| gm Bankless Nation,

Hyperliquid is facing growing competition, but its long-term potential remains interesting. Not sure how to dive in, though? Let's catch you up with a quickstart guide! Today's Issue ⬇️ - ☀️ Need to Know: DAT Insider Trading?

U.S. agencies launch investigations. - 🗣️ Tactic: Getting Started on Hyperliquid

A 101 guide for beginners. - 🎧 Early Access: Crypto vs. Banks

The war for the future of money.

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet. . . . NEED TO KNOW DAT Insider Trading? - 🔎 SEC, FINRA Launch Crypto DAT Insider Trading Probe. U.S. regulators are probing suspicious trading in companies that adopted crypto-treasury strategies, with the SEC and FINRA flagging unusual volume and price jumps ahead of public announcements.

- 🤝 Aster Reimburses Traders After XPL Perpetual Market Anomaly. Aster has fully reimbursed users after a sharp pricing anomaly on its XPL perpetual contracts liquidated traders, distributing compensation in USDT.

- 💸 SoftBank and Ark Eye Stake in Tether at $500B Valuation. Tether is reportedly entertaining talks with SoftBank and Ark Invest on a funding round that will value it at $500B.

📸 Daily Market Snapshot: After a large dip yesterday, the total crypto market cap recovered 1% to $3.89B today while ETH led top 10 coins with a 24h gain of nearly 5%. | Prices as of 3pm ET | 24hr | 7d |  | Crypto $3.89T | ↗ 1.0% | ↘ 9.0% |  | BTC $110,162 | ↗ 0.5% | ↘ 4.7% |  | ETH $4,054 | ↗ 4.6% | ↘ 9.1% | . . . TACTIC Getting Started on Hyperliquid Launched in late 2024, Hyperliquid has since had one of the most meteoric rises in crypto history. As things stand now: - Its app is the premier onchain perps exchange.

- Its network is the 9th-largest in DeFi, with +100 protocols building atop it.

- Its token, HYPE, recently hit a new ATH of $59.

- Meanwhile Hyperliquid just got a native stablecoin, USDH, after multiple top projects bid to build it.

- Plus, new integrations (e.g. Rabby and Rainbow) are picking up steam.

With this sort of momentum, Hyperliquid still has room to grow. If you're new to the ecosystem and not sure where to start, no worries. Let's walk you through all the basics. How Hyperliquid worksAt its core, Hyperliquid is a network + app combo. The tandem is built to feel fast and responsive like a centralized exchange, though everything runs onchain. The network itself is powered by two key layers: - HyperCore — This is the engine that runs the Hyperliquid app's orderbooks. Every perp and spot order, cancel, trade, and liquidation is written directly onchain here.

- HyperEVM — This is a companion execution layer that’s fully EVM-compatible, meaning devs can deploy Solidity contracts here. These contracts can read and write to HyperCore’s orderbooks, so new ecosystem apps don’t have to bootstrap their own liquidity.

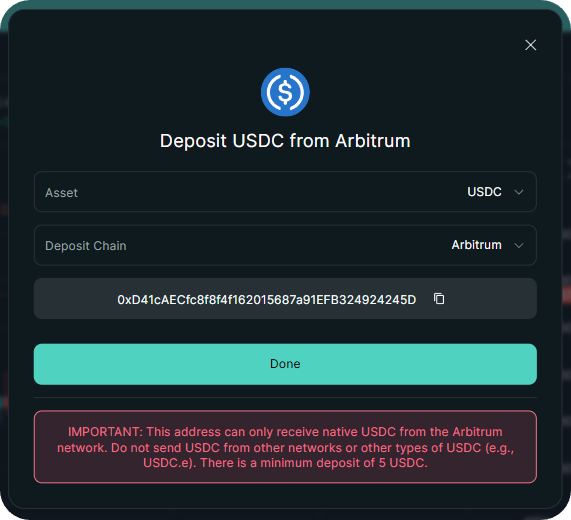

Altogether, then, Hyperliquid offers traders a non-custodial exchange with sub-second blocks and transparent books, while builders can compose against those same books, whether it’s for lending, structured products, or new experiments altogether. How to onboardOn app.hyperliquid.xyz you can connect an existing wallet or sign up for an account using your email. Then you'll need to onboard some funds. The primary way to load your Hyperliquid account is to deposit USDC from Arbitrum. An integration with Unit Protocol also allows deposits of ETH from Ethereum, BTC from Bitcoin, and SOL from Solana. Keep in mind the minimum deposit levels, as you'll lose your money if you send less than these sums: - 5 USDC (Arbitrum)

- 0.05 ETH (Ethereum)

- 0.002 BTC (Bitcoin)

- 0.2 SOL (Solana)

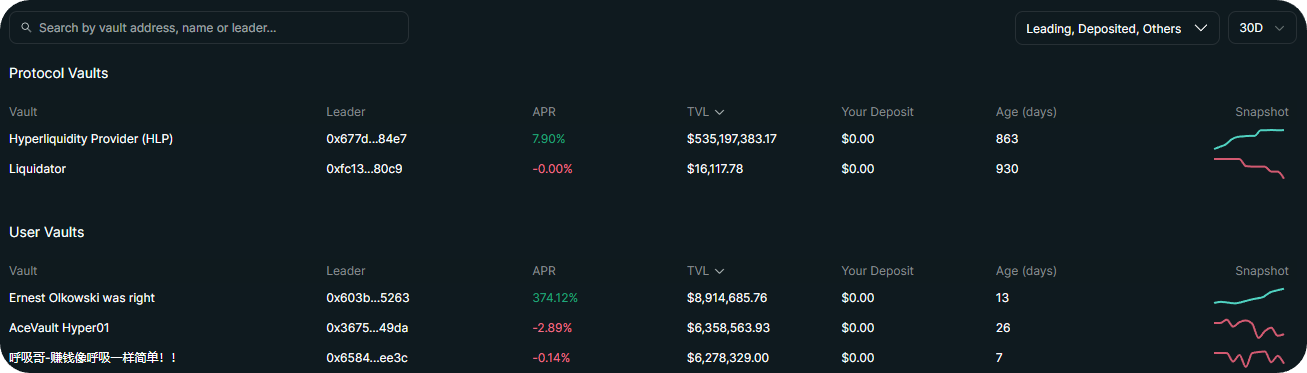

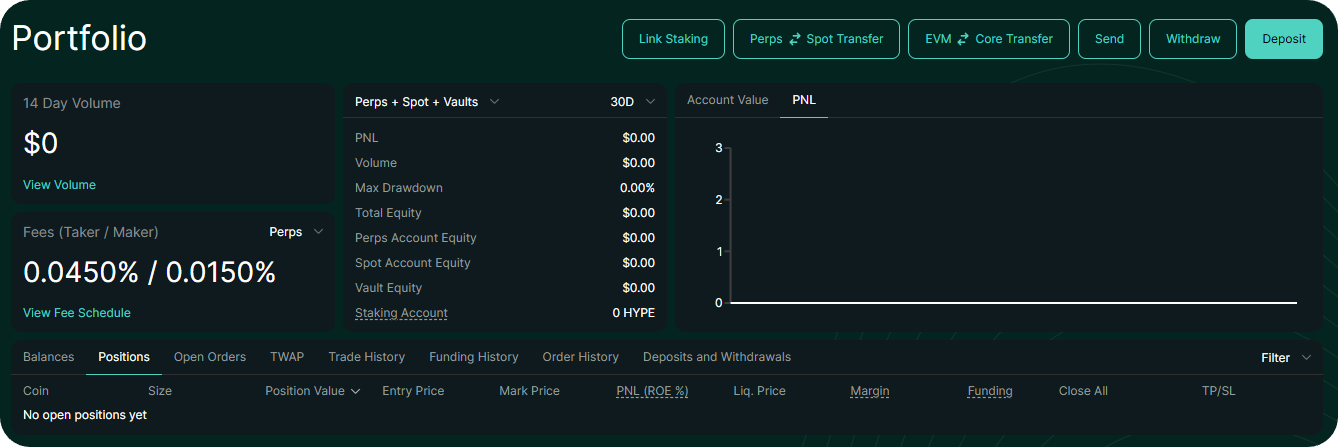

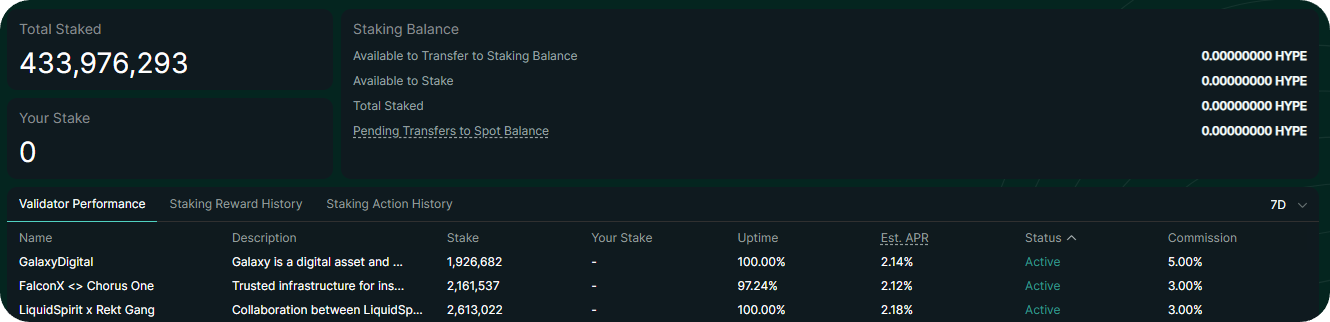

Navigating the Hyperliquid appOnce you’ve got funds deposited, the main app breaks down into a few core tabs. The main ones are: Trade This is the heart of the app. Pick your market, view the orderbook, and place perp or spot trades. You’ll see live funding rates, open interest, and price charts. You'll also find risk controls like leverage sliders here. Vaults A place to put your capital to work passively. Protocol vaults like the HLP provide liquidity and handle liquidations, while user-created vaults let you follow strategies from individual leaders. Each vault shows its TVL and performance stats so you can evaluate before depositing. Portfolio Your personal dashboard. This page aggregates your balances, positions, PnL, and fee stats. It’s also where you’ll find your trade history, funding payments, and order logs, plus a HyperCore <> HyperEVM transfer tool. Staking Hyperliquid runs on proof-of-stake, so this is where you can delegate your HYPE tokens to validators. This area makes it simple to compare validator performances, commission rates, and staking rewards. Transfers between your spot balance and staking balance are also managed here, with an easy flow for delegating and undelegating. Exploring the HyperEVMIf you want to branch out beyond the main Hyperliquid app, you can consider exploring the HyperEVM app ecosystem. To do this, first add the network to your preferred Ethereum wallet using ChainList. Then it's just about finding apps you'd like to try. According to DeFiLlama, and not counting the Hyperliquid perps platform itself, the 5 biggest DeFi apps here currently are Kinetiq (liquid staking), Pendle (yield), HyperLend (lending), Veda (capital allocator), and Morpho (lending). But there are plenty more options. If you want to dive deeper into different categories of apps, from AI to SocialFi projects, you can skip a scavenger hunt by checking out community directories like HypurrCollective, Hyperliquid Wiki, and HL Eco. Zooming outHyperliquid blurs the lines between exchange and chain, app and ecosystem. And in doing so, it's become an onchain sensation. Of course, you might feel late to the party, so to speak. But considering Hyperliquid's dominance today and its potential for further growth, it still makes sense to learn the basics and to gain a foothold here. If the project's bull case continues to play out, the experience will be valuable. FRIEND & SPONSOR: UNICHAIN Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today. . . . EARLY ACCESS Crypto vs. Banks What happens when crypto’s rails seriously threaten the banks’ grip on America’s money? Summer Mersinger, CEO of the Blockchain Association and a former CFTC Commissioner, walks us through the fight to roll back the GENIUS Act, why 4% stablecoin rewards spook sub-1% banks, and how a $700M lobbying machine and shifting Hill politics might reshape financial innovation in the U.S. Listen to the full episode 👇 |

No comments:

Post a Comment