Bitcoin Is Building a Base as ETF Flows StabilizeAlso Ethereum’s Discount Reflects Weak Demand, Not Opportunity & Inflation Numbers You Can’t Fully TrustWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

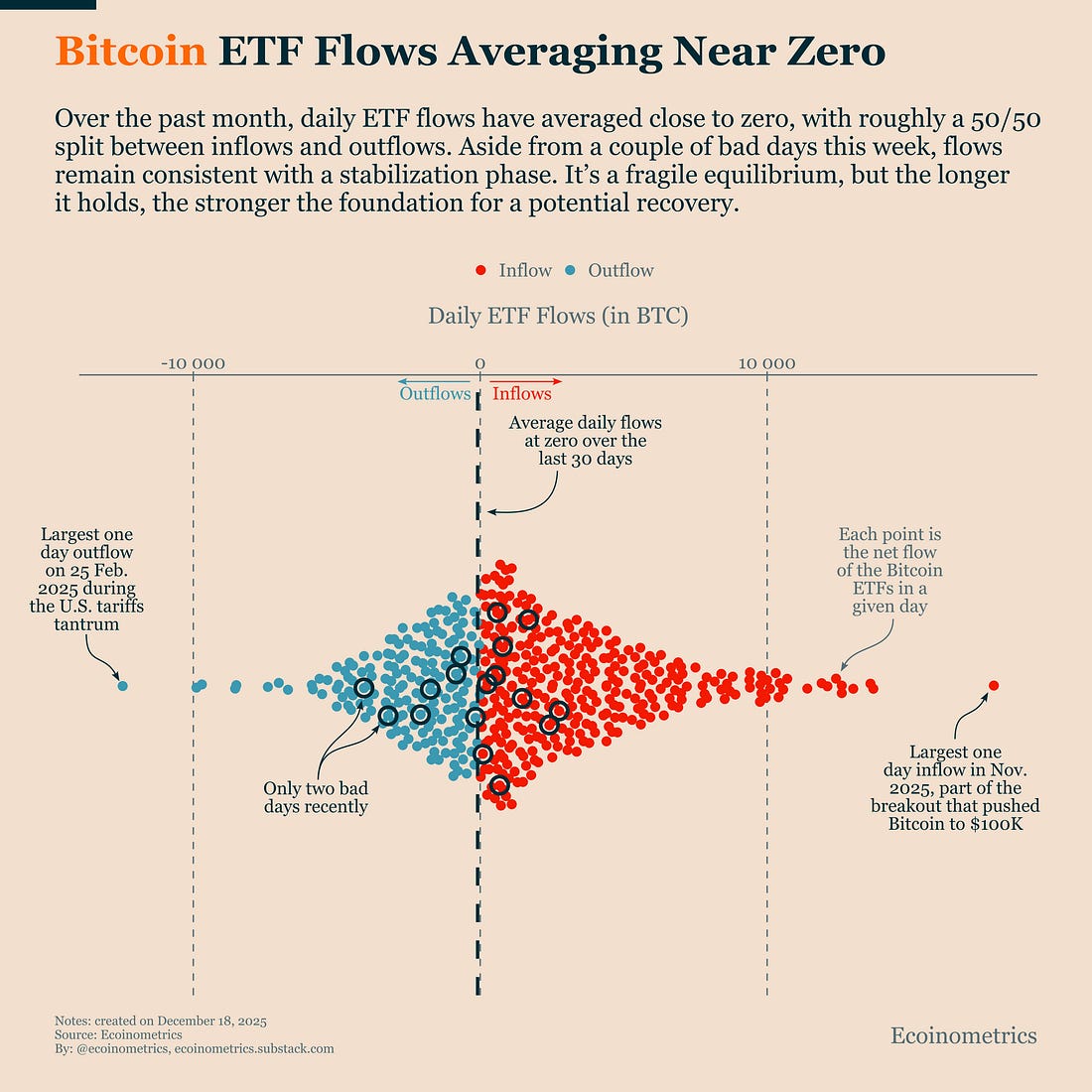

Taken together, these three signals describe a market stuck in a holding pattern. Bitcoin is stabilizing but lacks a catalyst, Ethereum’s apparent cheapness reflects weak demand rather than opportunity, and macro inflation data is too distorted to anchor decisions. In this environment, patience and positioning discipline matter more than prediction. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin Is Building a Base as ETF Flows StabilizeAs we discussed in more depth in Wednesday’s correlation report, the current market environment offers little directional guidance for Bitcoin. Without a broader risk-on impulse and with no clear catalyst on the horizon, Bitcoin continues to gravitate toward its ETF-flows-implied fair value, currently around $87K. In this type of environment, price is driven less by momentum and more by marginal positioning. The chart below shows the distribution of daily net Bitcoin ETF flows over the past month. What stands out is how little directional pressure there has been. Average daily flows are close to zero, with a near-even split between inflow and outflow days. Aside from two notably weak days earlier this week, there is no sustained run of outflows. This explains why rolling ETF flows have slowly recovered back toward neutral and why Bitcoin has stopped trending lower. This kind of stabilization should not be mistaken for a bullish signal. It does not create upside momentum on its own, but it does allow Bitcoin to rebuild a base rather than continue to unwind. At the same time, downside risks remain meaningful. With flows still fragile and macro conditions unresolved, Bitcoin’s path is not clearly biased to the upside. Until a new quarter brings clearer evidence of capital rotating into Bitcoin investors are better served staying cautious rather than chasing a recovery that has yet to be confirmed.

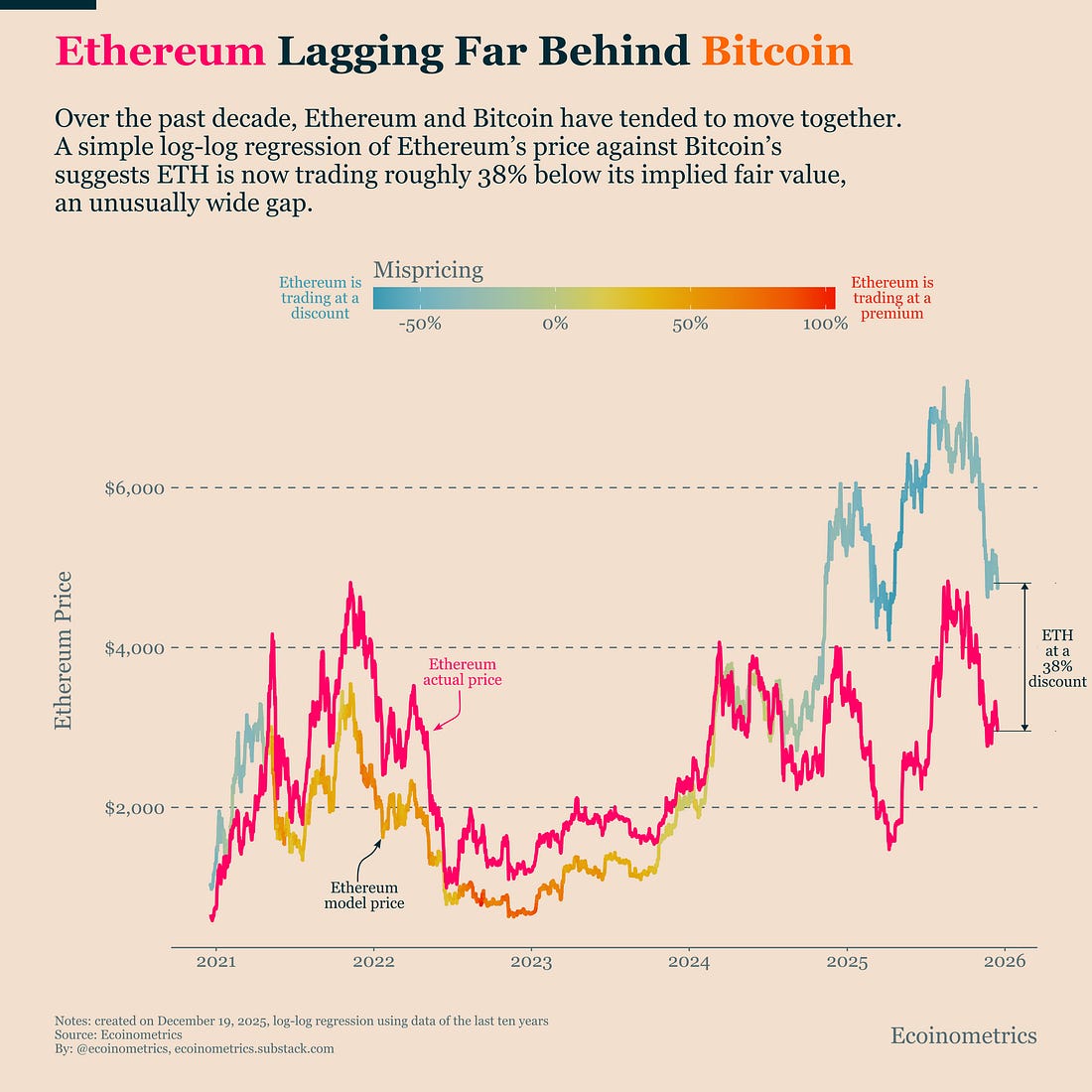

Ethereum’s Discount Reflects Weak Demand, Not OpportunityEthereum continues to underperform, both in absolute terms and, more importantly, relative to Bitcoin. Earlier this year, we argued that the only compelling case for Ethereum was a relative one: a closing of the wide gap versus Bitcoin, driven by sustained capital inflows into Ethereum ETFs. That trade relied on a simple mechanism, investors reallocating within crypto rather than expanding overall risk exposure. For that thesis to work, Bitcoin itself needed to be trending higher. In that scenario, Ethereum could outperform on a relative basis as capital chased higher beta. That condition is clearly not in place today. The chart below shows Ethereum’s actual price compared to its Bitcoin-implied price, derived from a long-run log-log relationship between the two assets. By that measure, Ethereum currently trades at roughly a 38% discount. That is a large gap, and on paper it may look attractive. But relative discounts only matter when there is a reason for capital to close them. At the moment, Ethereum lacks a strong narrative, has not seen meaningful ETF-driven inflows, and has a recent history of underperforming Bitcoin during risk-off phases. In other words, this discount reflects weak demand rather than hidden value. Until capital starts rotating down the crypto risk curve, relative valuation alone is not a catalyst. In the current environment, Bitcoin remains the cleaner exposure. It sits lower on the risk curve, attracts the bulk of institutional flows, and has consistently proven more resilient within crypto when conditions deteriorate. Ethereum, by contrast, remains a lagging asset rather than a contrarian opportunity.

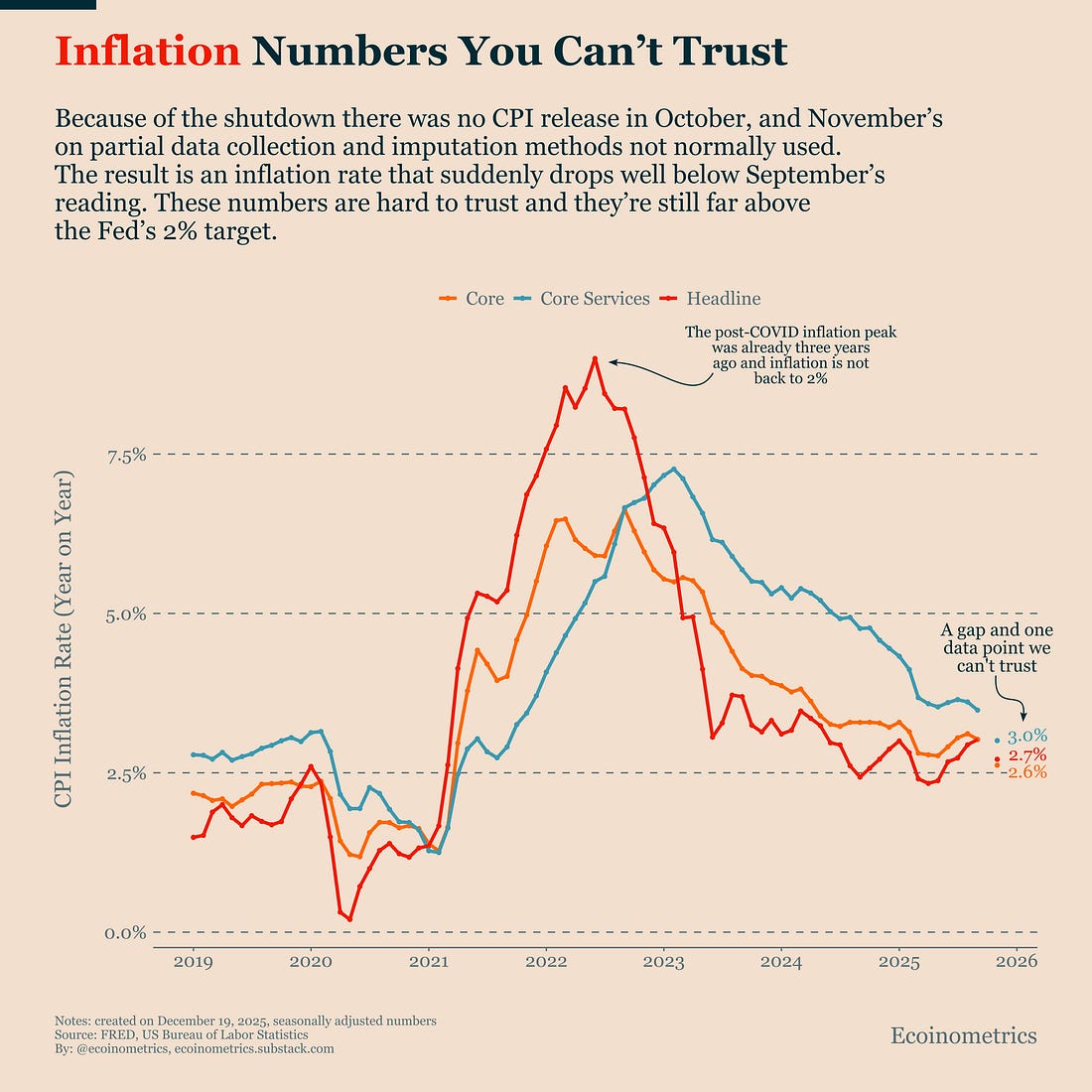

Inflation Numbers You Can’t Fully TrustBecause of the unusually long U.S. government shutdown, we are currently operating in a macro data fog. For roughly six weeks, several federal agencies responsible for collecting economic data were unable to perform their normal surveys. That disruption created gaps that cannot be fully repaired after the fact. The November CPI release is a clear example. No CPI data was collected in October, meaning there is no October print. In November, data collection only resumed in the second half of the month, forcing the Bureau of Labor Statistics to rely on partial samples and imputation methods that are not typically used. As a result, the November CPI print is both incomplete and heavily assumption-driven, with some components effectively carried forward from September. Unsurprisingly, the outcome is a simultaneous drop in headline, core, and core services inflation. To be clear, inflation may well have eased modestly. But no serious investor or policymaker should treat this print as a reliable signal. That includes us at Ecoinometrics, and it includes Federal Reserve officials who are openly acknowledging the limits of recent data. Even taken at face value, a 2.7% year-on-year headline inflation rate remains well above the Fed’s 2% target. Inflation normalization is incomplete, regardless of the measurement noise. So once again, we are left with a macro data release that fails to clarify the economic outlook. That is frustrating, especially for investors looking for clean signals. But in environments like this, restraint is a feature, not a flaw. Unless you are materially overexposed to Bitcoin given the remaining downside risks, this is not a moment to act. It is a moment to wait for the data fog to clear before drawing conclusions.

Tactical TakeawayRight now, the risk is reacting to signals that look meaningful but aren’t. Neutral ETF flows, weak relative performance below Bitcoin, and distorted macro data all point to a market that is stabilizing without conviction. Until flows turn decisively positive or macro data regains credibility, restraint remains the most rational posture. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, December 19, 2025

Bitcoin Is Building a Base as ETF Flows Stabilize

Subscribe to:

Post Comments (Atom)

Popular Posts

-

It's no secret that ETH spent a lot of this cycle on the sidelines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment