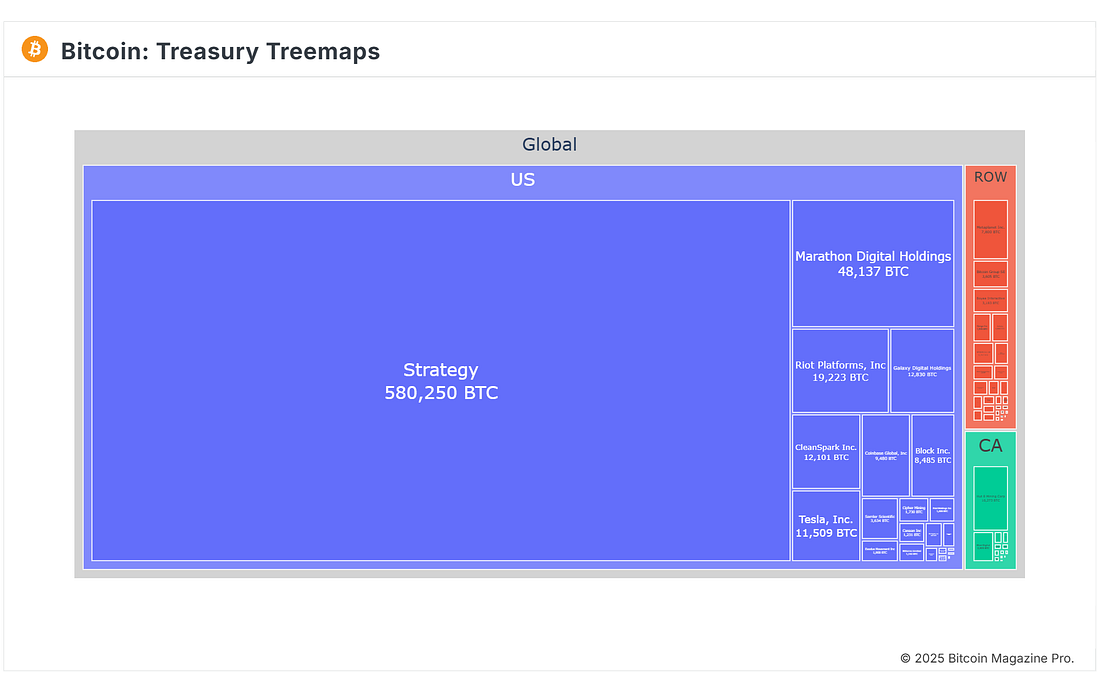

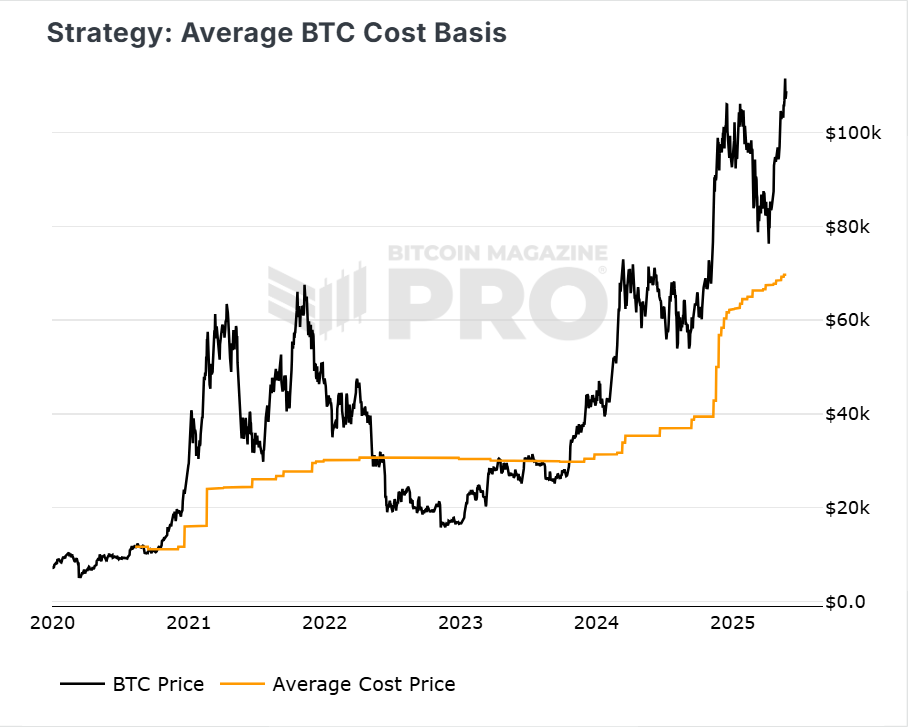

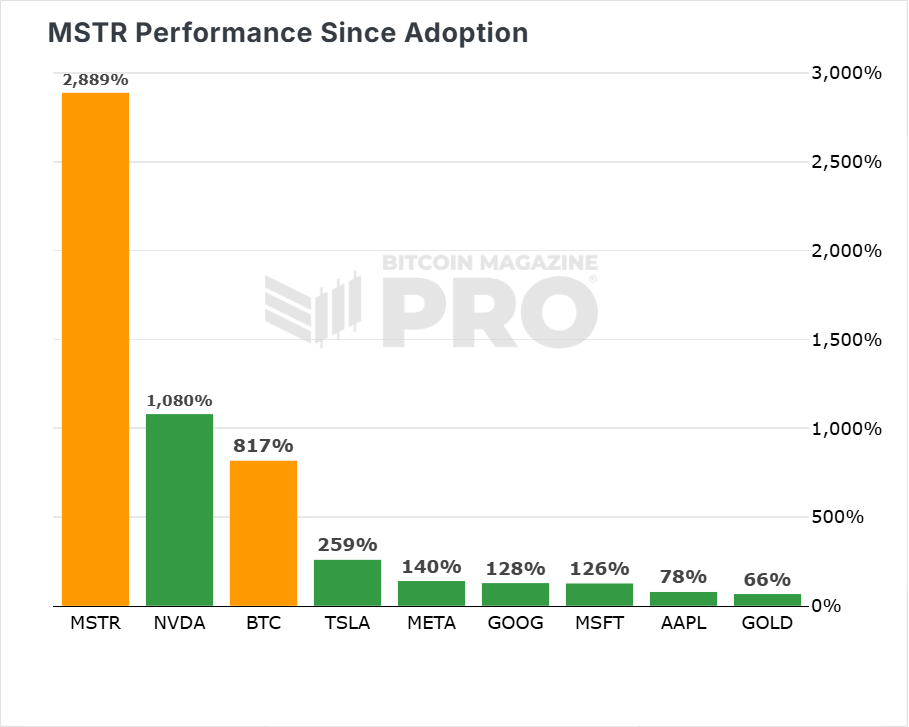

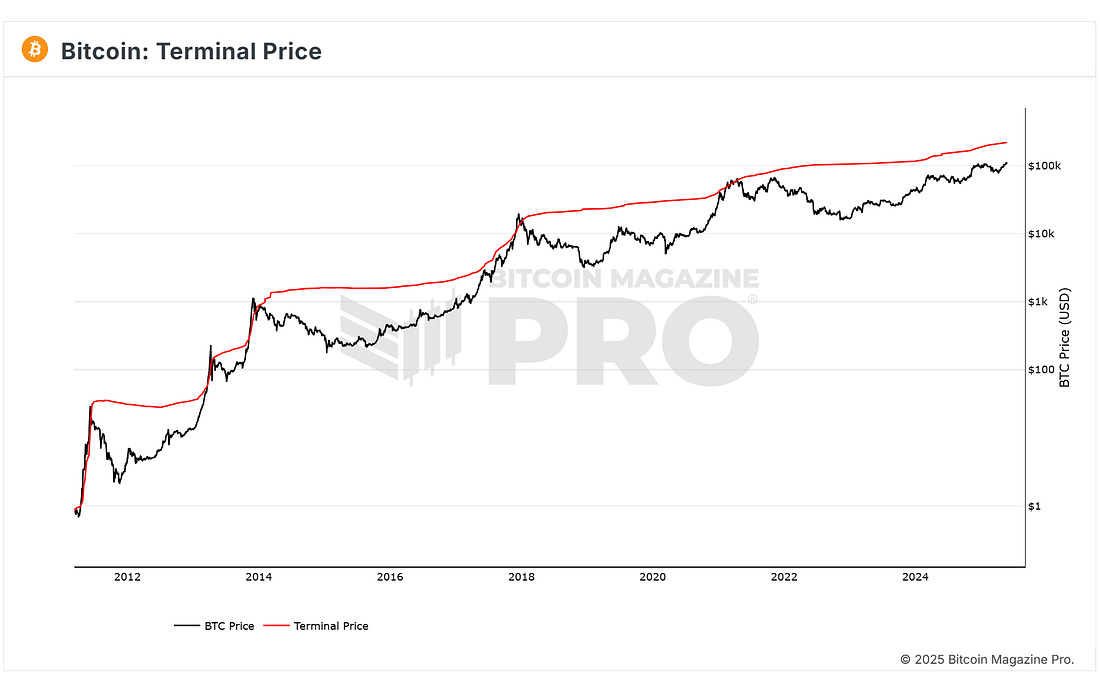

News HeadlinesPrice ActionLast week saw a fresh all-time-high for BTC as it reached $111,900. Since then it retraced but managed to stay above the range resistance highlighted on the chart below. This is bullish as it shows strength to stay above the previous range even after a pullback. At the time of writing BTC is at $109,475. Figure 1: BTC has so far held above the range resistance. Zooming out, BTC is continuing its relentless rise upwards, with a gain of +30% over the past three months. Figure 2: BTC past 3 months price action. More than half of that gain has come in just the past month alone. Figure 3: BTC rapidly climbing higher the past month. In this weeks Chart of the Week below, we will take a look at a possible level that BTC may top out at this cycle. Spoiler alert, it is much higher than current prices!!! The Big Story: Strategy’s Bitcoin Stash Grows AgainStrategy has added another 4,020 BTC to its treasury, spending roughly $427 million. The purchase, funded in part by proceeds from a recent convertible-notes sale, lifts the firm’s total holdings to 580,250 BTC. That is significantly more than any other public company and worth nearly $40 billion at current prices. The sheer scale of Strategy dominance when it comes to public company treasury holdings can be seen in this treemap below. More than half of all bitcoin held by public companies is held by Strategy alone! Figure 4: Strategy dominating public company bitcoin holdings. The average cost basis for the entire stack now sits near $69,708, reflecting Michael Saylor’s long-standing view of Bitcoin as “digital gold” and a superior reserve asset. Figure 5: Strategy average cost basis of bitcoin purchased. By continuing to deploy both cash flow and debt to expand its position, MicroStrategy is doubling down on a strategy that bets corporate balance-sheet strength on Bitcoin’s long-term scarcity and adoption. It has worked well so far with the Strategy stock, $MSTR, increasing +2889% since they adopted their bitcoin standard. Figure 6: MSTR relative performance. Whether future returns justify the bold approach remains an open question, but the message is clear: MicroStrategy is still buying, and its conviction shows no sign of waning. You can view the full Strategy dashboard of charts here. Chart of the week - Terminal PriceFigure 7: Terminal Price What it Terminal Price Terminal Price is an onchain indicator that estimates where price might hit at the end of the bull cycle. It incorporates long-term holding behavior by analyzing Coin Days Destroyed (CDD) - a measure that accounts for both the quantity of Bitcoin transacted and the duration each coin was held before being moved. By factoring in Bitcoin's supply and the time it has been in circulation, the Terminal Price provides a normalized view of Bitcoin's valuation over time. When BTC price (black line) reaches Terminal Price (red line) that has indicated that the bull market is overheated. Current Status Currently, Terminal Price is at $218,110 and is trending up! So, if BTC does reach it again in this bull cycle it will likely be above $250,000. You can read more about it and view the live chart here. We will have to wait and see how accurate it is this bull cycle! Certainly an exciting metric many people are tracking on the Bitcoin Magazine Pro platform. Speak again soon, The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, May 26, 2025

How High BTC May Go This Cycle

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hear why at DAS NYC ...

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Hyperliquid's HIP-3 framework is putting gold and Tesla stock into the mix for perps traders. ...

-

Also Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data Distortions ͏ ͏ ͏ ...

-

Is global macro currently a headwind or tailwind for risk? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment