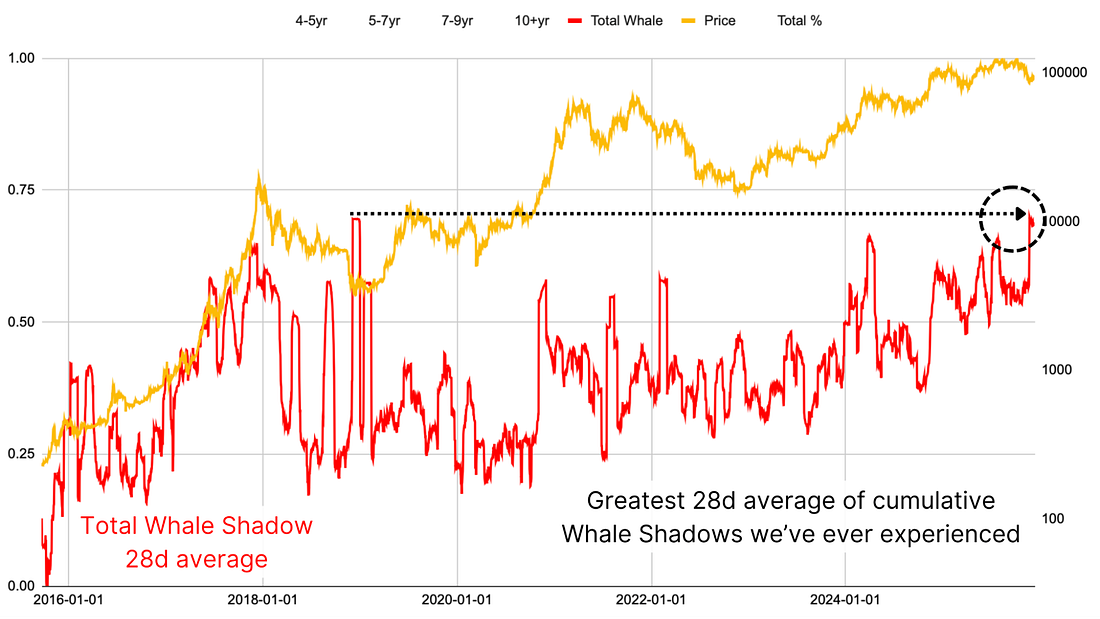

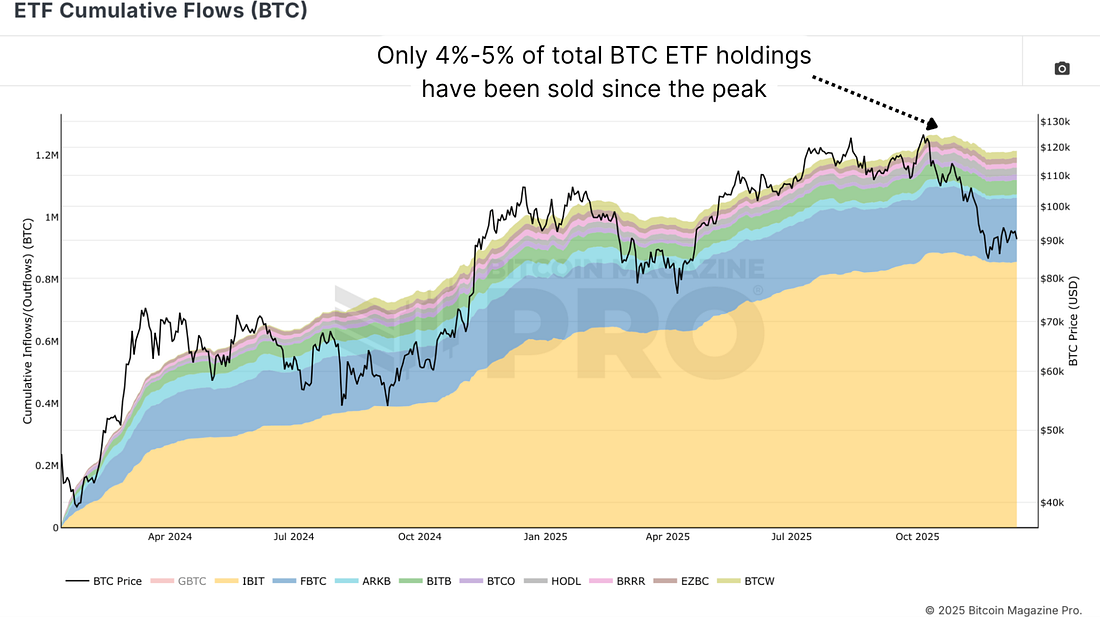

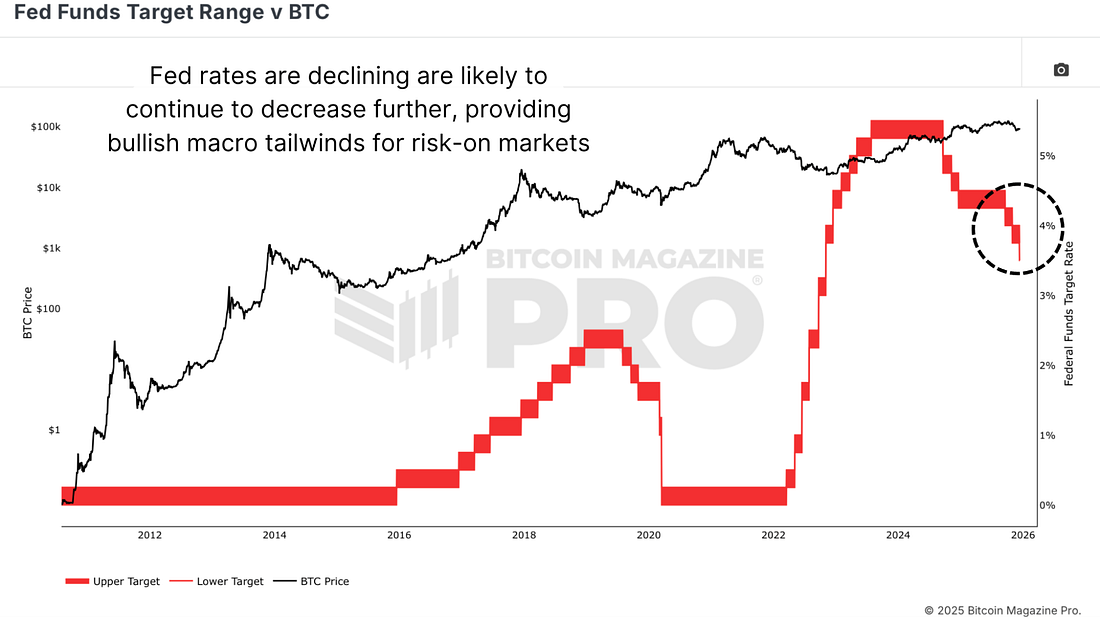

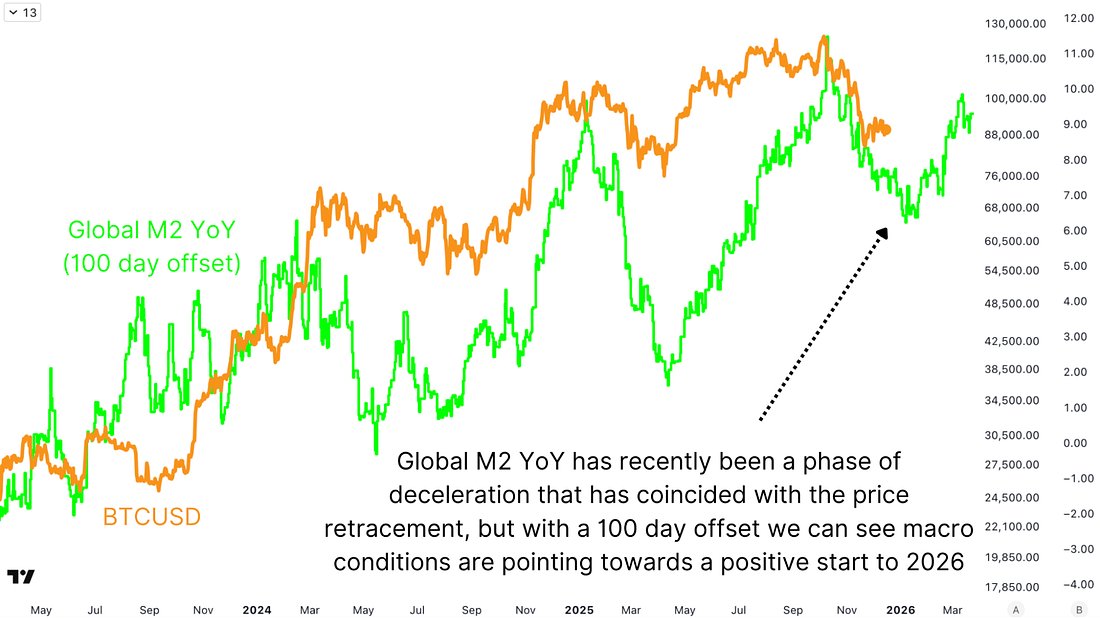

Bitcoin enters 2026 with substantial macroeconomic tailwinds despite 2025’s disappointing price action. While the year ahead remains uncertain, multiple indicators suggest the worst of the selling may have already occurred, with long-term holder capitulation reaching historic extremes and on-chain metrics pointing toward potential stabilization in early 2026. 2025 RetrospectiveWhile Bitcoin set new all-time highs in USD-denominated terms during 2025, when measured against Gold, a more accurate representation of true purchasing power, Bitcoin actually peaked approximately one year ago in December 2024 and has since declined by over 50%. This divergence explains the psychological pain many investors experienced despite nominal price records. The year was characterized by extraordinary whale activity, with the cumulative long-term holder Whale Shadows metric reaching the highest level ever recorded, indicating unprecedented volumes of long-term holder Bitcoin being transferred to the market. Figure 1: In 2025, unprecedented volumes of significant long-term holders transferred BTC. Remarkably, long-term holders distributed approximately 7–8 million Bitcoin throughout 2025, while treasury companies and ETF Cumulative Flows collectively accounted for only around 2 million. This means roughly 75% of long-term holder distributions were absorbed by retail investors, a development that, while appearing bearish on the surface, actually carries significant bullish implications. The distribution represents a transfer of holdings from early adopters who purchased Bitcoin for potentially fractions of a penny to more recent long-term holders, less vulnerable to quick liquidations or panic selling. Figure 2: Since the cycle peak, Bitcoin ETF holdings have only dropped by less than 5%. This extreme level of long-term holder selling, combined with Bitcoin’s price resilience and the fact that ETFs have only sold approximately 4–5% of their holdings despite having sufficient liquidity, suggests that the fundamental demand structure remains intact. In any previous bull market context, a 35% pullback from all-time highs would have been classified as a standard bull market dip! Macroeconomic IndicatorsThe Fed Funds Target Range continues declining with market expectations for further rate cuts. The 2Yr Treasury Yield Spread sits beneath implied rate expectations, and the potential replacement of Federal Reserve Chair Jerome Powell with a more aggressive, crypto-friendly alternative represents a significant policy shift. Quantitative tightening ended on December 1, 2025, marking the third such cessation in Bitcoin history, with previous instances in 2010, 2012, and 2019 all preceded significant Bitcoin rallies, though the 2019 development was followed by COVID-19 before substantial gains materialized. Figure 3: The falling Fed Funds Target Range could reignite demand for risk-on markets. Global Liquidity SignalsThe Global M2 money supply, measured on a year-on-year basis with a 100-day offset, has historically provided near-perfect Bitcoin price prediction. After topping out, coinciding almost exactly with the October 2025 Bitcoin market cycle peak, this metric is now beginning to expand again, pointing toward potential bottom formation in early 2026. Figure 4: The offset YoY Global M2 money supply correlation suggests Bitcoin market recovery from early 2026. 2026 Probability-Weighted ScenariosThree primary scenarios emerge for 2026: Bearish Case (25% probability): Further capitulation drives Bitcoin to the 15.44 Fibonacci retracement level, resulting in approximately $66,000 in current valuations, potentially declining further to $60,000 or lower if Gold simultaneously retraces. This scenario assumes significant risk-off conditions, potential recession, or a major black swan event. Base Case (50% probability): Further near-term downside toward $70,000–$75,000 occurs before stabilization and recovery beginning in late 2025 or early 2026. From this floor, Bitcoin recovers toward $100,000 and the 365-day moving average, potentially reaching the 2021 bull market peak in Gold terms. This scenario reflects an underwhelming bear market that matches the lackluster bull market that preceded it, with 2026 ending modestly positive but not dramatically outperforming. Bullish Case (25% probability): Bitcoin accelerates toward the upper 52.55 ounces of Gold target, potentially reaching $200,000+ in USD terms (or higher if Gold appreciates further). This scenario requires significant liquidity injections and capital rotation from alternative risk assets into Bitcoin. Figure 5: Using three probability-weighted scenarios to predict 2026 BTC price action. ConclusionBitcoin’s underwhelming 2025 performance, despite new USD all-time highs, should be contextualized within longer-term trends. The broad distribution of 7–8 million Bitcoin from early holders to more committed recent investors, combined with historic whale and long-term holder capitulation, represents a structural maturing of the Bitcoin market. The legitimization by institutional investors, treasury companies, and ETFs suggests Bitcoin is transitioning from extreme volatility cycles toward more normalized price movements. While 2026 remains inherently uncertain, current data suggests Bitcoin’s worst price action may already be in the past. Macroeconomic tailwinds, including potential rate cuts, the ending of QT, and currency debasement pressures, create structurally favorable conditions. The historic capitulation from long-term holders, combined with retail absorption of these distributions and ETF conviction (evidenced by minimal selling despite liquidity), suggests the market has priced in substantial downside. For a more in-depth look into this topic, watch our most recent YouTube video here: How 2026 Plays Out For Bitcoin  Matt Crosby Lead Analyst - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, December 19, 2025

Bitcoin's 2026 Data-Driven Outlook

Subscribe to:

Post Comments (Atom)

Popular Posts

-

It's no secret that ETH spent a lot of this cycle on the sidelines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment