Bitcoin's volatility is goneAlso no aggressive rate cuts on the horizon and the new normal for inflationWelcome to the Friday edition of the Ecoinometrics newsletter. Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets. Today we'll cover:

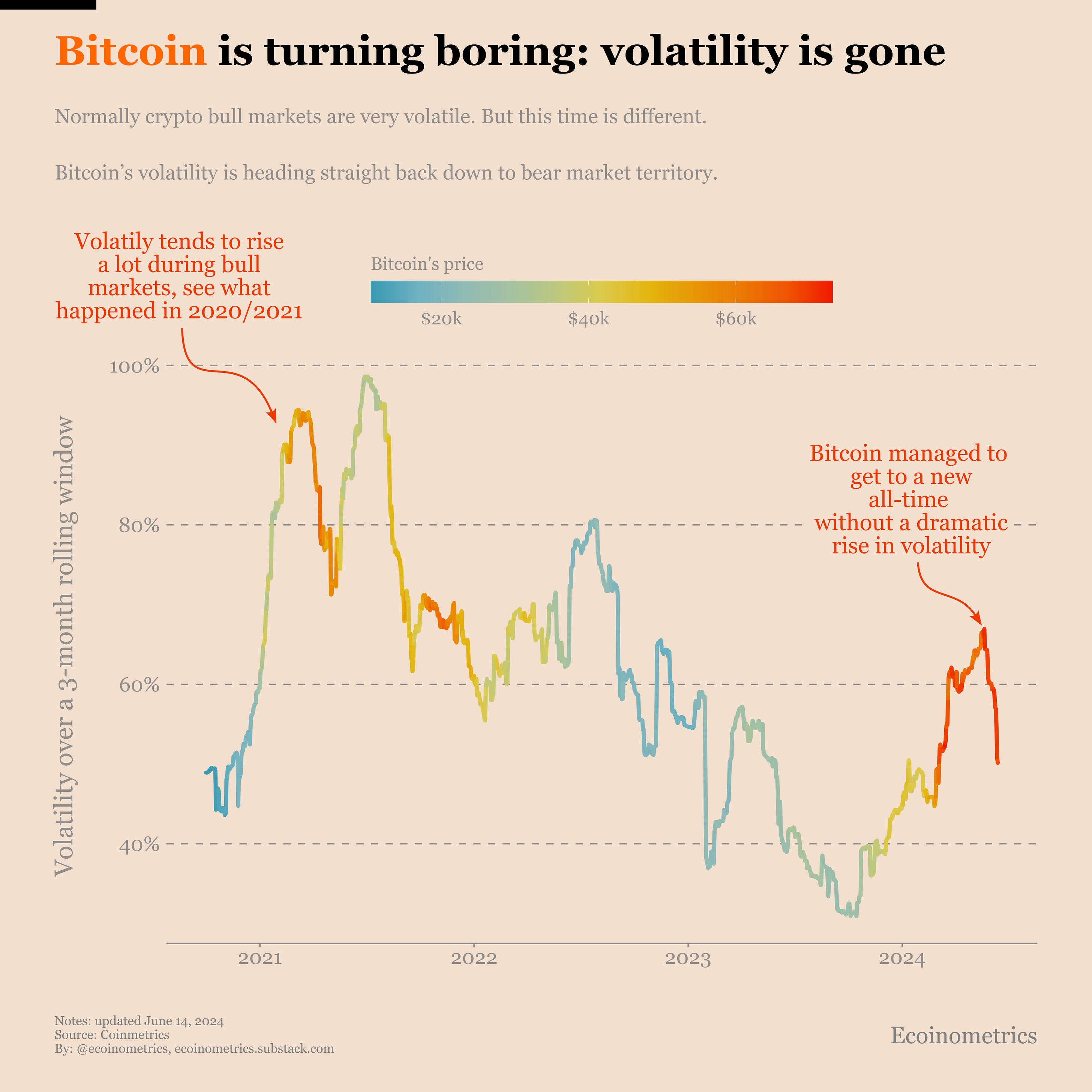

Each topic comes with a small explanation and one big chart. So let’s dive in. In case you missed it, here are the other topics we covered this week: If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox: Bitcoin volatility is goneOver the years Bitcoin has become less volatile. That’s a fact. Since the 3rd halving cycle we no longer see extreme volatility spikes. And so far in this bull market we are seeing a continuation of the same trend. Take a look at the chart below. It shows the evolution of Bitcoin’s volatility over a 28-day rolling window. The colour code overlays Bitcoin’s price on it. Bitcoin managed to go from $20k all the way to a new all-time high with a very modest rise in volatility. Big contrast to what happened in 2020/2021. Another sign that the Bitcoin market is getting more mature. Aggressive rate cuts are not on the horizonOutcome of the FOMC meeting this week (we will discuss the meeting in more details on Monday):

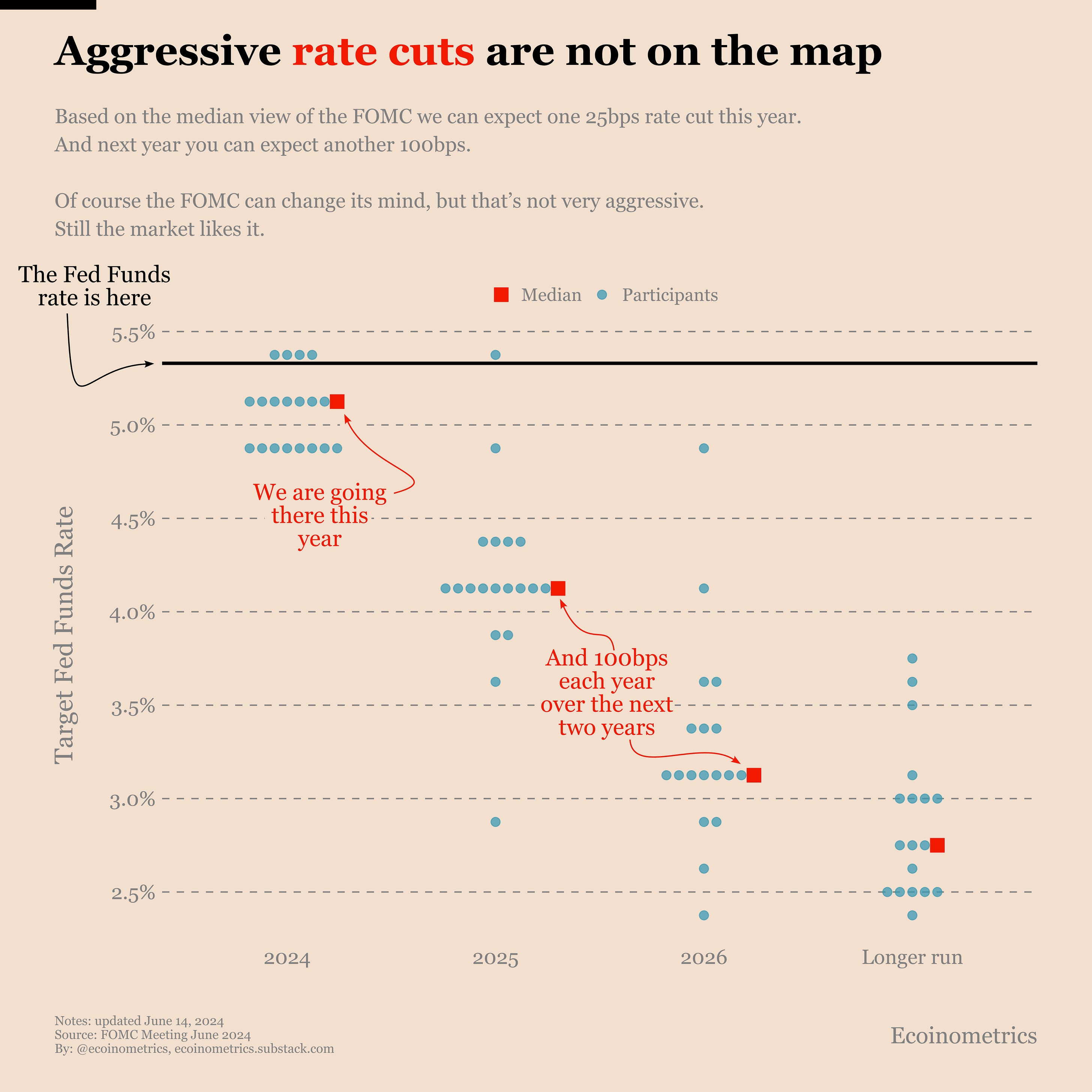

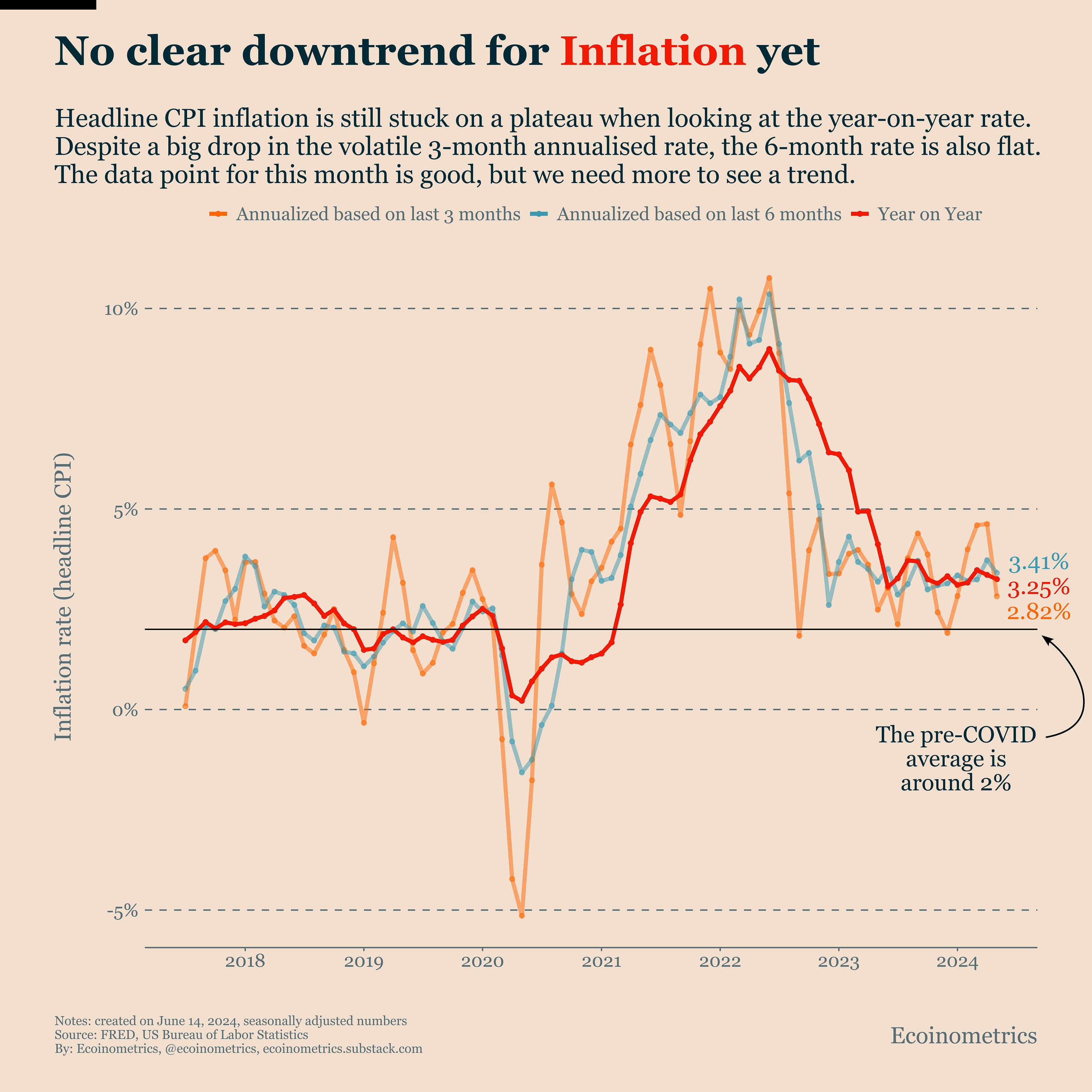

Honestly the Federal Reserfve can’t predict what’s going to happen next quarter, even less next year. So whatever the median rate is doesn’t really matter. What matters is the direction and the slope of the cuts. And based on that they are signalling mild rate cuts. But rate cuts nevertheless. That means they are acting the end of QT (same as the European Central Bank) while at the same time acknowledging they don’t expect inflation to be back to its pre-COVID level in the foreseeable future. Inflation: the new normalWhich brings us to inflation. We just got the CPI numbers and they are not as good as the reaction of the stock market would have you think. Yes there was a big drop in the month-on-month headline inflation rate this month. And because of that when you look at the annualized trend over the last three months you get inflation at 2.82%. But that’s just one data point. If you zoom out and look at the annualized inflation rate based on the last six months there is no change. CPI inflation is stuck on a plateau above 3%. And the actual year-on-year inflation rate is also stuck at 3.25%. So there is no clear downtrend. It has been a year and inflation is basically stabilizing at a new normal level that is significantly higher than the pre-COVID level. Apparently central banks are fine with that. After all a moderate inflation rate that’s higher than it was in the past is exactly what you need to keep the interest payments on the debt under control. That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts. Cheers, Nick P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics. Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets. Armed with those insights you can make better investment decisions. Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, June 14, 2024

Bitcoin's volatility is gone

Subscribe to:

Post Comments (Atom)

Popular Posts

-

New Updates From Safe, Gravity and More. Presented by Today's News Recap Suit Settled - Galaxy Digital settles $200M lawsui...

-

Bitcoin's Role in Geopolitical Crises with Safe Haven Status, Academic Insights, and Inflation Hedging Capabilities, plus a Bonus Chart ...

-

Morgan Stanley, Ledger, One River: Strategies Defining Digital Assets Today. ...

-

Courts move slowly — it's best to remember that ...

-

The top of investing bubbles, so obvious in hindsight, are notoriously impossible to time ...

No comments:

Post a Comment