Good morning Readers! $100,000…incredible, isn’t it? After many Thanksgiving dinners (hope you all had a great one, by the way) being the laughingstock at the table, how the tables have turned. In today’s Weekly, we want to slow it down from the excitement around six digits. As we break through $100,000, we enter price discovery territory, and we have more questions than answers. Here’s what we’ll statistically inquire today:

So, without further ado, welcome to TBL Weekly #121. Grab a coffee, and let’s dive in. Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year. Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order? If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul. Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way. With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: Weekly MonitorWeekly AnalysisBitcoin:Today we bring back a chart that we used a few weeks back displaying weekly changes in bitcoin’s price.

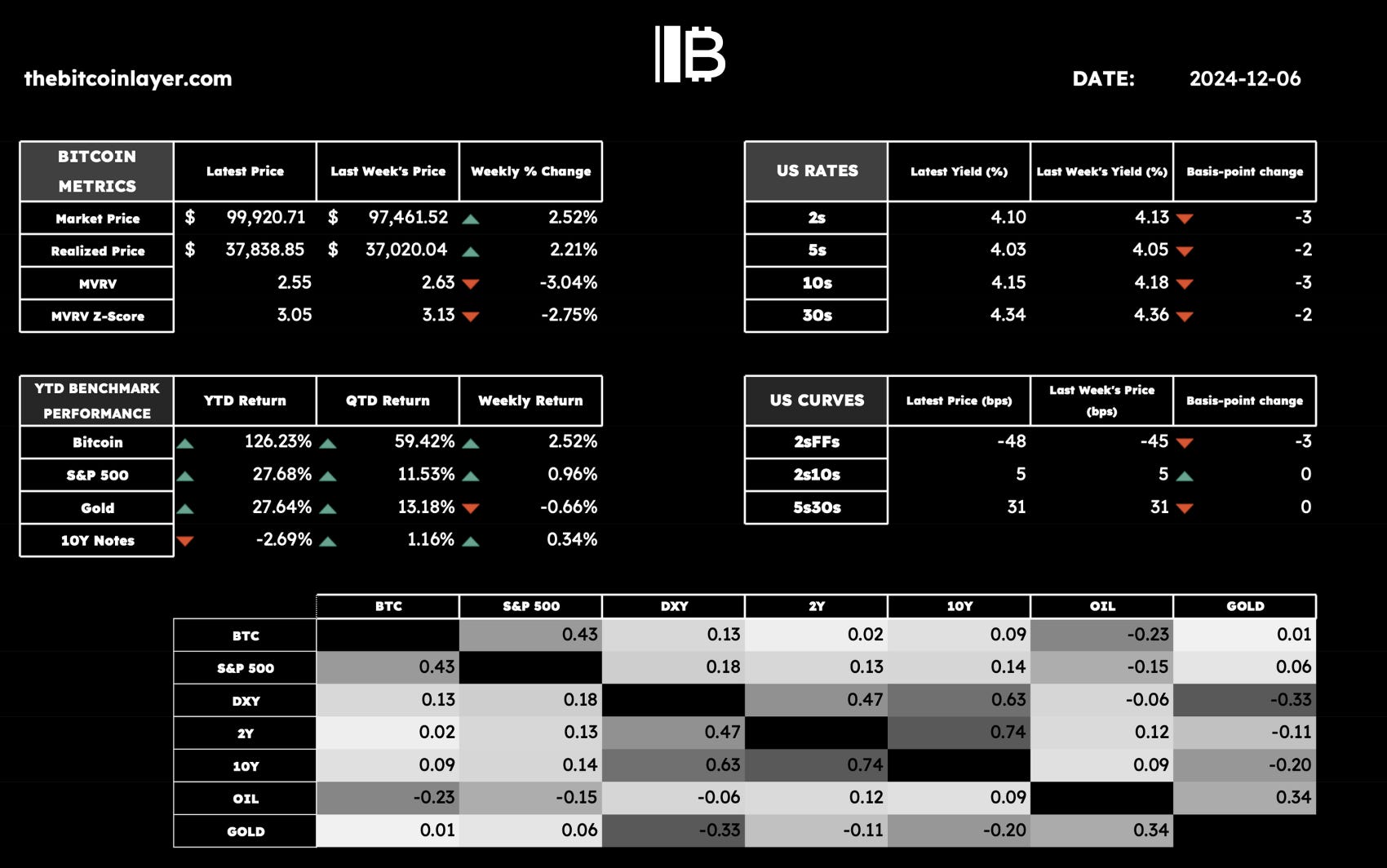

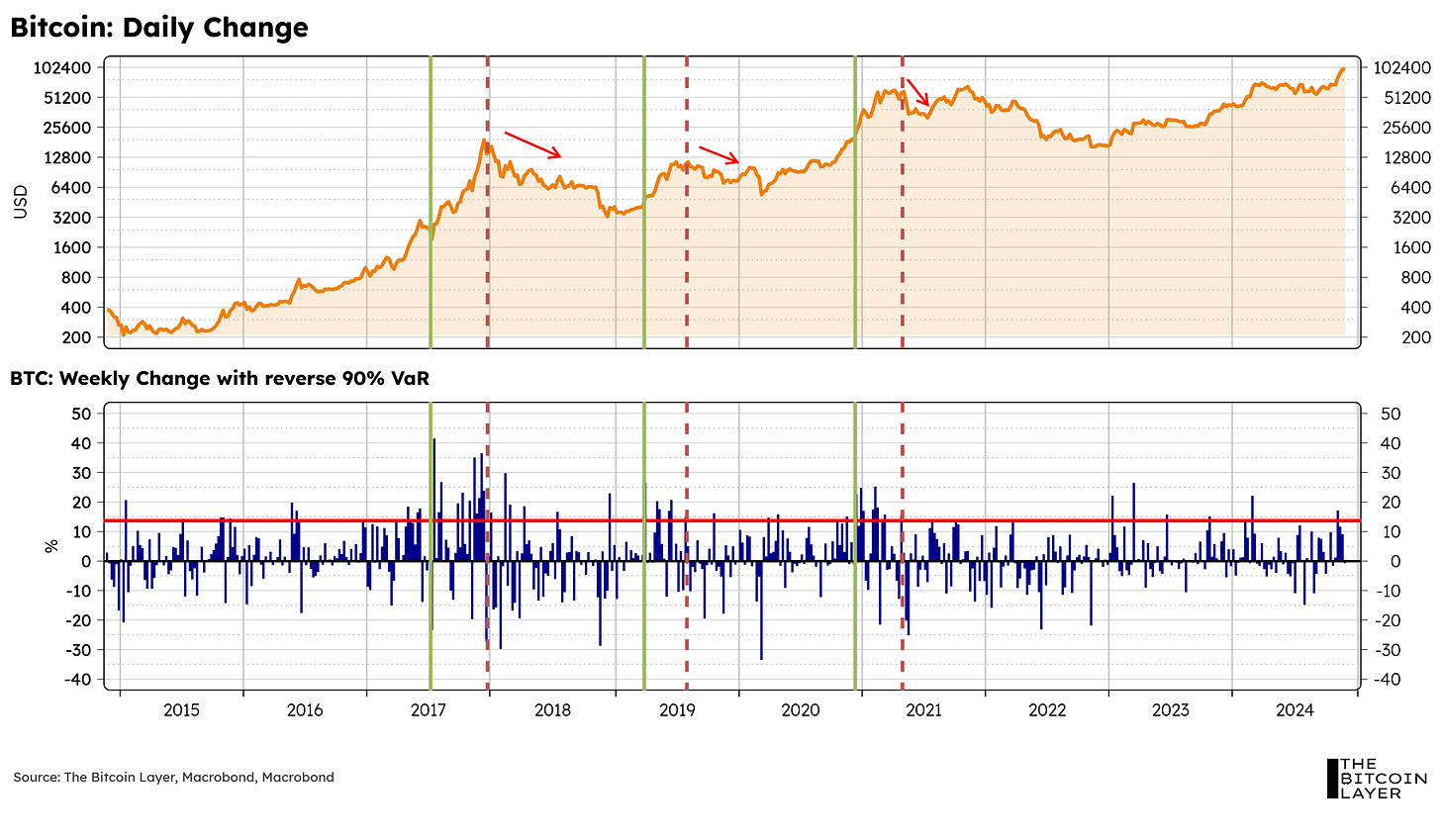

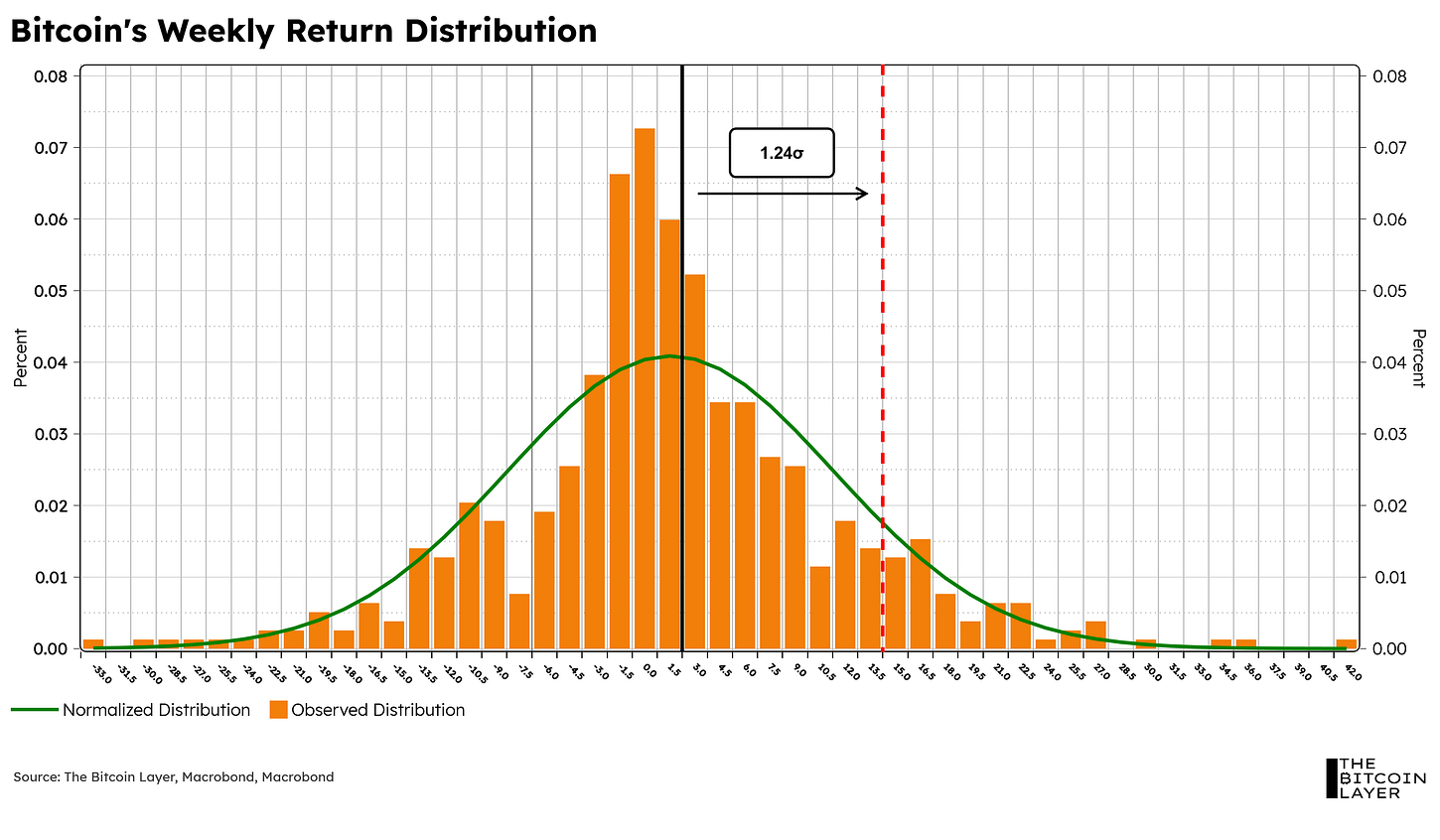

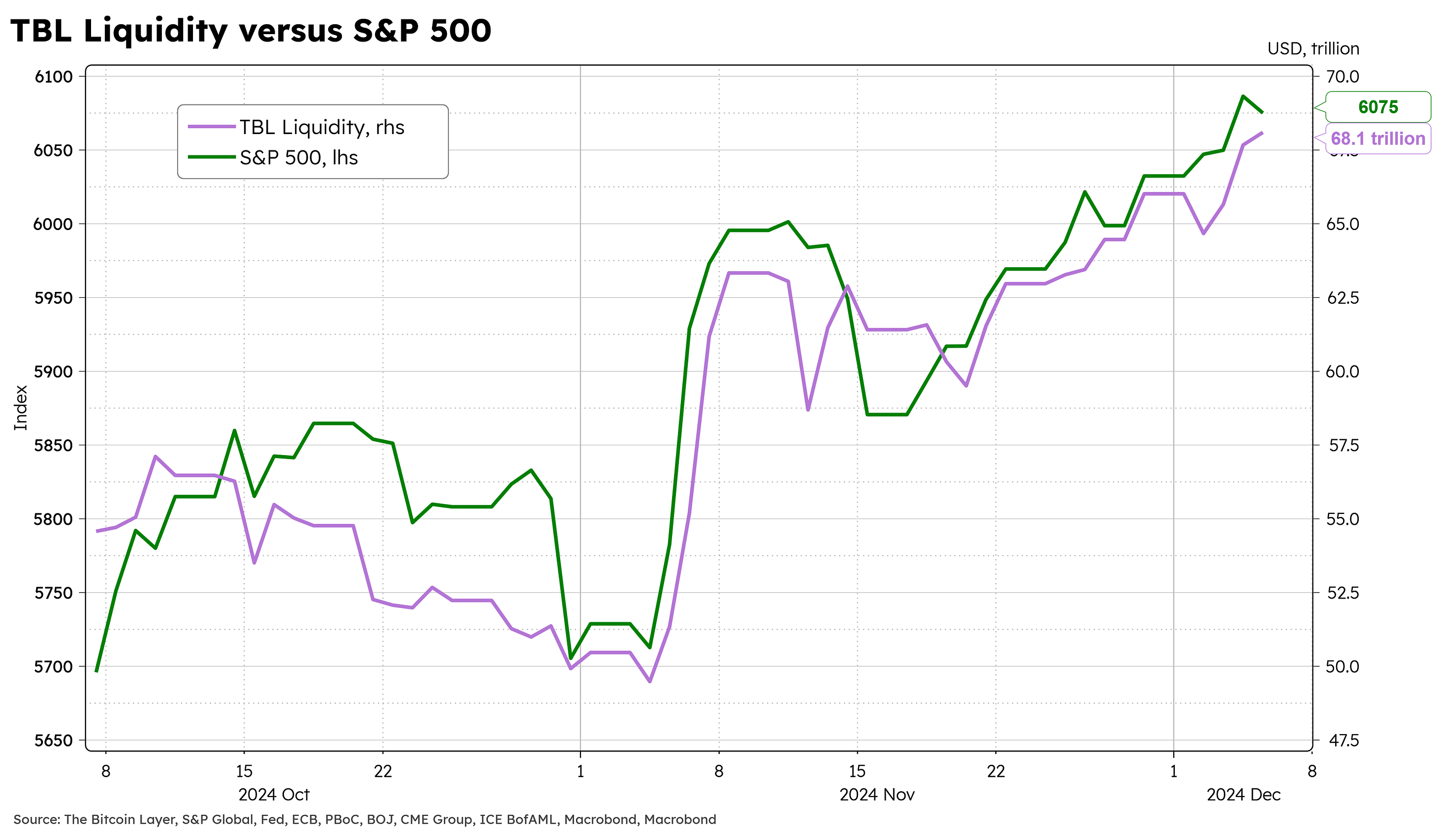

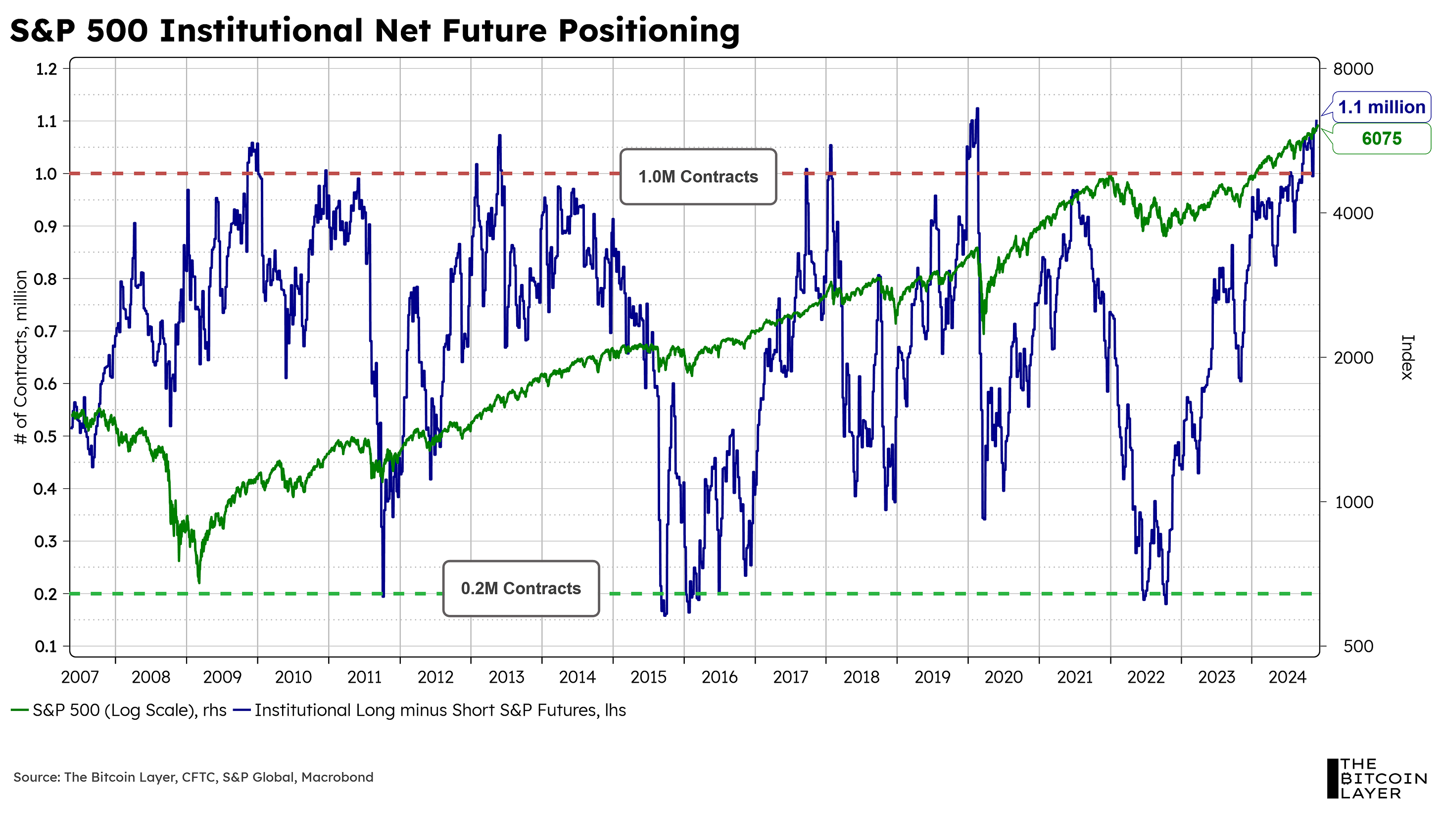

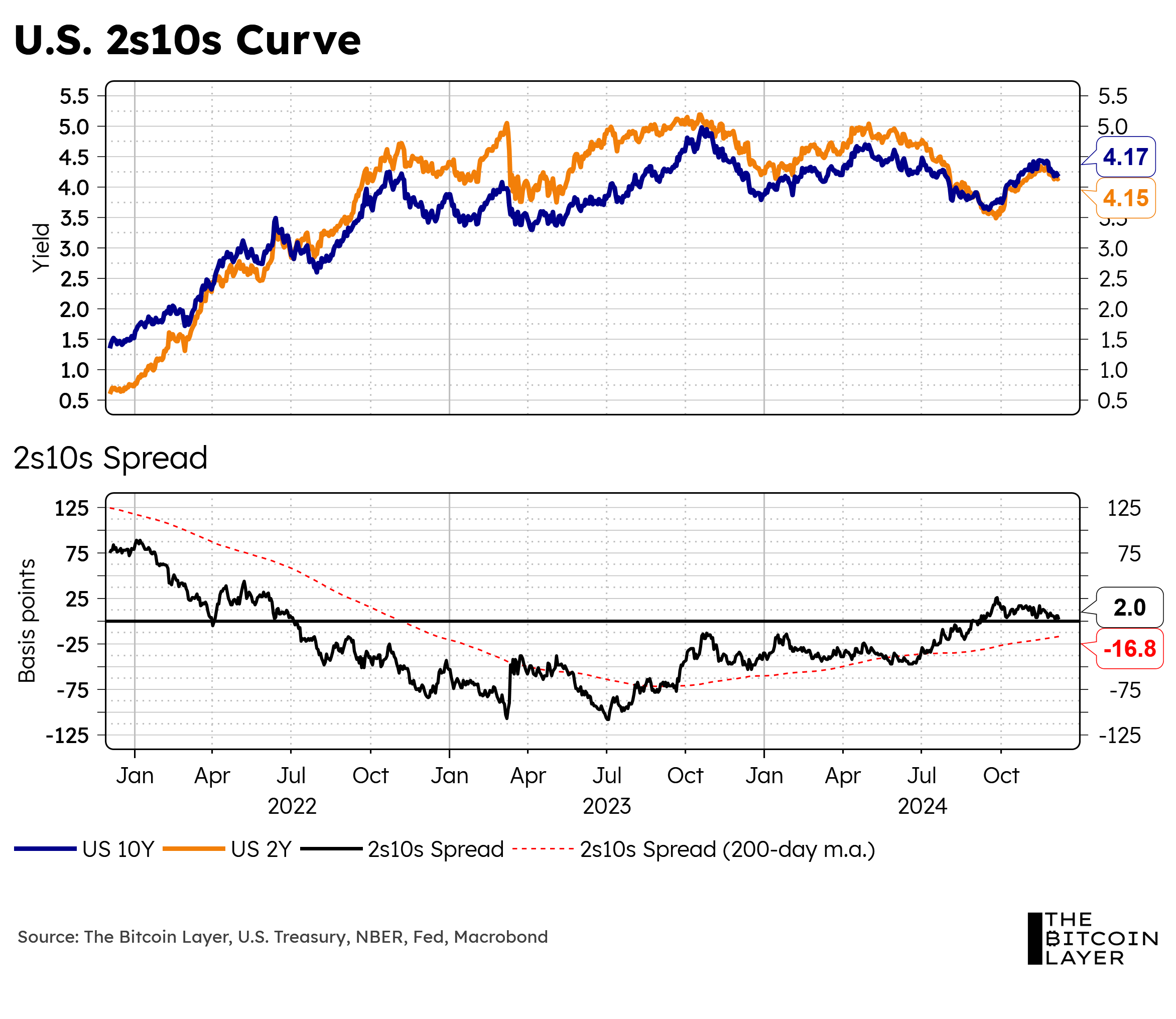

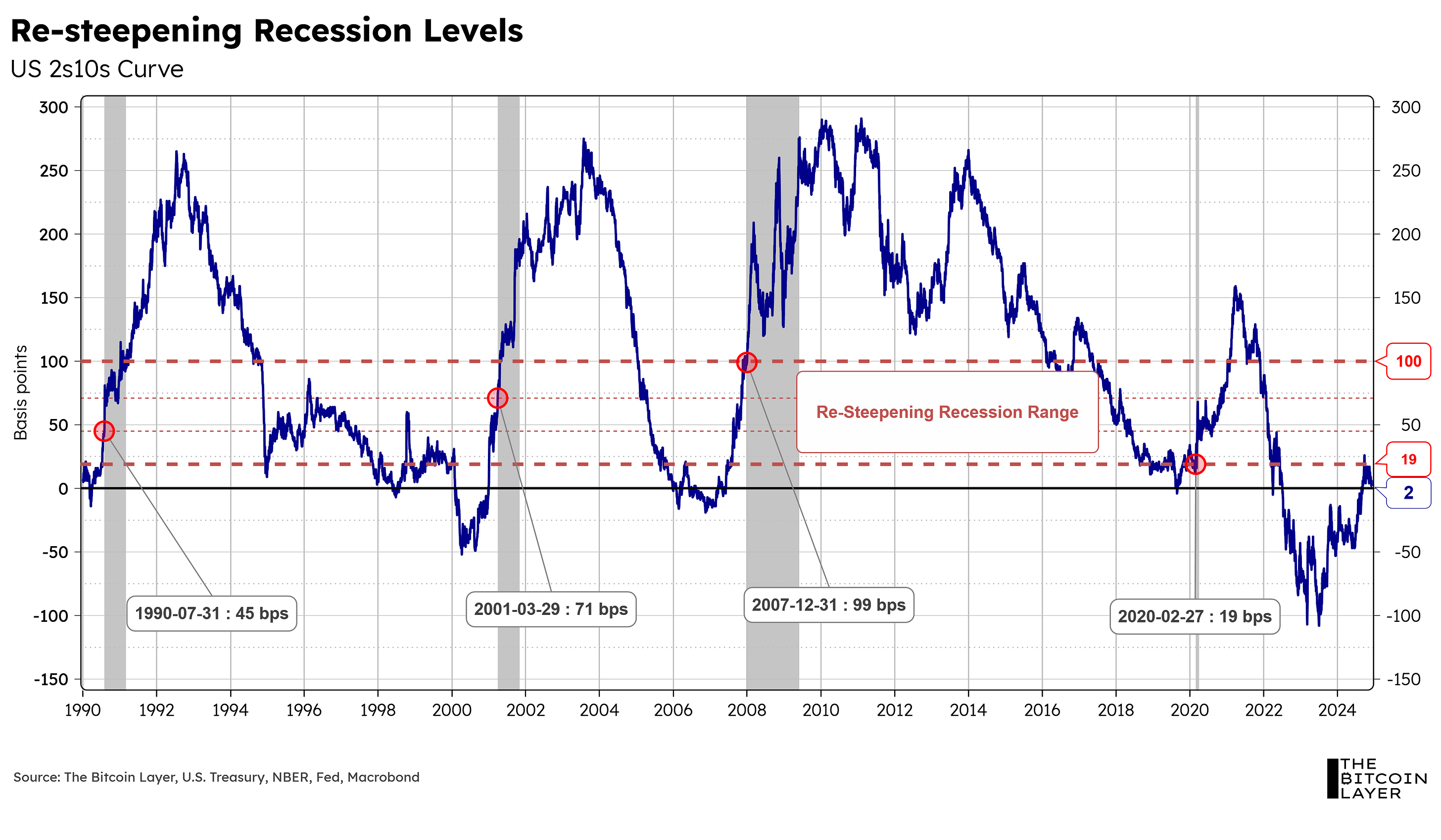

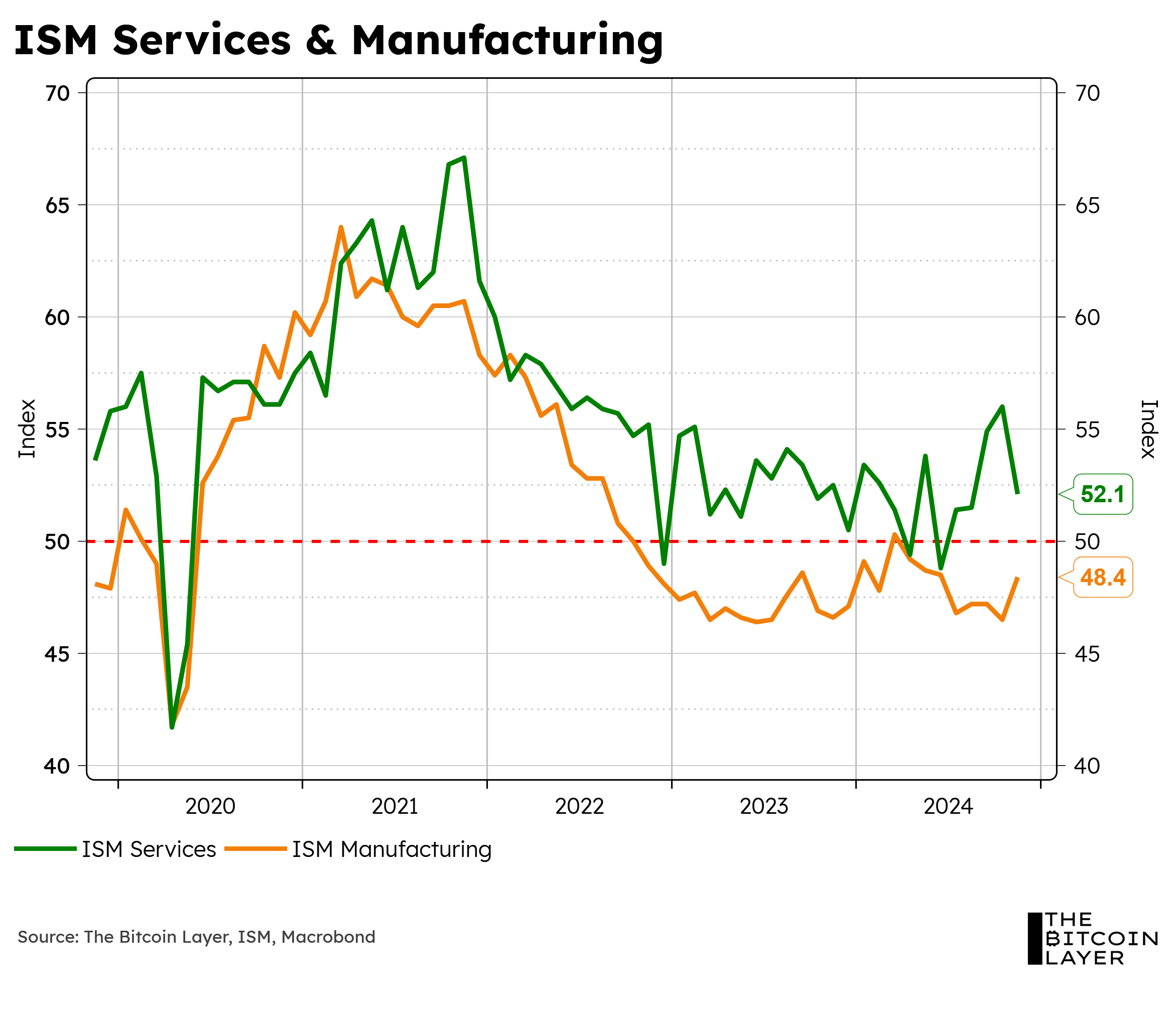

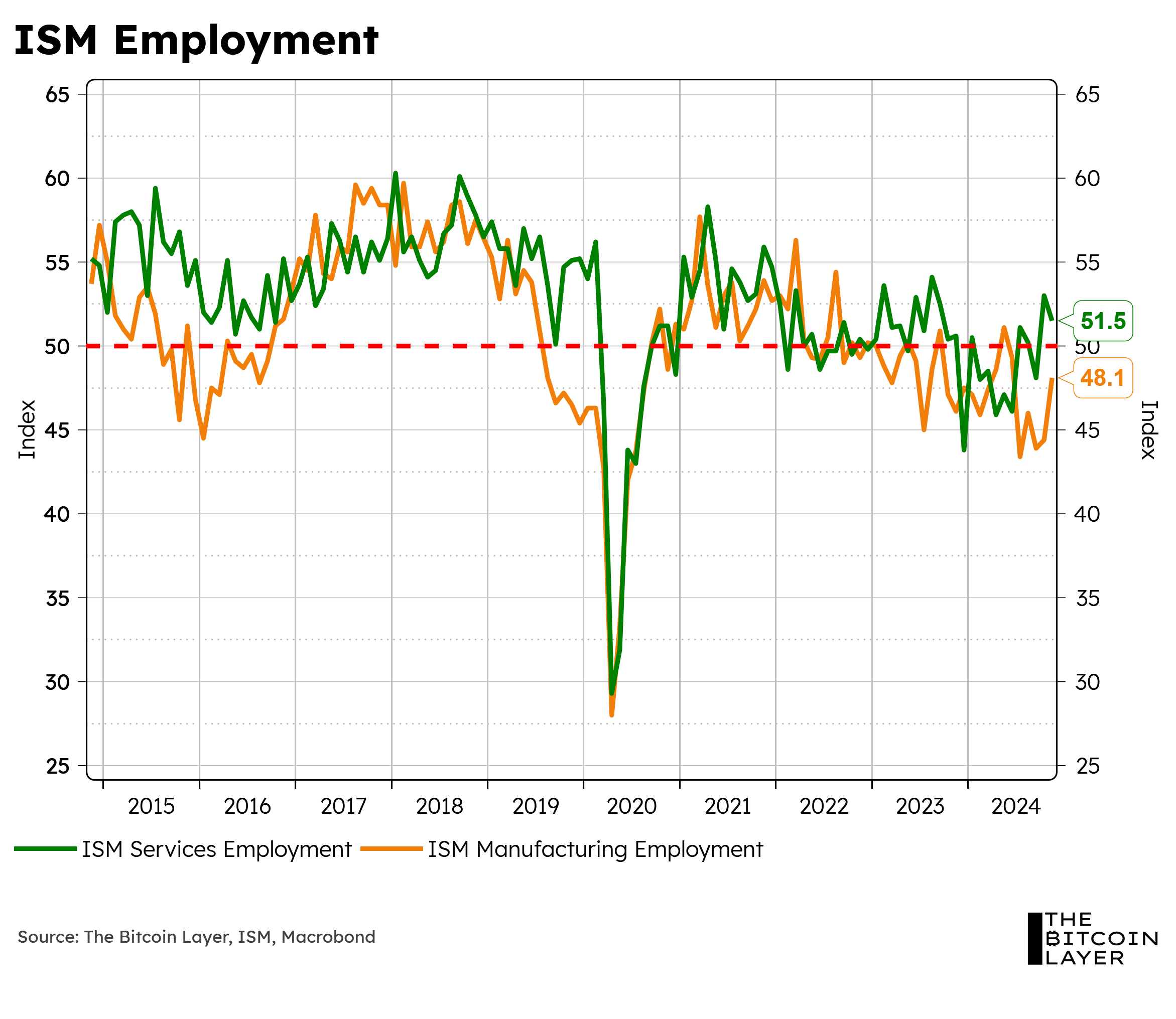

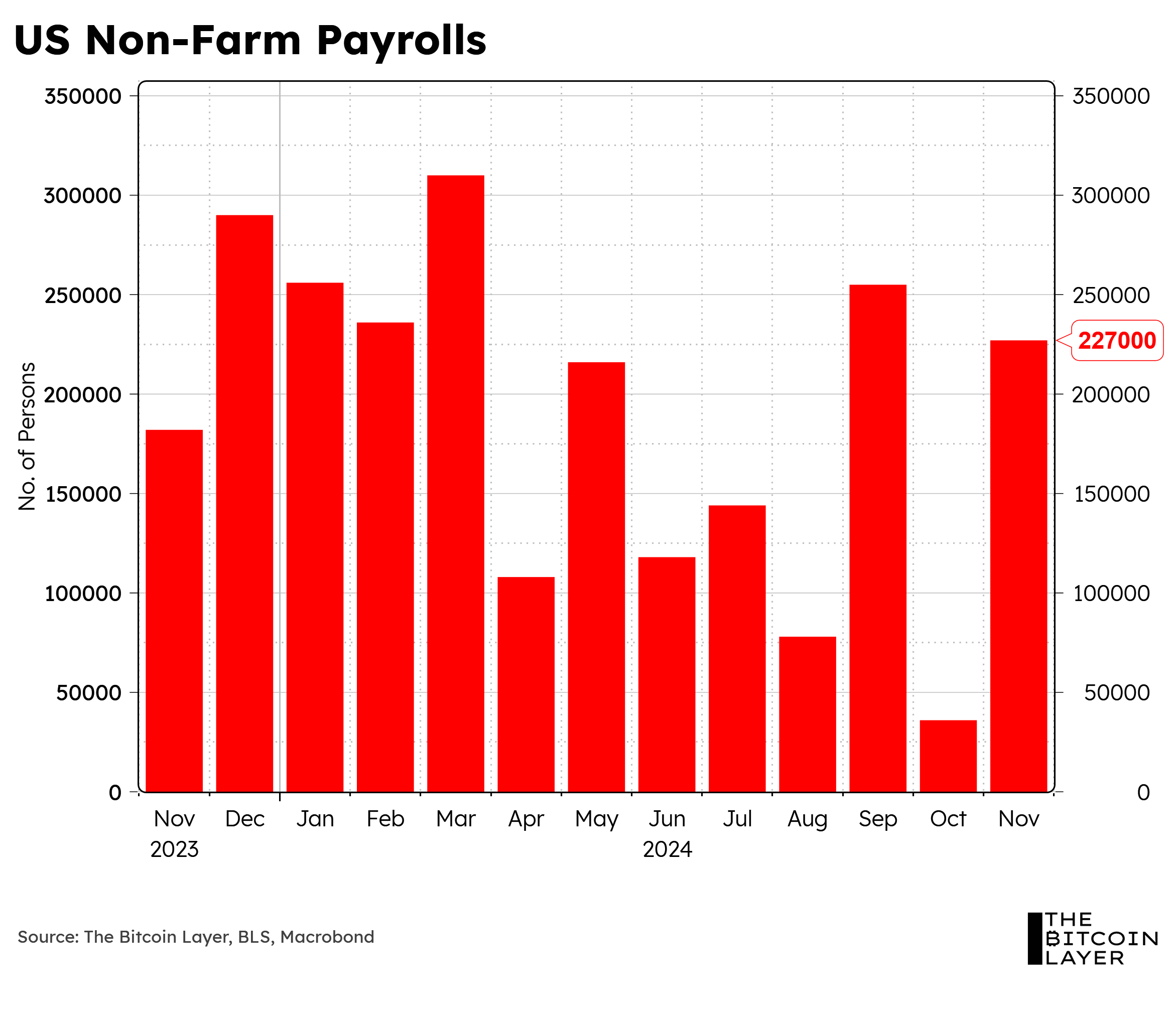

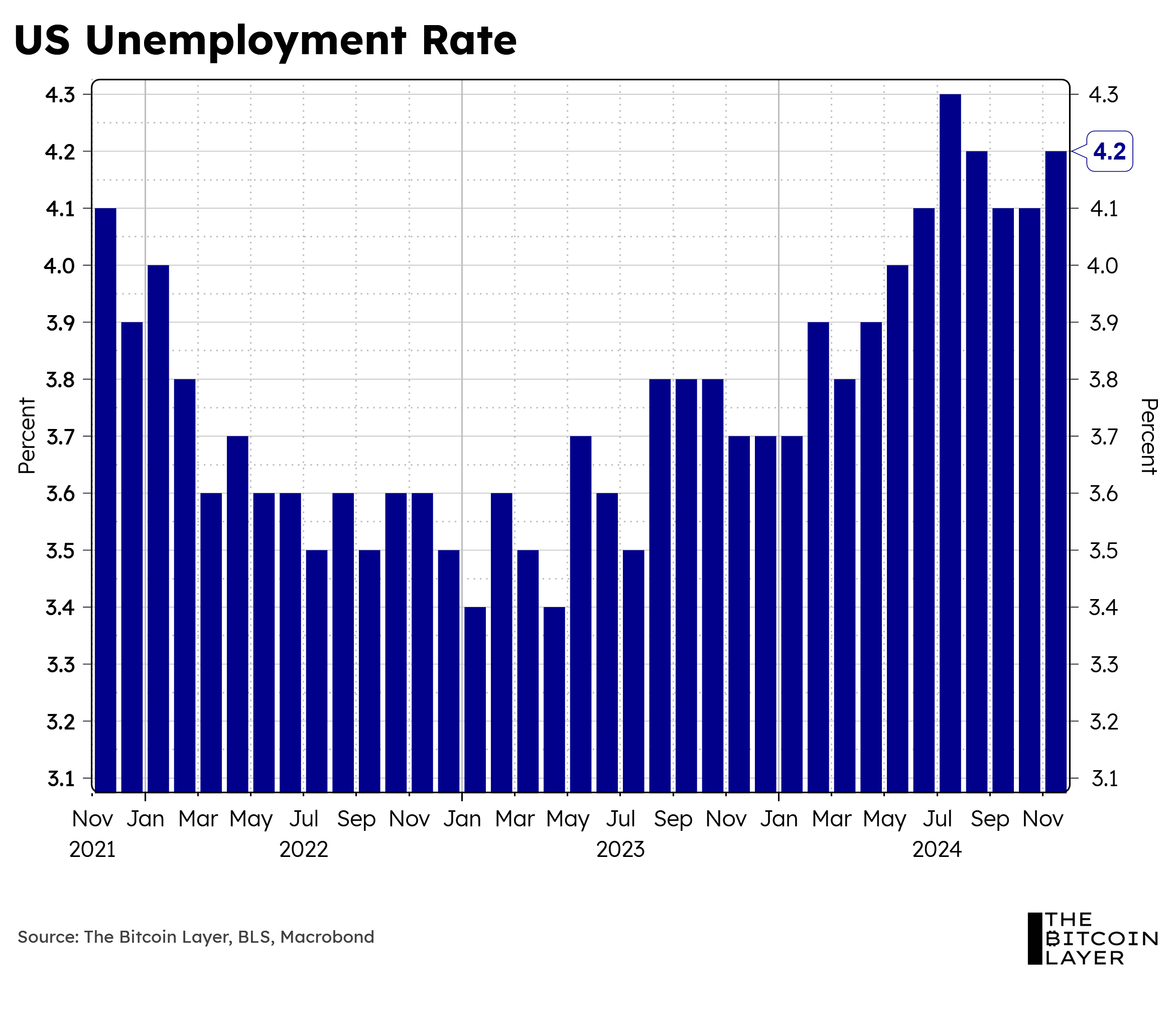

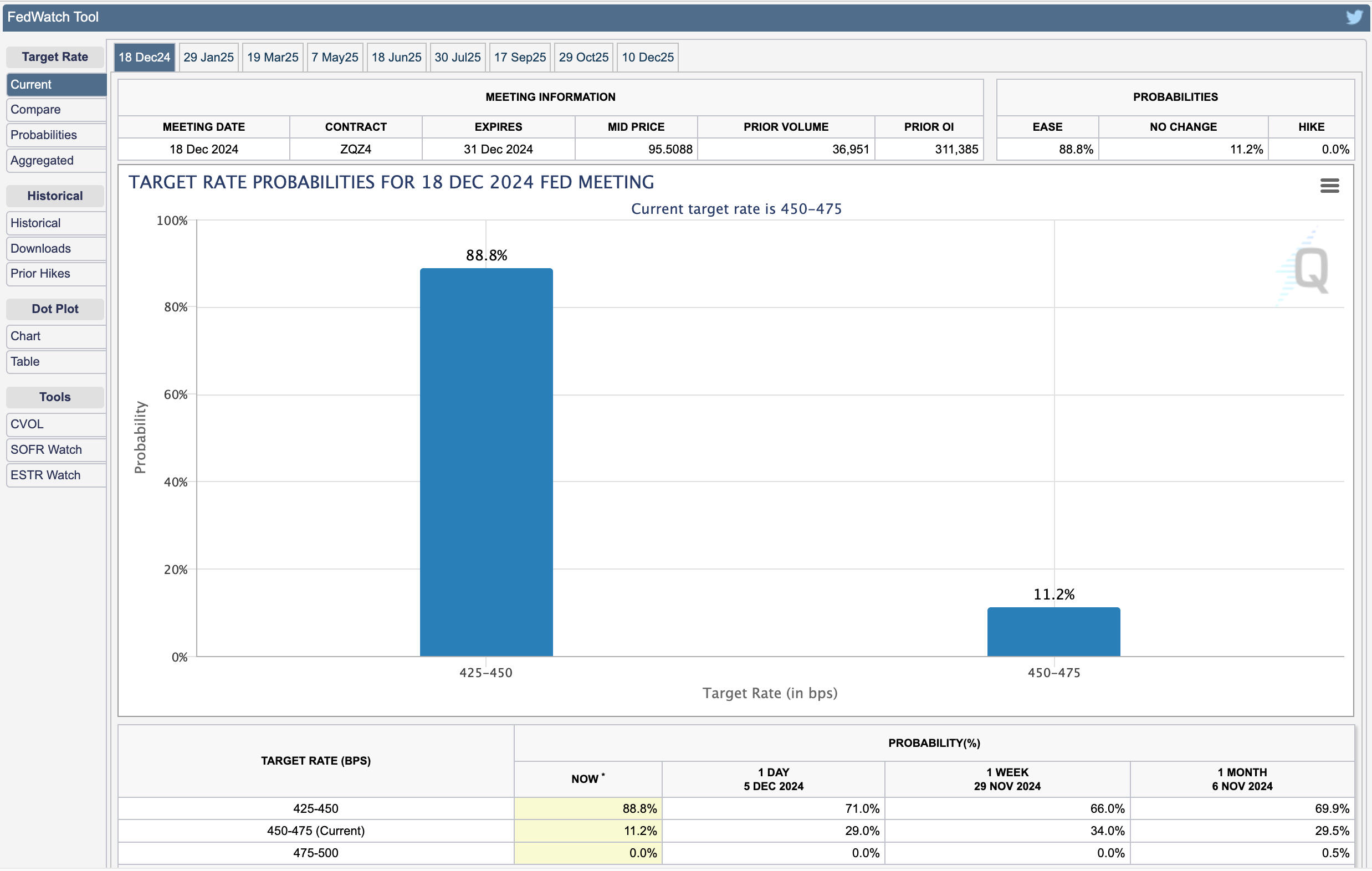

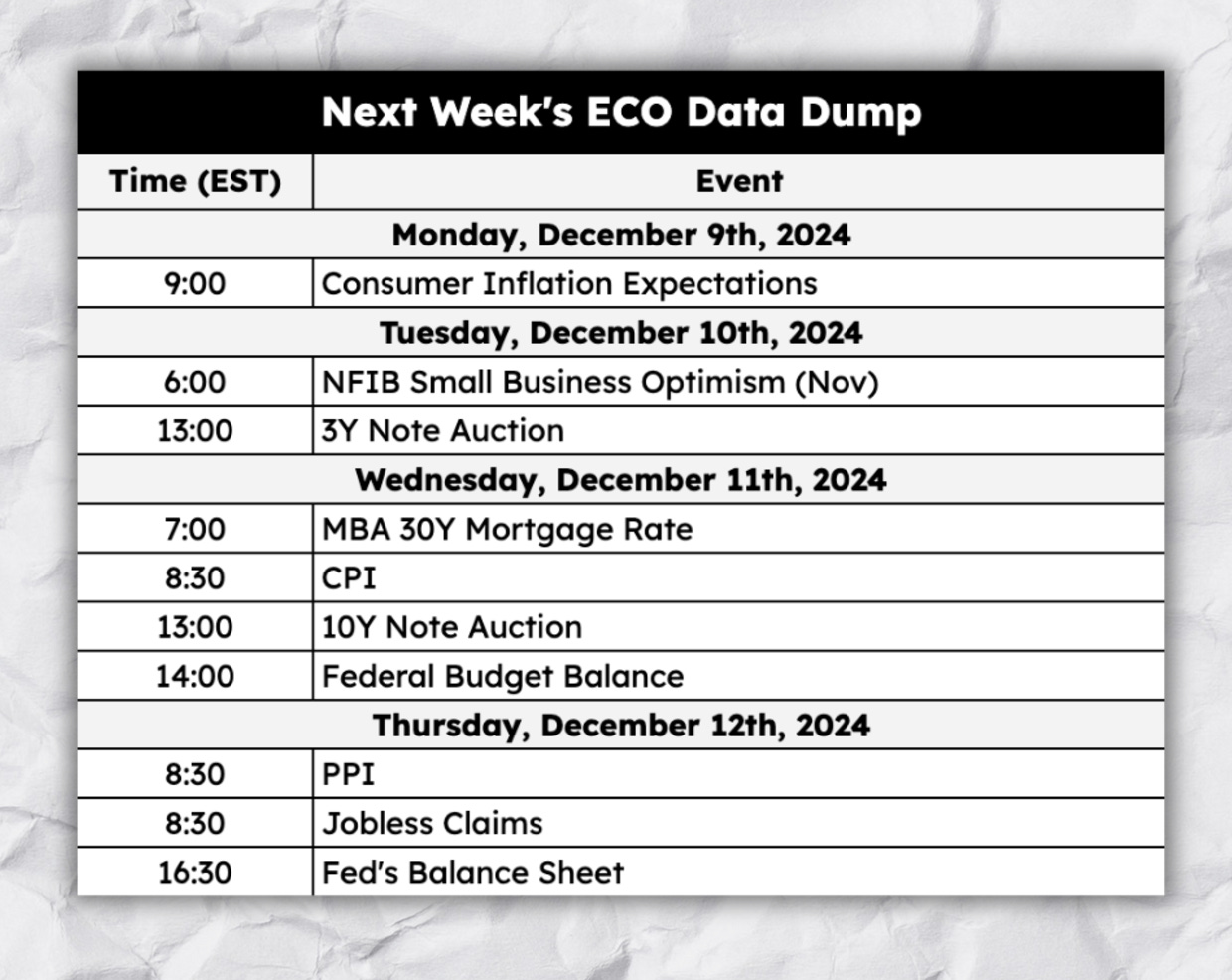

As you can see on the bottom pane, whenever we get an accumulation of tall blue bars, bitcoin’s price falls because gains are overdone. We would like to quickly draw your attention to the horizontal red line on the bottom pane, what we call the “outsized gains” VaR—that line is drawn at a weekly return of 13.6%, which is exactly 1.24 standard deviations away from the mean weekly return of 1.5%. Here’s another chart to showcase this: Why do we care about this? We know that 10% of all weekly returns over the past 10 years lie beyond this vertical, dashed line (the right-tail of this distribution). However, as you can see from the opening chart, most of these observations are not equally spread across bitcoin’s history. In reality, these high returns happen back-to-back (for the most part). The past four weeks have averaged approximately 9.5% weekly returns, and only one of them went above our threshold. We need to see a cluster to sound an alarm, and at this point, we’d characterize the existence of outsized weekly returns as a “gathering,” as opposed to a party. Lastly, a trio of 14% gains from here puts the price at $150,000. Equity Markets:One place to watch for negative signs for bitcoin is the US stock market. TBL Liquidity, our model for risk assets, is ticking nicely with the S&P 500: As you can see, over the past 2 months, liquidity has driven markets upward, mainly as a result of more stable Treasury collateral. However, we are also wary of S&P 500 futures positioning of institutional asset managers: What is this telling us? Managers are very bullish on equities (currently near record highs). Historically, whenever we reach this level of net long positions on futures, we experience some pullbacks on the S&P 500. It is also important to note here that bitcoin’s 3-month rolling correlation with equities lies near 40%, so a pullback on equities could also suppress bitcoin’s returns. We’re trying to look for signs of risk to counter our bullishness in new six-figure territory. US Rates:Now, let’s dive into one of our favorite charts: the 2s10s curve. US Treasuries have been in a bull-flattening recovery mode since mid-November, which continues to fight off any re-steepening potential. This has resulted in stronger collateral and therefore more market liquidity—hence the growth in both bitcoin and equities. That being said, we want to point out an observation here. As time passes, the 2s10s spread gap between its 200-day-moving-average has been closing, now approximately 19 basis points wide. The last time these two lines touched was in July of this year, and the curve started to steepen soon after. We may be approaching that time again—especially as the Fed sets to cut in the upcoming meeting. Speaking of re-steepening, let’s look at one more chart: Using previous recessionary periods and looking at where the 2s10s curve was at the time those recessions started, we derived a “watch” range: 19-100 basis points. If the curve surpasses the 19-basis-points level and makes its way to 32 basis points (halfway between the 2020 and 1990 re-steepeners), we will start looking for signs of an economic slowdown, which leads us to our next section. ECO & The Fed:Here are the most important economic data dumps of the week: After nearly five months of growth in the services sector, we finally saw a slowdown in this seemingly omnipotent portion of the US economy—granted it is still above 50, and therefore in expansionary territory, but a slowdown, nonetheless. Interestingly, just as services started slowing, we also saw a manufacturing sector showing signs of recovery. As per the labor market, despite the recovery from non-farm payrolls (mainly as a result of normalizing data from hurricane and corporate strikes outliers), unemployment ticked upward, which has put more than a thumb—perhaps an entire arm—on the scale in favor of a rate cut. Although this is bullish for bitcoin in the short run, after December’s cut, we expect the Fed to momentarily pause any more cuts as we start 2025. Over the past two weeks, some Fed officials have spoken up about their hawkish stance—in short, they are in a “proceed with caution” mode. This, in turn, creates another headwind for bitcoin and equities going into 2025, except for those who understand what they are buying. Next Week:In case you missed it: TBL on YouTubeGlobal Liquidity with Michael Howell: Trump 2.0, US Dollar Influence, and the Next Economic Era In this episode, liquidity expert Michael Howell explores the economic implications of Trump 2.0, focusing on the US dollar's pivotal role in global liquidity and market dynamics. He examines how a strong dollar helps contain domestic inflation while tightening monetary conditions abroad, fueled by capital inflows into the US and the risks of exceptionalism driving market bubbles. Howell also discusses the Federal Reserve’s easing stance, rising public debt, and the challenges posed by the 2025 maturity wall. Offering a global outlook, he addresses Europe’s economic struggles, China’s dollarized economy, and investment strategies for inflation hedges like Bitcoin and gold, highlighting opportunities amid shifting market conditions.  Here are some of the key insights:

Can We Really Abolish the Federal Reserve? An Interview with Peter St Onge In this video, Peter St. Onge breaks down the complex machinery of the Federal Reserve, exploring the historical, economic, and political dimensions of potentially abolishing central banking. From the evolving landscape of populism to the intricate power structures governing monetary policy, Peter dissects the moral hazards of bailouts, examines the historical context of financial crashes, and challenges conventional wisdom about the Fed's necessity. Peter also walks Nik through the shifting Overton window, the potential for radical tax reforms, and a provocative look at how free speech and economic policy intersect in shaping our financial future. This interview provides a blueprint for reimagining the fundamental structures of modern economics.  Here are some of the key insights:

Retire with Bitcoin: Leveraging IRAs, Custody, and Long-Term Wealth Strategies In this episode, Nik Bhatia is joined by Connor Dolan of Unchained to explore the growing intersection of Bitcoin and retirement planning. They discuss how individuals can leverage tax-advantaged accounts like IRAs and 401(k)s to incorporate Bitcoin into their long-term financial strategy, emphasizing the critical role of secure multisig custody solutions in eliminating single points of failure. Connor highlights the benefits of donor-advised funds for tax-efficient charitable giving and how Unchained’s innovative custody and retirement solutions empower individuals to take control of their Bitcoin investments. They share educational resources for navigating Bitcoin’s evolving role in wealth management and the importance of a proactive, long-term approach to financial planning.  Here are some of the key insights:

$100,000+ Bitcoin: The Revelation Behind Its Path to $1 Million In this episode, Nik delivers TBL's most critical global macro update yet, breaking down Bitcoin’s surge past $102,000 and unveiling a revelation that redefines its path to $1 million. By exposing the transformative role of credit creation in Bitcoin’s rise, Nik challenges traditional views of asset rotation and highlights the forces driving its explosive growth. He analyzes key technical and on-chain metrics, macroeconomic trends like Treasury yields and dollar strength, and the broader implications of institutional activity. Closing with insights into geopolitical and fiscal shifts heading into 2025, Nik outlines how this revelation could shape the next era for Bitcoin and global markets.  Here are some of the key insights:

❌ DON’T WRITE YOUR SEED ON PAPER 📝 It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Take 15% off with code TBL. Get your Stamp Seed today! TBL on SubstackEvery week, we bring you our global events recap TBL Thinks. This week we look into France’s current political shifts and the future of trade in North America under Trump’s administration. Check out TBL Thinks here: What TBL Pro Is ReadingNik also published his weekly letter where he explains his foundational reasons for why he believes the world is changing, and what his overall expectations are under this new era. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year. Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order? If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul. Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way. With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: Thanks for reading The Bitcoin Layer — for access to all content, upgrade to paid! |

Saturday, December 7, 2024

$100,000: TBL Weekly #121

Subscribe to:

Post Comments (Atom)

Popular Posts

-

The crypto privacy renaissance continues as tools for shielding your transactions grow more frictionless than ever. ...

-

ETF flows have turned supportive, but confirmation is still missing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Gold's steady gains steal the spotlight in the past year, but Bitcoin's 86% 3-year DCA return still outpaces gold, equities, and pro...

-

Opinion markets have arrived. Unlike Polymarket and Kalshi, there are no wrong answers here. ͏ ...

No comments:

Post a Comment