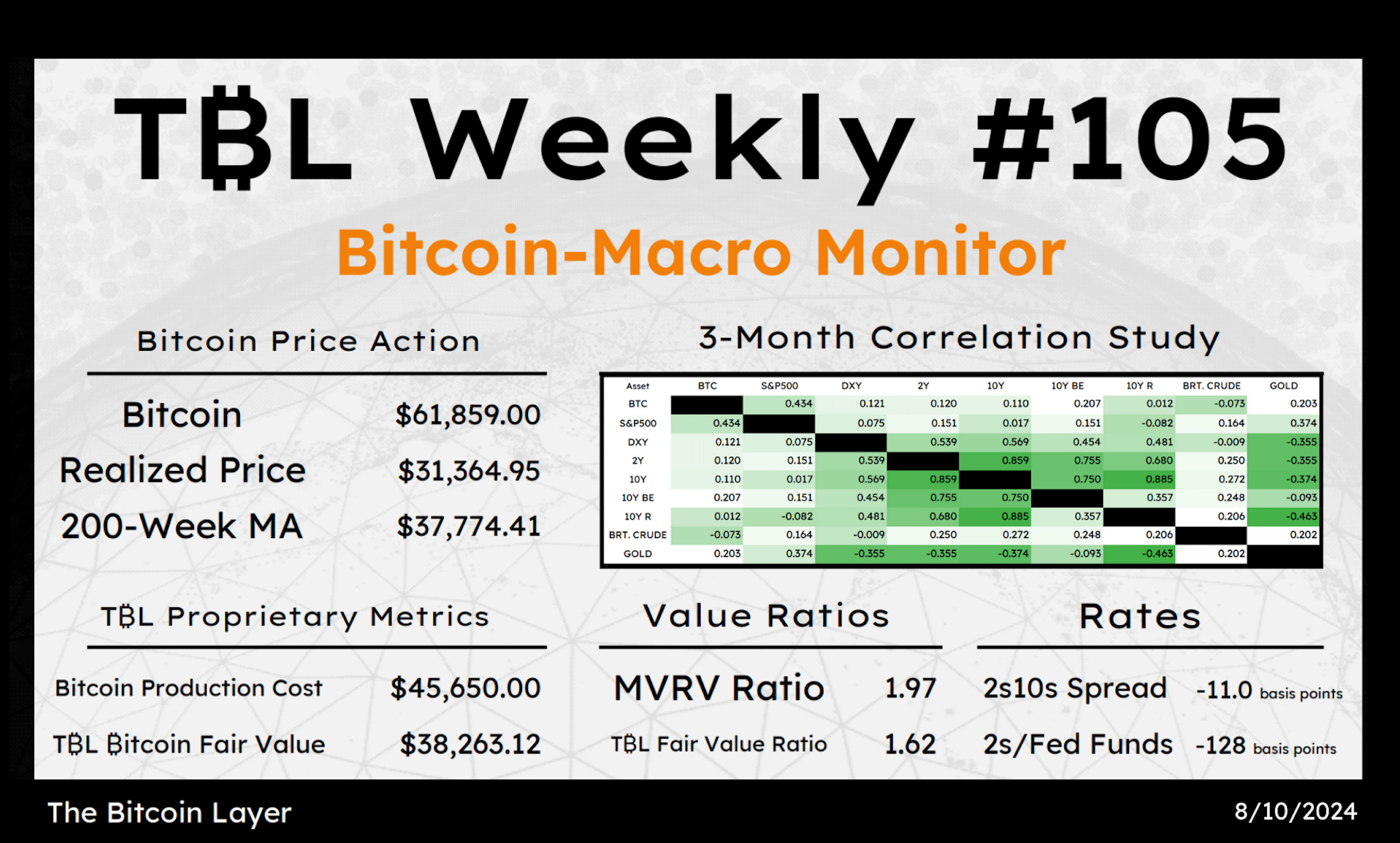

Welcome to TBL Weekly #105—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

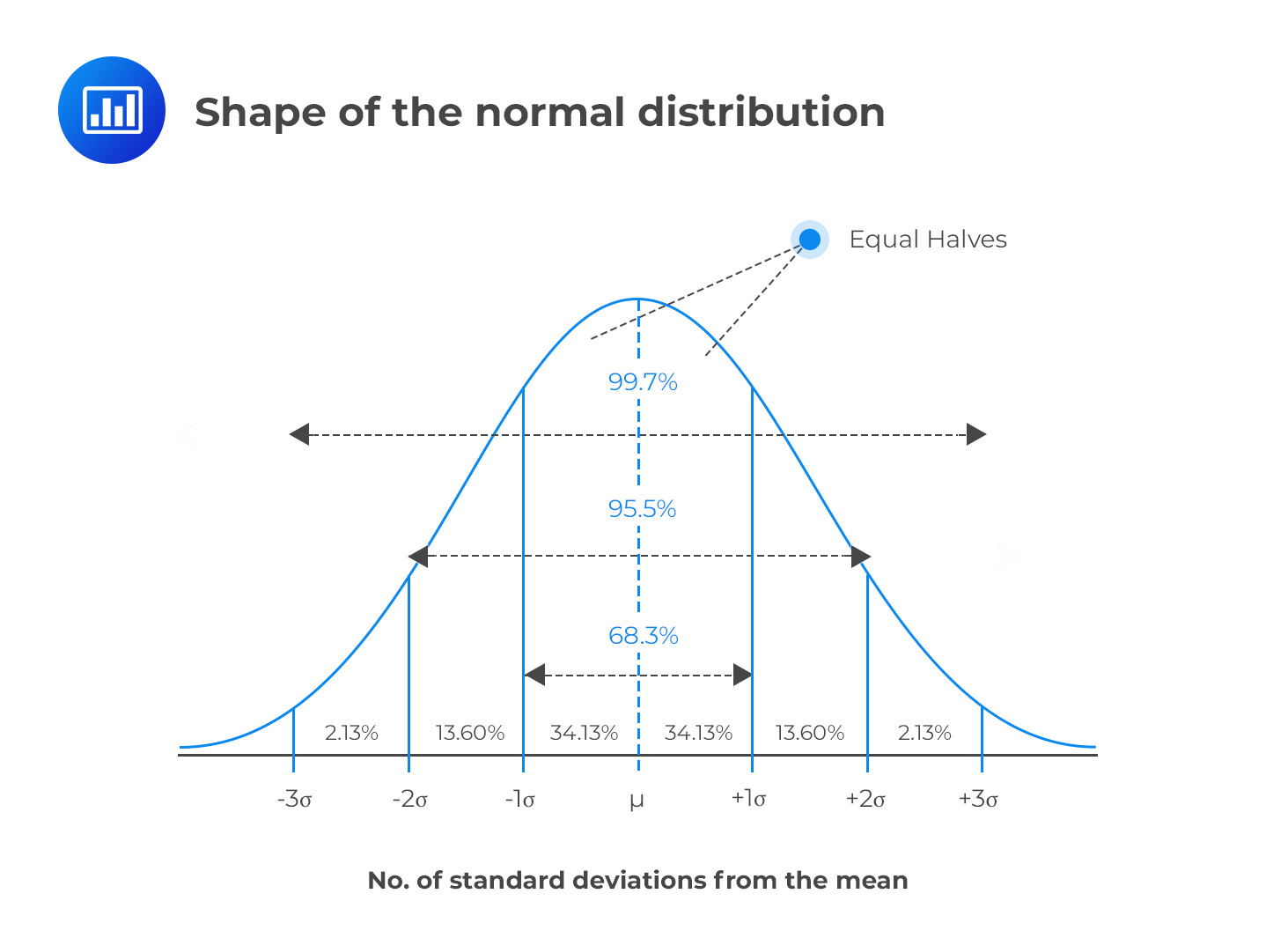

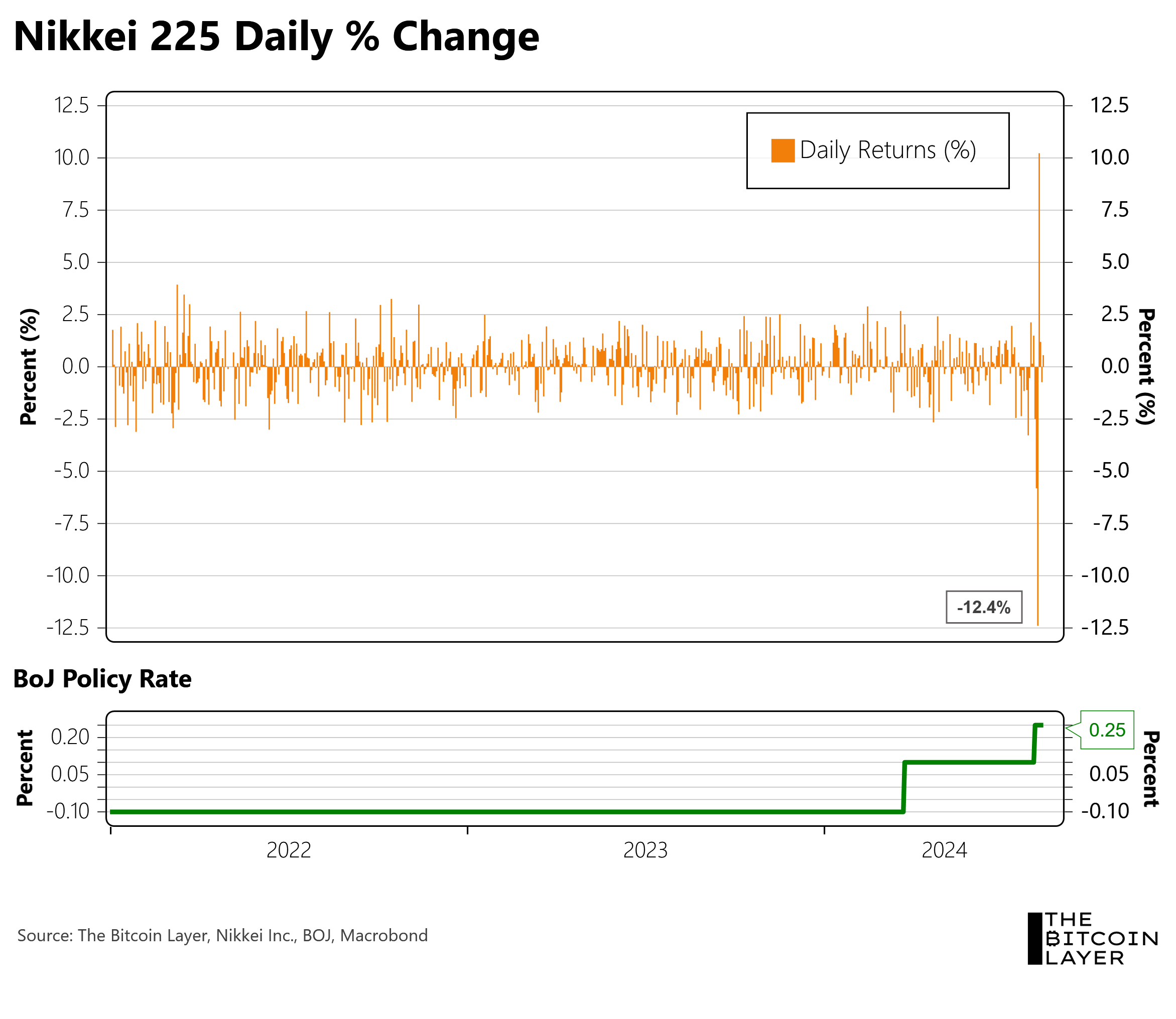

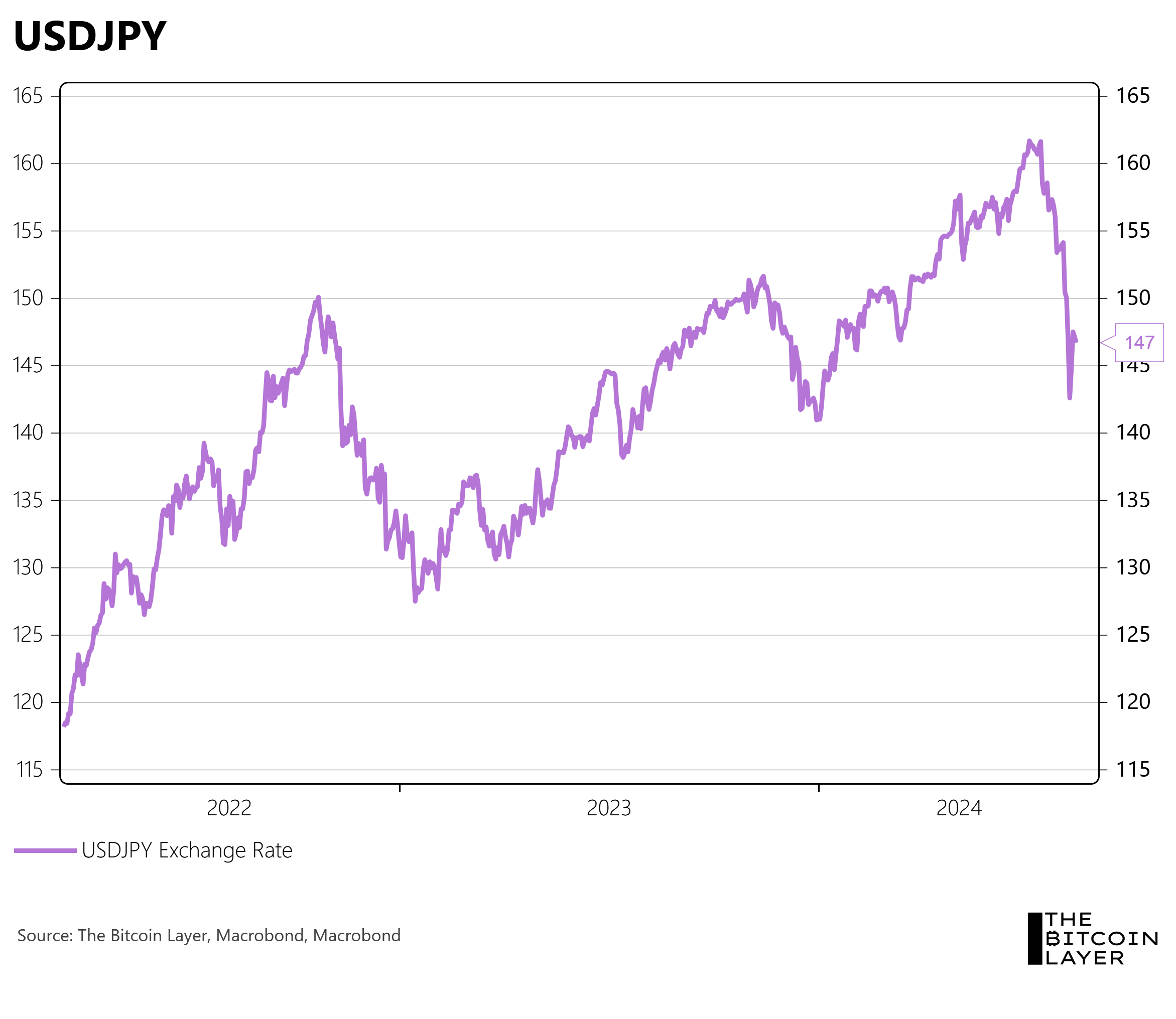

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Save $1,745 on a bitcoin IRA & keep control of your keys—now with no setup fee and your first year free. Use promo code AUGUSTIRA when you create an account. Limited time offer. Good morning TBL Readers, happy Saturday ☕ While Joe takes well-deserved time away from the screens, I’m excited to recap this week’s action across financial markets in addition to the usual look ahead to next week. In the most eventful price action week of the year, market observers were quick to point out the effect of a Japanese rate hike on the entire world. In order to help you understand how things unfolded, we begin with two core components of our global macro framework to comprehend what transpired. 1. Tail risks aren’t really at the tailThe first big-picture item we must review is the statistical tail. In a normal distribution, we observe that about 68% of all results exist only one standard deviation from the mean. In other words, most results are close to the average. When an event that is supposed to only happen once every 1,000 events occurs, statistically speaking, it should not happen again within the next 1,000 replays. It is our experience, and backed up by the data itself, that market events such as this week’s volatility out of Japan—that spilled over to global markets—are only three standard deviation events in name. In reality, they happen all the time. Silicon Valley Bank’s demise in 2023 was less than a year and a half ago. Yet the volatility around that episode and this week’s carry trade unwind are supposed to be statistically rare. The tails of the distribution are not thin and rare, but fat and occur frequently. In this spirit, we must expect outsized volatility events. 2. Policy responses are swiftNever forget the speed at which policymakers rescued the entire financial system last year. With unlimited insurance on bank deposits thanks to the FDIC and a joint effort from the Treasury and the Fed, risk barely had time to realize any losses. This type of response must be your base expectation—all disruptions to financial markets are met with incredibly swift bailouts, whether explicit or verbal. Moving to the change in Japanese equity markets, you can see the sheer size of the change, both down and then up, as the BoJ raised policy rates to 0.25%. The moves that took place on Monday and Tuesday this week were both over 8 standard deviations away from the Nikkei’s historical daily mean—an incredible swing. This level of interest rate, while appearing minuscule to Western market participants, is more aggressive than any time in decades. Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your crypto assets and personal data with the industry's most advanced security measures. Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan. How could the BoJ not see such a disruption coming, and why did it affect global markets so much? First, Japan sees a rate hiking cycle as a necessity now due to inflation tracking above their comfort zone. In a balance of outcomes, Japan’s central bank views a rate hike, and any ramifications, as worthwhile to counteract inflation. Those ramifications, including those on the price of the Japanese yen versus its trading partners’ currencies, are simply secondary. It’s not that BoJ policymakers are blind to the yen, but just as Powell claims the Fed does not target the price of the dollar and reminds constituents that it’s the job of the Treasury to maintain a dollar policy, Japan’s central bank is not focused on the price of the yen. That is why JPY interventions are conducted by the Ministry of Finance (Treasury). Now that you understand the yen is not a primary care for the BoJ, a BoJ hike basically kicks off a chain reaction that essentially falls outside of its domain. In a linear fashion, higher Japanese rates make the yen more attractive. This might cause any yen shorts to cover, sending the currency higher in price (lower on this chart versus USD). A stronger yen set off a chain reaction. Many investors have continued to use JPY as a funding currency, borrowing at low rates and then converting to another currency to invest. But when the yen strengthens, all of a sudden to repay the loan, investors need to pony up additional local currency to buy the yen back. A skyrocketing yen makes the Nikkei—Japanese stock market—less attractive to foreign investors. Both higher Japanese rates and a stronger Japanese currency cause a lot of problems outside of Japan because of the funding-currency nature embedded in the JPY. You might wonder if a strong yen, the result of the BoJ’s rate hike, is a desired outcome in that it reduces inflation. It is an indirect result via the energy import channel. With a stronger JPY, oil becomes less expensive for Japanese companies and consumers, which can reduce inflation. Rate hikes to tame inflation can only last so long, however, as we are seeing in the US. Eventually, companies stop hiring, feeding through to the consumer to the point when it’s time to ease. Sounds familiar, right? ❌ DON’T WRITE YOUR SEED ON PAPER 📝 It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

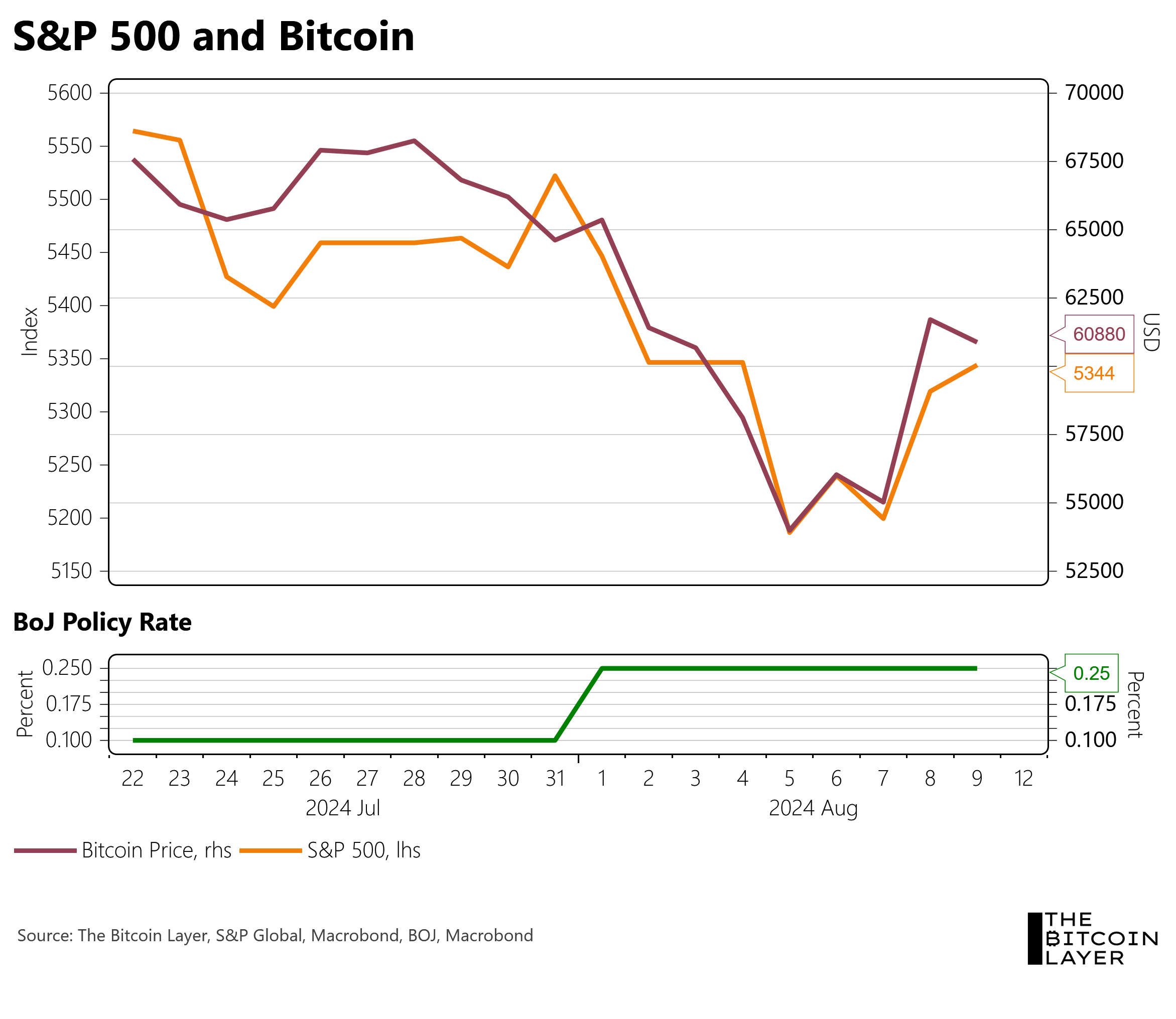

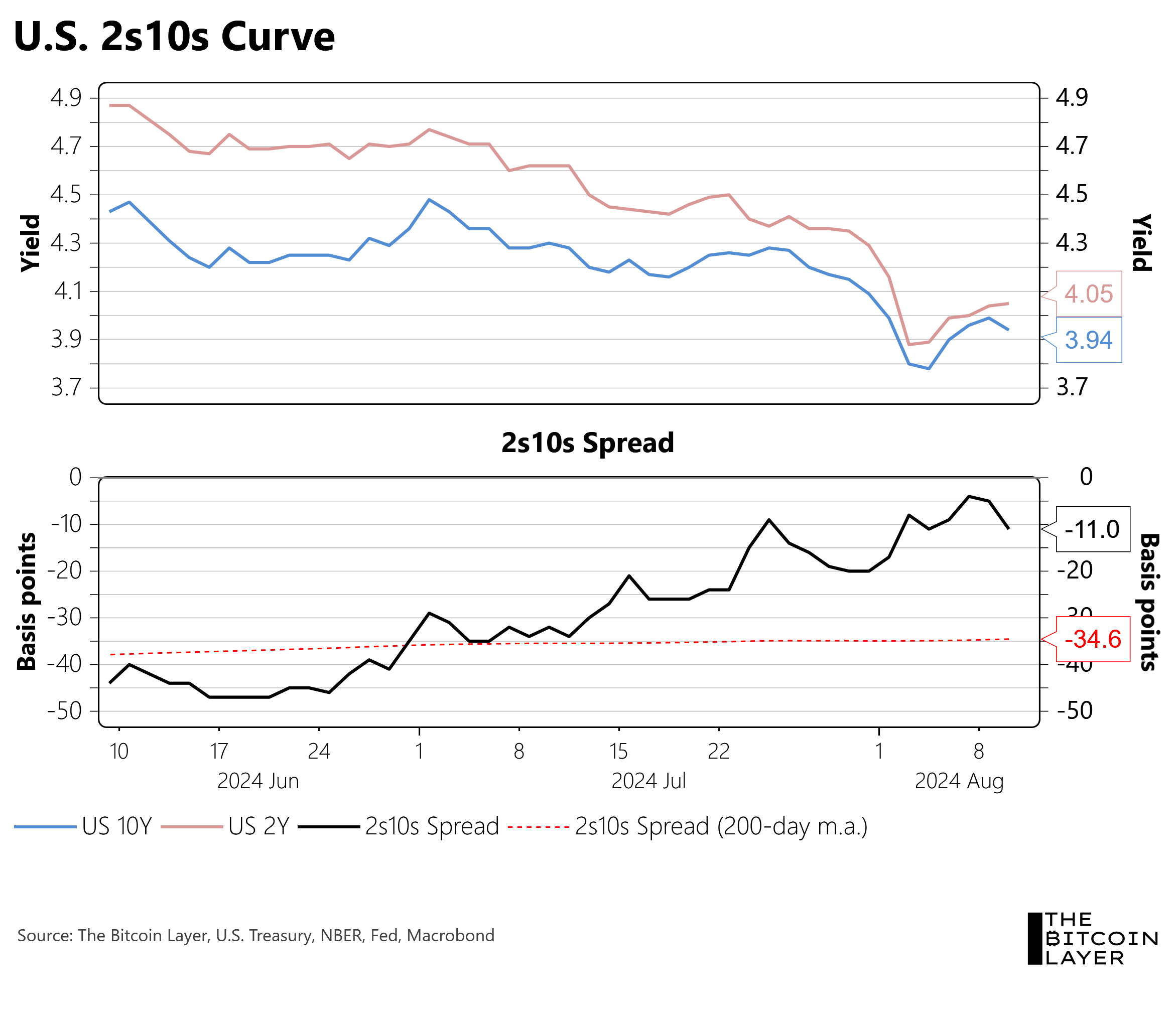

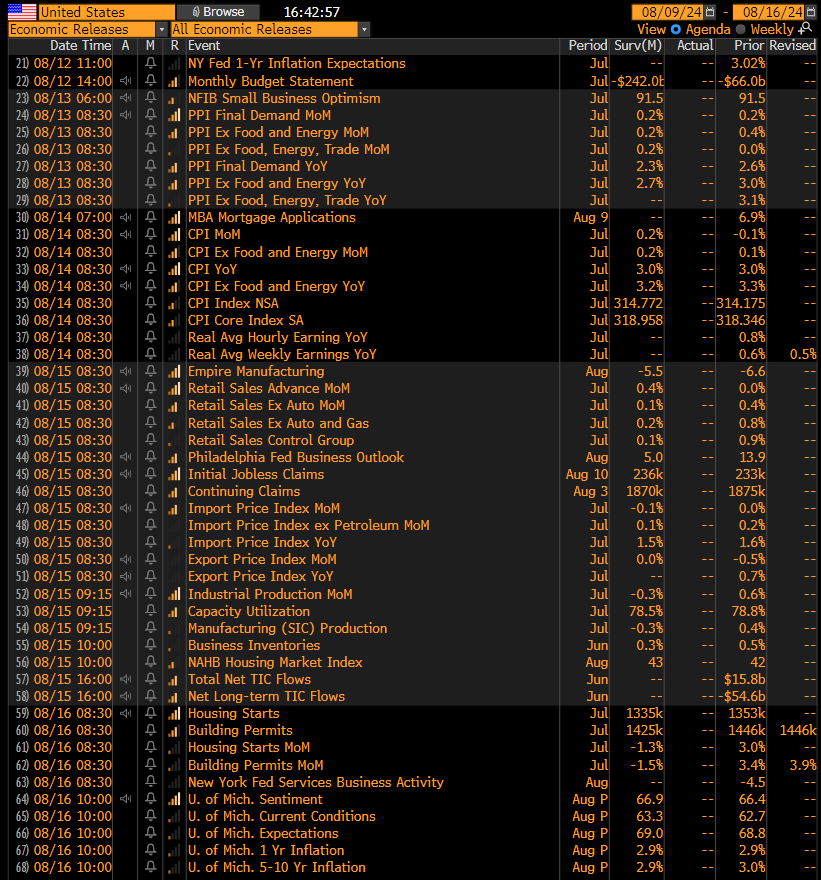

Take 15% off with code TBL. Get your Stamp Seed today! You can see that the BoJ rate hike directly corresponded with enormous volatility in both US stocks and bitcoin. Both started to stabilize later in the week after hard bounces. Stocks and bitcoin are experiencing another very strong period of volatility—in tumultuous markets, expect all correlations to rise near 100%. While all moves seemed to be connected to Japan to start the week, the bounce in risk carried through despite a genuine lack of policymaker rhetoric trial balloons. These large volatility events are sometimes just a single trade blowing up, dragging down margin extenders, triggering stop losses where needed. My thoughts on the recovery stem from last year’s SVB drama: if policymakers move in to save the day, they do so faster than you can even realize, and the bear impulse to risk disappears in a flash. This generally makes it very difficult for a short seller to participate—eventually, and now it seems to only be days—the opportunities don’t last. The US Treasury yield curve is almost back to flat despite some brief trading in positive territory to start the week. It remains inverted for now in a message to all investors that the scarcity of long-term US Treasuries is recognized by the market. The price keeps dancing higher without any assistance from the Federal Reserve. Talk around dismal Treasury auction statistics while yields are gradually falling from auction to auction appears as misinformed as ever. Then again, dogma is hard to shake. Next Week with NikIn the week ahead, markets are stopped in their tracks for Wednesday’s CPI print, which should have some impact on the intensity of the cutting cycle. With futures markets pricing in over 1% of cuts over the September, November, and December meetings, CPI will not disappoint in helping us determine the official path alongside the Fed. We’ve said this week that the difference between 25 and 50 basis points for a September cut doesn’t excite us too much, but the shape of the yield curve will always be the strongest signal for the appropriateness of policy rates. A steep curve implies the Fed has done enough to keep long-term expectations higher than the policy rate, while a flat or inverted curve means the Fed is still too restrictive because future growth expectations fall. Retail sales will also have our attention—despite all the bad news around the unemployment rate, the Atlanta Fed’s GDP tracker is still registering at 2.9%. An enormous far cry from the recession that everybody, including we at TBL, keep talking about. If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month. Here are some quick links to all the TBL content you may have missed this week: MondayJapan is in an unprecedented meltdown. Global stock markets are tumbling. Rates cratered on Friday and continue tonight. The yield curve has practically un-inverted. We cover historic moves in today’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. WednesdayIn this episode, Joe Consorti sits down with Matt Pines, the Director of Intelligence at Sentinel One and National Security Fellow at the Bitcoin Policy Institute. They dive into a multifaceted discussion covering the mechanics behind a strategic Bitcoin reserve, geopolitical flashpoints, advancements in AI technology, and the intriguing topic of UFOs. Matt Pines explains the strategic Bitcoin reserve bill and how the U.S. government could operationalize it. They discuss the feasibility and implications of holding Bitcoin as a financial asset. The conversation shifts to AI advancements, examining security challenges and how governments and private entities can prepare for these risks. Geopolitical tensions around Taiwan and its role in the semiconductor industry are analyzed, focusing on their impact on U.S.-China relations. Lastly, they tackle the subject of UFOs and the credibility of recent claims. Matt shares his thoughts on potential government disclosures and their implications for public trust and national security. Check out—Exploring Bitcoin's Strategic Role & AI's National Security Impact with Matt Pines  In this episode, Nik recaps one of the most eventful few days for financial markets this decade. With the soft landing narrative quickly giving way to a recession after last week's employment data, global markets went into a full tailspin, with US Treasuries dramatically bull steepening, stocks crashing, and bitcoin dipping below $50,000. He analyzes recent economic releases, discusses the volatility event and unwind of the Japanese yen carry trade, and carefully breaks down the price action from Tuesday's sharp, albeit partial, recovery. Check out—GLOBAL MARKETS PANIC: Bitcoin & Stocks CRASH But Recover  ThursdayAre you enjoying the volatility? I’m going to be honest, and I hope it’s not rude, but if you aren’t, I’m not sure what you’re doing here. Investing in bitcoin is not for the faint of heart, and it certainly isn’t for those wishing for a calm, slow, and steady financial ride. When people wonder why bitcoin has such large swings, the most obvious explanation is probably the correct one—if an asset goes from an academic cryptography paper to a $10 trillion asset (currently $1 trillion), would you expect the ascent to be stair-like, or instead something you might experience at Six Flags? The correct answer is the roller coaster because the reality is that no amount of steady climb can result in annual gains bordering on 1,000%. That also means select annual losses will be extreme, and days can wipe out an entire year. Even if you’ve already accepted the above, technical levels are worth integrating, even if it is only for peace of mind. Some of you are actively trading, but many are just trying to appropriately stack and not get shaken out. Levels help. We’ll also touch on rates, the Fed, and bring you an important update on our TBL Liquidity indicator, which is proving to have some predictive power. In this episode, Nik is joined by bitcoin developer and educator Stacie Waleyko to discuss her educational bitcoin pocket guides and brand new online game called Saving Satoshi. Stacie explains the type of student she is trying to reach and shares with us a vision of how Saving Satoshi can become one of the most powerful educational resources in all of bitcoin. Stratum V2, a bitcoin mining protocol, is also discussed. Check out—How Stacie Waleyko is Transforming Bitcoin Education  FridayIt’s Thinking Time! We have a good one for you this week as we go straight into AI’s potential effects on India’s tech outsourcing market, AirBnB shares plunging, the increasing costs of utilities, and a sharp fall in mortgage rates. TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! That’s all for our markets recap—have a great weekend, everyone! Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Save $1,745 on a bitcoin IRA & keep control of your keys—now with no setup fee and your first year free. Use promo code AUGUSTIRA when you create an account. Limited time offer. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, August 10, 2024

Bitcoin's BTFD, Japanese Whipsaws, Welcome to Tail Risk: TBL Weekly #105

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Our bi-weekly quantitative risk report for TBL Pros: May 14th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

While the token 'exploration' comment from last week stole headlines, the Base Camp event showcased the network's scal...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Plasma ICO participants made >30x. Many of the new ICOs are seeing insane demand. Here's how you can get st...

No comments:

Post a Comment