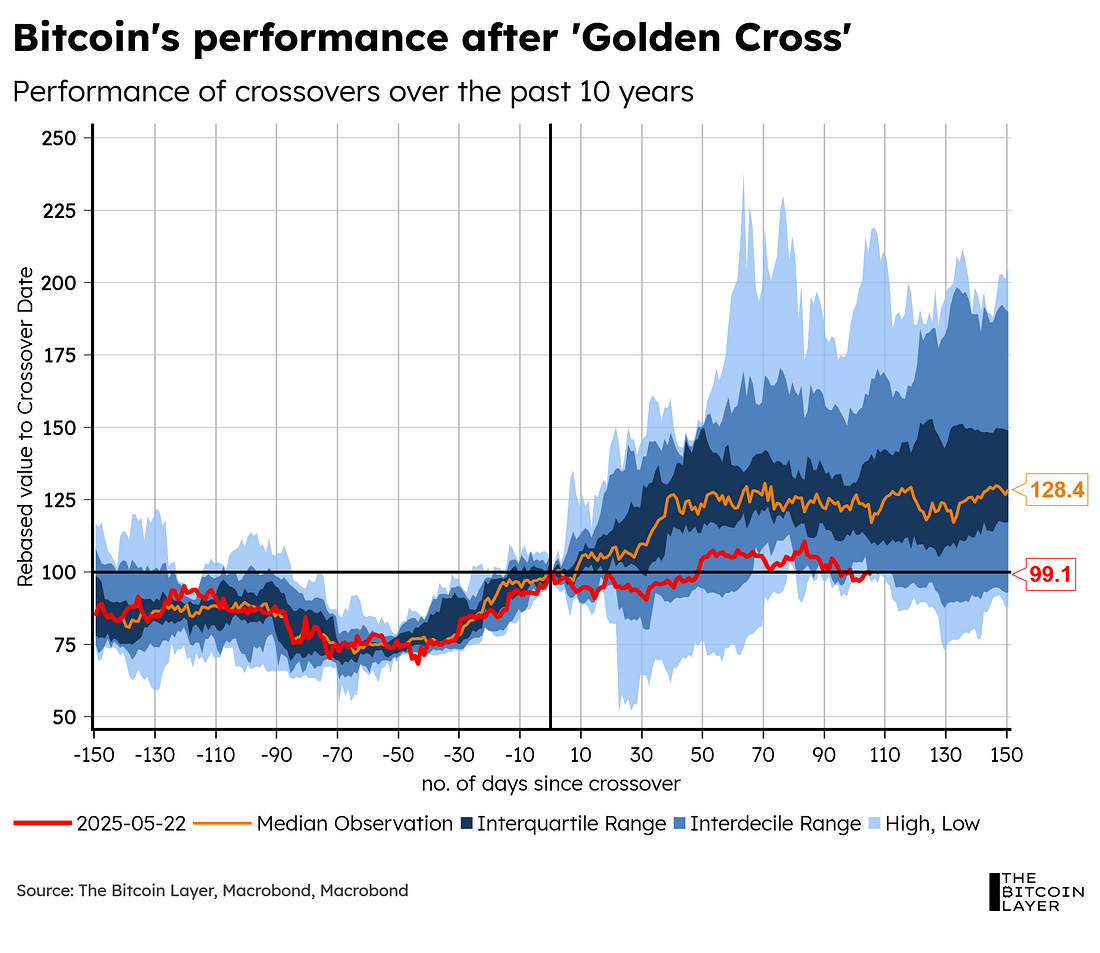

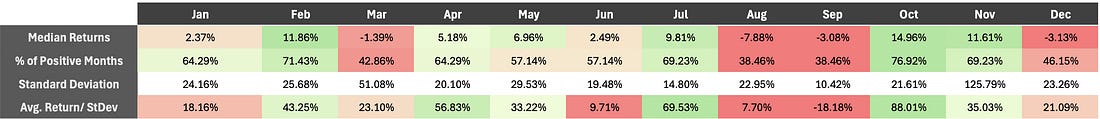

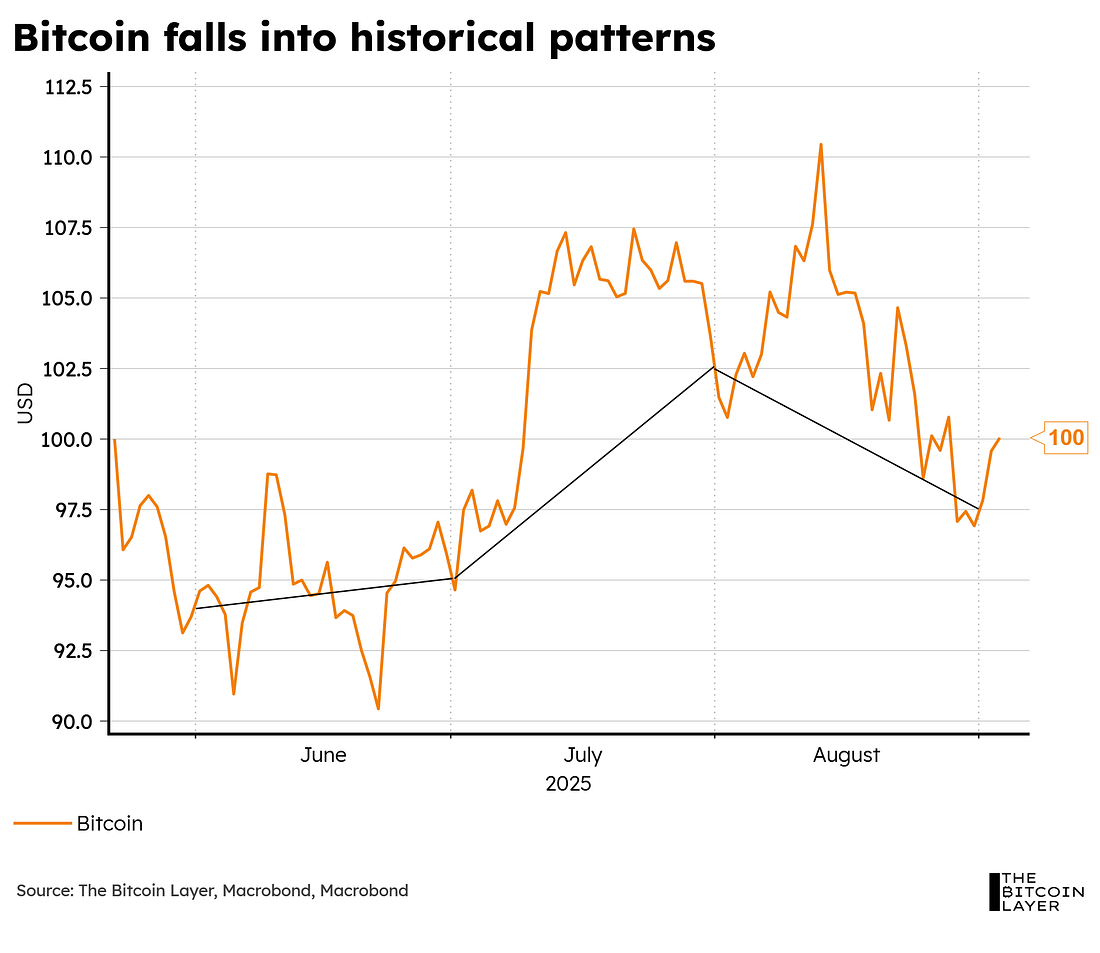

Dear Readers, At the start of July, we brought up a technical indicator, wherein a 50-day moving average crosses above a 200-day moving average—famously known as the Golden Cross. We mentioned how buying bitcoin at the start of a Golden Cross scenario has historically proven to be a solid opportunity, yielding positive returns on average over the past 10 years after 150 days of the cross. As you can see from the chart, however, bitcoin has barely made par since the most recent Golden Cross on May 22nd of this year. This rather weak performance showcases how bitcoin has fallen victim to its own seasonal patterns. Over the past 10 years, June, August, and September have been the worst-performing months for bitcoin, with median monthly returns at 2.49%, -7.88%, and -3.08%, respectively. July, on the other hand, has been one of the best, with a median return of nearly 10%. Take a look at bitcoin’s performance this year throughout June, July, and August - the months following the Golden Cross. June was relatively flat, July was great, and August in the red: Thus, the repetition of these historical patterns would suggest that September will continue to be slow (perhaps even negative) before the happy months of October and November, which have historically yielded median returns of 15% and 11.61%, respectively. We can’t just assume that history will repeat, but this just helps to anchor expectations. These slow expectations ultimately bring us back to our TBL Liquidity Quarterly Cycle. Over 10,000 investors downloaded the original report calling for $120k when bitcoin was just $27k. With that price level now achieved, Tuur is back with the 2025 edition refreshed for the bull run with new data and insights—including Adamant Research’s latest price outlook. The bull run is heating up—now is the time to take it seriously. You’ll also get exclusive access to an HD recording of Tuur Demeester’s new 30-minute video presentation, Charting Our Way Through Chaos, breaking down why this boom might be only just beginning—and what forces could push it to the next level. Read the first-ever mid-cycle report from Adamant Research: Blockstream Jade Plus is the easiest, most secure way to protect your Bitcoin—perfect for beginners and pros alike. With a sleek design, simple setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes. Seamlessly pair with the Blockstream app on mobile or desktop for smooth onboarding. As your stack grows, Jade Plus grows with you—unlock features like the air-gapped JadeLink Storage Device or QR Mode for cable-free transactions using the built-in camera. Want more security? Jade Plus supports multisig wallets with apps like Blockstream, Electrum, Sparrow, and Specter. Protect your Bitcoin, sleep better, stack harder. Use code: TBL for 10% off. We are also happy to announce our newest sponsor this month: Arch Lending! At TBL, we help you decode Bitcoin’s macro trends and give clear market signals—holding Bitcoin is just the beginning. Arch lets you borrow against your Bitcoin—unlock cash without selling:

Stay long, stay liquid. Use code “Nik” for 0.5% off interest rate for 2 years. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! “By the time you read about it in the Wall Street Journal, it’s already too late.” - The Wolf of Wall StreetEarlier this year, our TBL Liquidity Quarterly Cycle told us that the next market trough would take place sometime between July and August. We initially thought it would take place around mid-July using statistical analysis, but suppressed bond volatility and a weak dollar kept pushing our forecast further out into the year. By July 25, we made the call to push our next liquidity trough to mid-August. We made the right call, because as soon as August started, we got the long-awaited trough in our cycle:... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, September 5, 2025

TBL Liquidity, US Rates, Employment, & AI: TBL Weekly #155

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

No comments:

Post a Comment