| gm Bankless Nation,

Is Ethereum L1 finality too slow for the Stripes of the world? Today's Issue ⬇️ - ☀️ Need to Know: Tether's USA Play

Tether's Genius-compliant stablecoin is here. - 🗣️ Analysis: Fast Tracking Fast Finality

Stripe's L1 move is causing an Ethereum L1 stir. - 🎧 Early Access: Recessions Dead?

How to invest in The Debasement Era.

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . NEED TO KNOW Tether's USA Play - 🇺🇸 Tether Debuts GENIUS-Compliant USAT Stablecoin. Its U.S. business will be led by former White House crypto advisor Bo Hines.

- 👯♀️ Gemini Raises $425M in Oversubscribed Crypto IPO. The Winklevoss-led exchange priced above earlier guidance ahead of its Friday Nasdaq debut.

- 🧱 BlackRock Considers Tokenizing ETFs. The world’s largest asset manager may soon bring its ETFs and RWA products onchain.

📸 Daily Market Snapshot: ETH climbed back above $4,600 as crypto assets saw green Friday. SOL is seeing its own traction, breaking $240, now 18% shy of its all-time highs. | Prices as of 3pm ET | 24hr | 7d |  | Crypto $4.06T | ↗ 1.9% | ↗ 6.3% |  | BTC $116,588 | ↗ 1.9% | ↗ 4.7% |  | ETH $4,641 | ↗ 4.8% | ↗ 7.3% | . . . ANALYSIS A Faster Push for Fast Finality When Paradigm's Matt Huang sought to justify why Stripe chose to build Tempo as a new L1 rather than an Ethereum L2, he offered a laundry list of reasons. And while a good deal of said reasons seemed to be summarily shrugged off by the Ethereum community, developers paid close attention to his mentions of Fast Finality. "We are prioritizing attributes like fast finality," Huang had written, adding that while "some of these are technically possible for an L2... L2s are generally only as final as the underlying L1."

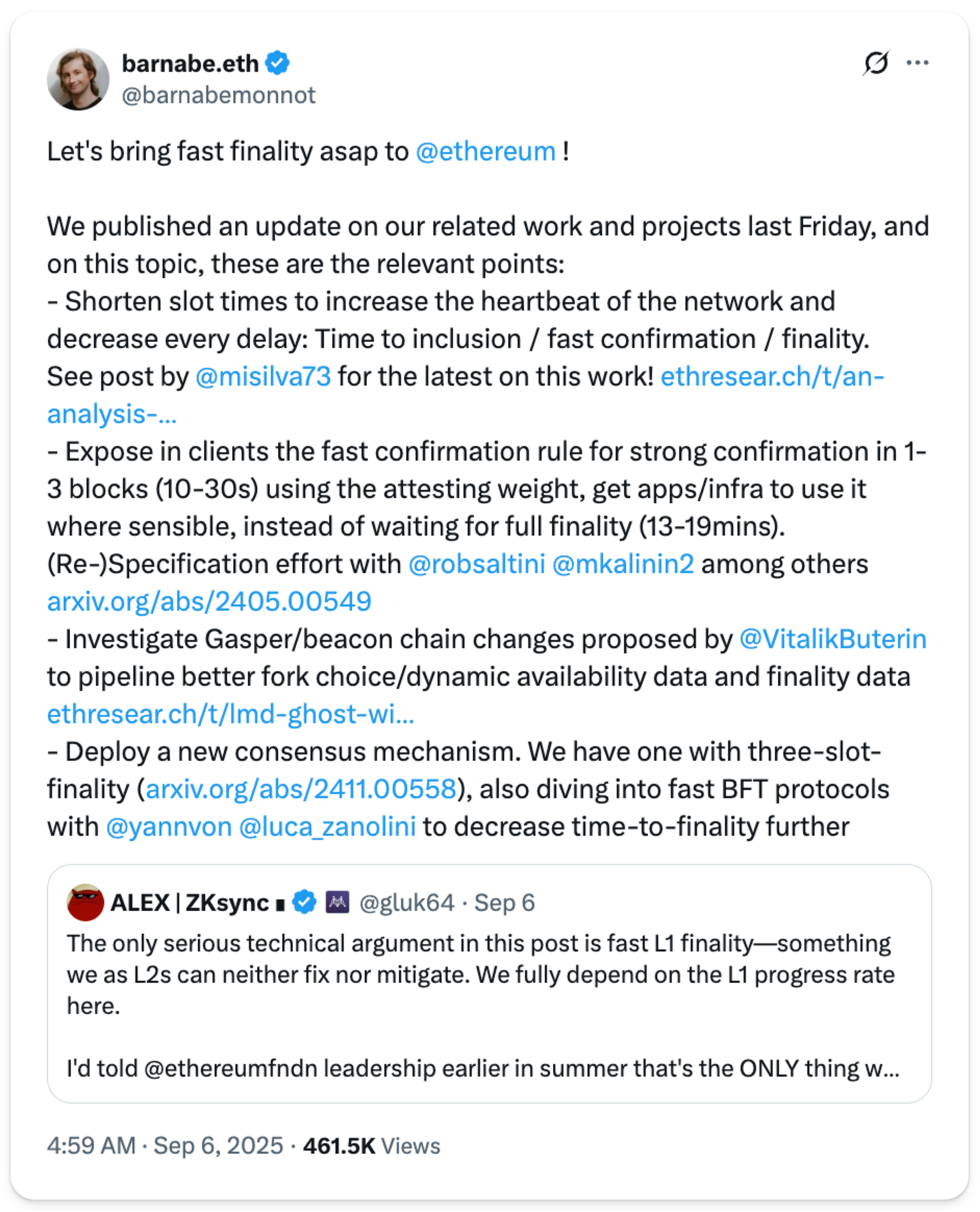

The responses to Huang's post were varied, but showcased a clear reality for Ethereum: in the race to build global payment infrastructure, speed has become non-negotiable. And while Ethereum's development team has made great strides here, market expectations may necessitate sharpening this focus. What is Fast Finality?At its core, finality in blockchain is the guarantee that once a transaction is confirmed, it's set in stone — irreversible, unchangeable, and safe from any network hiccups or reorganizations. Fast finality simply delivers this assurance in seconds or even sub-seconds, rather than making you wait around, twiddling your thumbs. Ethereum's current setup is solid but arguably sluggish. Blocks come every 12 seconds, and transactions can be included pretty quickly, but full economic finality — the point where you're truly confident it won't get rolled back — comes around 12–15 minutes. That's the time it takes for two epochs under Proof-of-Stake, where validators pile on attestations to lock things in. While this has worked solidly enough to date, many players in the market are increasingly demanding that this stretch of time drops to 2 seconds or less. Scaling to meet the use cases of commercial payments and high-volume institutional flows necessitates a deeper commitment to speed at the L1 level. Why Fast Finality Matters NowEthereum doesn't need to be convinced here for its inclusion on the roadmap, with fast finality long embedded in its roadmap as a key upgrade to enhance user experience. Any rollout requires pushing speed across the network without compromising decentralization, an area where Ethereum inarguably bests its younger (and often faster) alt-L1 peers. Ethereum's network currently has more than 1.1 million validators running on everyday hardware with just 32 ETH (~$140K) staked. Ethereum's Roadmap in FocusWhile fast finality has long been set for inclusion, community members are increasingly pushing the EF to accelerate the push for the sake of Ethereum's long-term health. In conversations around Huang’s explanation, the EF’s Barnabe Monnot shared updates on the initiatives in motion to bring about the much desired fast finality: - They're working to reduce block intervals from 12 to 6 seconds, with successful tests already completed.

- A new "fast confirmation rule" will allow transactions to be strongly confirmed in just 1–3 blocks (10–30 seconds) instead of waiting for full finality.

- Core protocol improvements inspired by Vitalik's proposals are being explored, along with next-generation consensus mechanisms like three-slot finality.

The timeline, according to him, looks something like this: fast confirmation rules in 3–6 months, shortened block intervals in about a year via hard fork, core system enhancements in 1.5–2 years, and new consensus mechanisms in 2–3 years, though he suggests some of this could be accelerated. The Path ForwardEfforts are clearly being made, but critics are still fair to point out that 2–3 years is an eternity in crypto. It's plenty of time for specialized chains to carve out niches in payments and institutional settlement, despite lacking Ethereum's broader guarantees. Ethereum has solved the hard problems that make it suitable as global, public infrastructure. Yet for select use cases, prioritizing speed sooner could prevent it from being overlooked in the short term – something Ryan Berckman digs into further in this thread. Whether or not chains like Tempo gain traction temporarily, in the end it is difficult to imagine corporate chains selling the vision of non-neutral shared settlement space to the world's financial players as a lasting solution. Nevertheless, the wider trend embodied by Stripe's move showcases why bumping up fast finality as a priority aligns with Ethereum's strengths – not because speed trumps decentralization, but because combining the two ensures the network's achievements aren't sidelined, even temporarily. FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. . . . EARLY ACCESS Why Recessions Are Dead Why do recessions feel like a relic of the past?

Macro strategist Vincent Deluard argues we’ve entered an era where fiscal dominance, structural inflation, and relentless asset debasement reshape how capital flows and how investors must position themselves.

We cover the U.S. supercycle, the role of tech and energy, why the “2% inflation target” is dead, and what a portfolio looks like in the age of permanent stimulus. Listen to the full episode 👇 |

No comments:

Post a Comment