Welcome to TBL Weekly #107—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. Good morning TBL Readers, happy Saturday ☕ I’d like to give a big thank-you to Nik and Augustine for writing the Weekly in my stead as I was on vacation and proposing to my lovely fiancée! Now I’m back on the desk and ready to break down this week’s action for you guys. And what a week it was. Can you feel that? The ground just moved beneath our feet. Just 28 months after the Fed’s first increase of the Federal Funds rate, Jerome Powell just said “the time to come for policy to adjust.” The timeline of this cycle has been:

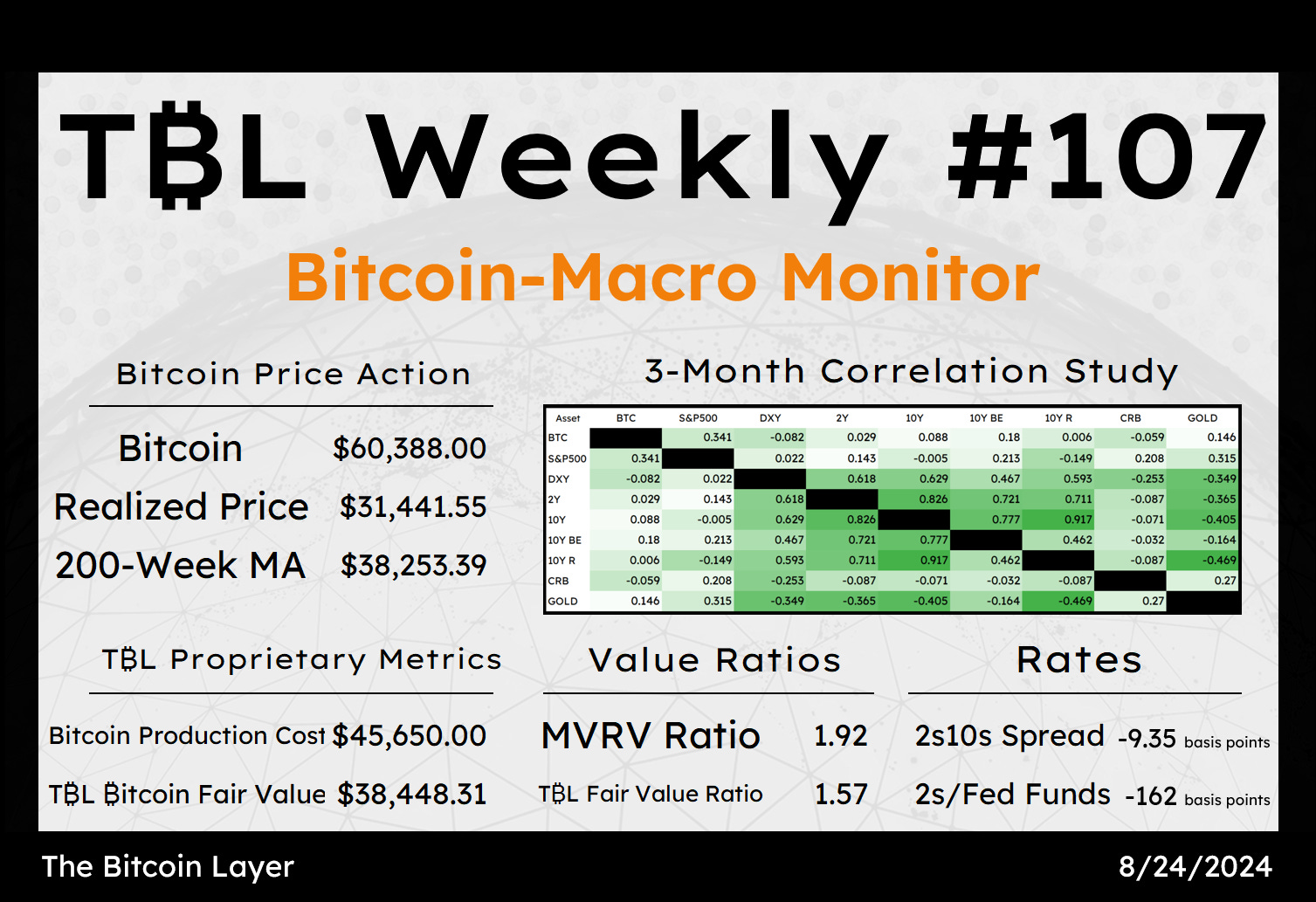

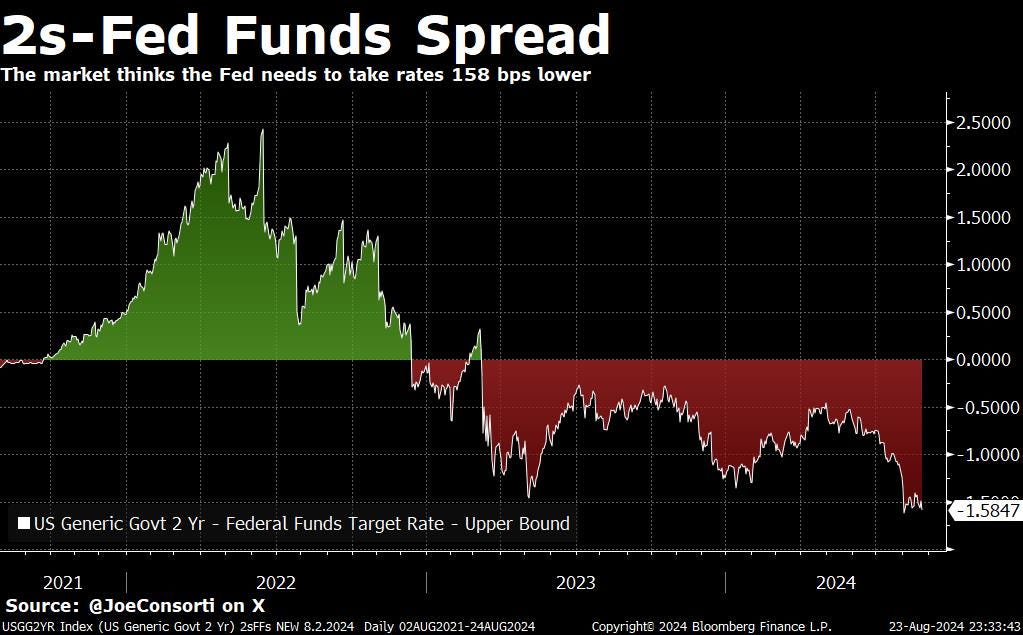

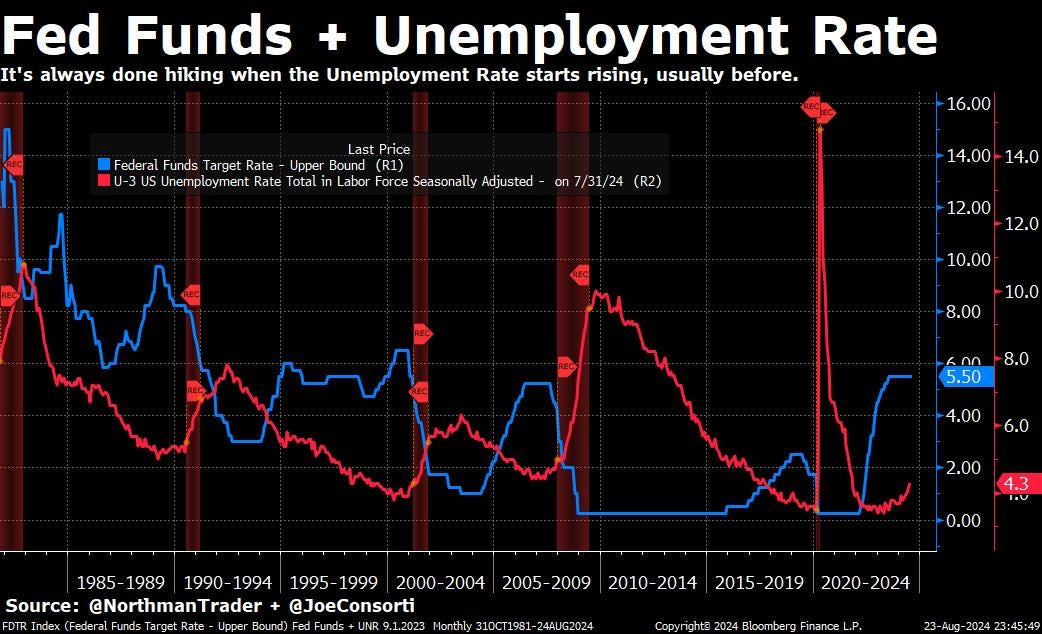

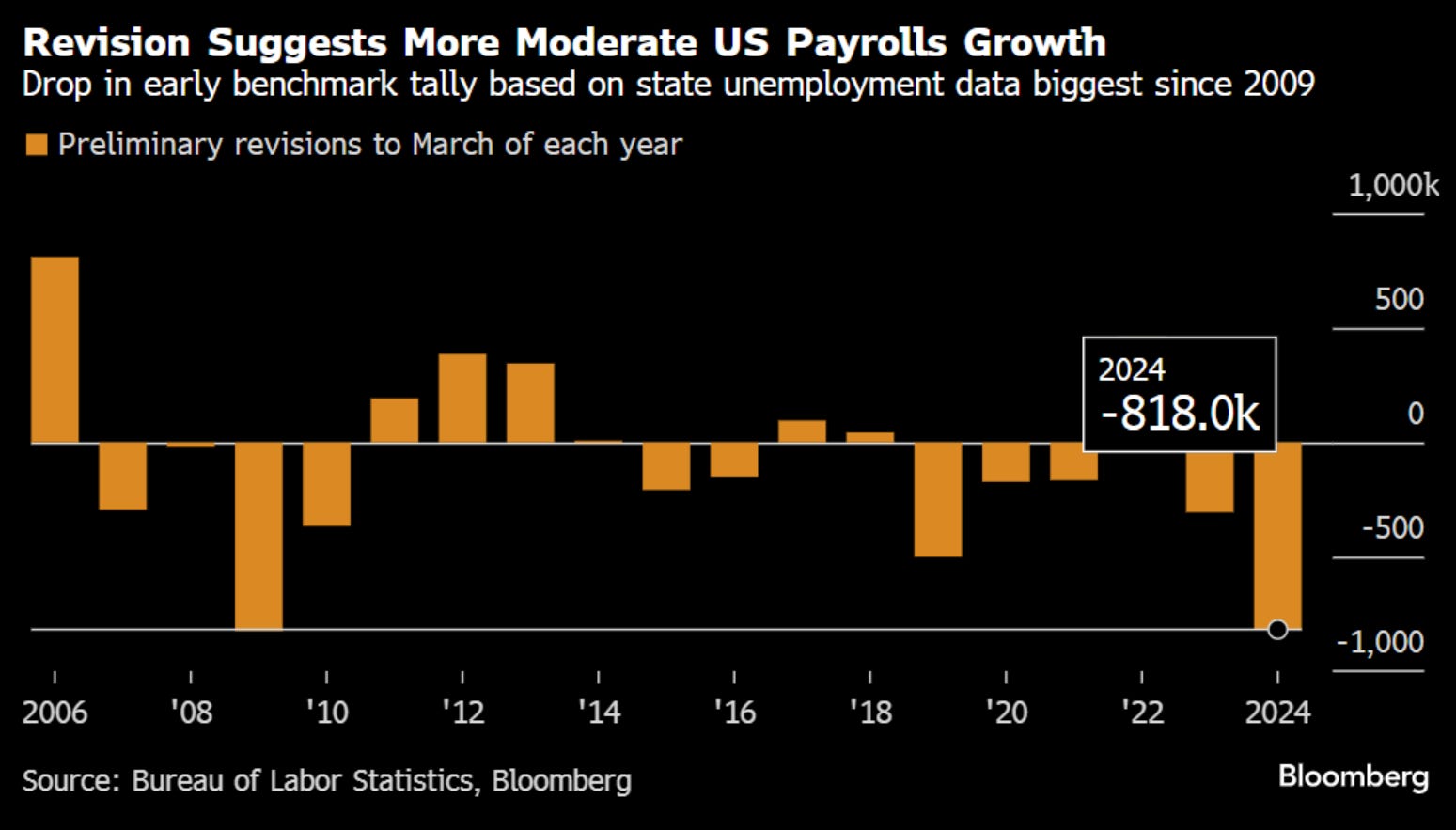

We have had 17 months of rate hikes, 13 months of on-hold tightness in financial conditions, and now easing up on financial conditions with the Fed starting its cutting cycle is finally in our sights in 3.5 weeks. Powell is rounding the corner on pulling off something that US financial markets have never seen before: normalization of the policy rate down to neutral without a recession. So far. The US Treasury market has been forecasting this move for months, which readers know is a pillar of our analysis here at The Bitcoin Layer. The Fed is a lagging indicator of where the US Treasury market is. It has finally caught up to what yields have been signaling for months: cuts are coming. The 2-year US Treasury yield is 158 basis points inverted to the Federal Funds rate, meaning the market is anticipating the Fed’s need to take its main policy interest rate 158 bps lower than it currently is. After 18 months of inversion, the Fed is finally taking cue from rates and packing it in: Down 109 basis points in 2 months, this chart that Nik created for 2s several months ago has played out to a T. The Fed is finally catching up to what rates have been pricing in for months, positioning itself for what’s ahead for the economy rather than the Fed’s signature method of conducting policy in the foggy rearview mirror: Powell cited the cooling labor market as the driver behind its decision to cut, something which we’ve also discussed ad nauseam. The Fed’s dual mandate of full employment and stable prices may well be called a dueling mandate, as they are always fighting for the top spot in how the Fed conducts policy. When the updraft of the economic cycle accelerates price inflation too high above the Fed’s 2% long-run goal, stable prices become the main lens through which the Fed conducts policy. Now that the Fed says “the upside risks to inflation have diminished",” it’s all eyes on the full employment side of the dual mandate. Powell went on to remark that “the downside risks to employment have increased,” and increase they certainly have. The balance of risks, as it were, has moved from sticky inflation to a rapidly cooling labor market, one that threatens to teeter from slowdown into contraction if the cooling persists at the going rate. Powell highlighted this risk in the presser with more dovish-than-expected language. He said that the Fed “do[es] not seek or welcome any further cooling in labor market conditions.” Unemployment has risen to a 3-year high of 4.3%, an “unmistakeable” cooling of the labor market, in Powell’s own words. The Fed usually starts cutting when the unemployment rate rises 10-20 basis points off of its cycle low. This time around, the unemployment rate has already risen 90 basis points off of its cycle low, and the Fed is only just now starting its cutting cycle. Too little, too late? Payrolls moderated by more than expected, shedding 818,000 in the Bureau of Labor Statistics’ annual preliminary revision to March of each year. This is the largest downward revision in the payrolls report since 2009. Two notes:

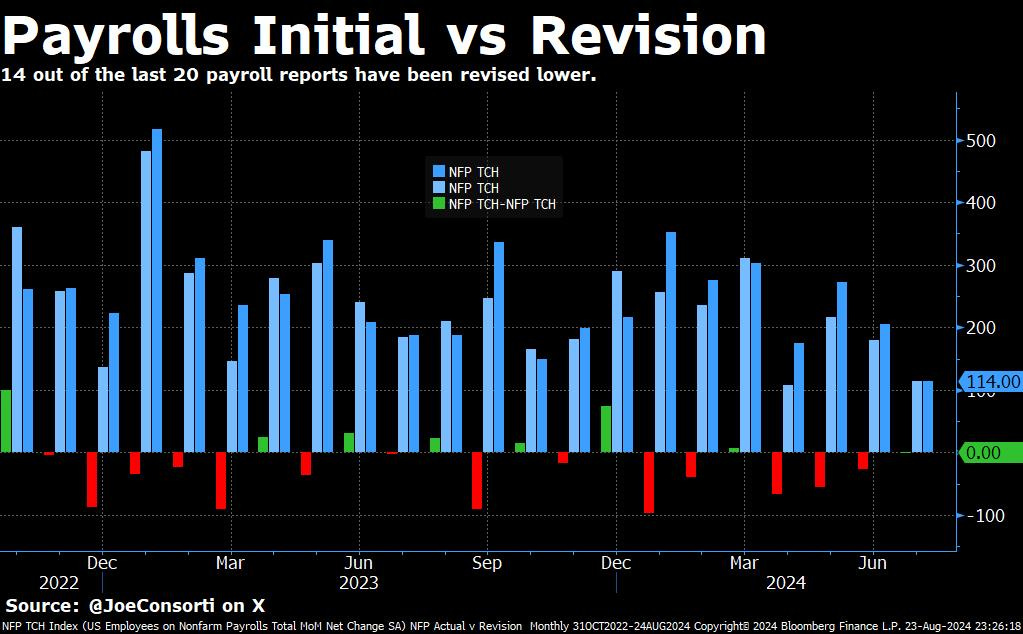

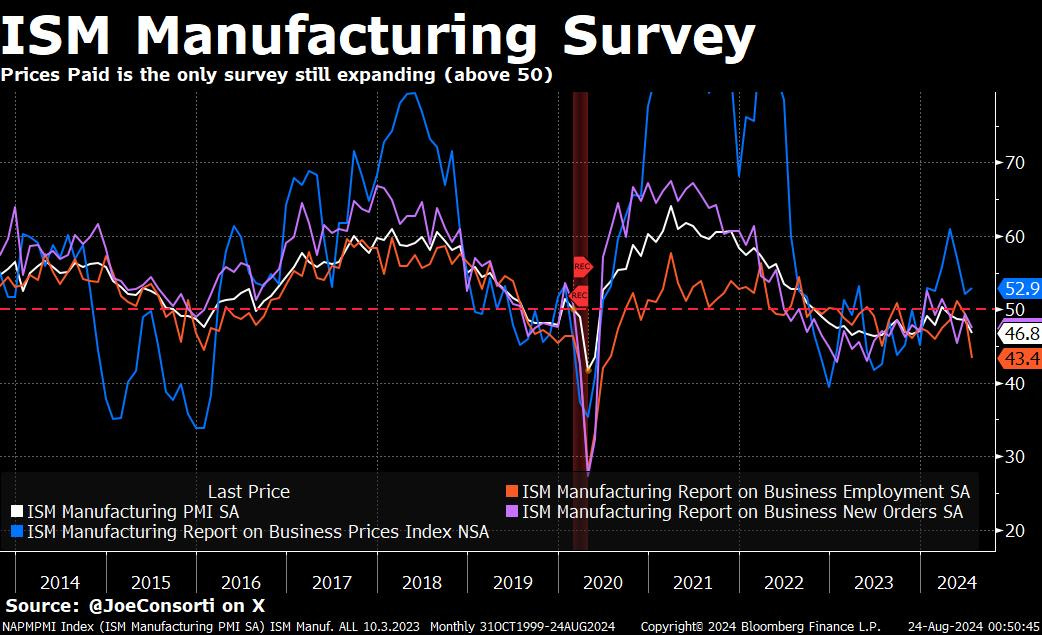

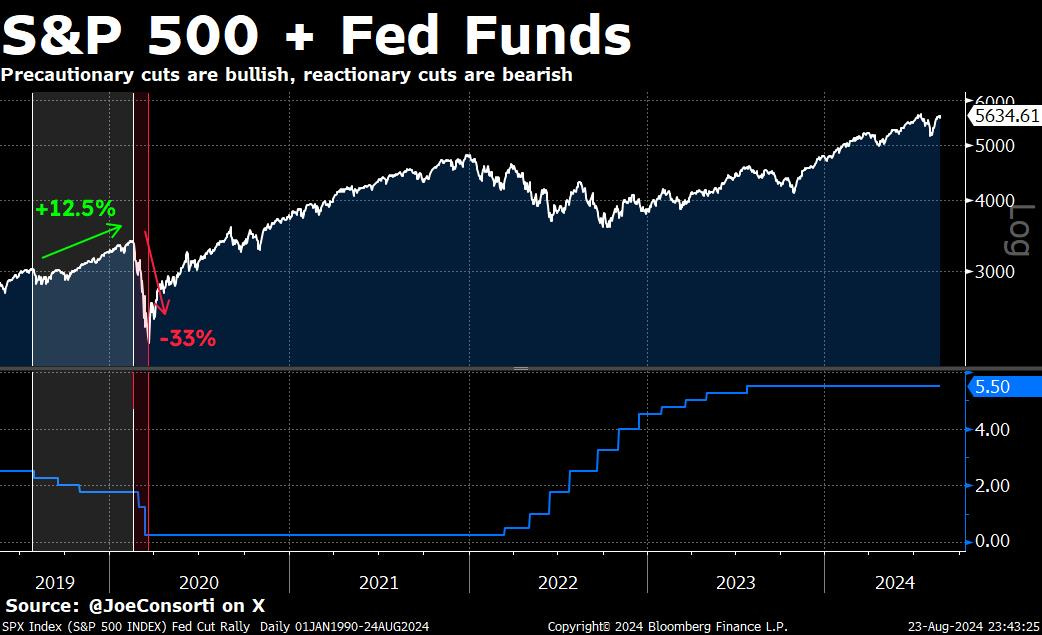

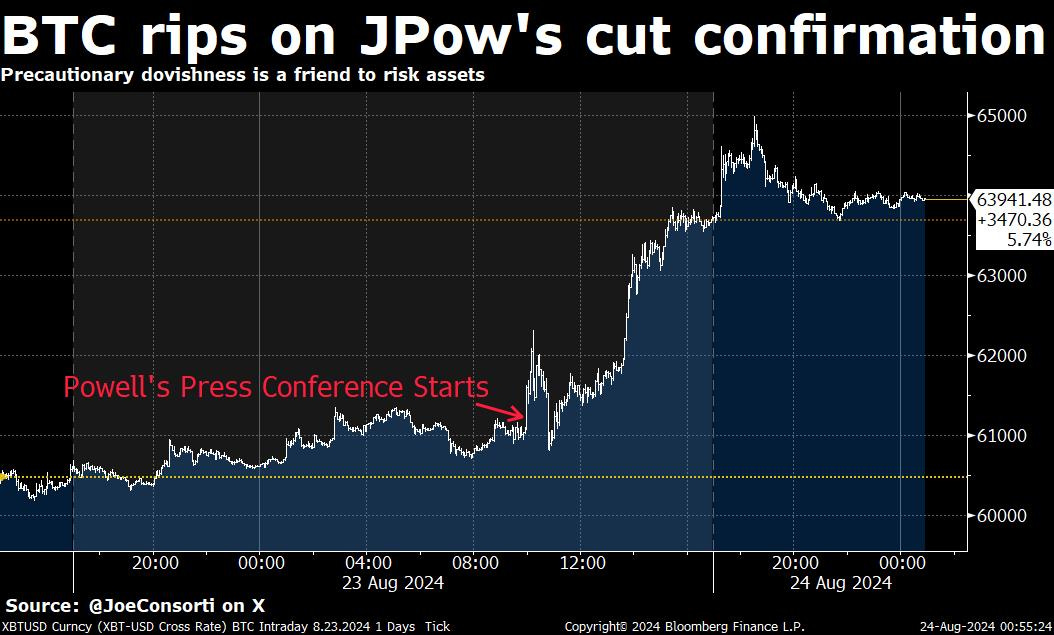

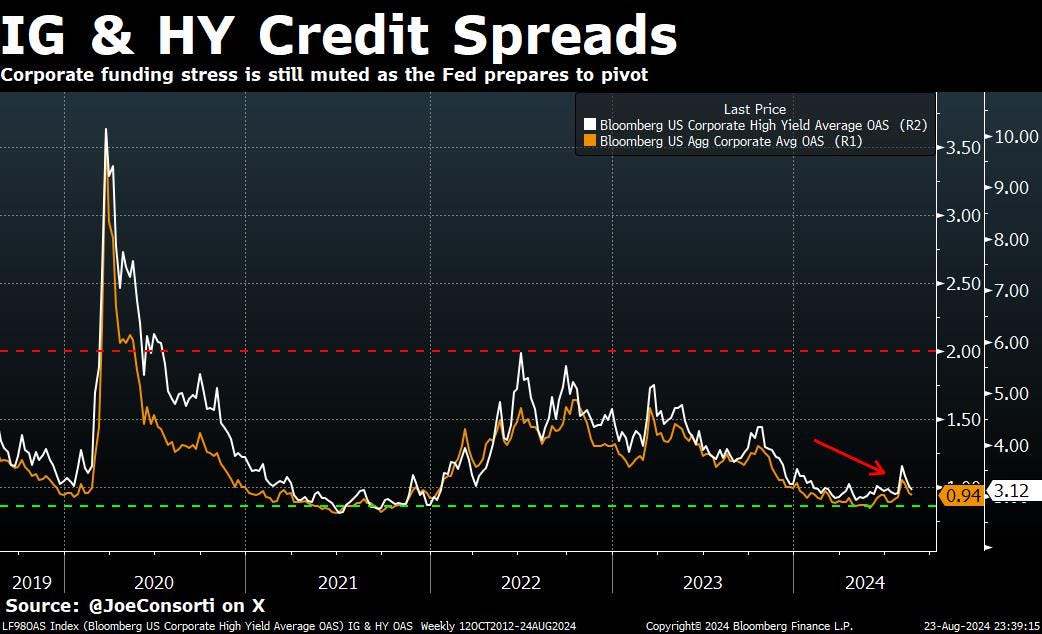

The BLS figures estimated that 2.9 million jobs were added from March 2023 to March 2024, averaging 242,000/month. This revision down to 2.08 million jobs added over that year brings that pace down to 174,000/month, or a pace of job growth 28% slower than initially estimated. There’s the cooling that Powell is talking about: Unless you’ve been living under a rock, this is not news to you. TBL readers will know that the BLS has systematically overestimated the strength of the US labor market during every meeting, quietly revising it down after the fact: The pace of labor market softening even drove the Fed to quietly consider beginning its cutting cycle in July, as revealed in last month’s FOMC meeting minutes, out in advance of the September estimate. Breaking Powell’s tried and true method of forwardly guiding the market by telling it what the Fed plans to do months in advance illustrates just how seriously they are viewing the pace of this downturn. The final view I’ll provide of the rapidly cooling labor market will be the easiest to understand, and the most downloadable and shareable chart for the day: the Labor Market Surprise Index. This is the percentage difference between the actual economic data release and the average of analysts’ forecasts for that release. Is the economy doing largely better or largely worse than what is expected? Survey says: much worse. The Labor Market Surprise Index printing in negative territory for the first time in two years with two consecutive prints, each worse than the last. Powell will have his eyes on next month’s release of the August payroll report to see whether the current deterioration of the US employment picture accelerates or moderates. This will influence the Fed’s decision to cut in a larger, 50-basis-point increment (which the market is currently assigning ~25% odds to) or stick with its incremental 25-bps loosening: ISMs reflect the exact same weakness in labor and consumption: Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your crypto assets and personal data with the industry's most advanced security measures. Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan. Now for the question on everyone’s mind. How do we know whether asset prices will go up or down in response to cuts? It depends on why the Fed is cutting. Cuts are coming and they are not in response to a recession, they are coming in response to a slowdown. It is important to note this difference. A long-standing bulwark at TBL is that the market reacts differently to different kinds of rate cuts. The Fed is observing disinflation and a snowballing slowdown in the labor market; it is cutting rates to prevent it from metastisizing into a full-blown spike in the unemployment rate and recession. Markets love this, as it is an accommodative move to keep financial conditions at the same level of tightness, if not loosen them. This is different from when the Fed cuts in response to a crisis, in which case the damage to financial markets is already done, and the cuts come as an emergency response. The Q3 2019 to Q1 2020 period is the best recent example of this difference in how stocks, and risk assets more broadly, react to the two types of cuts. A precautionary cutting cycle coincides with risk assets bidding up (marked in white). A reactionary cutting cycle coincides with risk assets selling off (marked in red). Why the Fed cuts is the difference between a bull market continuation and the start of a beat market: Right now, the Fed is performing precautionary cuts. Lo and behold, bitcoin loves it. Ripping 5.75% in the 8 hours since Powell’s dovish remarks, the market is running with the promise of loosening financial conditions into already cyclically loose financial conditions while the United States is running a $1.52-trillion deficit. This pop off of the announcement of cuts is a preview of bitcoin’s price action when the cuts themselves finally come, (if the labor market deterioration moderates rather than accelerates): Financial conditions are already quite loose, with borrowing conditions for risky and non-risky corporate borrowers near their narrowest cycle levels. This is a massive boon for asset prices, as cuts into loose financial conditions only serve to boost corporate margins and the stocks that trade off of forward earnings estimates. Bitcoin being tightly correlated with stocks gets dragged up in the mix, along with its already favorable characteristic of being the world’s liquidity sponge: One final note: with RFK Jr. dropping out of the Presidential race to endorse Doland Trump and cinch a seat in his administration, the United States’ first pro-Bitcoin Presidential cabinet just keeps getting bigger. ❌ DON’T WRITE YOUR SEED ON PAPER 📝 It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

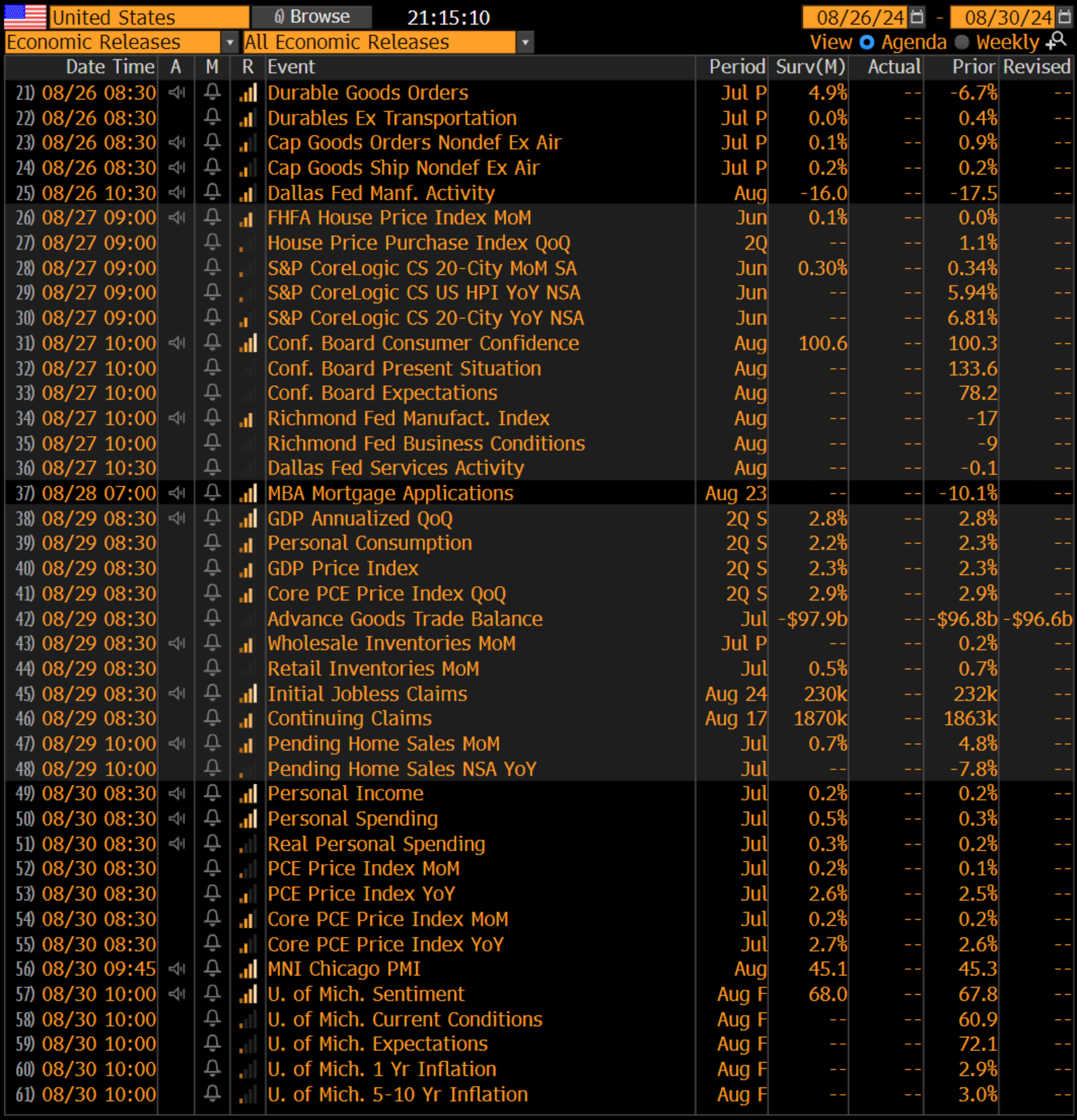

Take 15% off with code TBL. Get your Stamp Seed today! Next Week with NikAt this point in the cycle, almost none of the incoming data will meaningfully inform the market. With second-tier data during a mid- or late-cycle regime, investors pore over every ounce of data to extract information the market broadly might not understand. For example, during 2023, investors and researchers, including TBL, picked apart every housing, corporate, and consumer dataset to see if the Fed's tightening was working, or if large fiscal spending rendered interest rate hikes ineffective. A slowing economy was apparent to us and others, leading to an inverted yield curve in which investors are betting on a lower path of interest rates. But now that lower rates have prevailed, we aren't really looking too closely at every data print with the same "is it slowing or not?" mentality. Instead, TBL is shifting to a "how high will unemployment get?" stance, with almost nothing else relevant to the path of policy rates. Yes, inflation should move the market around, mostly through post-trauma motions, but we don't see it impacting the market relative to unemployment. The AI wave is here, software developer jobseekers are feeling the pain, Texas and Florida are in borderline real estate panic mode, and Powell is feeling the heat of overdoing it. A little overshoot on inflation readings just isn't going to cut it for the bears, and Treasury bulls know it. With falling rates, we can all feel the Treasury bulls leaning into their conviction that 5% Treasuries was, simply put, a gift. Now we watch the scarcity of good collateral reprice higher until the US government decides to print another wave, likely warranting some assistance from the central bank in financial system digestion. Next week brings many interesting data releases, but we'll look past them, allow Labor Day to pass while portfolio managers finish out their seaside vacations, and wait for September 6th's unemployment update. A bad report will solidify a 50 basis point rate cut, while a decent report will result in the 25 basis point increment the market has priced. Most interesting to us is the sneaky 1% of cuts through three meetings priced in, as even the cagiest bond traders believe data will be poor enough to warrant an accelerated pace of easing. The shape of the Treasury curve gently translates to: "Jay, you overdid it." If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month. Here are some quick links to all the TBL content you may have missed this week: MondayBitcoin’s consolidation period continues with no immediate signs of a change in sideways movement. To keep you in the loop, we have expanded our bitcoin section in this week’s edition of Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. WednesdayIn this episode, Nik brings us a global macro update to recap a most dramatic downward revision in labor statistics. He begins with the two most noteworthy items in economics: the downward revision of jobs added by almost one million, the rampant manipulation of labor statistics by the government, and the latest FOMC minutes which stated that the Fed was close to cutting rates in July. Nik breaks down the signals from the yield curve and discusses bitcoin's consolidation. Check out—Global Macro Update: Bitcoin, Government Lies On Labor Stats, Lower Rates  ThursdayEverybody’s homeboy Jerome Powell takes the stage tomorrow in Wyoming, and we genuinely await his speech. Unlike years passed when it felt like he was on borrowed time impersonating Paul Volcker, this year will require more truth-telling. We’ve noted throughout his reign that unlike his predecessor, who currently serves as Treasury Secretary, Powell generally doesn’t insult our intelligence. He knows how to watch repo markets (the single largest piece of evidence I personally need to take him seriously), watch corporate bond issuance, and interestingly enough, watch the Eurodollar market for signs of trouble. From that perspective, Powell is an admirable policymaker. The admiration, however, must give way to reality, in which the Fed drives an entire economy with a clean windshield and blurry rear-view mirror, but only chooses to use the latter. This week’s 818,000-job downward revision is a shining example—Powell hinted that this would be a primary justification for a rate cut earlier this summer but still couldn’t pull the trigger because the revision hadn’t yet occurred. Markets didn’t make that mistake, as today’s sub-4% Treasury yields aren’t the gift that investors need. Good economic data, still present, has asset allocators overweight risk, while bad data convinces Treasury bulls to settle in for a run. It turns ugly if volatility is unleashed. In this episode, Nik poses a question to the audience about quiet home mining. He goes through the social media responses to his question, and several home mining options are discussed. The Bitcoin Layer is not sponsored by any company discussed in this video, rather we attempt to understand the scope of options for quiet home mining. Enjoy this short episode to learn about this potential endeavor! Check out—How To Mine Bitcoin Quietly At Home  FridayIt’s Thinking Time! This week we cover flying cars and an emerging air-taxi market, a slight upturn in housing sales and changes to how we buy and sell houses, and the lockdown in Canada that has the potential to massively disrupt North American supply chains. TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy. In this episode, Nik recaps the news out of Jackson Hole, Wyoming that the Fed is now confirmed to start cutting rates in September. He explains how money markets and Treasury yields already showed us months ago that rate cuts would arrive, discusses the economy and unemployment as drivers of the Fed's latest announcement, and closes with an analysis of bitcoin's price and what rate cuts will mean for bitcoin going forward. Check out—Bitcoin Bounces As Fed Confirms Rate Cuts  Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! That’s all for our markets recap—have a great weekend, everyone! Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, August 24, 2024

Fed Confirms Rate Cuts After 28-Months of Tightening, BTC Soars: TBL Weekly #107

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hello guys and welcome to my blog, I tried to find one working faucet collector crack and here it is. Just download this crack, install d...

-

From BRICS Pay to Bitcoin, Comparison and Implied Breakdown of the Old System, Path to the New. ͏ ͏ ͏ ͏ ͏ ...

-

If we don't know where our investments are going, we might not get there ...

-

Zoomers' retirement accounts may be in trouble ...

-

Bitcoin On-Chain Activity Report, November 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment