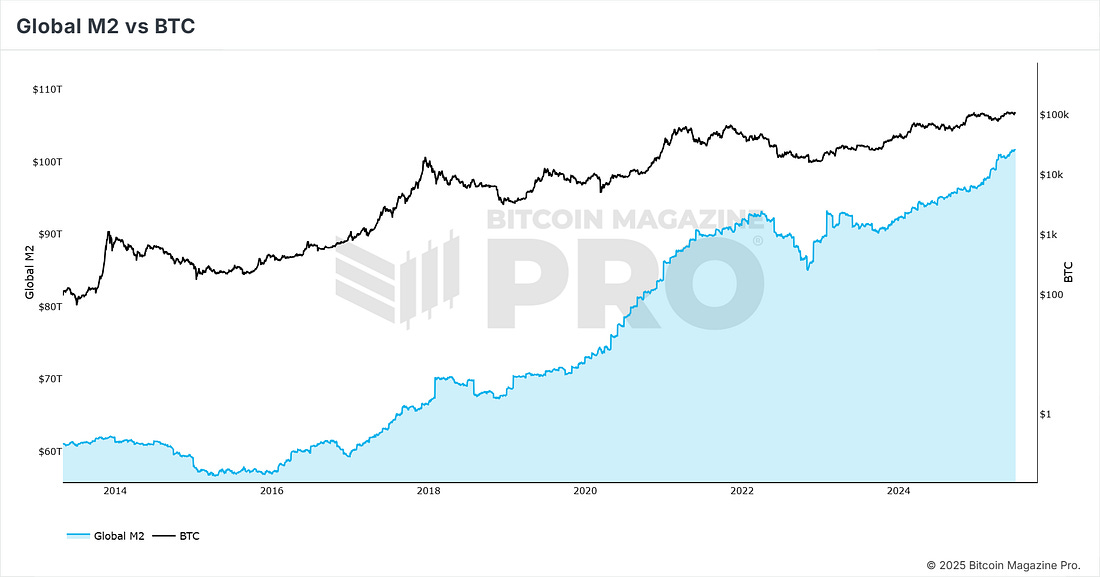

BTC ready to make a new high?BTC breaks range resistance again, eyeing $120K as S&P 500 hits new highs.News Headlines Price Action BTC has managed to regain its position above the range resistance line for a third time. Will this be the time it finally breaks out and trends to the upside to make a new all-time-high run towards $120,000? Figure 1: BTC breaks above range resistance for a third time. At a current price of $107,500, BTC is less than 4% off its all-time high. With concerns about geopolitical tensions fading and traditional markets, such as the S&P 500, also reaching new highs, optimism is returning to the markets, which will likely bring a boost to BTC. Figure 2: S&P500 making new highs…again. From its low three months ago, BTC is now up nearly 30%. Figure 3: BTC past three months' performance. This illustrates the extreme volatility of BTC, even in bull markets, and why it is crucial not to get shaken out at the lows when the broader market is panicking. The Big Story: Global Liquidity New Highs Aggregate M2 money supply (also known as Global Liquidity) has surged to fresh all-time highs once again, adding roughly $15 trillion since the 2022 trough. This is another factor that is boosting confidence in the Bitcoin market. Why does this matter for BTC? When central banks expand the monetary base, every existing unit of currency is implicitly debased. Therefore, scarce, hard-capped assets like Bitcoin (with a fixed supply of 21 million coins) stand out as a direct hedge against that dilution. Figure 4: Global M2. Each new high in global M2 has historically preceded major advances in BTC, and the broad upward slope of both sets of data on the chart underscores the asset’s reflexive relationship with liquidity. With Global Liquidity rising in this manner, Bitcoin is likely to follow suit and move aggressively upward. As it does, media coverage will intensify, which will likely bring in new participants to purchase BTC. At Bitcoin Magazine Pro, we can monitor new addresses buying bitcoin and track when the value in those addresses becomes overheated. That has historically coincided with major cycle highs for BTC. Figure 5: BTC Cycle Capital Flows. Over the last two cycles, when the addresses that have held bitcoin for less than 1 month (represented by the red section of the chart above) hold more than 40% of the value on the bitcoin network, it has been a warning that a BTC cycle high is near. The latest data is at just 17%, which suggests that the market is nowhere near overheating just yet. With Global Liquidity continuing to rise at a rapid rate, along with many other favorable tailwinds for Bitcoin, we do expect increased positive media coverage in the coming months. This will help bring new money into the ecosystem, which in turn will help push BTC price higher. This is, therefore, a crucial chart to track as we move further into the bull market to understand whether things are getting overheated. Bitcoin Magazine Pro platform subscribers can track the chart as it updates here. Watch out for moves above +30% as the market starts to heat up! Speak again soon, Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, June 30, 2025

BTC ready to make a new high?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin On-Chain Activity Report, August 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment