Bitcoin ETF Flows Signal Investor HesitationAlso Gold Pulls Ahead of Bitcoin & No Easy Path for the FedWelcome to Ecoinometrics' Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we'll cover:

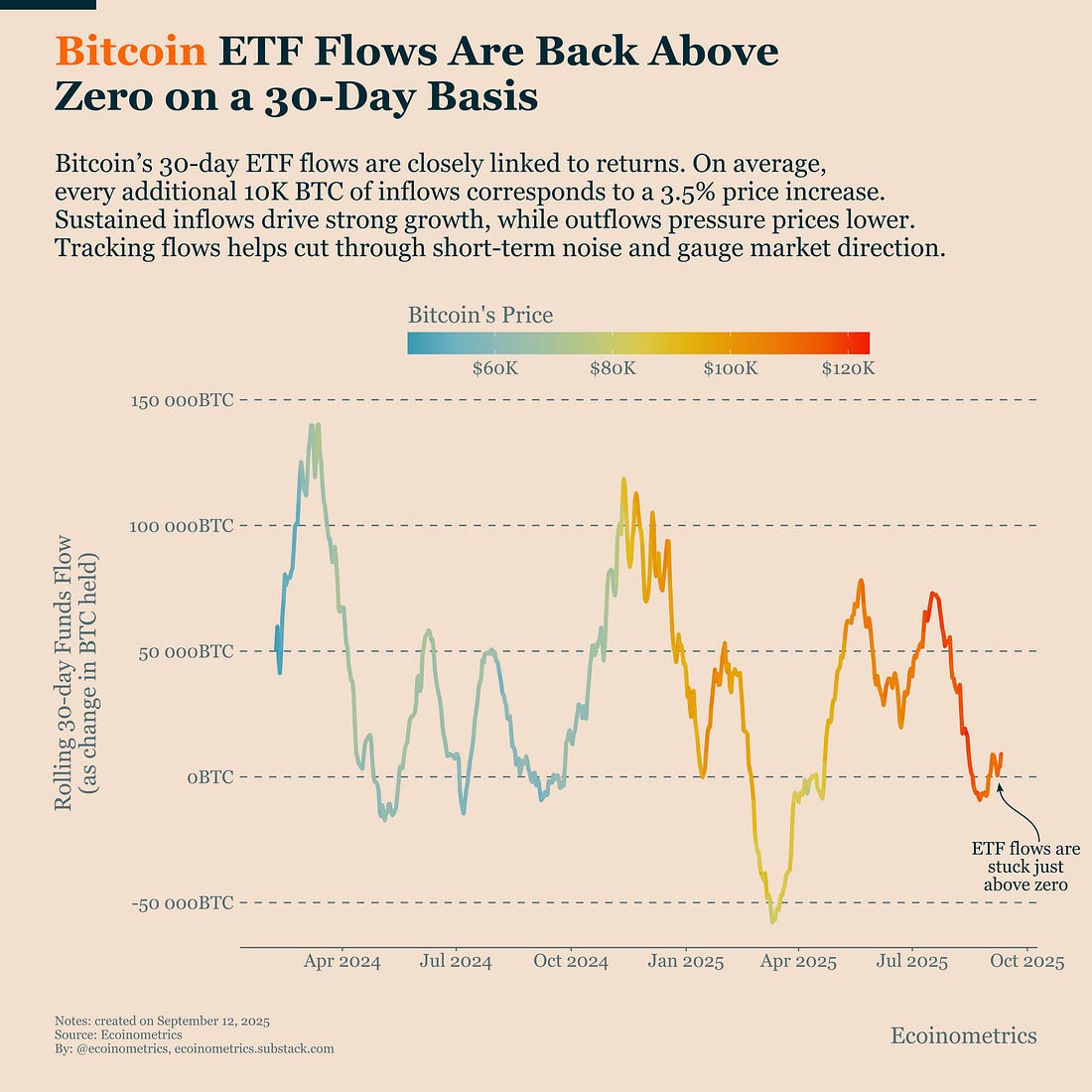

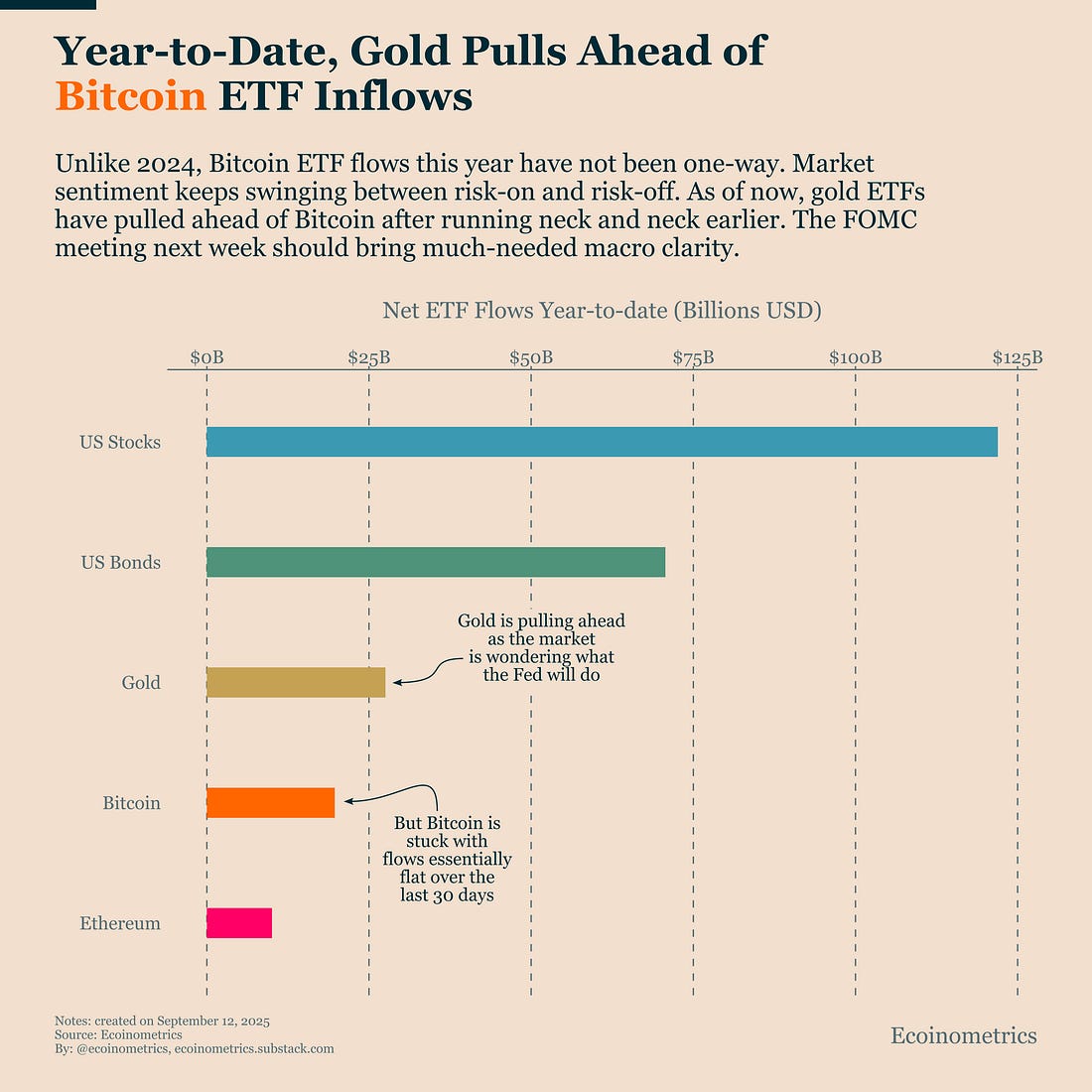

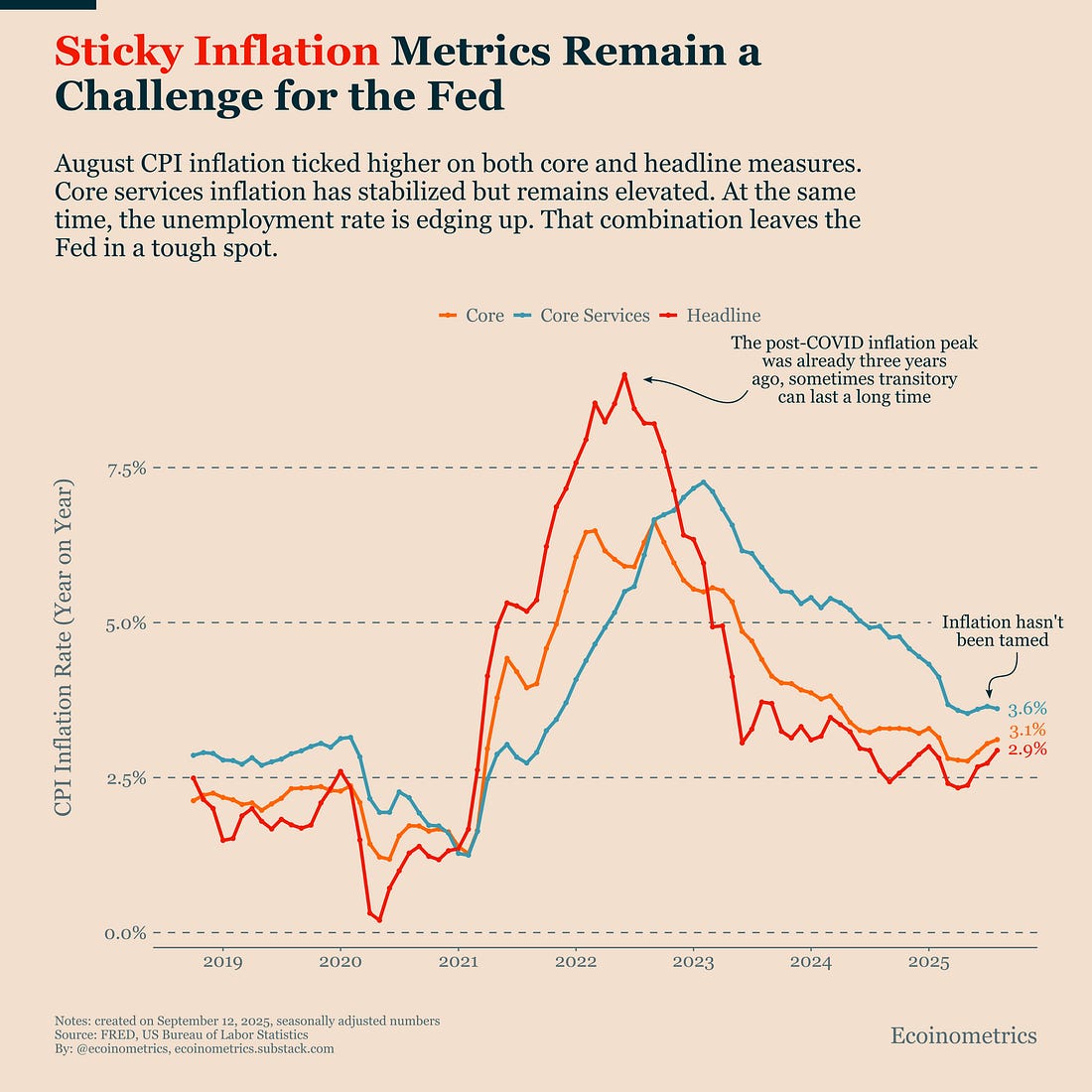

Together, these three signals highlight the same underlying reality: investors are waiting for clarity from the Fed. Bitcoin flows have stalled, gold is drawing cautious bids, and inflation data keeps policy decisions complicated. Until the Fed sets the tone next week, positioning across risk assets will remain tentative. The takeaway is simple: don’t confuse short-term price momentum with a confirmed trend. Sustained ETF inflows will be the true signal that institutional demand is back, and that’s what investors should watch most closely after the Fed meeting. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - your daily read on Bitcoin’s cycle, from macro trends to ETF flows, giving you everything you need for tactical investment decisions: Get these professional-grade insights delivered to your inbox: Bitcoin ETF Flows Signal Investor HesitationBitcoin is pushing above $115K with positive momentum ahead of next week’s FOMC meeting. That looks encouraging, but I would caution against too much optimism. Yes, the public companies with an active Bitcoin treasury strategy are still buying. But the real driver of sustained trends, i.e. demand from institutional investors, isn’t showing up yet. On a rolling 30-day basis, net ETF flows are flat or just barely positive. That’s not what you’d expect if investors were already confident about the Fed’s next move. Flat flows point to lingering uncertainty. A rate cut is widely expected, but what really matters is the forward guidance. If ETF inflows accelerate after the meeting, that will confirm the start of a stronger trend. If not, the rally risks stalling. Still, the absence of outflows is worth noting. Investors aren’t reducing exposure, they’re simply waiting for clarity. That leaves room for a sharp pickup in demand if the Fed’s message tilts dovish. In the meantime, keep an eye on flows over the next ten days, they will be the clearest signal of whether Bitcoin’s current momentum can last. Gold Pulls Ahead of BitcoinUntil recently, Bitcoin’s flat flows didn’t translate into gains for gold. That has changed. Gold ETFs have started to attract inflows again, pushing them ahead of Bitcoin year-to-date. Part of this rotation reflects different investor views. Some are betting on a lower rate environment but also on inflation staying sticky. In that scenario, gold is seen as the safer hedge. Others may be positioning defensively in case the Fed makes a policy mistake that tips the market into a clear risk-off mode. If next week’s FOMC meeting delivers strong guidance on rate cuts for the next year, Bitcoin flows should pick up again and close the gap with gold. But for now, the back-and-forth in 2025 has been much more frequent than in 2024, and that has weighed on Bitcoin’s relative performance. Still, both Bitcoin and gold stand out compared to traditional assets. On a risk-adjusted basis, they continue to deliver stronger returns than stocks or bonds. It’s also notable that while the gold market is much larger, institutional demand for Bitcoin ETFs is getting close to parity. And as we discussed on Monday, there is a clear case to be made for Bitcoin’s long term growth based on fundamental macro drivers. Flat Bitcoin flows on one side and rising gold flows on the other show the same thing: investors are waiting for the Fed before making a decisive move. No Easy Path for the FedWe might have hoped that data released since Jackson Hole would clear the way for an easy Fed decision next week. That hasn’t happened. The unemployment rate has ticked up to 4.3%. Job openings are falling, and initial claims are rising. That creates pressure to cut rates to prevent further labor market weakness. At the same time, CPI inflation is moving higher on both headline and core measures, while core services remain elevated. That argues for caution or even for slowing the pace of cuts. The market, however, is leaning dovish. As of now, it’s pricing:

That adds up to more easing than the Fed has promised. I find this a stretch given the risk of re-igniting inflation. Here’s the asymmetry:

The Fed’s double mandate is to pursue both maximum employment and stable prices. In today’s environment, the downside looks greater in cutting too fast than in holding steady for longer. Of course, there are risks outside the mandate. Staying hawkish could trigger a selloff in risk assets, and it could create political friction with an administration eager for lower rates to finance government debt. Put together, it’s a complicated balancing act. Next week’s FOMC meeting will be as much about guidance as the cut itself. That's it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. Invite your friends and earn rewardsIf you enjoy Ecoinometrics, share it with your friends and earn rewards when they subscribe. |

Friday, September 12, 2025

Bitcoin ETF Flows Signal Investor Hesitation

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment