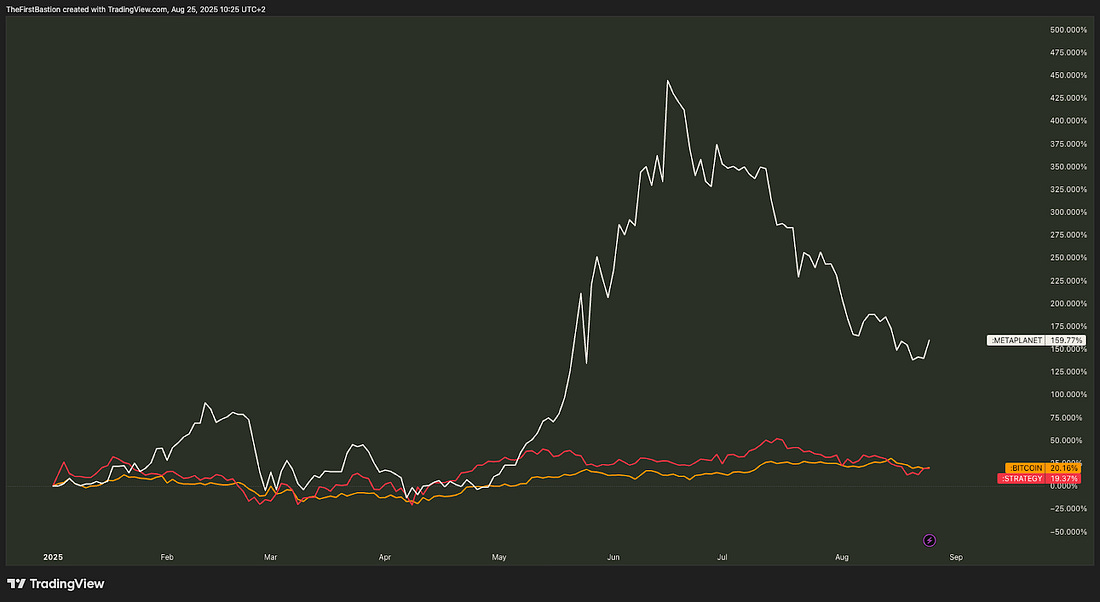

Strategy (MSTR) & the BTC-Backed Yield CurveA deep dive into constructing a yield curve with STRC, and what Strategy needs to prevent dilution of MSTR.In this letter we want to dive deeper into the latest developments of the BTCTCs (Bitcoin Treasury Companies). The reason this topic keeps coming back is because it makes up a large part of the current demand for bitcoin. As you all know, demand is a huge factor in determining the price of any asset. By better understanding the dynamics at play, one can make a clearer assessment of where the price might go in the near future. Over 10,000 investors downloaded the original report calling for $120k when bitcoin was just $27k. With that price level now achieved, Tuur is back with the 2025 edition refreshed for the bull run with new data and insights—including Adamant Research’s latest price outlook. The bull run is heating up—now is the time to take it seriously. You’ll also get exclusive access to an HD recording of Tuur Demeester’s new 30-minute video presentation, Charting Our Way Through Chaos, breaking down why this boom might be only just beginning—and what forces could push it to the next level. Read the first-ever mid-cycle report from Adamant Research: Blockstream Jade Plus is the easiest, most secure way to protect your Bitcoin—perfect for beginners and pros alike. With a sleek design, simple setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes. Seamlessly pair with the Blockstream app on mobile or desktop for smooth onboarding. As your stack grows, Jade Plus grows with you—unlock features like the air-gapped JadeLink Storage Device or QR Mode for cable-free transactions using the built-in camera. Want more security? Jade Plus supports multisig wallets with apps like Blockstream, Electrum, Sparrow, and Specter. Protect your Bitcoin, sleep better, stack harder. Use code: TBL for 10% off. Before we dive in, it felt appropriate to visualize the Venn diagram that Preston Pysh mentioned in a recent interview. Analyzing BTCTCs can feel daunting because it touches on so many different topics: bitcoin and sound money, the equity market and security analysis, the bond market, risk free rates, credit spreads, and many more. The reason we write and talk about this is because we love these topics and feel like a fish in water when thinking about them. That doesn’t mean we think people should invest in these companies or that it’s better than simply owning bitcoin. If you don’t feel comfortable with one or more of these topics, caution is warranted. As always, it’s Strategy that takes the lead, and Metaplanet is acknowledging the approach as the right one and preparing to follow a similar path. Right now, sentiment among BTCTC investors on X is pretty dire. People are blaming each other for the decline in price, even calling others ‘satan’. While bitcoin has reached new all-time highs, Strategy for example hasn’t. Bitcoin is seeing a minor pullback of about 10% from the highs, but Strategy has been flat for 9 months and is down 25% from July’s peak. It’s strange to see bitcoin hovering around $110,000 while the mood on X feels like we’re in the depths of a bear market. And that feeling makes sense, because if you lump-summed into a BTC Treasury Company and you’re down 25% — or more than 50% in the case of some Metaplanet investors — life is tough at the moment. But if you run a quick performance check since the start of 2025, Metaplanet has actually doubled versus bitcoin, and Strategy is underperforming, but not by much. Looking back further to the start of 2024, Strategy more than doubled bitcoin’s performance. Metaplanet wouldn’t be a fair comparison there, since they didn’t have a bitcoin strategy at that time. In this letter, we’re going to talk about the newest preferred stock Stretch (STRC), the building out of a bitcoin-backed yield curve, and the likely implications of this strategy for the broader capital markets, so make sure to read it all. Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Monday, August 25, 2025

Strategy (MSTR) & the BTC-Backed Yield Curve

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment