Bitcoin at $80,000: Defying ETF Selling PressureAlso Mining Stocks: Underperforming in Bull and Bear Markets & Markets Price In No Fed Rate Cut Until JuneWelcome to Ecoinometrics' Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we'll cover:

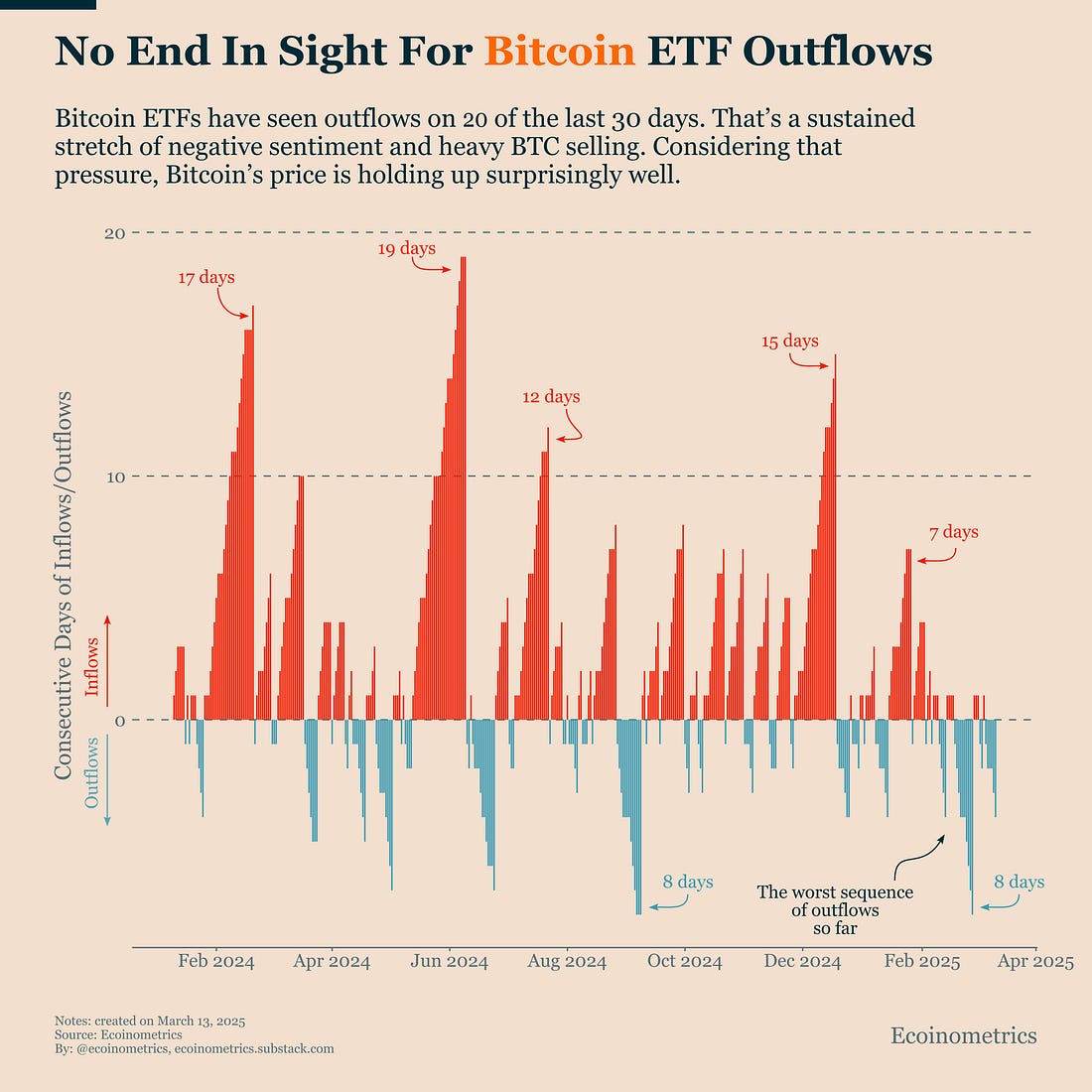

This week's analysis reveals a market at a crucial juncture: Bitcoin shows surprising strength despite heavy ETF outflows, while mining stocks struggle to find their footing in this new ETF-driven landscape. Meanwhile, delayed rate cut expectations remind us that macro headwinds persist. Let's dig into the data. In case you missed it, here are the other topics we covered this week: Essential Decision-Making Tools Bitcoin Market Monitor - Key Drivers in Key Charts: Bitcoin Market Forecast - Probability Scenarios & Risk Metrics: Get these professional-grade insights delivered to your inbox: Bitcoin at $80,000: Defying ETF Selling PressureThe last month has been extremely tough for Bitcoin, especially when looking at ETF outflow sentiment. Twenty of the last thirty ETF trading days have seen outflows. Over a rolling 30-day window, more than 50,000 Bitcoins have moved out already. The chart below shows the duration of consecutive inflow and outflow days. During this period, there haven't been any notable inflow streaks worth discussing. This represents the worst sequence of outflows since the ETFs launched last year. And yet... Bitcoin's price is still holding around $80,000 as I write these lines. This price is high considering the outflows we're seeing. If you follow our Bitcoin Market Monitor, you'll know that our ETF flows model suggests Bitcoin should be worth about $70,000 right now. In fact, $80,000 is more than two standard deviations above the model's expectations. Here's what this means: if other temporary factors supporting the price fade and we're left with just the weight of the outflows driving Bitcoin's price, we could see a 12%-15% correction from current levels. This is worth watching closely. Mining Stocks: Underperforming in Bull and Bear MarketsBitcoin hasn't surrendered all its Q4 2024 gains despite the recent downturn. While BTC might drop further if ETF outflows persist and stock market pressure continues, it's currently holding steady. The same can't be said for Bitcoin mining stocks. Throughout this cycle, mining stocks have underperformed compared to previous bull markets, even during the upswing from late 2023 to the end of 2024. Now, as Bitcoin dips, mining stocks have not only erased all their gains from last fall but continue to decline. They've delivered the worst of both worlds this cycle:

It's effectively like taking on leverage risk without the usual upside potential. This persistent underperformance might signal a deeper shift in the market. With ETFs now available, institutional investors appear to prefer direct Bitcoin exposure or ETF holdings over mining stocks for their crypto allocation. However, a deeper correction in risk-on assets could create opportunities for long-term investors. Miners with strong balance sheets and active Bitcoin treasuries typically trade at significant discounts before returning to their historical BTC correlations. We're tracking these developments closely. Markets Price In No Fed Rate Cut Until JuneIs the Federal Reserve ready to cut interest rates as US inflation shows slight softening? The Fed Fund futures paint a clear picture:

While some investors are banking on a June rate cut, that's still a quarter away. The Fed might seriously consider cutting if inflation declines for three consecutive months leading to June. However, this scenario faces challenges. With the US involved in multiple trade disputes, goods prices are unlikely to decrease naturally. This means any significant drop in inflation would likely come from reduced consumer spending. Lower consumer spending means a slower US economy, not great for risk-on assets in the short term. We've known this for two years: controlling inflation requires consumers to spend less. When that happens, recession risk increases. Yes, rate cuts would follow, but they'd be more of a consolation prize for risk assets than a growth catalyst. For Bitcoin, this means there's no clear path to ideal growth conditions right now. That's it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, March 14, 2025

Bitcoin at $80,000: Defying ETF Selling Pressure

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Welcome back to the Citizen Daily Brief. Put your stablecoins to work. This is the future of finance, after all. ...

-

Plus $200 off! ...

-

gm Bankless Nation, another week, another data leak. This time though, it was the largest in history, reinforcing the need for pri...

-

Aave and Morpho are the top two lending giants. And they're battling for dominance on Base. Here's what...

-

Hey, I wanted to remind you that The DeFi Edge Pro closes in a few hours . This is the final enrollment window for a while, ...

No comments:

Post a Comment