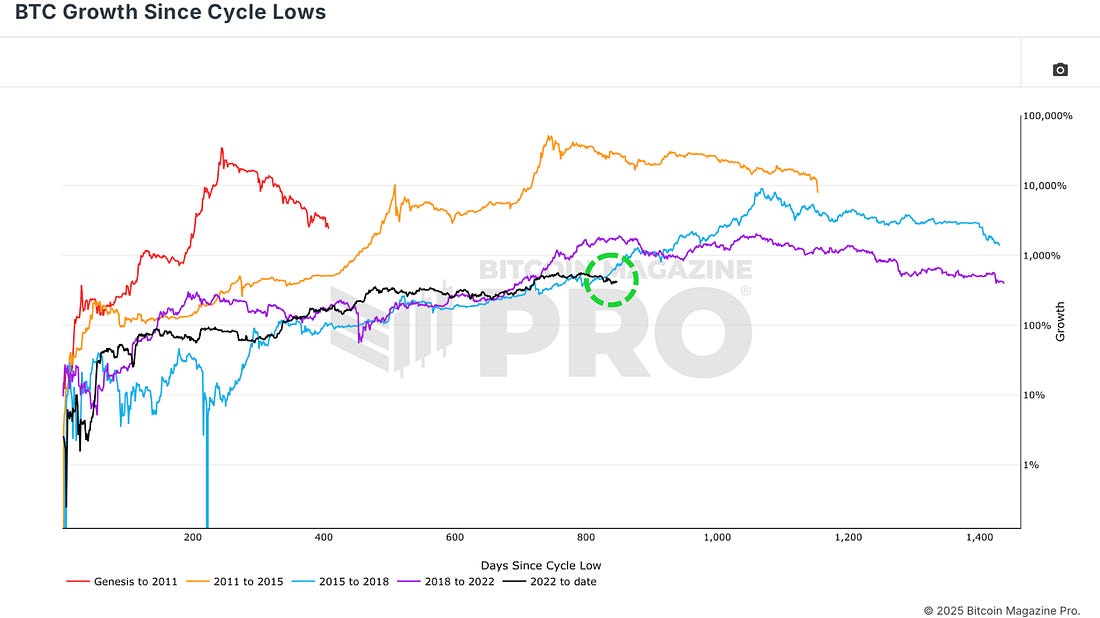

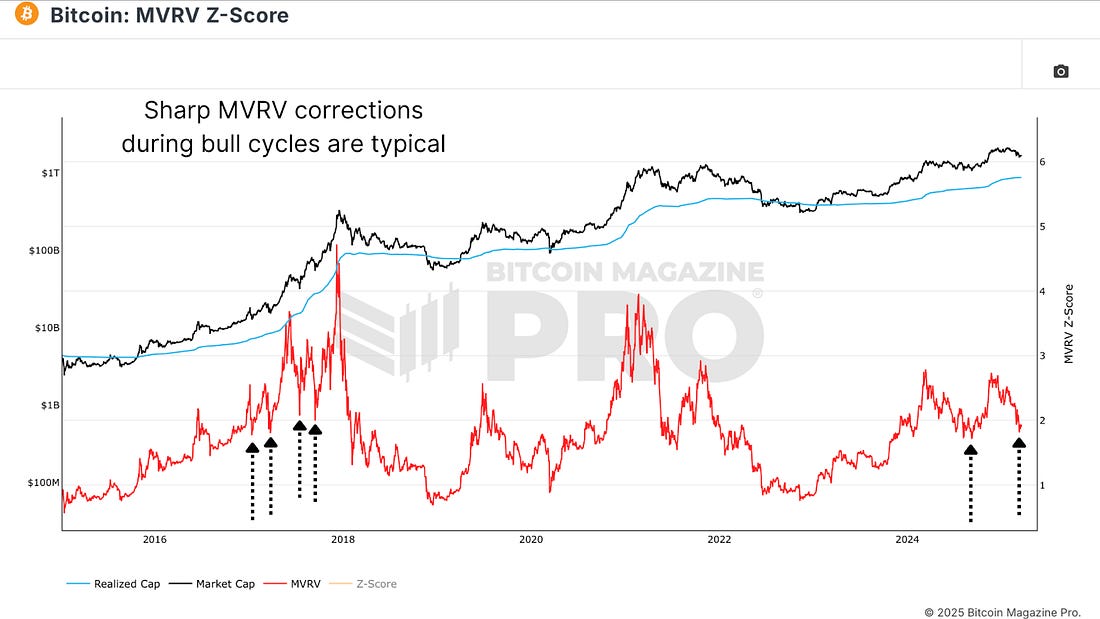

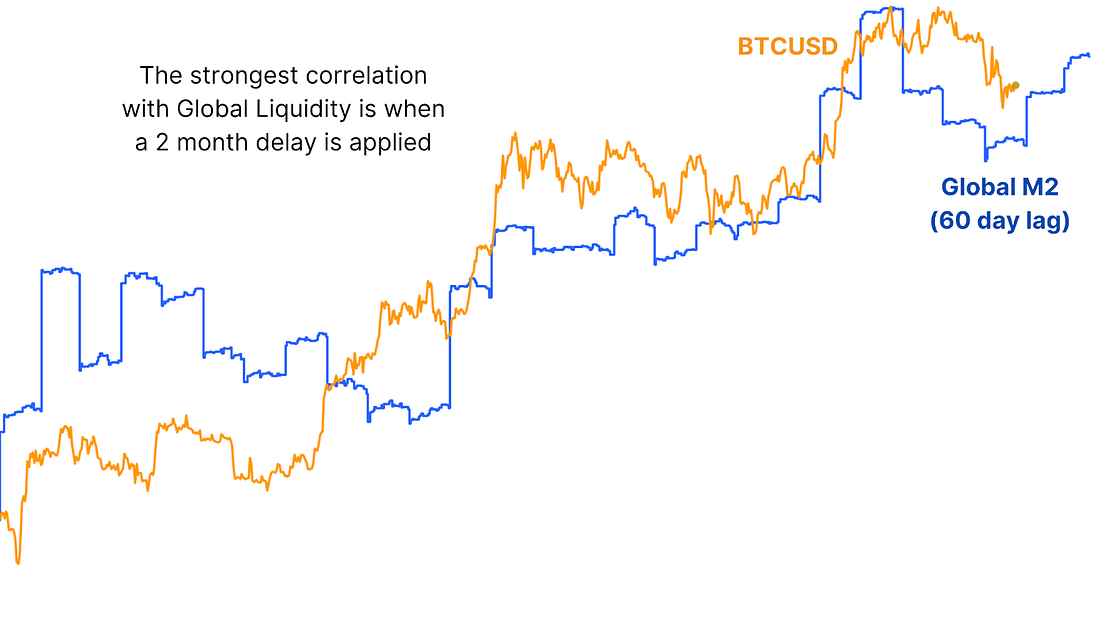

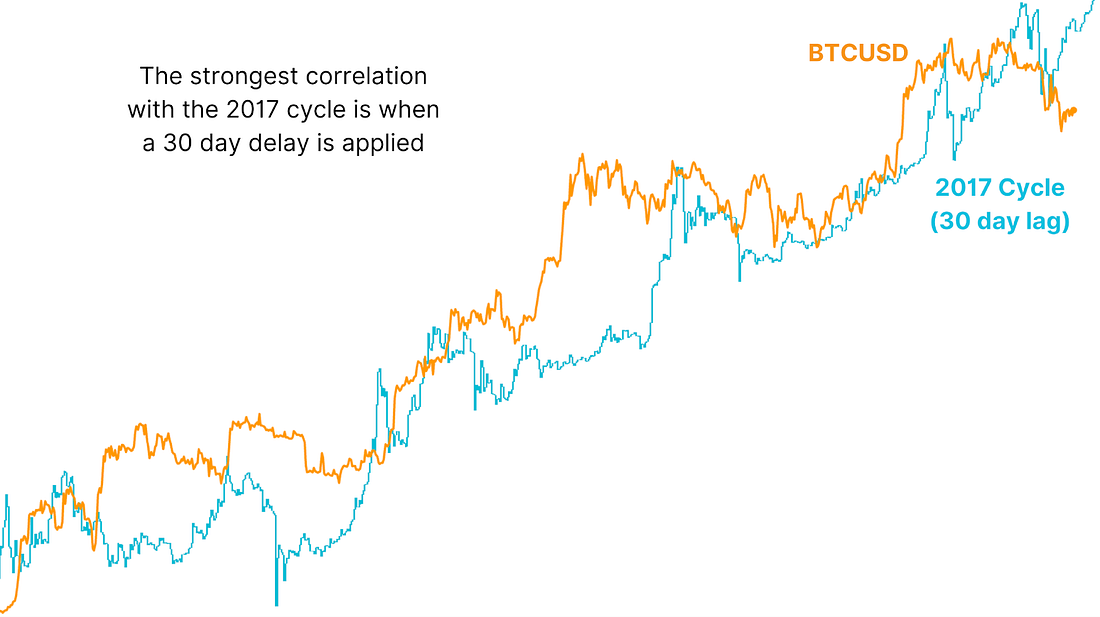

Is Bitcoin Still Following the 2017 Bull Cycle?Can Bitcoin Resume the 2017 Cycle Path After the Current Multi-Week Decline?After reaching an all-time high above $100,000, Bitcoin has entered a multi-week downtrend. This correction has naturally raised questions about whether Bitcoin is still aligned with the 2017 cycle. Here we’ll analyze the data to assess how closely Bitcoin’s current price action correlates with previous bull markets, and what we can expect next for BTC. Following 2017?Bitcoin’s price trajectory since the cycle lows set during the 2022 bear market has shown remarkable similarities to the 2015–2017 cycle, the bull market that culminated in Bitcoin reaching $20,000 in December 2017. However, Bitcoin’s recent downtrend marks the first major divergence from the 2017 pattern. If Bitcoin were still tracking the 2017 cycle, it should have been rallying to new all-time highs over the past month, instead, Bitcoin has been moving sideways and declining, suggesting that the correlation may be weakening. Figure 1: The current cycle trajectory has recently diverged from historical patterns. Despite the recent divergence, the historical correlation between Bitcoin’s current cycle and the 2017 cycle remains surprisingly high. The correlation between the current cycle and the 2015–2017 cycle was around 92% earlier this year. The recent price divergence has reduced the correlation slightly to 91%, still an extremely high figure for financial markets. Investor BehaviorThe MVRV Ratio is a key indicator of investor behavior. It measures the relationship between Bitcoin’s current market price and the average cost basis of all BTC held on the network. When the MVRV ratio rises sharply, it indicates that investors are sitting on significant unrealized profits, a condition that often precedes market tops. When the ratio declines toward the realized price, it signals that Bitcoin is trading close to the average acquisition price of investors, often marking a bottoming phase. Figure 2: The MVRV Ratio is still moving similarly to the 2017 cycle. The recent decline in the MVRV ratio reflects Bitcoin’s correction from all-time highs, however, the MVRV ratio remains structurally similar to the 2017 cycle with an early bull market rally, followed by multiple sharp corrections, and as such, the correlation remains at 80%. Data LagOne possible explanation for the recent divergence is the influence of data lag. For example, Bitcoin’s price action has shown a strong correlation with Global Liquidity, the total supply of money in major economies; however, historical analysis shows that changes in liquidity often take around 2 months to reflect in Bitcoin’s price action. Figure 3: Global M2 has a delayed impact on BTC price action. By applying a 30-day lag to Bitcoin’s price action relative to the 2017 cycle, the correlation increases to 93%, which would be the highest recorded correlation between the two cycles. The lag-adjusted pattern suggests that Bitcoin could soon resume the 2017 trajectory, implying that a major rally could be on the horizon. Figure 4: Price is still very closely following the 2017 data when delayed by 30 days. ConclusionHistory may not repeat itself, but it often rhymes. Bitcoin’s current cycle may not deliver 2017-style exponential gains, but the underlying market psychology remains strikingly similar. If Bitcoin resumes its correlation with the lagging 2017 cycle, the historical precedent suggests that Bitcoin could soon recover from the current correction, and a sharp upward move could follow. For a more in-depth look into this topic, check out a recent YouTube video here:  Matt Crosby Lead Analyst - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! 🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, March 21, 2025

Is Bitcoin Still Following the 2017 Bull Cycle?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hear why at DAS NYC ...

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Hyperliquid's HIP-3 framework is putting gold and Tesla stock into the mix for perps traders. ...

-

Also Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data Distortions ͏ ͏ ͏ ...

-

People building freedom technology across the globe are watching freedoms disappear at home. ͏ ...

No comments:

Post a Comment