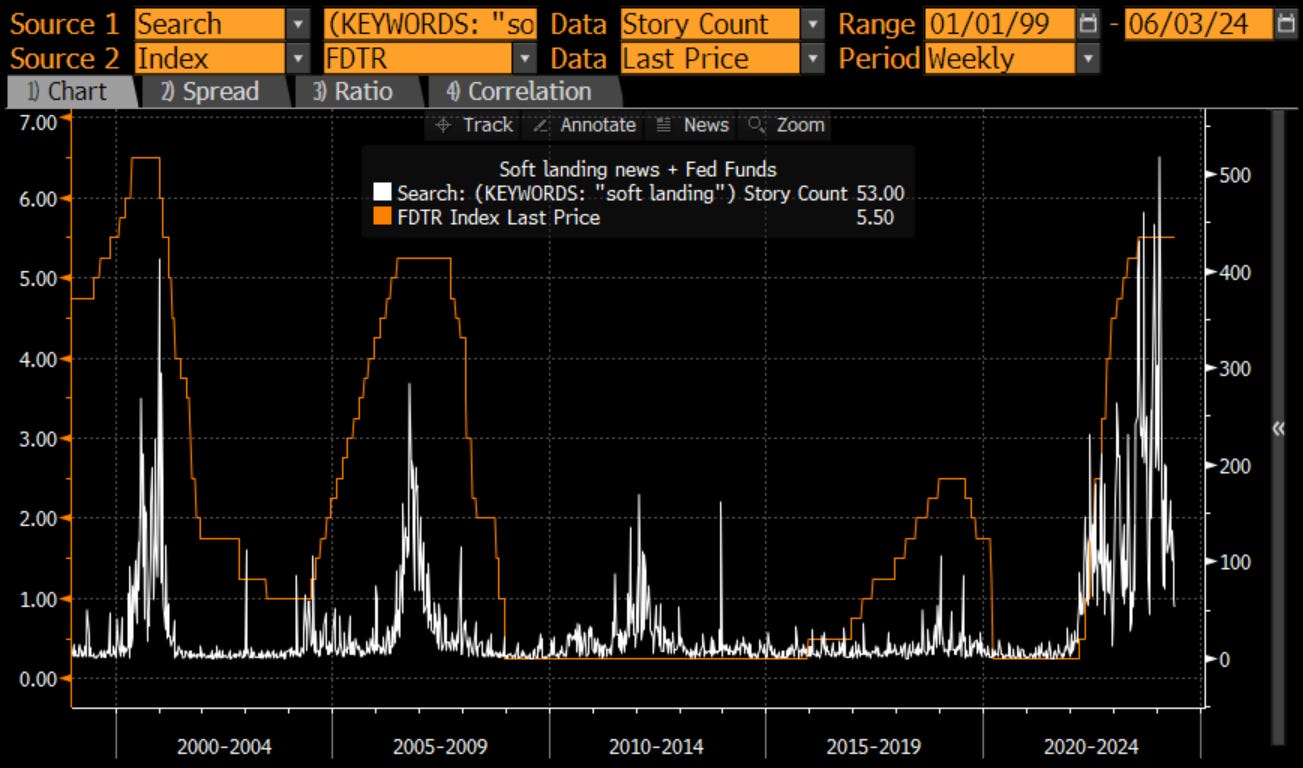

A phrase we’ve used before here at TBL: ”All eyez on CPI,” and we’ll certainly be doing that come next week when we receive May’s CPI data on the same morning of the June FOMC meeting. We are in the midst of an extended on-hold period as CPI notches lower, very slowly, back to where the Fed wants it. As such, the Fed is more focused on employment since CPI at its current rate won’t reach the target for some time. It does not like hearing and seeing job cuts accelerate, and that is what we are unequivocally seeing in the tape. With consumption slowing and leading economic indicators confirming the same, a secular shift toward decelerating activity and eventually contraction looks to be afoot. I’ve had this tweet pinned for ages, and many were clowning on me for keeping it up as long as I have. Cycles don’t lie. They are different, but cycle theory is not broken. The longer phase of the higher for longer always ends in misery: Here’s an update on that chart. Soft landing headlines are nowhere to be found. Look at what happened with this dynamic in 2000 and 2008. Uh oh: Looks like vindication for my reply guys underneath that pinned tweet may be nigh. Sweet vindication. In the meantime though, let’s enjoy new all-time highs for bitcoin. Until next time, Joe Consorti River is our Bitcoin exchange of choice. Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients. Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free. Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Tuesday, June 4, 2024

Bitcoin is raring to breakout

Subscribe to:

Post Comments (Atom)

Popular Posts

-

PLUS: Is RWA the best opportunity in crypto right now? 👀 ...

-

From BRICS Pay to Bitcoin, Comparison and Implied Breakdown of the Old System, Path to the New. ͏ ͏ ͏ ͏ ͏ ...

-

Plus, Curve founder Michael Egorov said he's committed to the DeFi protocol ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

PLUS: Nvidia vs. Bitcoin Gain-off 🤼 ...

No comments:

Post a Comment