Tokenized Stocks Get Greenlit gm Bankless Nation, markets stayed steady this week, with key headlines from Dinari, Ripple, and the Federal Housing Finance Agency, which may soon allow crypto-backed mortgages. Today's Issue ⬇️ - 🗞️ Recap: Tokenized Stocks Get Greenlit

Dinari secures first U.S. license for tokenized stocks - 📺 Rollup: Next Crypto Meta Is Loading

What can overthrow BTC dominance? - 🕰️ Catch Up: What We Published

Guide to Privacy Tech. Using Crypto Options.

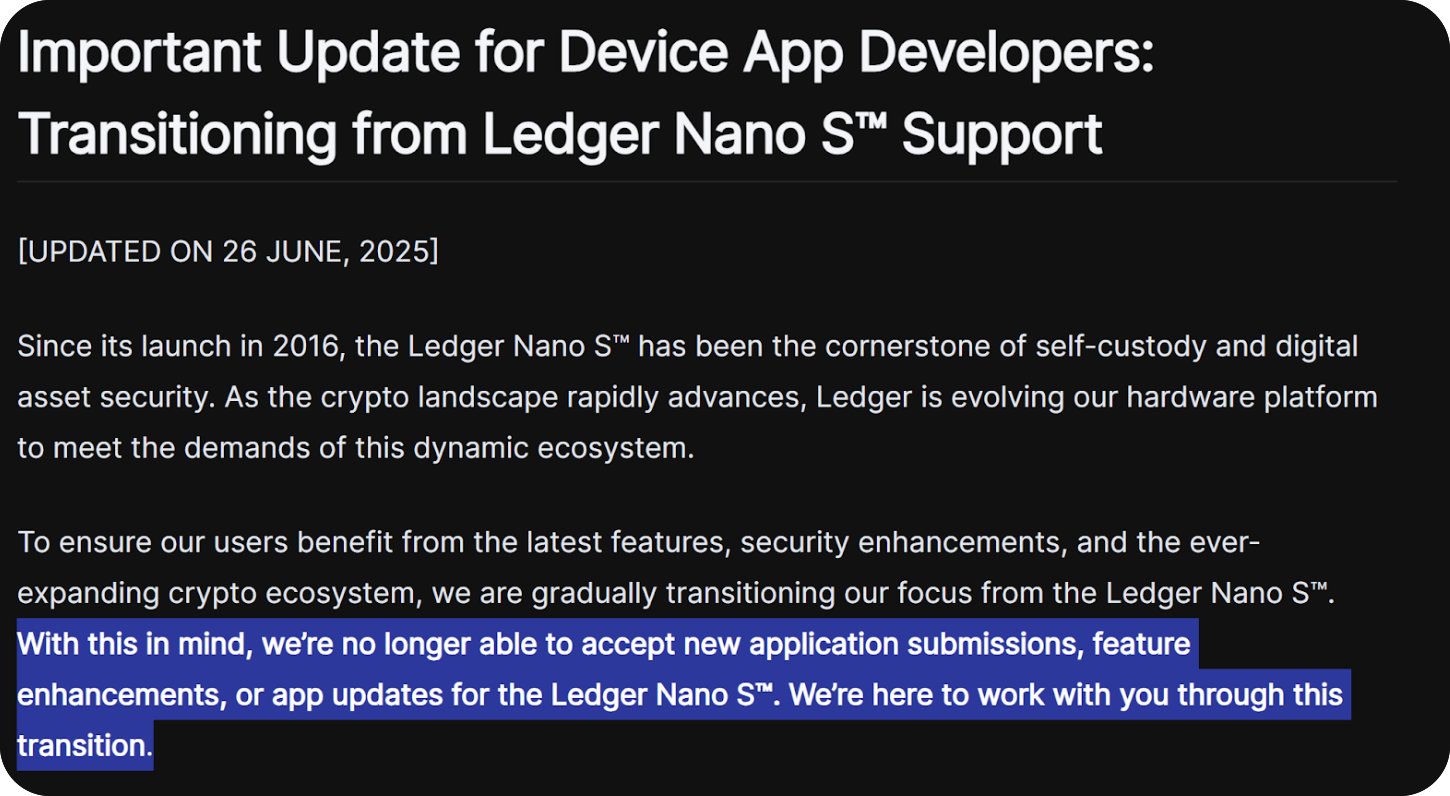

Sponsor: Uniswap Labs — Unichain is live! Bridge & swap with Uniswap Labs' web app or wallet. . . . WEEKLY RECAP Tokenized Stocks Get Greenlit 1️⃣ Dinari Tokenized StocksIn a Reuters interview released Thursday, public markets platform Dinari confirmed it secured a broker-dealer license to issue tokenized stocks in the United States. According to FINRA's "BrokerCheck" report, Dinari's license took effect on June 20, 2025. This enables the San Francisco startup to offer tokenized "dShares" through American stock brokerages and fintech apps in the coming months. The launch is subject to final SEC coordination. This makes Dinari the first company cleared to issue tokenized stocks for American investors. Dinari recently announced its $12.6M Series A raise in May, co-led by HackVC and Blockchange Ventures. Crypto-native exchanges Coinbase and Kraken are also seeking SEC permission to sell tokenized stocks to U.S. users. 2️⃣ Ledger Axes Nano SAnger erupted across Crypto Twitter this week after the community noticed a May Ledger announcement. The hardware wallet provider will no longer support the Nano S. The Nano S Plus remains fully supported. First launched in 2016 and pulled from shelves in 2022, the Ledger Nano S remains crypto's best-selling hardware wallet. The policy change means Ledger won't accept new application submissions, feature enhancements, or app updates for the Nano S. Nano S users can still send, receive, buy, sell, and access assets. But their wallets won't receive new Ledger features or upgrades — including improvements to usability and security. Notably, the Nano S is the only Ledger device incompatible with Ledger Recover. This optional multi-party key recovery service was compared by some in crypto to a pre-installed backdoor.

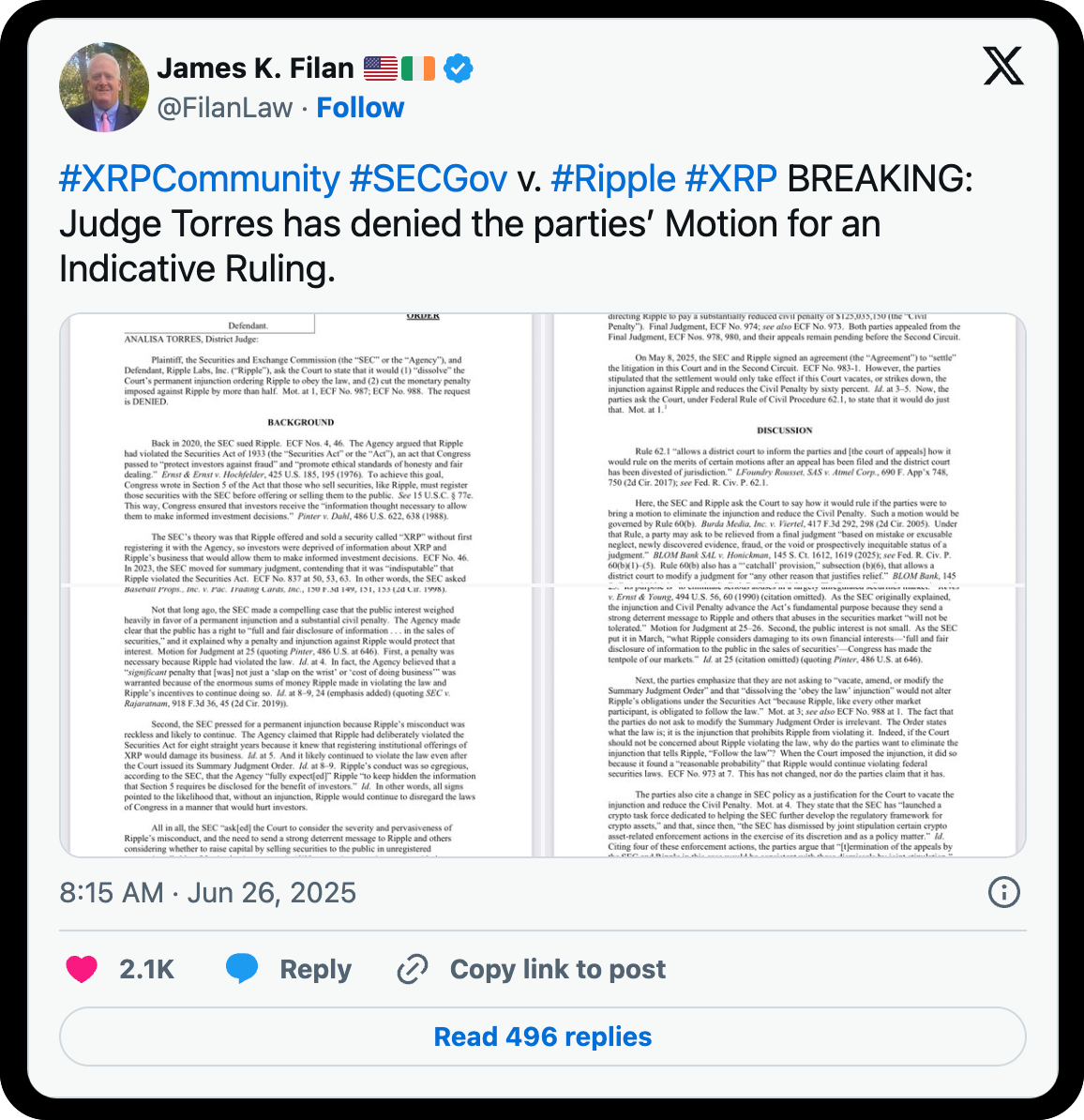

3️⃣ Crypto MortgagesU.S. Federal Housing Finance Agency Director William Pulte directed government-sponsored loan securitizers Fannie Mae and Freddie Mac to consider borrowers' cryptocurrency holdings as assets in single-family loan wealth calculations. Pulte is an heir to home construction behemoth PulteGroup. Widely regarded as a major win for crypto, Pulte's directive lets crypto holders qualify for larger home loans without converting digital assets to dollars. Only assets held with "U.S.-regulated centralized exchanges" count. Risk adjustments for volatility and liquidity may apply. Before implementing changes, Fannie and Freddie need approval from their Boards of Directors. They must also submit plans to the FHFA for review. 4️⃣ Kraken Launches KrakThursday, Kraken Exchange launched Krak, a crypto-enabled payments app built for instant sending, digital rewards, and full flexibility. The app lets users send over 300 digital assets in seconds free of charge to residents of 110 countries. According to Kraken, this app fixes outdated legacy finance norms by blending crypto technology with the exchange's trusted banking relationships and payment partnerships. Krak positions itself as a compelling alternative to existing fintech platforms for users seeking free international payments, seamless crypto accessibility, and native yield. While KYC requirements make Krak more intrusive than permissionless crypto networks, the user experience is undeniably simpler. 5️⃣ Ripple Dismissal DeniedU.S. District Judge Analisa Torres denied a joint motion from the SEC and Ripple Labs. The motion sought to dissolve her prior injunction, which prohibited XRP sales as securities to certain institutional buyers. It also sought to cut monetary penalties imposed on Ripple by more than half. The SEC cited Trump Administration policy changes as reason to vacate the judgment. But Judge Torres reaffirmed that existing securities laws apply to digital assets. She rejected the parties' attempt to circumvent a court's final determination that Ripple violated the law. The XRP token itself remains a non-security. To contest the security status of certain institutional sales and related fines, however, the SEC and Ripple must advance their case through the appeals process. In an unexpected twist late Friday, Ripple CEO Brad Garlinghouse claimed his firm would drop its appeal and indicated that he expects the SEC to do the same, potentially signaling a satisfactory end to a years-long legal battle that has been ongoing since December 2020 for both parties.  FRIEND & SPONSOR: UNISWAP Unlock the power of Unichain – a fast, decentralized Ethereum Layer 2 network built to be the home for DeFi and cross-chain liquidity. To bridge tokens to Unichain and start swapping today, get started with Uniswap Labs’ web app or mobile wallet. . . . WEEKLY ROLLUP Is Crypto’s Next Meta About to Make Markets Explode? This week, David and guest co-host Tom Schmidt (Dragonfly) unpack a deceptively quiet crypto market with Bitcoin dominance hitting 66% and altcoins eerily still. What meta could flip the trend?

They dive into Circle’s explosive 10x IPO, Robinhood’s surprise crypto surge, and why Coinbase is finally catching up. Plus: the Kalshi vs. Polymarket drama, ICOs creeping back, and how meme coins might soon help you get a mortgage.

Also: Vitalik’s Layer 1 pivot, prediction markets heating up, and signs of a new retail cycle forming. Tune into this week's rollup! 👇 . . . GET CAUGHT UP What We Published 📰 Articles:📺 Shows: . . . Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor |

No comments:

Post a Comment