Bitcoin Pulls Back Even as Financial Conditions Stay LooseAlso Ethereum Keeps Closing the Gap on Bitcoin & Despite Uncertainty, Bond Market Bets on Rate CutsWelcome to Ecoinometrics' Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we'll cover:

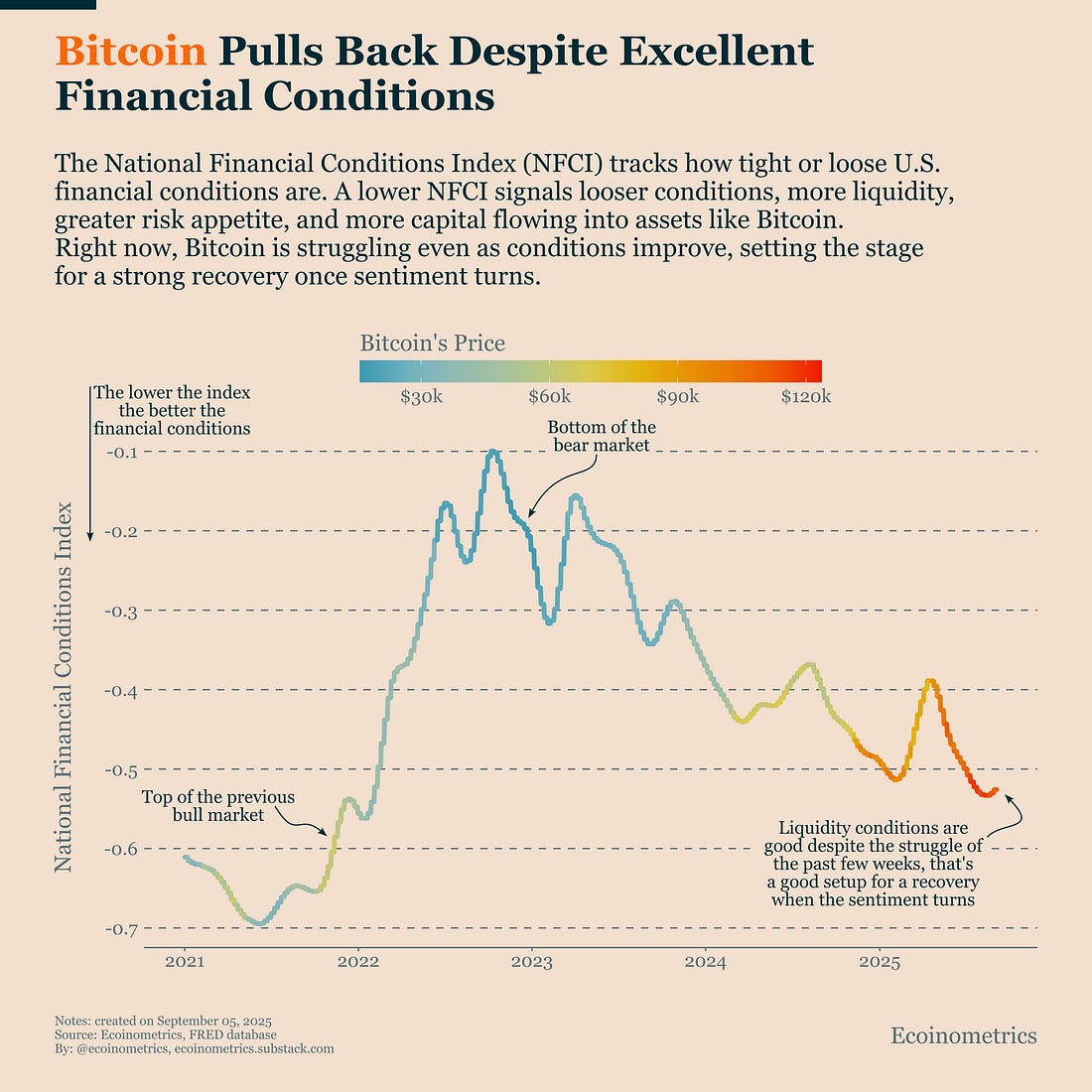

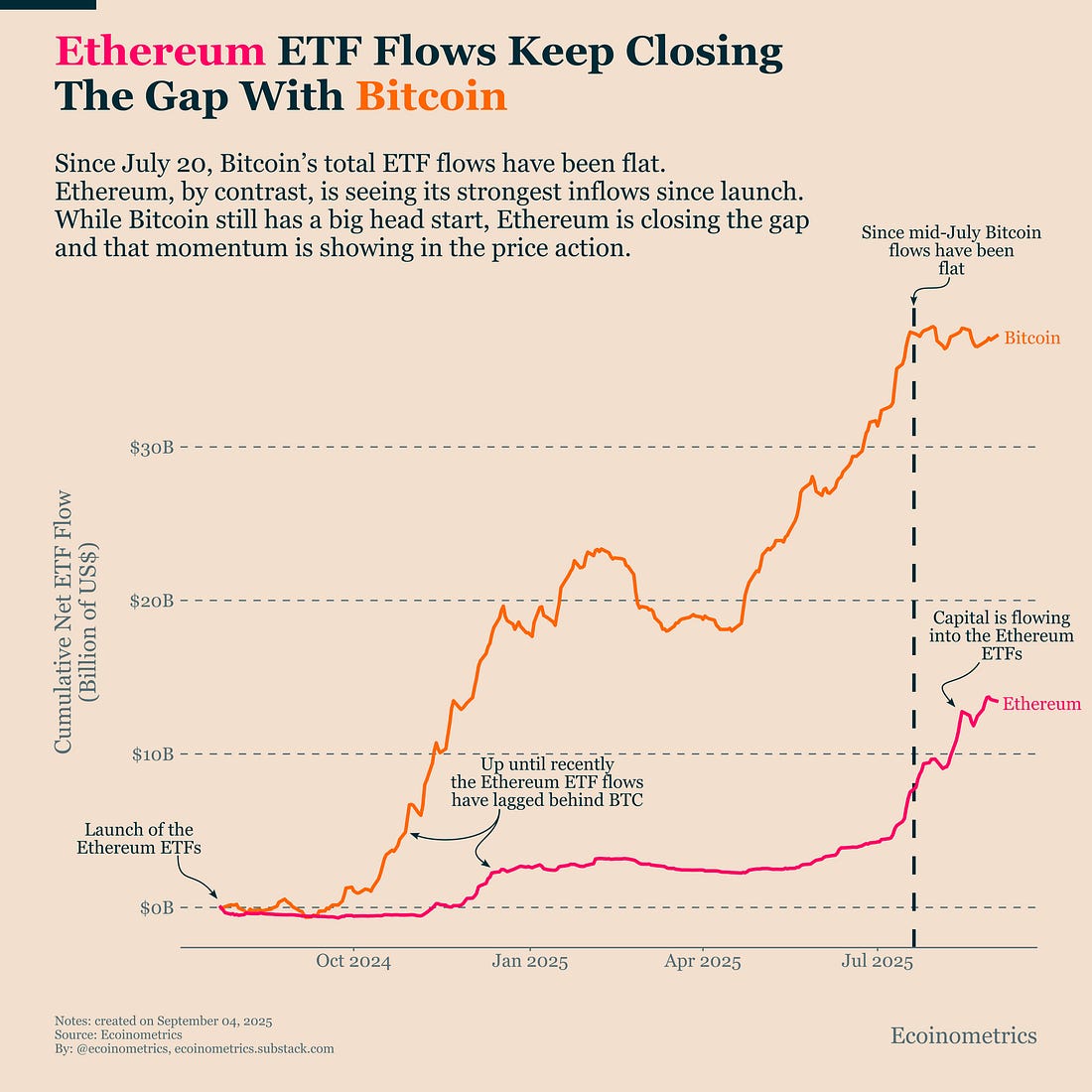

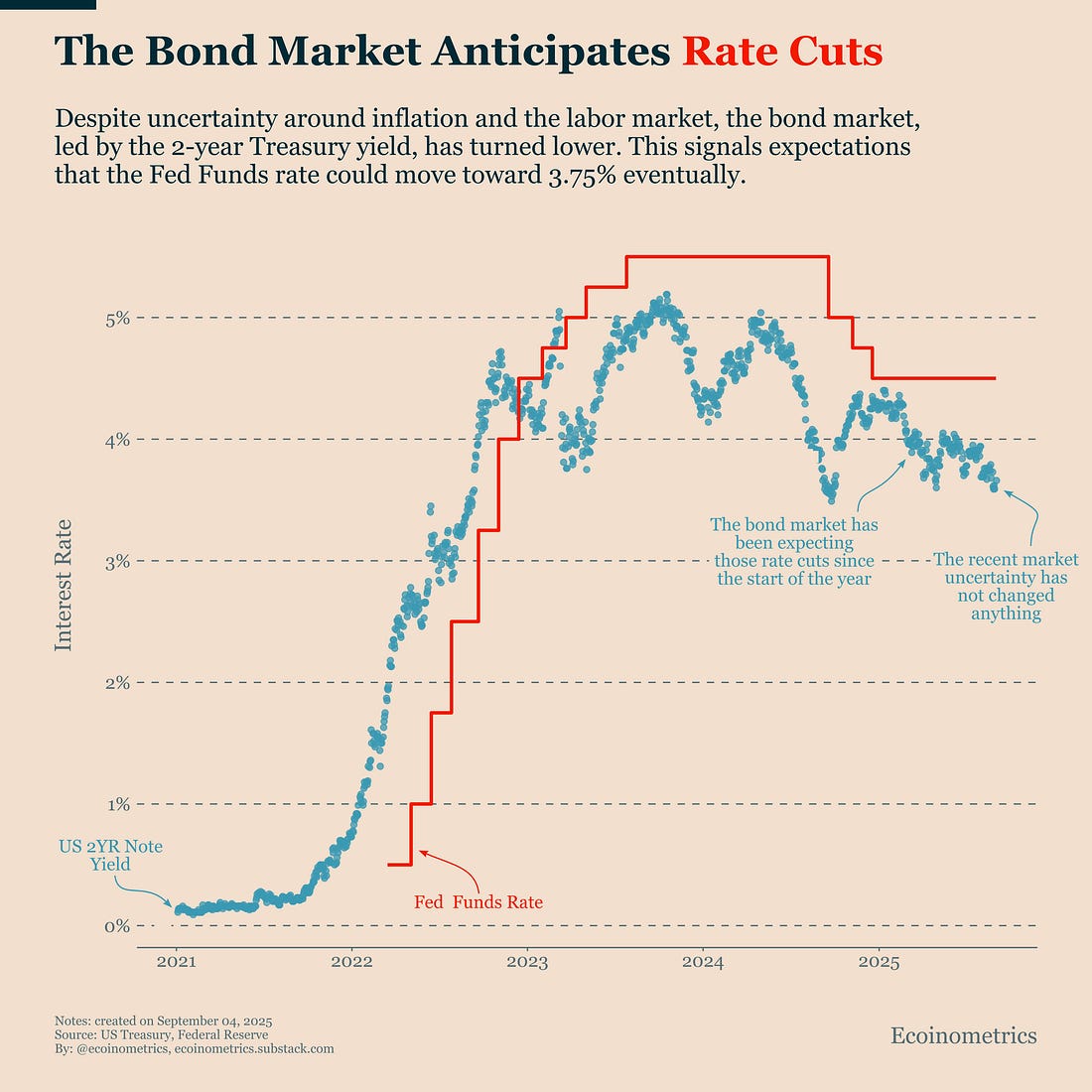

Together, these charts highlight the disconnects that matter right now: Bitcoin is lagging despite loose financial conditions, Ethereum is attracting flows in a catch-up trade, and the bond market is already leaning toward rate cuts. In other words, liquidity is supportive, positioning is shifting, and the policy backdrop could soon turn more favourable. That's the kind of setup where sentiment becomes the key swing factor. In case you missed it, here are the other topics we covered this week: Essential Decision-Making Tools Bitcoin Market Monitor - Key Drivers in Five Charts: Bitcoin Market Forecast - Probability Scenarios & Risk Metrics: Get these professional-grade insights delivered to your inbox: Bitcoin Pulls Back Even as Financial Conditions Stay LooseBitcoin has been pulling back recently, mostly because of macro uncertainty. The market is waiting for the Federal Reserve’s guidance at the upcoming FOMC meeting. And that leaves the door wide open for multiple outcomes, which is why our ETF-based forecast for the next 30 days keeps three scenarios equally likely. That said, the liquidity backdrop is not bad at all for Bitcoin. The National Financial Conditions Index (NFCI) tracks how tight or loose U.S. financial conditions are. A lower NFCI means looser conditions: more liquidity, easier access to credit, and greater risk appetite. In other words, it’s a measure of how much financial fuel is available for assets like Bitcoin. If we look at the NFCI today, we’re still in the broad trend toward looser conditions that has held for the past couple of years. Even more striking: the index is now at the same absolute level it was before the Fed started hiking rates in 2022. Put simply, the Fed funds rate is around 4.3%, yet liquidity is as good as it was in the zero-interest-rate era. That’s an unusual but favourable setup. So even if conditions stall here for a few weeks, they remain supportive for Bitcoin. If risk sentiment turns positive, there’s enough liquidity for Bitcoin to track the bullish path we mapped out in our model. Nothing is guaranteed, but this looks more like a pause for risk assets than the start of a bearish sequence. As always, watch ETF flows closely as macro data comes in ahead of the Fed meeting. They’ll tell you whether the market is ready to move. Ethereum Keeps Closing the Gap on BitcoinBitcoin’s price is struggling to hold around $110K, and its ETF flows have been flat since mid-July. Ethereum, by contrast, is seeing its strongest inflows since launch. That divergence is a clear sign Ethereum is in a catch-up, or mean-reversion, trade relative to Bitcoin. At first glance, the setup looks odd. Both assets are risk-on plays, and in an environment of macro uncertainty, you’d expect them to behave more alike. The fact that capital is flowing into Ethereum while Bitcoin stalls suggests investors are betting on Ethereum narrowing the gap. Now, Ethereum still lacks a long-term independent narrative that could sustain growth over the long run. But the gap with Bitcoin remains wide, and the relative value trade has room to run. Based on its historical relationship with Bitcoin, Ethereum is still priced about 40% below fair value. That leaves plenty of upside if momentum continues. Despite Uncertainty, Bond Market Bets on Rate CutsWe don’t yet know what the Federal Reserve will decide at this month’s FOMC meeting, or what tone it will set for the rest of the year. Based on the data, we’ve argued that inflation remains the bigger risk, which makes a gradual pace of small rate cuts the most reasonable path forward. Not everyone agrees with that view, but the bond market is leaning in the same direction. Since the 2022 hiking cycle, the yield on the 2-year U.S. Treasury has been a reliable proxy for the market’s medium-term view of Fed policy. That’s because the 2-year maturity closely aligns with the horizon the Fed can directly influence. Of course, the record isn’t perfect. In 2023 and 2024, the market often got ahead of itself, pricing in deeper cuts than the Fed was willing to deliver. Still, the 2-year yield consistently gave a strong signal of how expectations were shifting. Today, even with macro uncertainty, the 2-year yield is drifting lower. That signals the bond market is betting on the Fed following through with rate cuts, potentially moving toward 3.75% over time. If the Fed confirms that direction this month, it would be a tailwind for risk assets, including Bitcoin. That's it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, September 5, 2025

Bitcoin Pulls Back Even as Financial Conditions Stay Loose

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

No comments:

Post a Comment